Business

Canada falling behind on tax competitiveness

The Canadian Taxpayers Federation is calling on politicians to prioritize tax relief in response to the 2024 International Tax Competitiveness Index, which shows Canada’s tax system is becoming less competitive.

“Canada is falling behind many of our peers on tax competitiveness and this report should be a five-alarm siren to stop hiking taxes,” said Franco Terrazzano, CTF Federal Director. “Canadians know our economy is not firing on all cylinders and that’s because our governments are taking too much money from families and businesses.”

The Tax Foundation’s 2024 International Tax Competitiveness Index compares tax systems for 38 countries that belong to the Organization for Economic Co-operation and Development.

Key findings from the report include:

- Canada ranked 17th (out of 38) on overall tax competitiveness, which is two spots worse than last year’s rank

- Canada ranked 31st on individual tax competitiveness

- Canada ranked 26th on business tax competitiveness

- Canada ranked 25th on property tax competitiveness

- Canada ranked 8th on consumption tax competitiveness

Weaknesses of Canada’s tax system include taxing capital gains “well above” the OECD average, higher business taxes than the OECD average and implementing a digital services tax, according to the report.

“This report shows high capital gains taxes are a reason Canada is falling behind on tax competitiveness and it’s more proof Prime Minister Justin Trudeau is wrong to hike capital gains taxes,” Terrazzano said. “We need politicians to encourage success in Canada and stop punishing our doctors, entrepreneurs and people saving for retirement.”

The report notes “some strengths of the Canadian tax system” include the fact “Canada does not levy wealth, estate, or inheritance taxes.”

“A bright spot for Canada’s competitiveness is that we don’t have a wealth tax and politicians should avoid this damaging tax,” Terrazzano said. “Instead of more government spending, politicians should let families and businesses keep more of their money to grow the economy.”

You can find the Tax Foundation’s 2024 International Tax Competitiveness Index here.

Business

Net Zero by 2050: There is no realistic path to affordable and reliable electricity

By Dave Morton of the Canadian Energy Reliability Council.

By Dave Morton of the Canadian Energy Reliability Council.

Maintaining energy diversity is crucial to a truly sustainable future

Canada is on an ambitious path to “decarbonize” its economy by 2050 to deliver on its political commitment to achieve net-zero greenhouse gas (GHG) emissions. Although policy varies across provinces and federally, a default policy of electrification has emerged, and the electricity industry, which in Canada is largely owned by our provincial governments, appears to be on board.

In a November 2023 submission to the federal government, Electricity Canada, an association of major electric generators and suppliers in Canada, stated: “Every credible path to Net Zero by 2050 relies on electrification of other sectors.” In a single generation, then, will clean electricity become the dominant source of energy in Canada? If so, this puts all our energy eggs in one basket. Lost in the debate seem to be considerations of energy diversity and its role in energy system reliability.

What does an electrification strategy mean for Canada? Currently, for every 100 units of energy we consume in Canada, over 40 come to us as liquid fuels like gasoline and diesel, almost 40 as gaseous fuels like natural gas and propane, and a little less than 20 in the form of electrons produced by those fuels as well as by water, uranium, wind, solar and biomass. In British Columbia, for example, the gas system delivered approximately double the energy of the electricity system.

How much electricity will we need? According to a recent Fraser Institute report, a decarbonized electricity grid by 2050 requires a doubling of electricity. This means adding the equivalent of 134 new large hydro projects like BC’s Site C, 18 nuclear facilities like Ontario’s Bruce Power Plant, or installing almost 75,000 large wind turbines on over one million hectares of land, an area nearly 14.5 times the size of the municipality of Calgary.

Is it feasible to achieve a fully decarbonized electricity grid in the next 25 years that will supply much of our energy requirements? There is a real risk of skilled labour and supply chain shortages that may be impossible to overcome, especially as many other countries are also racing towards net-zero by 2050. Even now, shortages of transformers and copper wire are impacting capital projects. The Fraser Institute report looks at the construction challenges and concludes that doing so “is likely impossible within the 2050 timeframe”.

How we get there matters a lot to our energy reliability along the way. As we put more eggs in the basket, our reliability risk increases. Pursuing electrification while not continuing to invest in our existing fossil fuel-based infrastructure risks leaving our homes and industries short of basic energy needs if we miss our electrification targets.

The IEA 2023 Roadmap to Net Zero estimates that technologies not yet available on the market will be needed to deliver 35 percent of emissions reductions needed for net zero in 2050. It comes then as no surprise that many of the technologies needed to grow a green electric grid are not fully mature. While wind and solar, increasingly the new generation source of choice in many jurisdictions, serve as a relatively inexpensive source of electricity and play a key role in meeting expanded demand for electricity, they introduce significant challenges to grid stability and reliability that remain largely unresolved. As most people know, they only produce electricity when the wind blows and the sun shines, thereby requiring a firm back-up source of electricity generation.

Given the unpopularity of fossil fuel generation, the difficulty of building hydro and the reluctance to adopt nuclear in much of Canada, there is little in the way of firm electricity available to provide that backup. Large “utility scale” batteries may help mitigate intermittent electricity production in the short term, but these facilities too are immature. Furthermore, wind, solar and batteries, because of the way they connect to the grid don’t contribute to grid reliability in the same way the previous generation of electric generation does.

Other zero-emitting electricity generation technologies are in various stages of development – for example, Carbon Capture Utilization and Storage (CCUS) fitted to GHG emitting generation facilities can allow gas or even coal to generate firm electricity and along with Small Modular Reactors (SMRs) can provide a firm and flexible source of electricity.

What if everything can’t be electrified? In June 2024, a report commissioned by the federal government concluded that the share of overall energy supplied by electricity will need to roughly triple by 2050, increasing from the current 17 percent to between 40 and 70 percent. In this analysis, then, even a tripling of existing electricity generation, will at best only meet 70 percent of our energy needs by 2050.

Therefore, to ensure the continued supply of reliable energy, non-electrification pathways to net zero are also required. CCUS and SMR technologies currently being developed for producing electricity could potentially be used to provide thermal energy for industrial processes and even building heat; biofuels to replace gasoline, diesel and natural gas; and hydrogen to augment natural gas, along with GHG offsets and various emission trading schemes are similarly

While many of these technologies can and currently do contribute to GHG emission reductions, uncertainties remain relating to their scalability, cost and public acceptance. These uncertainties in all sectors of our energy system leaves us with the question: Is there any credible pathway to reliable net-zero energy by 2050?

Electricity Canada states: “Ensuring reliability, affordability, and sustainability is a balancing act … the energy transition is in large part policy-driven; thus, current policy preferences are uniquely impactful on the way utilities can manage the energy trilemma. The energy trilemma is often referred to colloquially as a three-legged stool, with GHG reductions only one of those legs. But the other two, reliability and affordability, are key to the success of the transition.

Policymakers should urgently consider whether any pathway exists to deliver reliable net-zero energy by 2050. If not, letting the pace of the transition be dictated by only one of those legs guarantees, at best, a wobbly stool. Matching the pace of GHG reductions with achievable measures to maintain energy diversity and reliability at prices that are affordable will be critical to setting us on a truly sustainable pathway to net zero, even if it isn’t achieved by 2050.

Dave Morton, former Chair and CEO of the British Columbia Utilities Commission (BCUC), is with the Canadian Energy Reliability Council.

Business

Ottawa’s Plastics Registry A Waste Of Time And Money

From the Frontier Centre for Public Policy

By Lee Harding

Lee Harding warns that Ottawa’s new Federal Plastics Registry (FPR) may be the most intrusive, bureaucratic burden yet. Targeting everything from electronics to fishing gear, the FPR requires businesses to track and report every gram of plastic they use, sell, or dispose of—even if plastic is incidental to their operations. Harding argues this isn’t about waste; it’s about control. And with phase one due in 2025, companies are already overwhelmed by confusion, cost, and compliance.

Businesses face sweeping reporting demands under the new Federal Plastics Registry

Canadian businesses already dealing with inflation, labour shortages and tariff uncertainties now face a new challenge courtesy of their own federal government: the Federal Plastics Registry (FPR). Manufacturers are probably using a different F-word than “federal” to describe it.

The registry is part of Ottawa’s push to monitor and eventually reduce plastic waste by collecting detailed data from companies that make, use or dispose of plastics.

Ottawa didn’t need new legislation to impose this. On Dec. 30, 2023, the federal government issued a notice of intent to create the registry under the 1999 Canadian Environmental Protection Act. A final notice followed on April 20, 2024.

According to the FPR website, companies, including resin manufacturers, plastic producers and service providers, must report annually to Environment Canada. Required disclosures include the quantity and types of plastics they manufacture, import and place on the market. They must also report how much plastic is collected and diverted, reused, repaired, remanufactured, refurbished, recycled, turned into chemicals, composted, incinerated or sent to landfill.

It ties into Canada’s larger Zero Plastic Waste agenda, a strategy to eliminate plastic waste by 2030.

Even more troubling is the breadth of plastic subcategories affected: electronic and electrical equipment, tires, vehicles, construction materials, agricultural and fishing gear, clothing, carpets and disposable items. In practice, this means that even businesses whose core products aren’t plastic—like farmers, retailers or construction firms—could be swept into the reporting requirements.

Plastics are in nearly everything, and now businesses must report everything about them, regardless of whether plastic is central to their business or incidental.

The FPR website says the goal is to collect “meaningful and standardized data, from across the country, on the flow of plastic from production to its end-of-life management.” That information will “inform and measure performance… of various measures that are part of Canada’s zero plastic waste agenda.” Its stated purpose is to “keep plastics in the economy and out of the environment.”

But here’s the problem: the government’s zero plastic waste goal is an illusion. It would require every plastic item to last forever or never exist in the first place, leaving businesses with an impossible task: stay profitable while meeting these demands.

To help navigate the maze, international consultancy Reclay StewardEdge recently held a webinar for Canadian companies. The discussion was revealing.

Reclay lead consultant Maanik Bagai said the FPR is without precedent. “It really surpasses whatever we have seen so far across the world. I would say it is unprecedented in nature. And obviously this is really going to be tricky,” he said.

Mike Cuma, Reclay’s senior manager of marketing and communications, added that the government’s online compliance instructions aren’t particularly helpful.

“There’s a really, really long list of kind of how to do it. It’s not particularly user-friendly in our experience,” Cuma said. “If you still have questions, if it still seems confusing, perhaps complex, we agree with you. That’s normal, I think, at this point—even just on the basic stuff of what needs to be reported, where, when, why. Don’t worry, you’re not alone in that feeling at all.”

The first reporting deadline, for 2024 data, is Sept. 29, 2025. Cuma warned that businesses should “start now”—and some “should maybe have started a couple months ago.”

Whether companies manage this in-house or outsource to consultants, they will incur significant costs in both time and money. September marks the first phase of four, with each future stage becoming more extensive and restrictive.

Plastics are petroleum products—and like oil and gas, they’re being demonized. The FPR looks less like environmental stewardship and more like an attempt to regulate and monitor a vast swath of the economy.

A worse possibility? That it’s a test run for a broader agenda—top-down oversight of every product from cradle to grave.

While seemingly unrelated, the FPR and other global initiatives reflect a growing trend toward comprehensive monitoring of products from creation to disposal.

This isn’t speculation. A May 2021 article on the World Economic Forum (WEF) website spotlighted a New York-based start-up, Eon, which created a platform to track fashion items through their life cycles. Called Connected Products, the platform gives each fashion item a digital birth certificate detailing when and where it was made, and from what. It then links to a digital twin and a digital passport that follows the product through use, reuse and disposal.

The goal, according to WEF, is to reduce textile waste and production, and thereby cut water usage. But the underlying principle—surveillance in the name of sustainability—has a much broader application.

Free markets and free people build prosperity, but some elites won’t leave us alone. They envision a future where everything is tracked, regulated and justified by the supposed need to “save the planet.”

So what if plastic eventually returns to the earth it came from? Its disposability is its virtue. And while we’re at it, let’s bury the Federal Plastics Registry and its misguided mandates with it—permanently.

Lee Harding is a research associate for the Frontier Centre for Public Policy.

-

C2C Journal2 days ago

C2C Journal2 days ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

Opinion2 days ago

Opinion2 days agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

International1 day ago

International1 day agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

2025 Federal Election1 day ago

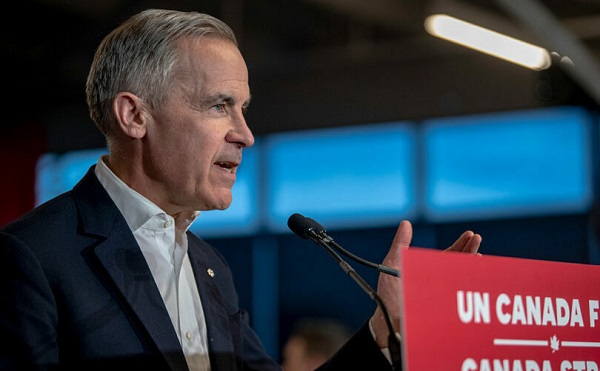

2025 Federal Election1 day agoMark Carney: Our Number-One Alberta Separatist

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoCanada is squandering the greatest oil opportunity on Earth

-

International15 hours ago

International15 hours agoU.S. Army names new long-range hypersonic weapon ‘Dark Eagle’