Economy

Canada can’t have fast population growth, housing supply constraints, and housing affordability

From the MacDonald Laurier Institute

By Steve Lafleur

No one wants to solve the housing crisis enough to make the hard choices.

It’s tempting to try to have it all and policymakers are not immune to this. There are tradeoffs in everything. Ignoring those tradeoffs might work for awhile, but eventually reality catches up to you. Try as we might, we can’t have it all.

For instance, we can’t have rapid population growth, housing supply constraints, and housing affordability all at the same time. We’ll call this the housing affordability trilemma.

The idea of a policy trilemma comes from the Mundell-Fleming model which is included in most introductory economics textbooks. The model was named after Canadian economist Robert Mundell and British economist Marcus Fleming, who developed the idea in the early 1960s. The basic premise of the model, also called the “impossible trinity” or “trilemma” is that you can have two of three policies, but not all three (namely, free capital flow, a fixed exchange rate, and a sovereign monetary policy).

The idea of an impossible trinity can and has been applied to other situations, like the euro crisis in the early 2010s, and provides a useful way of looking at seemingly intractable problems. Plotting the related problems on a Venn Diagram helps visualize the problem. Here is the Mundell-Flemming model, visualized.

(Source: Author’s creation, graphic recreated)

Now, let’s return to housing policy. Few Canadian problems are as intractable as the now nationwide housing affordability crisis. Rents are rising quickly, apartment availability is falling, and home prices are the highest relative to incomes in the G7. As we’ve shown in a recent paper for the MacDonald Laurier Institute, Canada’s population growth is outstripping housing growth. This, unsurprisingly, has undermined housing affordability. Let’s visualize this trilemma.

(Source: Author’s creation, graphic recreated)

At the root of Canada’s housing woes is a severe shortage of homes relative to the number needed. We simply don’t build enough homes to adequately house current and future Canadians.

Not only is there cross-party consensus that there’s a housing shortage, but most parties in provincial and federal elections have proposed policies aimed at addressing it. So why do we still have a shortage?

Let’s go through the elements of the Canada’s housing trilemma (or housing impossibility trinity).

The first element is a fast-growing population. Canada has the fastest growing population in the G7, and last year alone grew by more than a million people. Barring any major shifts in immigration policy, this trend is unlikely to change any time soon. Indeed, the population grew by 430,635 in the third quarter of 2023. That’s the highest quarterly growth rate since 1957.

The second element is restrictions on homebuilding. Whether intended or not, a suite of policies processes and regulations that prevent or limit the addition of more homes both in existing neighbourhoods and at the urban fringe. Barriers to density include local zoning bylaws, lengthy and uncertain consultation processes, and growth plans that exclude building or upgrading the infrastructure necessary to enable more homebuilding in existing neighbourhoods. Policies explicitly preventing the addition of homes outside of existing neighbourhoods include Ontario’s Greenbelt and British Columbia’s Agricultural Land Reserve, while softer versions include local planning targets limiting the share of development slotted to occur on city outskirts. Given these limitations, it’s no surprise that we’ve rarely surpassed 200,000 housing completions annually since the 1970s, while the rate of population growth has reached generational highs.

The third element is housing affordability. That is, the ability for individuals and families earning local incomes to comfortably meet their housing needs. This means shelter costs don’t prevent them from feeding and clothing themselves, but also allow saving and investing in an education, for instance. For example, some peg the cut-off for affordability at 30 percent of income. By that measure, a household would require an income of over $100,000 to afford a one-bedroom apartment in Vancouver, for example.

Whether we like it or not, we can’t have fast population growth, rigid housing supply constraints, and housing affordability all at the same time.

For most of our recent past, the choice we’ve collectively made is to accelerate population growth while maintaining many (if not most) restrictions on both outward and upward growth, meaning we’ve excluded the possibility of achieving broad affordability. The consequences? All the symptoms mentioned before: rising rents, falling vacancies, higher ownership costs.

Despite recent pivots by a growing number of local and provincial governments, the balance of housing and land-use policies remains firmly tilted against reaching the level of homebuilding we need to restore some semblance of affordability, which by some estimates means more than doubling homebuilding. To wit, housing construction has remained remarkably stagnant—even slightly declining—in recent decades. Even the bold changes to zoning recently passed in British Columbia, Ontario and Nova Scotia are unlikely to double the number of housing built provincewide.

But, as the housing trilemma suggests, there are alternative routes. If Canadians remain adamant about affordability, we can demand more meaningful reduction or removal of policies preventing a growth in housing supply, or we can demand a reduction in population growth, or both. These are not easy choices but ignoring them doesn’t make them go away. We need to build upwards, outwards, or both, in order to meaningfully increase housing production. We can’t say no to every solution and expect better results.

The point is, there’s broad consensus that Canada faces a housing crisis, and that major policy actions are needed to fix the problem. There’s also a tacit consensus that the policies feeding the crisis should remain in place.

To put it more bluntly, everyone wants to solve the housing crisis, but no one wants to solve the housing crisis enough to make the hard choices. Until we collectively shift our priorities, we are choosing to sacrifice housing affordability. We can’t have it all. If we insist on maintaining fast population growth and restrictions on supply, we’ll get the broken housing market we deserve.

Steve Lafleur is a public policy analyst who researches and writes for Canadian think tanks.

Economy

Clearing the Path: Why Canada Needs Energy Corridors to Compete

From Energy Now

Originally published by Canada Powered by Women

-

Keystone XL ($8 billion), cancelled in 2021

-

Energy East ($15.7 billion), cancelled in 2017

-

Northern Gateway ($7.9 billion), cancelled in 2016

These projects were cancelled due to regulatory challenges, environmental opposition, and shifting political decisions on both sides of the border. This left Canada without key infrastructure to support energy exports.

For years, companies have tried to build the infrastructure needed to move Canadian oil and gas across the country and to sell to global markets. Billions of dollars have been invested in projects that never materialized, stuck in regulatory limbo, weighed down by delays, or cancelled altogether.

The urgency of this issue is growing.

Last week, 14 CEOs from Canada’s largest pipeline and energy companies issued an open letter urging federal leaders from all parties to streamline regulations and establish energy corridors, warning that delays and policy uncertainty are driving away investment and weakening Canada’s position in global energy markets.

The U.S. recently imposed tariffs on Canadian energy, adding new pressure to an already lopsided trade relationship. According to the 2024-2025 Energy Fact Book from Natural Resources Canada, the U.S. accounted for 89% of Canada’s energy exports by value, totalling $177.3 billion. This leaves the economy vulnerable to shifts in American policy. Expanding access to other buyers, such as Japan, Germany, and Greece, would help stabilize and grow the economy, support jobs, and reduce reliance on a single trading partner.

At the heart of this challenge is infrastructure.

Without reliable, efficient ways to move energy, Canada’s ability to compete is limited. Our existing pipelines run north-south, primarily serving the U.S., but we lack the east-west capacity needed to supply our own country and to diversify exports. Energy corridors (pre-approved routes for major projects) would ensure critical infrastructure is built fast, helping Canada generate revenue from its own resources while lowering costs and attracting investment.

This matters for affordability and reliability.

Our research shows engaged women are paying close attention to how energy policies affect their daily lives — 85 per cent say energy costs impact their standard of living, and 77 per cent support the development and export of liquefied natural gas (LNG) to help provide energy security and to generate revenue for Canada.

With increasing concern over household expenses, food prices, and economic uncertainty, energy corridors have become part of the conversation about ensuring long-term prosperity.

What are energy corridors, and why do they matter?

Energy corridors are designated routes for energy infrastructure such as pipelines, power lines, and transmission projects. With an energy corridor, environmental assessments and stakeholder consultations are completed in advance, allowing development to proceed without ongoing regulatory hurdles which can become costly and time consuming. This provides certainty for energy projects, reducing delays, lowering costs, and encouraging investment. They are also not a new concept and are applied in other parts of the world including the U.S.

In Canada, however, this isn’t happening.

Instead, each project must go through an extensive regulatory process, even if similar projects have already been approved. Energy companies spend years trying to secure approvals that don’t come to fruition in a reasonable time and as a result projects are cancelled due to sky-rocketing costs.

“Getting regulatory approval for energy transportation projects in Canada takes so long that investors are increasingly looking elsewhere,” said Krystle Wittevrongel, director of research at the Montreal Economic Institute. “Energy corridors could help streamline the process and bring back much-needed investment to our energy industry.”

Jackie Forrest, executive director at the ARC Energy Research Institute, pointed out that the time it takes to get projects approved is a major factor in driving investment away from Canada to other countries.

“Projects are taking five or more years to go through their regulatory review process, spending hundreds of millions if not a billion dollars to do things like environmental assessments and studies that sometimes need to be carried out over numerous seasons,” she said.

The cost of missed projects

Over the past decade, multiple major energy projects in Canada have been cancelled or abandoned. Among them:

- Keystone XL ($8 billion), cancelled in 2021

- Energy East ($15.7 billion), cancelled in 2017

- Northern Gateway ($7.9 billion), cancelled in 2016

These projects were cancelled due to regulatory challenges, environmental opposition, and shifting political decisions on both sides of the border. This left Canada without key infrastructure to support energy exports.

LNG projects have faced similar setbacks. More than a dozen LNG export proposals were once on the table, but these same issues made most of these projects not viable.

Meanwhile, the United States rapidly expanded its LNG sector, now exporting far more than Canada, capturing global markets that Canada could have served.

“Ten to 15 years ago, there were about as many LNG projects proposed in Canada as in the U.S.,” said Forrest. “We have not been able to get those projects going. The first Canadian project is just starting up now, while the Americans are already shipping out far more.”

She cited a report that shows LNG development in the U.S. has added $408 billion to GDP since 2016 and created 270,000 direct jobs.

“That’s a major economic impact,” she said. “And Canada hasn’t been able to take part in it.”

The case for energy corridors: Creating prosperity, keeping costs in check

Energy corridors could help Canada build long-term prosperity while addressing affordability, job creation, and energy reliability.

“More efficient infrastructure reduces supply chain delays, helping to lower consumer energy costs and related expenses like food and transportation,” said Wittevrongel.

Wittevrongel notes that projects that cross provincial borders face both provincial and federal impact assessments which leads to duplication of effort and delays. Reducing this overlap would shorten approval timelines and provide more certainty for investors.

“One of the ways to improve this process is having the federal government recognize provincial environmental assessments as being good enough,” she said. “There has to be a way to balance that.”

Forrest said investors have already taken note of Canada’s high project costs and long approval timelines.

“TC Energy just built a pipeline to connect the BC gas fields with the West Coast that cost about twice as much as originally expected and took a lot longer,” she said. “Meanwhile, they recently completed a $4.5-billion natural gas project in Mexico under budget and ahead of schedule. Now they’re looking at where to put their next investment.”

Forrest explained that energy corridors could help de-risk infrastructure projects by front-loading environmental and stakeholder work.

“If we just had a pre-approved corridor for things like pipelines and transmission lines to go through, where a lot of this groundwork had already been done, it would really reduce the timeline to get to construction and reduce the risk,” she said. “That would hopefully get a lot more capital spent more quickly in this country.”

The path forward

Without changes, investment will continue to flow elsewhere.

“Energy corridors can go a long way to restoring Canada’s attractiveness for energy transportation and infrastructure projects as it cuts down on the lengthy bureaucratic requirements,” said Wittevrongel.

And Forrest agrees.

“We need to pick key projects that are going to be important to the sovereignty and economic future of Canada and get them done,” Forrest said. “I don’t think we can wait for long-term legislative reform — we need to look at what the Americans are doing and do something similar here.”

Energy corridors are about ensuring Canada remains competitive, lowering costs for consumers, and creating the infrastructure needed to support long-term economic prosperity.

For engaged women, this translates into a stronger economy, lower costs, and more reliable energy for their families.

“The two areas that this will be felt for every family are in lower energy costs and also in lower grocery or food prices as transportation of these things becomes easier on rail, or exporting grain reduces the price, for instance, ” said Wittevrongel.

Whether policymakers take action remains to be seen, but with growing trade pressures and investment uncertainty, the conversation around energy corridors is needed now more than ever.

Business

Tariff-driven increase of U.S. manufacturing investment would face dearth of workers

From the Fraser Institute

Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

Donald Trump has long been convinced that the United States must revitalize its manufacturing sector, having—unwisely, in his view—allowed other countries to sell all manner of foreign-produced manufactured goods in the giant American market. As president, he’s moved quickly to shift the U.S. away from its previous embrace of liberal trade and open markets as cornerstones of its approach to international economic policy —wielding tariffs as his key policy instrument. Since taking office barely two months ago, President Trump has implemented a series of tariff hikes aimed at China and foreign producers of steel and aluminum—important categories of traded manufactured goods—and threatened to impose steep tariffs on most U.S. imports from Canada, Mexico and the European Union. In addition, he’s pledged to levy separate tariffs on imports of automobiles, semi-conductors, lumber, and pharmaceuticals, among other manufactured goods.

In the third week of March, the White House issued a flurry of news releases touting the administration’s commitment to “position the U.S. as a global superpower in manufacturing” and listing substantial new investments planned by multinational enterprises involved in manufacturing. Some of these appear to contemplate relocating manufacturing production in other jurisdictions to the U.S., while others promise new “greenfield” investments in a variety of manufacturing industries.

President Trump’s intense focus on manufacturing is shared by a large slice of America’s political class, spanning both of the main political parties. Yet American manufacturing has hardly withered away in the last few decades. The value of U.S. manufacturing “output” has continued to climb, reaching almost $3 trillion last year (equal to 10 per cent of total GDP). The U.S. still accounts for 15 per cent of global manufacturing production, measured in value-added terms. In fact, among the 10 largest manufacturing countries, it ranks second in manufacturing value-added on a per-capita basis. True, China has become the world’s biggest manufacturing country, representing about 30 per cent of global output. And the heavy reliance of Western economies on China in some segments of manufacturing does give rise to legitimate national security concerns. But the bulk of international trade in manufactured products does not involve goods or technologies that are particularly critical to national security, even if President Trump claims otherwise. Moreover, in the case of the U.S., a majority of two-way trade in manufacturing still takes place with other advanced Western economies (and Mexico).

In the U.S. political arena, much of the debate over manufacturing centres on jobs. And there’s no doubt that employment in the sector has fallen markedly over time, particularly from the early 1990s to the mid-2010s (see table below). Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

| U.S. Manufacturing Employment, Select Years (000)* | |

|---|---|

| 1990 | 17,395 |

| 2005 | 14,189 |

| 2010 | 14,444 |

| 2015 | 12,333 |

| 2022 | 12,889 |

| 2024 | 12,760 |

| *December for each year shown. Source: U.S. Bureau of Labor Statistics | |

Economists who have studied the trend conclude that the main factors behind the decline of manufacturing employment include continuous automation, significant gains in productivity across much of the sector, and shifts in aggregate demand and consumption away from goods and toward services. Trade policy has also played a part, notably China’s entry into the World Trade Organization (WTO) in 2001 and the subsequent dramatic expansion of its role in global manufacturing supply chains.

Contrary to what President Trump suggests, manufacturing’s shrinking place in the overall economy is not a uniquely American phenomenon. As Harvard economist Robert Lawrence recently observed “the employment share of manufacturing is declining in mature economies regardless of their overall industrial policy approaches. The trend is apparent both in economies that have adopted free-market policies… and in those with interventionist policies… All of the evidence points to deep and powerful forces that drive the long-term decline in manufacturing’s share of jobs and GDP as countries become richer.”

This brings us back to the president’s seeming determination to rapidly ramp up manufacturing investment and production as a core element of his “America First” program. An important issue overlooked by the administration is where to find the workers to staff a resurgent U.S. manufacturing sector. For while manufacturing has become a notably “capital-intensive” part of the U.S. economy, workers are still needed. And today, it’s hard to see where they will be found. This is especially true given the Trump administration’s well-advertised skepticism about the benefits of immigration.

According to the U.S. Bureau of Labor Statistics, the current unemployment rate across America’s manufacturing industries collectively stands at a record low 2.9 per cent, well below the economy-wide rate of 4.5 per cent. In a recent survey by the National Association of Manufacturers, almost 70 per cent of American manufacturers cited the inability to attract and retain qualified employees as the number one barrier to business growth. A cursory look at the leading industry trade journals confirms that skill and talent shortages remain persistent in many parts of U.S. manufacturing—and that shortages are destined to get worse amid the expected significant jump in manufacturing investment being sought by the Trump administration.

As often seems to be the case with Trump’s stated policy objectives, the math surrounding his manufacturing agenda doesn’t add up. Manufacturing in America is in far better shape than the president acknowledges. And a tariff-driven avalanche of manufacturing investment—should one occur—will soon find the sector reeling from an unprecedented human resource crisis.

Jock Finlayson

Senior Fellow, Fraser Institut

-

Health2 days ago

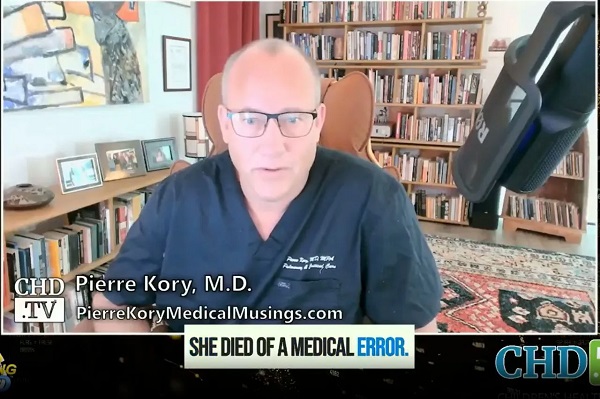

Health2 days agoRFK Jr. says ‘everything is going to change’ with CDC vaccine policy in Michael Knowles interview

-

Business2 days ago

Business2 days agoLabor Department cancels “America Last” spending spree spanning five continents

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

Addictions2 days ago

Addictions2 days agoThere’s No Such Thing as a “Safer Supply” of Drugs

-

Uncategorized13 hours ago

Uncategorized13 hours agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

Censorship Industrial Complex10 hours ago

Censorship Industrial Complex10 hours agoWelcome to Britain, Where Critical WhatsApp Messages Are a Police Matter

-

Economy1 day ago

Economy1 day agoClearing the Path: Why Canada Needs Energy Corridors to Compete

-

International23 hours ago

International23 hours agoTrump signs executive order to make Washington D.C. “safe and beautiful”