Alberta

Budget 2023 – Alberta’s Affordability Action Plan

Budget 2023 funds ongoing programs and services that support Albertans and builds on Alberta’s Affordability Action Plan, expanding relief for high utility costs and providing new measures for students, workers in the social services and disability sectors, and in continuing care.

Alberta’s government is permanently extending the natural gas rebate program. Moving forward, whenever natural gas prices exceed $6.50 per gigajoule, the rebate will take effect.

“Inflation continues to challenge Albertans, and affordability remains top of mind for many. That’s why we are working hard to save Albertans money so they can focus on what really matters. Budget 2023’s strong affordability measures – including extended fuel tax relief, continued utility rebates and new supports for students and social services workers – will help to keep life affordable for families, seniors, individuals and vulnerable groups across the province.”

Supporting post-secondary students

Post-secondary students in Alberta will see real relief, thanks to $238 million for new, targeted affordability measures.

Budget 2023 caps tuition fee increases for domestic students at two per cent annually effective for the 2024-25 school year.

Students receiving financial assistance will get more help repaying their loans, with an extension of the student loan grace period from six months to one year and an increase to the threshold for eligibility for the loan repayment assistance plan to $40,000, up from $25,000 in income.

Albertans repaying student loans will see their payments drop by an average of $15 per month thanks to the new student loan interest rate being reduced from prime plus one per cent to prime.

“These new measures will help all students keep up with the increased cost of living. We are committed to keeping post-secondary education accessible and affordable so that all Albertans can gain the skills and knowledge they need to build successful careers and secure Alberta’s future.”

Supporting families

Parents shouldn’t have to choose between filling up the car and putting food on the table. Budget 2023 leaves more money in the pockets of Alberta families by funding affordability measures, including direct payments of $100 per month through June 2023. All parents or guardians of a dependent under 18 can still apply to get $100 per month for six months for each child if their adjusted household income is below $180,000, based on the 2021 tax year.

Through Budget 2023, investments of $90 million over three years will help secure more supports for families with young children by indexing the Alberta Child and Family Benefit to inflation, increasing benefit amounts by six per cent in 2023.

Enabling parents to expand their families and helping more children find their forever home by making in-Alberta adoptions more affordable is an important initiative in Budget 2023. Alberta’s government is investing $12 million more over three years and providing supplementary health benefits for children adopted from government care or through licensed adoption agencies to ensure more successful adoptions. In addition, there is $6,000 in grant funding for prospective adoptive parents making less than $180,000 a year and an increase of the provincial adoption expense tax credit to $18,210 to match the federal threshold in 2023.

Budget 2023 allocates $1.3 billion in 2023-24, $1.4 billion in 2024-25 and $1.6 billion in 2025-26 in operating expense in the Child Care program from provincial funding and Alberta federal-provincial child-care agreements.

An additional operating expense of $143 million over three years responds to the increasing complexity of children receiving child intervention services and an additional $26 million over three years will support youth and young adults in care transitioning to adulthood.

“We want a better future for our children, which is why we are continuing to prioritize making high-quality child care more affordable and accessible for Alberta families. We are also providing more supports to reduce barriers in the adoption process as well as increasing supports for vulnerable children and youth in care while advancing our government’s priority of making life more affordable for all Albertans.”

Supporting seniors and other vulnerable Albertans

Seniors aged 65 and over with a household income under $180,000 based on the 2021 tax year are still eligible to receive direct payments of $100 per month for six months (January 2023 to June 2023).

Albertans who receive the Alberta Seniors Benefit, AISH and Income Support have been automatically enrolled to receive the same Affordability Relief Payments of $600 over six months.

Alberta’s government is further supporting seniors, low-income and vulnerable Albertans with a six per cent increase to core benefits in 2023. Benefits including AISH, Income Support and the Alberta Seniors Benefit are indexed to inflation, which is helping Albertans combat today’s increased cost of living.

Budget 2023 helps put food on Albertans’ tables by funding local food banks, including $10-million direct funding through the Family and Community Support Services Association of Alberta and $10 million to match private donations, over two years.

Alberta’s government values the work done by disability service providers and workers throughout the province in caring for the disability community. That is why Budget 2023 provides a five per cent increase to the disability sector to help with administration costs in Persons with Developmental Disabilities (PDD) and Family Support for Children with Disabilities (FSCD) provider contracts and family-managed agreements.

It is important that Albertans are able to get to and from work, to a doctor’s appointment, the grocery store or a pharmacy. To support low-income transit pass programs, Budget 2023 is investing $16 million in 2023-24 to support municipalities throughout the province as they provide affordable transit to their residents.

“For so many seniors, low-income individuals and Albertans living with disabilities, the increased cost of living has made life more and more difficult to afford. Alberta’s government is continuing to take steps to support these individuals and families, which I know will have a huge impact for many households across the province.”

Supporting social services and disability services workers

The government is helping to attract and retain more social service workers to support more people in need. Budget 2023 includes $102 million in 2023-24 to increase wages for more than 20,000 workers in disability services, homeless shelters and family violence prevention programs. This funding builds on the $24 million the government provided to service providers in February to enable wage increases retroactive to Jan. 1, 2023.

Alberta’s government is also providing $8 million in 2023-24 for disability service providers to address increasing administrative costs.

Budget 2023 secures Alberta’s bright future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

Alberta

Province introducing “Patient-Focused Funding Model” to fund acute care in Alberta

Alberta’s government is introducing a new acute care funding model, increasing the accountability, efficiency and volume of high-quality surgical delivery.

Currently, the health care system is primarily funded by a single grant made to Alberta Health Services to deliver health care across the province. This grant has grown by $3.4 billion since 2018-19, and although Alberta performed about 20,000 more surgeries this past year than at that time, this is not good enough. Albertans deserve surgical wait times that don’t just marginally improve but meet the medically recommended wait times for every single patient.

With Acute Care Alberta now fully operational, Alberta’s government is implementing reforms to acute care funding through a patient-focused funding (PFF) model, also known as activity-based funding, which pays hospitals based on the services they provide.

“The current global budgeting model has no incentives to increase volume, no accountability and no cost predictability for taxpayers. By switching to an activity-based funding model, our health care system will have built-in incentives to increase volume with high quality, cost predictability for taxpayers and accountability for all providers. This approach will increase transparency, lower wait times and attract more surgeons – helping deliver better health care for all Albertans, when and where they need it.”

Activity-based funding is based on the number and type of patients treated and the complexity of their care, incentivizing efficiency and ensuring that funding is tied to the actual care provided to patients. This funding model improves transparency, ensuring care is delivered at the right time and place as multiple organizations begin providing health services across the province.

“Exploring innovative ways to allocate funding within our health care system will ensure that Albertans receive the care they need, when they need it most. I am excited to see how this new approach will enhance the delivery of health care in Alberta.”

Patient-focused, or activity-based, funding has been successfully implemented in Australia and many European nations, including Sweden and Norway, to address wait times and access to health care services, and is currently used in both British Columbia and Ontario in various ways.

“It is clear that we need a new approach to manage the costs of delivering health care while ensuring Albertans receive the care they expect and deserve. Patient-focused funding will bring greater accountability to how health care dollars are being spent while also providing an incentive for quality care.”

This transition is part of Acute Care Alberta’s mandate to oversee and arrange for the delivery of acute care services such as surgeries, a role that was historically performed by AHS. With Alberta’s government funding more surgeries than ever, setting a record with 304,595 surgeries completed in 2023-24 and with 310,000 surgeries expected to have been completed in 2024-25, it is crucial that funding models evolve to keep pace with the growing demand and complexity of services.

“With AHS transitioning to a hospital-based services provider, it’s time we are bold and begin to explore how to make our health care system more efficient and manage the cost of care on a per patient basis. The transition to a PFF model will align funding with patient care needs, based on actual service demand and patient needs, reflecting the communities they serve.”

“Covenant Health welcomes a patient-focused approach to acute care funding that drives efficiency, accountability and performance while delivering the highest quality of care and services for all Albertans. As a trusted acute care provider, this model better aligns funding with outcomes and supports our unwavering commitment to patients.”

“Patient-focused hospital financing ties funding to activity. Hospitals are paid for the services they deliver. Efficiency may improve and surgical wait times may decrease. Further, hospital managers may be more accountable towards hospital spending patterns. These features ensure that patients receive quality care of the highest value.”

Leadership at Alberta Health and Acute Care Alberta will review relevant research and the experience of other jurisdictions, engage stakeholders and define and customize patient-focused funding in the Alberta context. This working group will also identify and run a pilot to determine where and how this approach can best be applied and implemented this fiscal year.

Final recommendations will be provided to the minister of health later this year, with implementation of patient-focused funding for select procedures across the system in 2026.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney To Ban Free Speech if Elected

-

2025 Federal Election2 days ago

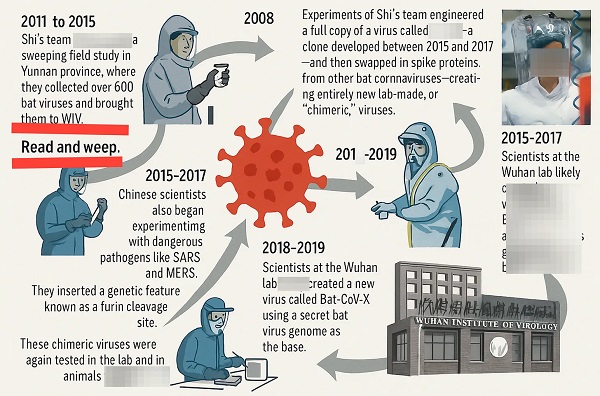

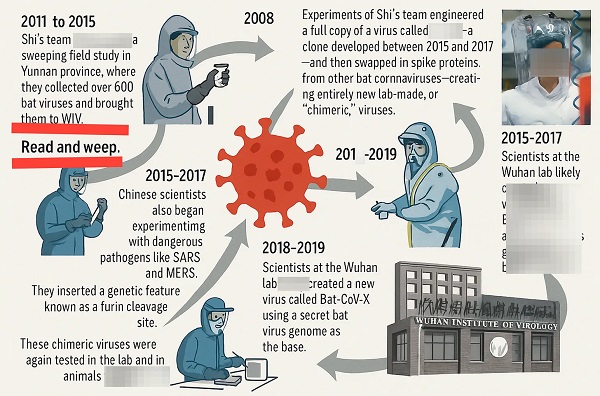

2025 Federal Election2 days agoBLOCKBUSTER REPORT: Canada’s ties to Wuhan Institute of Virology and creation of COVID uncovered by Sam Cooper of The Bureau

-

Freedom Convoy1 day ago

Freedom Convoy1 day agoA Miscarriage of Justice

-

Business2 days ago

Business2 days agoTrumpian chaos—where we are now and what’s coming for Canada

-

espionage2 days ago

espionage2 days agoHong Kong Detains Parents of Activist Frances Hui Amid $1M Bounty, Echoing Election Interference Fears in Canada

-

Business2 days ago

Business2 days agoClosing information gaps to strengthen Canada’s border security and track fentanyl

-

Health1 day ago

Health1 day agoExpert Medical Record Reviews Of The Two Girls In Texas Who Purportedly Died of Measles

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoPPE Videos, CCP Letters Reveal Pandemic Coordination with Liberal Riding Boss and Former JCCC Leader—While Carney Denies Significant Meeting In Campaign