Business

BlackRock’s woke capitalist vision is failing: here’s why

Larry Fink, New York Times DealBook 2022. Thos Robinson/Getty Images for The New York Times

From LifeSiteNews

By Frank Wright

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission

The always engaging James Corbett has produced some of the most informative guides to the power of BlackRock – who together with second-placed Vanguard Group own a combined 15 trillion U.S. dollars of assets under management.

In this report I relate how Corbett argues for a fightback against BlackRock and the asset management giants like them, who use their power to shape the world regardless of public consent. His views are more than corroborated by the news which followed the release of his video.

Corbett’s September 21 presentation, “How to Defeat BlackRock,” followed up by his excellent, “How BlackRock Conquered the World,” begins with some very encouraging news about the fortunes of the global investment giants – and what can be done to stop them. Happily, this process is already underway.

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission.

According to Corbett, and a growing number of other sources, this pressure looks likely to force asset management giants like BlackRock out of the behavior business altogether.

READ: How Vanguard and BlackRock took control of the global economy

A faltering global agenda

The first piece of good news is that the brand of ESG (environmental, social and governance) is so toxic that not even BlackRock’s CEO wants to use it any more.

BlackRock, under the leadership of Larry Fink, has used its immense wealth for years to compel companies to adopt the ESG agenda, becoming the driving force of “woke” capitalism. Yet leveraging financial power to force social and political change in this way has led to a backlash – from the general public, from lawmakers – and from the financial sector itself.

Last December, the North Carolina State Treasurer Dale R. Folwell called for Fink’s resignation, threatening to withdraw over $14 billion in state funds from the investment firm. As The Daily Mail reported, Folwell said:

Fink is in ‘pursuit of a political agenda… A focus on ESG is not a focus on returns and potentially could force us to violate our own fiduciary duty.’

Six months later, in June 2023, Fink said he was “ashamed” of ESG which he said had become “politically weaponized.”

Though his company, BlackRock, has continued to rate businesses on the same criteria, it has removed almost every mention of the term from its communications.

Speaking in Aspen, Colorado, Fink admitted that the decision of Florida Governor Ron DeSantis to withdraw $2 billion in state assets managed by BlackRock had hurt the company. The ESG agenda advanced by BlackRock is so beleaguered, even its former champion will not speak its name.

The power of public opinion

What this shows, as Corbett argues, is a further piece of good news: that public opinion still matters. It is public knowledge of the unelected political meddling of BlackRock and others which has led to outrage – and to action.

As a result of extensive coverage – mainly from independent media – of the nefarious influence of his company, Larry Fink has faced sustained criticism for over a year. This in turn has led to the kind of legal and financial consequences which have made people like Fink think again.

READ: How Larry Fink uses ESG and AI to control the world’s money

This also shows why so much money is invested in propaganda, censorship and “narrative control.” Governments and corporations are afraid of a well-informed public, because such a public is very likely to demand they are held to account.

The case of BlackRock not only shows that what is in your mind can indeed matter, but also that the goliaths of globalism do not always win.

This is one reason for the ongoing information war, and the growing censorship-industrial complex. An informed citizenry has the power to hold the powerful to account. Taken together, public outrage can also move markets – and the money men who watch them.

I investigated some of the claims Corbett made about the financial world’s mounting unease with the involvement of BlackRock, Vanguard and other firms in pushing unelected political and social change. I found more cause for celebration than even Corbett himself would admit at the time.

Passive investments, legal actions

In further good news, mounting legal troubles have accompanied the practice of companies like BlackRock, Vanguard and State Street to leverage their enormous asset piles into social and political compliance engineering.

According to a June 2023 report from RIAbiz, an online journal for registered investment advisers (RIAs), BlackRock and Vanguard’s “fooling around” with ESG targets has left them exposed to prosecution.

The business of managing many assets is supposed to be “passive” – a legal term which means that companies such as BlackRock are prohibited from “exercising control” of the companies whose funds they manage.

Federal exemptions had been granted to these asset management giants, but their habit of forcing behaviors on issues such as carbon “net zero” and “diversity” has placed their capacity to do business in jeopardy.

In May of this year, BlackRock and Vanguard saw a legal challenge emerge, and one which not only deters investors, but may also lead to their being broken up.

As Oisin Breen reported on June 1:

Seventeen AGs moved on May 10 against BlackRock on the grounds that its climate-based activism and its pro-ethical, governance and social (ESG) stance make it an active investor, in breach of a FERC antitrust agreement.

The Federal Energy Regulatory Commission (FERC) is involved due to BlackRock’s – and Vanguard’s – holdings in domestic energy utilities. Breen continues:

Separately, 13 AGs filed a motion to block Vanguard from renewing its FERC exemption. They represent mostly energy-producing states like Texas, as do the 17 now pressing to have BlackRock’s exemption revoked.

Though Breen concluded that both firms had “won a reprieve” from immediate legal censure, the message appears to have been received.

Three months later, Fortune magazine reported:

Finance giants BlackRock and Vanguard – once ESG’s biggest proponents – seem to be reversing course.

Hitting the bottom line

The global business publication noted the legal complications of mixing finance with social, environmental and governance policies, saying:

It appears these strategic shifts are being driven by a combination of public backlash and a focus on their bottom lines.

Then, on October 23, leading U.S. insurance brokerage WTW reported that BlackRock, Vanguard and State Street had all seen significant drops in their total amounts of assets under management (AUM). BlackRock’s alone fell from over 10 trillion dollars to just over 8 trillion.

By October 31, Fortune returned with the verdict that BlackRock, Vanguard and State Street had all “turned against environment and social proposals… in a clear sign of backlash.”

Their report noted a “precipitous” fall in the support of all three asset giants’ commitment to these agendas – with BlackRock’s funding of “ESG” measures falling by over 30 percent from 2021.

Real world consequences

This is the delayed result of a reality which BlackRock themselves acknowledged – and one which drove much of the public disapproval – that the ESG agenda was an economic and social wrecking ball.

Remarkably, BlackRock itself admitted that its promotion of ESG, in the aggressive pursuit of net zero and diversity policies, had actually contributed to a severe economic downturn.

In its “2023 Outlook,” the asset giant said these initiatives had been a major factor in ending the decades-long period of prosperity in the West known as the Great Moderation.

READ: The End of Prosperity? How BlackRock manipulates the West’s economic downturn

Buycotts – not boycotts

In his video Corbett is frank about the limitations of individual consumer power. You cannot “access BlackRock directly,” as it is a management firm. You can, of course, withdraw support from the companies in which it and its fellow behemoths Vanguard and State Street have holdings.

Yet Corbett moves from boycotts of individual corporations to the intriguing concept of “buycotts.” What he means by this is “taking your money from the corporations and using it to build things you want to see.”

How realistic is this solution? Already, businesses are emerging to capitalize on growing public discontent with what is done with their money – without their consent or approval.

Changing our behaviors – for good

The investment platform Reverberate, for example, allows users to “Rate companies highly (over 2.5 stars) if they make your life better, or lower if they make your life worse.”

What is more, user feedback from the public will determine which shares it buys:

Our publicly-traded investment fund buys shares of companies whose average ratings are high and/or rising, and sells shares of those whose average ratings are low and/or falling.

On their website, Reverberate says:

This is our way of trying to align capital allocation with the interests of the general public, as estimated by us in a relatively unbiased, wide-reaching way.

The decline of the asset managers’ ESG agenda is a happy corrective to the damaging belief that nothing can be done about anything.

It shows how well-informed public opinion can lead to genuine change, and with some of Corbett’s insights, how we can move from complaint to constructive action in making a better world.

You can see Corbett’s entertaining case for countering the woke asset management giants here.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

Automotive

Electric cars just another poor climate policy

From the Fraser Institute

The electric car is widely seen as a symbol of a simple, clean solution to climate change. In reality, it’s inefficient, reliant on massive subsidies, and leaves behind a trail of pollution and death that is seldom acknowledged.

We are constantly reminded by climate activists and politicians that electric cars are cleaner, cheaper, and better. Canada and many other countries have promised to prohibit the sale of new gas and diesel cars within a decade. But if electric cars are really so good, why would we need to ban the alternatives?

And why has Canada needed to subsidize each electric car with a minimum $5,000 from the federal government and more from provincial governments to get them bought? Many people are not sold on the idea of an electric car because they worry about having to plan out where and when to recharge. They don’t want to wait for an uncomfortable amount of time while recharging; they don’t want to pay significantly more for the electric car and then see its used-car value decline much faster. For people not privileged to own their own house, recharging is a real challenge. Surveys show that only 15 per cent of Canadians and 11 per cent of Americans want to buy an electric car.

The main environmental selling point of an electric car is that it doesn’t pollute. It is true that its engine doesn’t produce any CO₂ while driving, but it still emits carbon in other ways. Manufacturing the car generates emissions—especially producing the battery which requires a large amount of energy, mostly achieved with coal in China. So even when an electric car is being recharged with clean power in BC, over its lifetime it will emit about one-third of an equivalent gasoline car. When recharged in Alberta, it will emit almost three-quarters.

In some parts of the world, like India, so much of the power comes from coal that electric cars end up emitting more CO₂ than gasoline cars. Across the world, on average, the International Energy Agency estimates that an electric car using the global average mix of power sources over its lifetime will emit nearly half as much CO₂ as a gasoline-driven car, saving about 22 tonnes of CO₂.

But using an electric car to cut emissions is incredibly ineffective. On America’s longest-established carbon trading system, you could buy 22 tonnes of carbon emission cuts for about $660 (US$460). Yet, Ottawa is subsidizing every electric car to the tune of $5,000 or nearly ten times as much, which increases even more if provincial subsidies are included. And since about half of those electrical vehicles would have been bought anyway, it is likely that Canada has spent nearly twenty-times too much cutting CO₂ with electric cars than it could have. To put it differently, Canada could have cut twenty-times more CO₂ for the same amount of money.

Moreover, all these estimates assume that electric cars are driven as far as gasoline cars. They are not. In the US, nine-in-ten households with an electric car actually have one, two or more non-electric cars, with most including an SUV, truck or minivan. Moreover, the electric car is usually driven less than half as much as the other vehicles, which means the CO₂ emission reduction is much smaller. Subsidized electric cars are typically a ‘second’ car for rich people to show off their environmental credentials.

Electric cars are also 320–440 kilograms heavier than equivalent gasoline cars because of their enormous batteries. This means they will wear down roads faster, and cost societies more. They will also cause more air pollution by shredding more particulates from tire and road wear along with their brakes. Now, gasoline cars also pollute through combustion, but electric cars in total pollute more, both from tire and road wear and from forcing more power stations online, often the most polluting ones. The latest meta-study shows that overall electric cars are worse on particulate air pollution. Another study found that in two-thirds of US states, electric cars cause more of the most dangerous particulate air pollution than gasoline-powered cars.

These heavy electric cars are also more dangerous when involved in accidents, because heavy cars more often kill the other party. A study in Nature shows that in total, heavier electric cars will cause so many more deaths that the toll could outweigh the total climate benefits from reduced CO₂ emissions.

Many pundits suggest electric car sales will dominate gasoline cars within a few decades, but the reality is starkly different. A 2023-estimate from the Biden Administration shows that even in 2050, more than two-thirds of all cars globally will still be powered by gas or diesel.

Source: US Energy Information Administration, reference scenario, October 2023

Fossil fuel cars, vast majority is gasoline, also some diesel, all light duty vehicles, the remaining % is mostly LPG.

Electric vehicles will only take over when innovation has made them better and cheaper for real. For now, electric cars run not mostly on electricity but on bad policy and subsidies, costing hundreds of billions of dollars, blocking consumers from choosing the cars they want, and achieving virtually nothing for climate change.

-

2025 Federal Election1 day ago

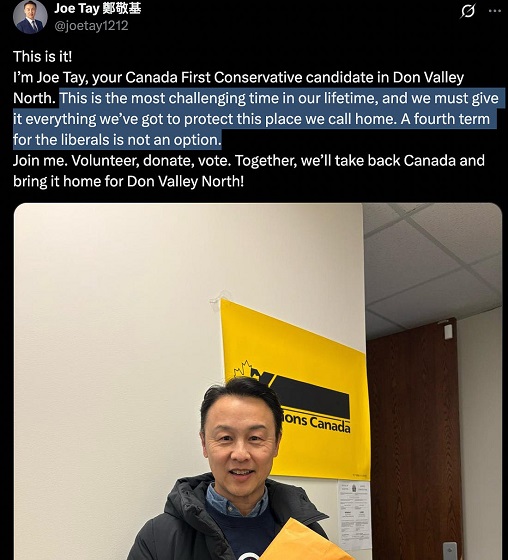

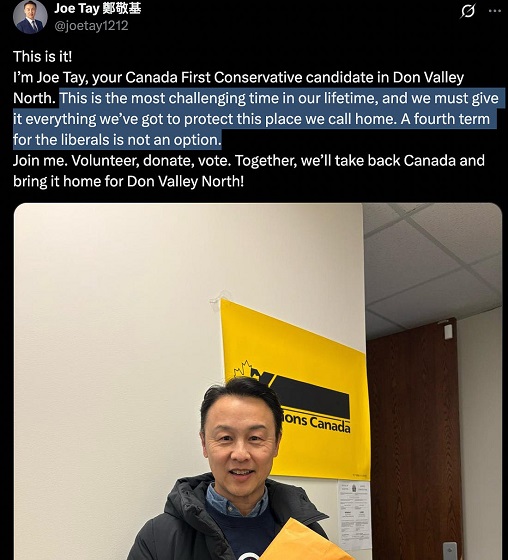

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

Daily Caller19 hours ago

Daily Caller19 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority