Crime

Biden’s Illegal Immigration Problem Has Gone From Bad To Worse As High-Profile Murders Rock US

From the Daily Caller News Foundation

From the Daily Caller News Foundation

A slate of high-profile crimes against women, allegedly committed at the hands of illegal migrants, has brought the issue of illegal immigration into sharper focus as the 2024 presidential election draws closer.

The killing of a nursing student in Georgia, the rape and murder of mother of five in Maryland, the strangulation killing of 12-year-old girl in Texas and several other significant local crimes has steadily compiled in recent months, prompting the passage of new legislation at the state level and keeping immigration in the news. The negative headlines have forced President Joe Biden, already dealing with low marks on immigration due to the ongoing border crisis, to remain on the defensive.

Biden was pushed into speaking about one significant murder during his most recent State of the Union speech.

“Lincoln [Laken] Riley, an innocent young woman who was killed,” Biden began to say during the 2024 State of the Union address. The president was speaking about border security when Georgia GOP Rep. Marjorie Taylor Greene yelled at him to “say her name.”

Biden held up a pin given to him by Greene and began to speak about the murder that took place a month prior.

“By an illegal. That’s right,” he said. “But how many of thousands of people are being killed by legals? To her parents, I say: My heart goes out to you. Having lost children myself, I understand.”

Riley — a nursing student living in Athens, Georgia — was abducted and murdered while jogging near the University of Georgia campus on Feb. 22. She died from blunt force trauma to the head, a coroner determined.

José Antonio Ibarra, a 26-year-old Venezuelan national, was subsequently arrested for her murder. Immigration and Customs (ICE) later confirmed that Ibarra entered the country illegally, further sparking statewide and national backlash.

The murder was followed by a recall campaign against Athens, Georgia, Mayor Kelly Girtz, the sheriff and the district attorney, with constituents calling on them to resign. Despite Girtz repeatedly saying in public that Athens was not a “sanctuary” city, unearthed emails revealed the mayor stating that he supported the town’s current policy of not being fully cooperative with immigration detainer requests.

At the state level, Riley’s killing was followed by Georgia Gov. Brian Kemp, a Republican, signing into law legislation that sheriffs cooperate with federal immigration authorities or else risk losing state funding. The new law mandates local jailers hold any foreign national in their custody when they are wanted by ICE agents.

As more details emerged about how Ibarra was able to be released into the U.S. and his brother’s alleged ties to a Venezuelan prison gang former President Donald Trump, an immigration hawk, highlighted the crime on the campaign trail. The Republican candidate met with Riley’s family at a Georgia campaign rally in March, and was photographed embracing them before a crowd.

“He’s got no remorse, he’s got no regret. He’s got no empathy,” Trump said of the current president. “No compassion, and worst of all, he has no intention of stopping the deadly invasion that stole precious Laken’s beautiful, American life.”

Riley’s killing proved to be just the first local crime involving immigration this year that rocketed to national attention.

The body of 12-year-old Jocelyn Nungaray was found floating in a north Houston creek in June. Following several days of investigation, local law enforcement arrested two Venezuelan nationals, 21-year-old Johan Jose Rangel Martinez and 26-year-old Franklin Jose Pena Ramos.

DNA tests determined that the 12-year-old had been sexually assaulted before she was strangled to death. Prosecutors believe both men tied her up, pulled her pants down, sexually assaulted her and then suffocated her before dumping her body in a nearby creek.

Federal immigration authorities soon confirmed that both men were living in the U.S. illegally, with one of them having only been in the country less than a month before allegedly killing the young girl. The incident immediately attracted national attention, with the House Homeland Security Committee later publishing a report that questioned why both men were released into the U.S. when there was more than enough detention space to keep them in physical detention at the time they illegally crossed the border.

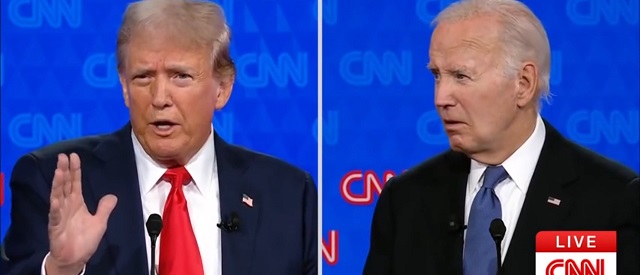

The alleged crime was not forgotten by Trump, even moments before the first 2024 presidential debate. The former president called Jocelyn’s mother just 10 minutes before his first debate with Biden to express his condolences, a gesture that reportedly “shocked” her, according to the New York Post.

It wasn’t the only time Trump reached out to an angel family that month.

The family of Rachel Morin, a Maryland mother of five who was allegedly murdered by an illegal migrant, revealed last month they were “deeply touched” by Trump’s outreach following news that a suspect had finally been apprehended.

“I am deeply touched by President Trump’s kindness and concern,” Patty Morin, Rachel’s mother, said in a statement released by the family’s attorney. “He was genuine and truly wanted to know how our family was coping.”

Authorities confirmed that Morin’s alleged killer, 23-year-old Victor Antonio Martinez-Hernandez, is also wanted for the murder of a woman in his home country of El Salvador — making him one of many illegal migrants who were able to enter the U.S. despite being wanted abroad for various heinous crimes.

The slate of killings have put a microscope on illegal immigration, a topic already of major concern for American voters as the border crisis has raged on. Under Biden, Border Patrol agents have encountered more than seven million migrants crossing illegally into the U.S. between ports of entry, according to the latest data by Customs and Border Protection (CBP).

Biden has enjoyed, very recently, a slowdown of migrant apprehensions thanks in large part to a crackdown by the Mexican government and an executive order last month that seeks to control the number of migrants seeking asylum. However, critics maintain that the record levels of illegal migration experienced under his tenure remain a problem of his doing.

In the first year of his presidency, Biden undertook 296 executive actions on immigration, according to an analysis by the Migration Policy Institute. Of those presidential proclamations, 89 specifically reversed or began the process of undoing Trump’s immigration policies — and Biden has undone major Trump-era policy initiatives, such as the shutdown of the Remain in Mexico program and the nixing of new border wall construction.

The president has also recently granted mass amnesty to half a million illegal migrants married to U.S. citizens — a move that critics say will only encourage more illegal immigration.

“There’s no reason to doubt that the Biden administration — with its history of paroling inadequately vetted, inadmissible aliens into the country — will rubber-stamp every application under the President’s executive order, thus granting half a million or more illegal immigrants permanent residency and, eventually, citizenship,” Erik Ruark, director of research for NumbersUSA, said in a statement to the Daily Caller News Foundation.

“Amidst an historic border crisis, President Biden’s illegal amnesty sends would-be migrants the message that our borders remain wide open, and that they will eventually be rewarded if they can get into the country,” Ruark continued.

The White House did not respond to a request for comment from the DCNF.

(Featured Image Media Credit: Screenshot/Rumble/CNN)

Crime

Project Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

U.S. surveillance image shows one of Sai Zhang’s top lieutenants crossing into Mexico with a money courier for the Sinaloa cartel. The photo revealed critical ties between Zhang’s transnational money laundering and drug trafficking operation and one of North America’s dominant fentanyl distributors.

Sam Cooper

Sam Cooper

Former senior DEA official describes covert global financial ecosystem tying Chinese students, Sinaloa fentanyl sales, cartel cash collection, and PRC state-linked infrastructure deals.

In January 2021, a grainy black-and-white surveillance photo quietly accelerated one of the most consequential geopolitical investigations in recent times — a case with influence over border security, trade policy, and tariff disputes shaping our era.

Captured at the U.S.-Mexico border, the image showed a thick-set Chinese man wearing a COVID-era face mask driving alongside a Mexican man — a key money launderer for the Sinaloa cartel. The Chinese man turned out to be a senior operative working for Sai Zhang, a younger Chinese international student living in the United States on a student visa.

To a small group of U.S. federal agents, the photo revealed a thread they had been painstakingly unraveling since 2018, part of an ongoing investigation known as Project Sleeping Giant.

The overarching task force, launched by senior DEA agent Don Im — whose career was built on decoding China’s paramount role in global money laundering and supply of chemicals used to produce methamphetamine and fentanyl — aimed to bring cases against Latin cartels working with Chinese money launderers.

This photo was the first concrete step toward proving a direct, operational bridge between Chinese underground banking networks and the blood-soaked heart of Mexico’s most notorious cartel.

While evidence of Sai Zhang’s commanding role in orchestrating Sinaloa fentanyl cash flows was stunning, the involvement of Chinese student networks followed its own curious logic, Im explained in an interview.

“Chinese banking networks were operating in the U.S. long before Zhang linked up with the Sinaloa cartel,” Im said, describing the system in which Chinese buyers bid on pools of drug cash collected in cities worldwide, paying a premium to receive laundered dollars in American locations and investments of their choosing. “The buyers were mostly wealthy Chinese seeking dollars for real estate or tuition in America. Payments were made in yuan through Chinese accounts. In return, Mexican cartels received goods or cash.”

In exclusive interviews, Im revealed in unprecedented details the breathtaking complexity of China’s global drug money laundering networks — a system of Byzantine paths that Sleeping Giant helped map and penetrate. The troubling implications help explain why Washington is now imposing trade sanctions targeting China and countries deeply entwined with its export-driven economy.

At the heart of it, Beijing’s centralized economic apparatus and the Chinese Communist Party’s regional governors knowingly align with global drug barons — channeling fentanyl cash, reintegrating it into China’s factory output, and exporting drug-funded “legitimate” goods worldwide. Meanwhile, Chinese immigrants and travelers access the other side of this narco-banking system, using it to bankroll overseas investments and strengthen the reach of the Chinese diaspora.

It is a system that works for China’s government and citizens alike — on the micro level, it pays for tuition and housing for Chinese students in America; on the macro level, it helps fund Xi Jinping’s Belt and Road infrastructure projects abroad, designed to bind other states more closely to China through trade, debt, and ultimately elite corruption. According to Im, the chemical precursors fueling the production of fentanyl, methamphetamine, and ecstasy in parts of Europe — as well as in countries like Canada and Mexico — are woven into this Belt and Road system.

“Their Belt and Road Initiative is now in over a hundred-and-some-odd countries — with ports, airports, shipping lanes, roads, highways, trains. And all of China’s precursor chemicals are being offloaded,” Im said. “Right now, China’s economy is in dire straits, and they’re looking for capital to pay off debt, fund projects, make investments, or transfer wealth out of China. And that’s huge business. It involves provincial authorities engaged in various organized crime activities, including bribery, intimidation, kickbacks, and providing tariff breaks to known illicit drug and chemical suppliers.”

Don Im has testified on these findings before Congress, and related U.S. government investigations have shown that Beijing provides tax incentives to fentanyl factories.

As Sleeping Giant revealed, a critical cog in Beijing’s Trojan horse system is the Chinese student visitor — exemplified by figures like Sai Zhang.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

The Student Banker

Sai Zhang arrived in the United States on a student visa. By the late 2010s, he had quietly transformed himself into a key broker in a vast underground banking network centered in Southern California. His customers were wealthy Chinese nationals circumventing Beijing’s strict $50,000 annual foreign exchange cap.

Zhang’s operation was deceptively elegant. He tapped into the surplus of U.S. dollars held by Mexican drug cartels from opioid-ravaged eastern states such as North Carolina to cartel-influenced streets in Los Angeles. The Sinaloa drug barons, flush with cash from fentanyl, meth, and cocaine sales, needed a discreet and cost-effective way to convert their U.S. dollar profits back into pesos in Mexico.

Zhang’s network — as is true for all Chinese money brokers — clipped both sides of the ticket, offering direct or indirect services to Mexican cartels, Chinese factory producers, Chinese diaspora retailers across Europe and the western hemisphere who sell Chinese goods, and Chinese citizens seeking to import their yuan-denominated wealth, receiving non-traditional banking payouts in American cities.

So Zhang bought the Sinaloa cartel’s fentanyl cash dollars at a discount, resold them at a premium to Chinese buyers, and closed a loop that turned violent, street-level drug cash into fuel for China’s GDP.

But for U.S. prosecutors working alongside DEA street teams, what had long been known by detectives since the landmark case of Mexican-Chinese methamphetamine baron Zhenli Ye Gon—that is, the deep integration between Chinese and Mexican narco networks—still had to be painstakingly proven in court.

For Sai Zhang, this meant cutting through a labyrinth of protective layers carefully constructed to shield elite money brokers from exposure.

As described in voluminous U.S. court records—and corroborated in detail by Don Im—Zhang relied on a sophisticated chain of cash couriers, brokers, and money mules to keep himself insulated from street-level narcotics transactions. DEA surveillance teams tracked network operators to numerous cash stash houses and clandestine parking lot exchanges, often coming tantalizingly close yet narrowly missing opportunities to link Zhang’s cash directly to drug shipments.

One example is detailed in the affidavit of lead investigator Steven Gonzales. Surveillance teams tracked Xuanyi Mu and Hang Su from the “Naomi Avenue” stash house in Arcadia to a parking lot, where they met Elizabeth Sevilla-Mendoza, a known narcotics courier. Su collected an orange tote bag from her before returning to her black Mercedes-Benz. Officers then directed a traffic stop and deployed a K-9 unit, which alerted to the scent of narcotics on the bag. Inside, agents discovered $34,000 in foil-wrapped cash, neatly stacked and bound with rubber bands.

But within 48 hours of seizing this cash, Zhang’s team shut down the Arcadia stash house, leaving DEA investigators without the drug seizure they needed and cutting off a valuable surveillance node.

The first major break came on October 18, 2022. Acting on a tip from DEA agents in Charlotte, North Carolina, investigators in California zeroed in on a supermarket parking lot in San Gabriel. A wiretap on a Chinese suspected narco in North Carolina named “Mimi” indicated that Sai Zhang had arranged to pick up a $300,000 drug cash payment outside the San Gabriel grocery. Hours later officers watched as a woman in a sleek blue Maserati leaned out and took a black bag — containing about $300,000 in cash — from the driver of a white Ram truck, a Hispanic man.

Gonzalez was well prepared, having spent months quietly briefing local police departments across Los Angeles County on the finely honed clockwork of the Chinese student’s network.

When the DEA called for backup, San Gabriel police launched. They tailed the big Ram truck for hours, weaving through LA’s dense murk until the truck finally stopped in a Compton parking lot. There, the driver transferred two boxes from a silver sedan into his truck. Moments later, officers swooped in, seizing 50 kilos of cocaine — concrete proof that the Chinese money trail led directly to narcotics.

Meanwhile, Steven Gonzalez, DEA’s lead detective, shadowed the blue Maserati east, far from Compton’s industrial edges, finally arriving in Temple City — a quiet suburban enclave in the western San Gabriel Valley, known for its large Chinese community and discreet residential streets. There, a person emerged with a bag and passed it to two women waiting in a car. When officers stopped her car, they found $25,000 in cash — dollars procured through Sai Zhang’s underground WeChat-based cash exchange.

The DEA team ultimately traced the white Ram truck — along with the same silver sedan that had delivered 50 kilos of cocaine to the Ram’s driver — back to a drug stash house in Rowland Heights. In December 2022, they intercepted another driver leaving that residence, seizing $500,000 in cash.

The next link in the Chinese-Sinaloa drug money chain closed the circle—from, in a sense, the Chinese student boss, Sai Zhang, down to his foot soldiers: Chinese exchange students in the United States, lured by the promise of easy spending money, and recruited through WeChat message boards to serve as money mules for organized crime.

These same students come from a vast pool of families whose North American tuition payments are themselves financed with laundered drug proceeds, weaving them even more tightly into fentanyl’s financial web.

A cinematic moment came on April 10, 2023. In the evening dusk officers watched a grocery bag of cash drop from a balcony belonging to one of Sai Zhang’s lieutenants. A Chinese man seen nervously pacing the sidewalk waiting for the bag drop scooped it up and drove off in a black Range Rover.

The Range Rover wound through Los Angeles, stopping at another pickup before heading to a quiet house in North Hills. There, the driver handed two bags to a tall young Chinese man — notable for his studious wire-frame glasses — waiting at the door.

Around midnight, officers knocked. An older woman nervously answered and led them to a bedroom. She told the officers she offered boarding to international exchange students. Under the bed, they found two grocery bags stuffed with $60,000 cash. The room belonged to a Chinese high-school student boarding in the home — a ground-level player in a global money chain, perhaps only vaguely aware, if at all, that their willingness to take “easy” money jobs in a parallel Chinese economy is driving overdose deaths and an overdue crackdown by American lawmakers.

In his affidavit, Steven Gonzales boils down the transnational model exposed by Zhang’s case in these terms: One method by which a Chinese businessman might purchase real estate in Los Angeles—while evading China’s strict currency export controls—involves acquiring U.S. dollars through an underground exchange. To do so, the businessman effectively “buys” dollars from a broker like Zhang who supplies drug cash already circulating in the United States.

In this arrangement, the Chinese investor transfers an equivalent amount of Chinese currency into a designated account in China controlled by the Mexican cartel. Once secured, those funds can then be used—legitimately on the surface—to settle debts owed by the cartel to Chinese manufacturers.

“The money in that account in China can legally be used to pay off legitimate debts to Chinese manufacturers who ship goods to Mexico,” U.S. court filings in Zhang’s indictment say.

The goods are shipped to Mexico, the DEA affidavit continues, where they are sold in the local market. The resulting pesos represent the final value of the drugs initially smuggled and sold in the United States, thereby closing the loop on the cartel’s illicit earnings and providing the Chinese investor with clean dollars to invest in U.S. assets.

Through this intricate scheme, the Chinese businessman successfully acquires the dollars needed to finance his Los Angeles property, while the Mexican traffickers are reimbursed for their American drug revenues.

Gonzales says that this scheme, known as trade-based money laundering, exploits legitimate international trade flows to conceal the movement of criminal proceeds—allowing transnational crime networks to move drugs across borders and launder and reintegrate illicit gains under the appearance of lawful commerce.

Invite your friends and earn rewards

The Belt and Road Driver: Don Im’s Analysis

For Don Im, the story of Zhang is far from new — just another chapter in a book he knows better than almost anyone. “We saw this going back to 2007, during the Zhenli Ye Gon era,” Im said. “It’s a bidding war. Whoever offers the highest price gets the drug dollars from North America and Europe.”

After listening to Don Im in hours of taped interviews, a metaphor suggests itself. China’s grip on the global economy — its underground and aboveground systems at work — is unimaginably complex. Black and white appear divided, but in fact are not. Like an Escher image maze, cash flows up, down, sideways — enters, exits, integrates, vanishes, reappears, reiterates. No exit, no end. A labyrinth of lies.

For this deep-dive story — to help explain the consequences to Western lawmakers, business leaders, and citizens affected by the fentanyl death crisis — Don Im provided sensitive details illustrating the scale and depth of money laundering and financial integration stemming from this narco economy.

“So you’re not seeing a direct, linear transfer of drug proceeds directly into China. You’ll see bulk cash being shipped. You’ll see money that’s placed and laundered within Canada or in the United States through local businesses. Then those funds are pulled into other accounts or investment vehicles—cryptocurrency, other so-called high-value assets, businesses, brick-and-mortar companies. And then they’re all sold again—homes as well.

And what’s that done? It’s offset with transfers of commodities that are equivalent to the millions of dollars or euros that are shipped from various companies in Guangzhou, where now you have, in those regions, thousands of Mexicans, Panamanians, and Colombians living and operating as their own diaspora with those Chinese manufacturing companies. Those companies are receiving orders from the Chinese businessmen in Mexico, Canada, Panama, Vancouver—requesting shipments of textiles, clothing, electronics, everyday products that the Chinese manufacture and we buy here and throughout the world.

And those are all equivalent to the amount of drug proceeds that the Chinese businessmen are buying in drug consumer countries. When I say North American consumer nations, I include Canada. Vancouver probably has the highest per capita overdose death rate in the world—the policy is insane there. So it’s essentially an indirect, asymmetric transfer of funds and value that has no direct correlation with, or link to, the drug proceeds that are generated off the streets—the heroin, the cocaine, the fentanyl, the marijuana, the methamphetamine.”

“They’ll deposit it into businesses and restaurants, and they’ll deposit those funds commingled with the legitimate funds they generate daily from restaurants, gas stations, convenience stores. And those will be deposited into numerous banks. Then the real drug proceeds—the profits—are transferred into a number of core accounts and pooled there. At that point, the owner in Mexico, Colombia, or Panama will decide where to send the money—to other accounts he controls.

Then he’ll go on WeChat and essentially enter one of those rooms—an auction for dollars. He’ll say, “Hey, listen, I’ve got a million in Vancouver, a million in New York, a million in Chicago—who wants to buy these?” And then you have Chinese citizens in China who are looking for dollars… to get their wealth out, or to pay off debt, or to get their kids into school elsewhere, or even to buy U.S. or Western products to ship into China. So they’ll bid—and they’ll pay a premium. Because what they’re doing is getting instructions to buy, say, a million dollars’ worth of commodities valued in Mexico, but in China it’s worth $800,000.”

Then the next time the cartel guy comes in and says, “Hey, I’ve got a million euros in Milan, Italy,” guess what? The Chinese businessman has the pesos to transfer to the cartel. So the Chinese businessman will pay $1.1 million—or a million dollars’ worth of renminbi or yuan—to ship internally in China to the manufacturing companies for all the commodities to be shipped to Mexico.

And once that’s shipped and the Chinese-Mexican businessman is satisfied with what he got, then he’ll say, “Okay, what do you want to do with the money in New York City?”

The Chinese businessman goes, “I want to look at a bunch of properties. I want you to send $200-some-thousand to New York University under the name of my son or nephew or niece.”

For those who might believe that China’s leaders are unaware of the global WeChat cash brokerage system — and its direct inputs into the Chinese factories powering Beijing’s mercantilist economy — Don Im offers a sobering set of facts.

“I brought it all together because I was running DEA’s money laundering operations at Special Operations Division, supporting undercover ops across the agency. DEA agents and analysts going back to the 2000’s tracked Mexicans and Colombians selling dollars to Chinese buyers. And they shared evidence with China law enforcement in circa 2012-2014.”

Im described even traveling to Beijing himself to brief the Ministry of Public Security.

“I personally went to Beijing in 2017, briefed top Ministry of Public Security officials. They listened when I explained how Chinese citizens use WeChat to buy drug dollars and then pay manufacturers in China to ship goods to brokers in Mexico. That was how the exchange happened.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

The Most Powerful People in the World

On June 26, leading Mexican cartel reporter Ioan Grillo posted this message to X: ‘You follow drugs, you get drug addicts and drug dealers. But you start to follow the money, and you don’t know where the f—k it’s gonna take you’ — from The Wire,” Grillo explained, “but also relevant to the historic orders by the U.S. Treasury against three Mexican banks, issued yesterday.”

Under the leadership of Treasury Secretary Scott Bessent, the U.S. formally sanctioned CIBanco, Intercam Banco, and Vector Casa de Bolsa on June 25, designating them “financial institutions of primary money-laundering concern.” The move effectively cuts these banks off from the U.S. financial system, citing their roles in laundering millions of dollars on behalf of Mexico’s most powerful cartels and facilitating payments for fentanyl precursor chemicals imported from China. The designations mark the first major use of new powers under the Fentanyl Sanctions Act.

For Don Im, this kind of action is long overdue — and, in his view, could probably go much farther and higher, into very discomforting areas for some world leaders.

A file called “Operation Heart of Stone” is illustrative. Im says he designed and ran this U.S. undercover operation targeting Horacio Cartes, Paraguay’s former president, who was accused of deep involvement in drug trafficking and money laundering. A 2010 U.S. State Department cable — leaked by WikiLeaks and derailing Heart of Stone’s momentum — labeled Cartes as the head of a major drug trafficking and laundering network. But, as Im points out, “we still got HSBC and hit them with a $1.9 billion fine.”

Speaking about this case and his decades spent infiltrating the world’s most dangerous criminal and financial networks, Im offered a set of opinions that — while carefully worded — amount to a kind of manifesto on who should be held accountable for opioid death tolls, and how to confront the system enabling them.

“Throughout the 1980s and 1990s, the DEA and US Customs (HSI) and IRS, had conducted numerous undercover money laundering operations against the drug cartels. Massive cash generated on the streets of North America and Europe were being deposited into thousands of banks,” Im said. “As a result, numerous anti-money laundering legislation efforts were implemented costing banks billions of dollars in compliance. At the same time, DEA, IRS and US Customs agents, established these money laundering operations by posing as money launderers and bankers to infiltrate the drug cartels.”

“These operations allowed law enforcement a door into the global underground banking system,” he continued. “DEA, USCS, IRS agents were able to track drug proceeds into the murky world where dirty cash was being cleaned by a global network of banks, businesses, law firms, NGO’s, corporations, offshore havens, philanthropic organizations, and reappearing into the accounts of corrupt government and politicians, millionaires and billionaires and their families.”

According to Im, it was DEA operations such as Swordfish, Pisces, Green Ice, Polar Cap, Casablanca, as well as Heart of Stone, Titan, and Green Treasure, that helped law enforcement capture evidence and intelligence into how the global system operates — with Sleeping Giant and Sai Zhang’s Chinese student and Sinaloa Cartel nexus being the latest sweeping case proving Im’s point.

“These investigations and similar investigations, led DEA to better understand how Chinese Money Laundering Organizations were leveraging trade, commerce, banking, technology and corruption to create a system of global bartering and unofficial banking,” Im said. “By using money to lure bad guys, and following the money upstream, DEA was able to seize billions of dollars of drug cash, seize and forfeit billions of dollars in assets purchased with drug proceeds, and even fine major banks such as Bank of America, Citibank, HSBC, Standard Charter, TD Bank, Wells Fargo, and many more. However, less than a handful of bank executives have ever been indicted and sent to prison.

Even with evidence, bankers, lawyers, accountants and politicians skirted prison sentences, while the low-hanging fruit drug traffickers were indicted and arrested. The judicial system is discriminatory when it comes to wealth, status and political convenience.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Banks

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces23 hours ago

armed forces23 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Business24 hours ago

Business24 hours agoCanada’s loyalty to globalism is bleeding our economy dry

-

Alberta23 hours ago

Alberta23 hours agoAlberta Next: Alberta Pension Plan

-

Economy2 days ago

Economy2 days agoTrump opens door to Iranian oil exports