Automotive

Biden’s Climate Agenda Is Running Headfirst Into A Wall Of His Own Making

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By WILL KESSLER

President Joe Biden’s administration unveiled tariffs this week aimed at boosting domestic production of green energy technology, but the move could end up hamstringing his larger climate goals.

The tariffs announced on Tuesday quadruple levies for Chinese electric vehicles (EVs) to 100% and raise rates for certain Chinese green energy and EV components like minerals and batteries. Biden has made the transition to green energy and EVs a key part of his climate agenda, but hiking tariffs on those products to help U.S. manufacturing could jack up prices on the already costly products, slowing adoption by struggling Americans, according to experts who spoke to the DCNF.

The risks posed by hiking levies on green technology expose the inherent tension between Biden’s climate agenda and his efforts to protect American industry, which often struggles to compete with cheap foreign labor. Items on his climate agenda typically raise costs, and requiring companies to comply could make them uncompetitive on the world stage.

“These tariffs are a classic example of the Biden administration’s left hand not knowing what the right hand is doing,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “The inability to import Chinese-made EVs due to prohibitively high costs will necessitate importing raw materials and parts for EVs from China. Since automakers can’t afford to build and assemble the vehicles here, prices will have to rise. In other words, American consumers will pay the cost of this tariff, not the Chinese.”

The White House, in its fact sheet, pointed to China artificially lowering its prices and dumping goods on the global market as the justification for the new tariffs in an effort to help protect American businesses. China has pumped huge subsidies into its own EV industry and supply lines over the past few years, spawning a European Union investigation into vehicles from the country.

“Tariffs on Chinese EVs won’t just make Chinese EVs more expensive, they will also make American EVs more expensive,” Ryan Young, senior economist at the Competitive Enterprise Institute, told the DCNF. “This is because domestic producers can now raise their prices without fear of being undercut by competitors. Good for them but bad for consumers — and for the Biden administration’s policy goal of increased EV adoption.”

Several American manufacturers are already struggling to sell EVs at a profit, with Ford losing $4.7 billion on its electric line in 2023 while selling over 72,000 of the vehicles. To ease price concerns and increase EV adoption, the Biden administration created an EV tax credit of $7,500 per vehicle, depending on where its parts are made.

The market share of EVs out of all vehicles fell in the first quarter of 2024 from 7.6% to 7.1% as consumers opted to buy cheaper traditional vehicles instead. Growth in EV sales increased by just 2.7% in the quarter, far slower than the 47% growth that the industry saw in all of 2023.

The Biden administration has also sought to use regulations to push automakers toward electrifying their offerings as consumers refuse to voluntarily adopt EVs, finalizing rules in March that effectively require around 67% of all light-duty vehicles sold after 2032 to be electric or hybrids.

“By raising the price — and thereby stunting the deployment — of EVs, the tariffs undermine the Biden administration’s stated goals of reducing carbon emissions (as many U.S. environmentalists and EV fans have recently lamented),” Clark Packard, research fellow in the Herbert A. Stiefel Center for Trade Policy Studies at the Cato Institute, wrote following the announcement. “The EV tariffs (and also-announced solar tariffs) would continue the administration’s habit of choosing politics and protectionism over their environmental agenda.”

Despite the subsidies, the 25% tariff that is currently in place for Chinese EVs already prices the product out of the U.S. market, resulting in no Chinese-branded EVs being sold in the country, according to Barron’s. Only a handful of the more than 100 EV models being sold in China appeal to American consumers, and none of them can compete under current levies.

“Something like this happened just a few years ago when former president Donald Trump enacted 25% steel tariffs in 2018,” Young told the DCNF. “Domestic steel producers raised their prices by almost exactly the amount of the tariff, and America soon had the world’s highest steel prices. As a result, car prices went up by about $200 to $300 on average. Larger trucks with more steel content increased even more. Now Biden is going to do the same thing to EVs.”

I won’t allow American towns and workers to be hurt by China’s unfair trade practices that flood our markets with cheap products.

That’s what these new tariffs are all about. pic.twitter.com/GGApGqtg7O

— President Biden (@POTUS) May 15, 2024

In the year following the increase in steel tariffs under the Trump administration, U.S. Steel’s operating profit rose 38%, prices were hiked 5 to 10% and revenue was up 15% due to reduced competition, according to CNN.

Despite the massive tariff hike on EVs, Biden only raised the tariff rate on Chinese lithium-ion EV batteries and battery parts to 25%, according to the White House. The tariff rate on certain essential minerals, like natural graphite, was also hiked to just 25%.

“Despite rapid and recent progress in U.S. onshoring, China currently controls over 80% of certain segments of the EV battery supply chain, particularly upstream nodes such as critical minerals mining, processing, and refining,” the White House wrote in its fact sheet. “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

China has broad control over the majority of minerals necessary to construct EVs, possessing nearly 90% of the world’s mineral refining capacity. Sources of the required minerals often also have serious human rights concerns, such as the world’s supply of cobalt, which has widespread ties to child labor.

Biden attacked former President Donald Trump during the 2020 election for the broad tariffs that he put on Chinese goods, noting that “any freshman econ student” could point out that the costs of the tariffs would be passed on to American consumers.

EV makers have increasingly struggled over the past year to maintain profits amid stalling demand, with the largest American EV manufacturer, Tesla, reporting a 10% drop in year-over-year revenue in the first quarter of 2024. Tesla is one of several EV makers that have announced layoffs in recent months.

“Fortunately, the EV market is still small in the U.S. and Chinese EVs are an even smaller slice of that small pie,” Antoni told the DCNF. “Even if the EV market in the U.S. were large, these tariffs would not help the domestic EV industry. While consumer demand for EVs would shift to domestic models, an increase in domestic production would rely on very expensive inputs from China, cutting into profits.”

The White House did not respond to a request to comment from the DCNF.

Automotive

America’s EV Industry Must Now Compete On A Level Playing Field

From the Daily Caller News Foundation

America’s carmakers face an uncertain future in the wake of President Donald Trump’s signing of the One Big Beautiful Bill Act (OBBBA) into law on July 4.

The new law ends the $7,500 credit for new electric vehicles ($4,000 for used units) which was enacted as part of the 2022 Inflation Reduction Act as of September 30, seven years earlier than originally planned.

The promise of that big credit lasting for a full decade did not just improve finances for Tesla and other pure-play EV companies: It also served as a major motivator for integrated carmakers like Ford, GM, and Stellantis to invest billions of dollars in capital into new, EV-specific plants, equipment, and supply chains, and expand their EV model offerings. But now, with the big subsidy about to expire, the question becomes whether the U.S. EV business can survive in an unsubsidized market? Carmakers across the EV spectrum are about to find out, and the outlook for most will not be rosy.

These carmakers will be entering into a brave new world in which the market for their cars had already turned somewhat sour even with the subsidies in place. Sales of EVs stalled during the fourth quarter of 2024 and then collapsed by more than 18% from December to January. Tesla, already negatively impacted by founder and CEO Elon Musk’s increased political activities in addition to the stagnant market, decided to slash prices in an attempt to maintain sales momentum, forcing its competitors to follow suit.

But the record number of EV-specific incentives now being offered by U.S. dealers has done little to halt the drop in sales, as the Wall Street Journal reports that the most recent data shows EV sales falling in each of the three months from April through June. Ford said its own sales had fallen by more than 30% across those three months, with Hyundai and Kia also reporting big drops. GM was the big winner in the second quarter, overtaking Ford and moving into 2nd place behind Tesla in total sales. But its ability to continue such growth absent the big subsidy edge over traditional ICE cars now falls into doubt.

The removal of the per-unit subsidies also calls into question whether the buildout of new public charging infrastructure, which has accelerated dramatically in the past three years, will continue as the market moves into a time of uncertainty. Recognizing that consumer concern, Ford, Hyundai, BMW and others included free home charging kits as part of their current suites of incentives. But of course, that only works if the buyer owns a home with a garage and is willing to pay the higher cost of insurance that now often comes with parking an EV inside.

Decisions, decisions.

As the year dawned, few really expected the narrow Republican congressional majorities would show the political will and unity to move so aggressively to cancel the big IRA EV subsidies. But, as awareness rose in Congress about the true magnitude of the budgetary cost of those provisions over the next 10 years, the benefit of getting rid of them ultimately subsumed concerns about the possible political cost of doing so.

So now, here we are, with an EV industry that seems largely unprepared to survive in a market with a levelized playing field. Even Tesla, which remains far and away the leader in total EV sales despite its recent struggles, seems caught more than a little off-guard despite Musk’s having been heavily involved in the early months of the second Trump presidency.

Musk’s response to his disapproval of the OBBBA was to announce the creation of a third political party he dubbed the American Party. It seems doubtful this new vanity project was the response to a looming challenge that members of Tesla’s board of directors would have preferred. But it does seem appropriately emblematic of an industry that is undeniably limping into uncharted territory with no clear plan for how to escape from existential danger.

We do live in interesting times.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

-

illegal immigration2 days ago

illegal immigration2 days agoICE raids California pot farm, uncovers illegal aliens and child labor

-

Uncategorized14 hours ago

Uncategorized14 hours agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

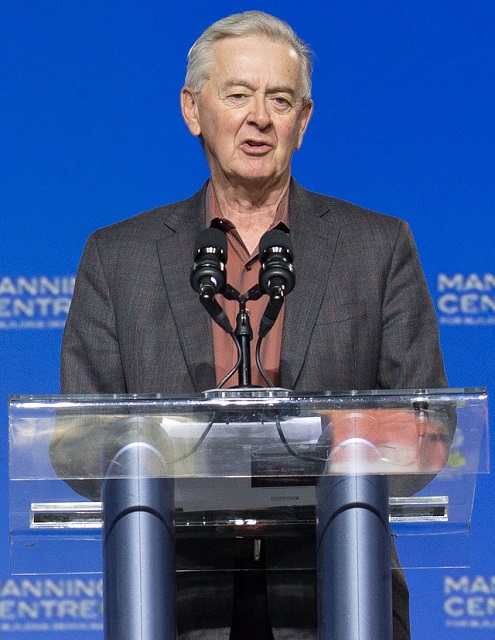

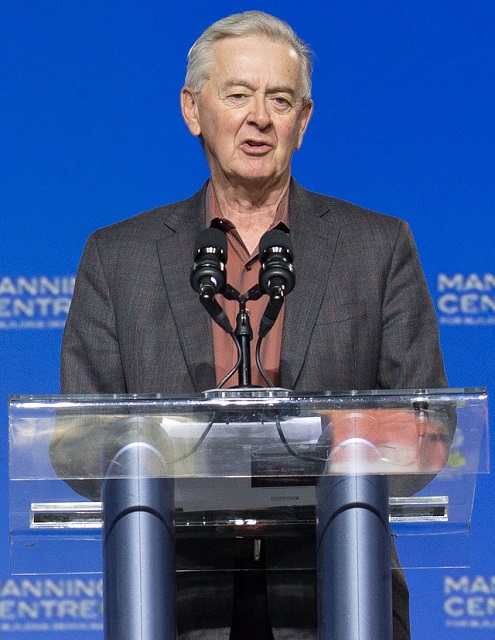

Opinion6 hours ago

Opinion6 hours agoPreston Manning: Three Wise Men from the East, Again

-

Addictions6 hours ago

Addictions6 hours agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business4 hours ago

Business4 hours agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoTrump to impose 30% tariff on EU, Mexico

-

Energy1 day ago

Energy1 day agoLNG Export Marks Beginning Of Canadian Energy Independence

-

Business1 day ago

Business1 day agoCarney government should apply lessons from 1990s in spending review