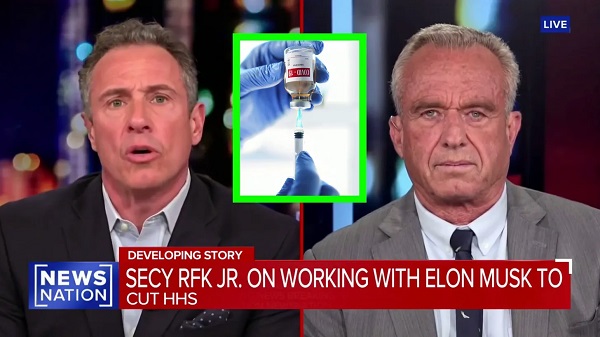

Economy

Biden environmental agenda under fire for increasing costs for Americans

By Casey Harper

The Biden administration’s energy policies are increasingly costly for Americans, a newly released report says.

U.S. House Oversight Committee Chair Rep. James Comer, R-Ky., released the report, which argues Biden’s energy policies have increased costs for Americans and hurt the economy.

“The Biden Administration weaponized the power of the executive branch to wage a war against American-made energy production and cement in place radical, far-left energy policies that jeopardize domestic energy development, overload America’s power grid, and raise costs on all American consumers and businesses,” Comer said in a statement.

In particular, President Joe Biden’s recent pause on liquefied natural gas exports, elevated gas prices, and the aggressive push toward transitioning toward electric energy are among the main criticisms lobbed at Biden.

Comer’s office cites analysis from the right-leaning American Action Forum released in April. AAF reports that in 2024 alone, Biden’s Environmental Protection Agency, as of the end of April, had proposed 38 new rules and finalized 63 rules. According to AAF, those rules total 33,138 pages and will cost the U.S. economy over a trillion dollars.

The report also highlights the cost of pushing America’s energy needs increasingly to the electric grid.

From the report:

Even as use efficiency improves, the U.S. Energy Information Administration projects U.S. utility-generated electricity demand to continue growing at an average annual rate of one percent through 2050. But radical new policies and regulations promulgated by the Biden Administration seek to transform power generation and electricity markets. The Biden Administration is moving to replace highly reliable and affordable existing sources of energy with new sources that are typically less reliable and more expensive. For consumers, the results of these initiatives will predictably be higher costs on utility bills, higher costs for goods and services that consume electricity, invisible energy subsidy costs paid through income and other taxes, as well as economic costs as high electricity prices push some business opportunities overseas.

The White House has cited climate change concerns as it rolled out several policies, including a pause on new export sites for liquefied natural gas.

That LNG pause has been particularly controversial, with a coalition of state and Congressional leaders rallying opposition against it. A lawsuit challenging the constitutionality has been filed by a coalition of states.

Biden’s Department of Energy has defended the decision and stressed that it will not stop any currently existing sales. The White House has also argued that the U.S. is already a leading exporter without new sales.

“Before issuing any new LNG export decisions, DOE is embarking on a transparent process to ensure we are using the most up-to-date economic and environmental analyses to determine whether additional approvals of LNG exports to non-FTA countries are in the ‘public interest,” the DOE said in a February post defending the decision.

Meanwhile, federal climate-related spending has come under fire.

During a news conference last week, U.S. Sen. Shelley Moore Capito, R-W.Va., sparked headlines by exposing that federal funds went to a climate group that was actively supporting the Oct. 7 Hamas attack on Israel, an attack that included rape, killing children, and hostage-taking.

“We went to the website of Climate Justice Alliance. This is what we found on the website that our taxpayer dollars are going to organizations such as this,” she said, referencing a pro-Hamas photo reportedly found on the group’s website.

Comer’s reports come as Biden’s Secretary of Energy, Jennifer Granholm, took questions from lawmakers last week about Biden’s energy policies.

Republicans took her to task for the increased costs Americans are facing. Energy costs have risen over 35% since Biden took office, according to federal data.

During the hearing, Granholm defended her agency’s work, including Biden’s decision to drain the nation’s Strategic Petroleum Reserve earlier in his term to help address soaring gas prices.

“The Administration remains committed to maintaining a robust and well-functioning SPR. In 2022, in response to Russia’s invasion of Ukraine and the resulting disruptions in the oil market, the President directed the sale of 180 million barrels,” Granholm said in her written testimony. submitted to the committee. “The emergency sales provided supply certainty and acted as a bridge until domestic production increased, which in turn helped to mitigate the cost increases for American families.”

Business

Canada may escape the worst as Trump declares America’s economic independence with Liberation Day tariffs

MxM News

MxM News

Quick Hit:

On Wednesday, President Trump declared a national emergency to implement a sweeping 10% baseline tariff on all imported goods, calling it a “Declaration of Economic Independence.” Trump said the tariffs would revitalize the domestic economy, declaring that, “April 2, 2025, will forever be remembered as the day American industry was reborn.”

Key Details:

-

The baseline 10% tariff will take effect Saturday, while targeted “reciprocal” tariffs—20% on the EU, 24% on Japan, and 17% on Israel—begin April 9th. Trump also imposed 25% tariffs on most Canadian and Mexican goods, as well as on all foreign-made cars and auto parts, effective early Thursday.

-

Trump justified the policy by citing foreign trade restrictions and long-standing deficits. He pointed to policies in Australia, the EU, Japan, and South Korea as examples of protectionist barriers that unfairly harm American workers and industries.

-

The White House estimates the 10% tariff could generate $200 billion in revenue over the next decade. Officials say the added funds would help reduce the federal deficit while giving the U.S. stronger leverage in negotiations with countries running large trade surpluses.

Diving Deeper:

President Trump on Wednesday unveiled a broad new tariff policy affecting every imported product into the United States, marking what he described as the beginning of a new economic era. Declaring a national emergency from the White House Rose Garden, the president announced a new 10% baseline tariff on all imports, alongside steeper country-specific tariffs targeting longstanding trade imbalances.

“This is our Declaration of Economic Independence,” Trump said. “Factories will come roaring back into our country — and you see it happening already.”

The tariffs, which take effect Saturday, represent a substantial increase from the pre-Trump average U.S. tariff rate and are part of what the administration is calling “Liberation Day” for American industry. Reciprocal tariffs kick in April 9th, with the administration detailing specific rates—20% for the European Union, 24% for Japan, and 17% for Israel—based on calculations tied to bilateral trade deficits.

“From 1789 to 1913, we were a tariff-backed nation,” Trump said. “The United States was proportionately the wealthiest it has ever been.” He criticized the establishment of the income tax in 1913 and blamed the 1929 economic collapse on a departure from tariff-based policies.

To underscore the move’s long-anticipated nature, Trump noted he had been warning about unfair trade for decades. “If you look at my old speeches, where I was young and very handsome… I’d be talking about how we were being ripped off by these countries,” he quipped.

The president also used the moment to renew his push for broader economic reforms, urging Congress to eliminate federal taxes on tips, overtime pay, and Social Security benefits. He also proposed allowing Americans to write off interest on domestic auto loans.

Critics of the plan warned it could raise prices for consumers, noting inflation has already risen 22% under the Biden administration. However, Trump pointed to low inflation during his first term—when he imposed more targeted tariffs—as proof his strategy can work without sparking runaway costs.

White House officials reportedly described the new baseline rate as a guardrail against countries attempting to game the system. One official explained the methodology behind the reciprocal tariffs: “The trade deficit that we have with any given country is the sum of all trade practices, the sum of all cheating,” adding that the tariffs are “half of what they could be” because “the president is lenient and he wants to be kind to the world.”

In addition to Wednesday’s sweeping changes, Trump’s administration recently imposed a 25% tariff on Chinese goods tied to fentanyl smuggling and another 25% on steel and aluminum imports—revoking previous carve-outs for countries like Brazil and South Korea. Future tariffs on semiconductors, pharmaceuticals, and raw materials such as copper and lumber are reportedly under consideration.

Trump closed his remarks with a message to foreign leaders: “To all of the foreign presidents, prime ministers, kings, queens, ambassadors… I say, ‘Terminate your own tariffs, drop your barriers.’” He declared April 2nd “the day America’s destiny was reclaimed” and promised, “This will indeed be the golden age of America.”

2025 Federal Election

Three cheers for Poilievre’s alcohol tax cut

By Franco Terrazzano

The Canadian Taxpayers Federation applauds Conservative Party Leader Pierre Poilievre’s commitment to end and reverse the alcohol escalator tax.

“Poilievre just promised major alcohol tax cuts and taxpayers will cheers to that,” said Franco Terrazzano, CTF Federal Director. “Poilievre’s tax cut will save Canadians money every time they have a cold one with a buddy or enjoy a glass of Pinot with their better half and it will give Canadians brewers, distillers and wineries a fighting chance against tariffs.”

Today, federal alcohol taxes increased by two per cent, costing taxpayers about $40 million this year, according to Beer Canada.

Poilievre announced a Conservative government “will axe the escalator tax on wine, beer and spirits back to 2017 levels, ending the automatic annual tax increases.”

The alcohol escalator tax has automatically increased excise taxes on beer, wine and spirits every year, without a vote in Parliament, since 2017. The alcohol escalator tax has cost taxpayers more than $900 million since being imposed, according to Beer Canada.

Taxes from multiple levels of government account for about half of the price of alcohol.

Meanwhile, tariffs are hitting the industry hard. Brewers have described the tariffs as “Armageddon for craft brewing.”

“Automatic tax hikes are undemocratic, uncompetitive and unaffordable and they need to stop,” Terrazzano said. “If politicians think Canadians aren’t paying enough tax, they should at least have the spine to vote on the tax increase.

“Poilievre is right to end the escalator tax and all party leaders should commit to making life more affordable for Canadian consumers and businesses by ending the undemocratic alcohol tax hikes.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

Business2 days ago

Business2 days agoTrump says ‘nicer,’ ‘kinder’ tariffs will generate federal revenue

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFight against carbon taxes not over yet

-

2025 Federal Election1 day ago

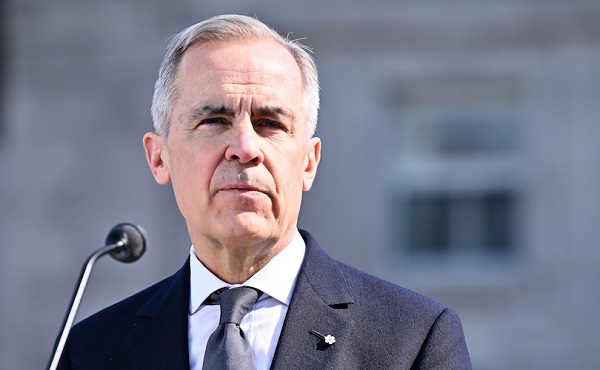

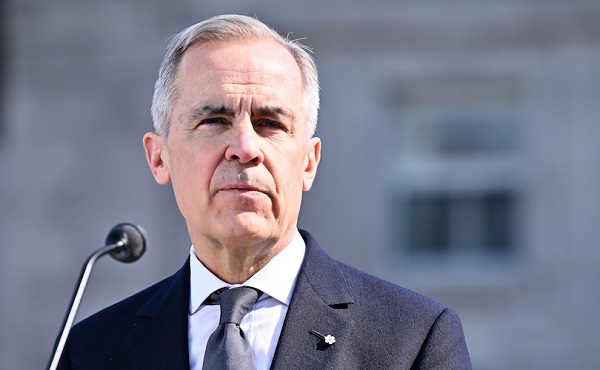

2025 Federal Election1 day agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Automotive1 day ago

Automotive1 day agoElectric cars just another poor climate policy

-

Energy1 day ago

Energy1 day agoWhy are Western Canadian oil prices so strong?

-

2025 Federal Election7 hours ago

2025 Federal Election7 hours agoWEF video shows Mark Carney pushing financial ‘revolution’ based on ‘net zero’ goals