Business

BC voters ditching climate crisis for promise to unlock natural resource development

From Energy Now

The LNG Canada facility under construction in Kitimat, British Columbia

Climate Goals Face B.C. Election Backlash in Home of Greenpeace – B.C. Conservatives Have Upended Race With Focus on Unlocking Natural Resource Development

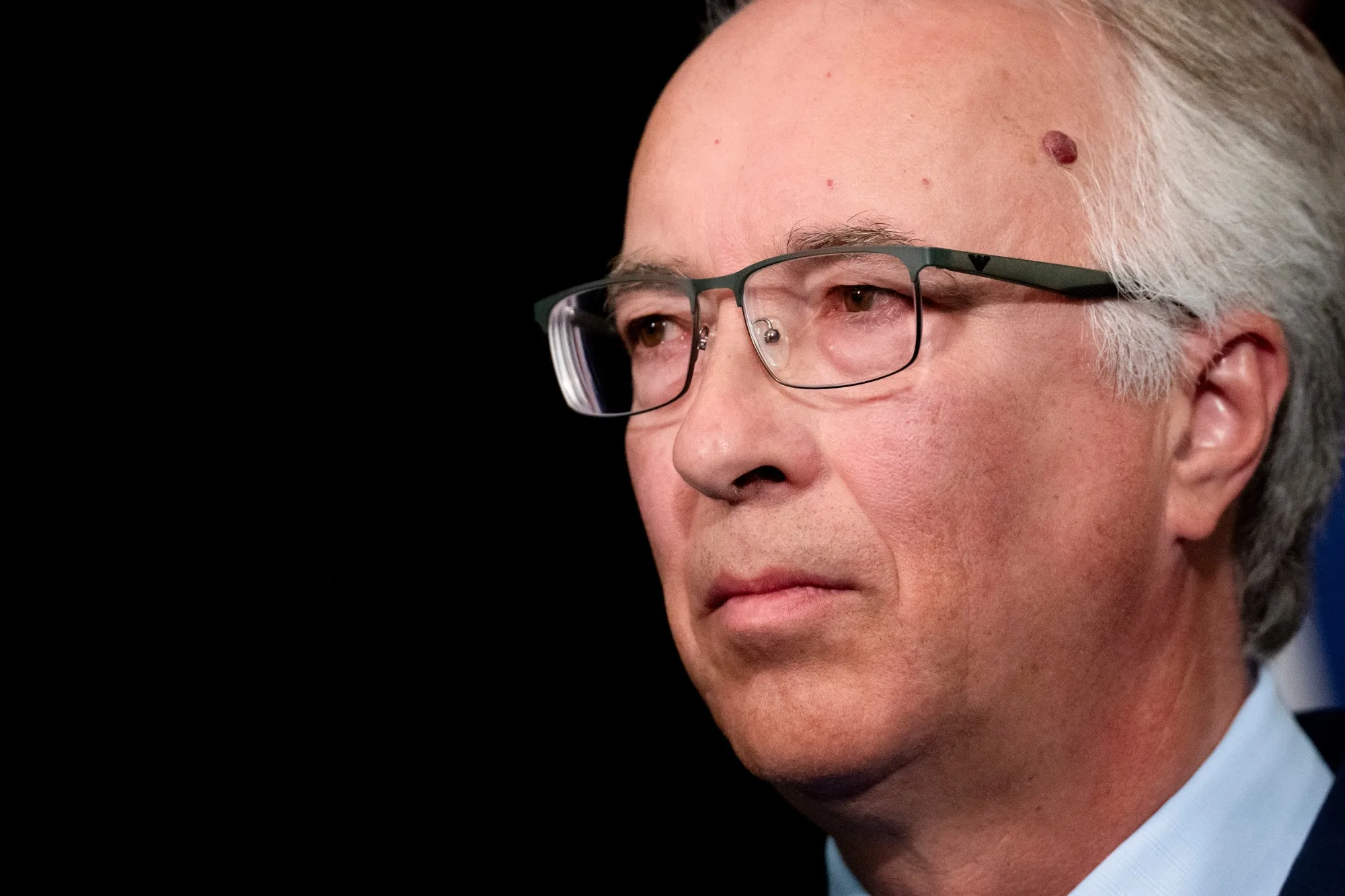

An unlikely political upstart in Canada’s third-largest province, expelled from his previous party for climate science skepticism, is within striking distance of winning power with promises to ditch environmental targets and unleash natural-resources development.

The surge in support for John Rustad’s Conservative Party of British Columbia ahead of the Oct. 19 election may have been helped by the popularity of the unaffiliated federal Conservatives. Victory would add to the roster of right-leaning premiers at odds with Prime Minister Justin Trudeau’s Liberal government in Ottawa.

A Conservative government in BC might mark a bigger shift than anywhere else in the country. The province is famous for environmentalism — Vancouver is the birthplace of Greenpeace and home to Canada’s most famous climate activist, David Suzuki. David Eby, the current premier, unsuccessfully opposed the expansion of the Trans Mountain oil pipeline, and back in 2008 the province brought in one of North America’s first carbon taxes.

Although polls favor Eby’s left-leaning New Democratic Party, it’s close, and a spread between pollsters suggests the result remains unpredictable.

The public has endured inflation and strained local services, slower growth in an economy dragged by higher interest rates and lower exports, and a government that’s gone from surplus to a record C$9 billion ($6.5 billion) deficit. British Columbia, once rated AAA by S&P Global Ratings, has suffered three credit rating downgrades in three years.

Conservatives Have Surged in BC Polls

British Columbia’s Conservatives vault official opposition in election surprise

The ruling NDP — whose origins lie in labor unions — is parrying criticism of its own mixed seven-year record in office. It’s running on blunting the cost of living with subsidies, tying the minimum wage to inflation, taxing home speculation, blocking Airbnb Inc.-style short-term rentals and using hydrocarbon revenues for a “clean economy transition fund.”

Rustad’s rise is also a stunning tale of revenge. The longtime representative of Nechako Lakes — a district 600 miles north of Vancouver in BC’s deep interior — was kicked out of the BC Liberal Party in 2022 on his birthday after sharing a social media post questioning carbon dioxide’s effect on the climate. He took over the BC Conservative Party, then a marginal force in provincial politics. Before long it had leapfrogged his old party in the polls.

Acrimonious talks to merge the two groups failed, and by August the previously formidable Liberals — which had rebranded as BC United — gave up, withdrawing from the election in an effort to unite voters against the NDP.

Unlocking Natural Resources

In an interview with Bloomberg, Rustad said he won’t cut social, health or education spending — a majority of the budget. He’s also promising tax cuts and plans to deepen the deficit to more than C$10 billion in his first year.

His plan to balance BC’s budget over eight years is based on an optimistic 5.4% average GDP growth rate to 2030 — more than double the average rate of the past five years — fueled by axing CleanBC, the NDP plan to cut BC’s emissions 40% by 2030. Rustad said that would save as much as C$2.5 billion in government spending, then bring in billions in extra revenue by unlocking industrial projects.

Foremost among them is LNG Canada, a new liquefied natural gas project in the remote north that the federal government said may be worth C$40 billion — possibly the largest private investment in the country’s history. There’s a plan to double its size, but it’s proving tricky to power with BC’s zero-emission hydroelectricity instead of fossil fuels, because it would need a new transmission line, with one previous cost estimate at C$3 billion.

Not a problem if looser rules let them burn gas.

“In British Columbia, we could stop everything we do, and by next year the increases from China and India will swamp anything that we’ve done,” Rustad told Bloomberg. “So my perspective is we need to make sure we’re looking after people. And so for a changing climate, we need to be able to adapt to it.”

When he appeared on climate-skeptic Canadian influencer Jordan Peterson’s podcast, Rustad said: “How is it that we’ve convinced carbon-based beings that carbon is a problem?”

Rustad also talked up billions in extra revenue from streamlining mine permits — one of BC’s oldest industries and more prominent in the remoter parts of the province he hails from.

Asked about BC’s rural vote, Rustad says: “There’s no question, the NDP completely ignored it.”

Rustad also wants to ditch BC’s carbon tax to cut costs for businesses and consumers. That’s also the top rallying cry for federal Conservatives, who are trying to force a “carbon tax election” to topple Trudeau. Provincial carbon taxes are federally back-stopped, so to banish the tax Rustad would need the Conservative Party of Canada to take power.

“The top-of-mind issues that people are frustrated about are inflation and the cost of living, housing and health care,” Kathryn Harrison, a political science professor at the University of British Columbia, said in an interview. “And what we’ve seen is that the federal Conservative Leader Pierre Poilievre has been able to connect those public concerns with the carbon tax. It’s given them something that they can focus their frustrations on.”

Even the climate-conscious NDP has pivoted away from defending the carbon tax to pledging they would repeal it for consumers — but unlike the Conservatives, they would shift the burden to corporate “polluters.”

In his plan to speed up business, Rustad has also taken issue with BC’s Declaration on the Rights of Indigenous Peoples Act because it causes “friction”. It requires government to seek Indigenous people’s “free, prior and informed consent” to implement measures that may affect BC’s more than 200 Indigenous communities.

Rustad’s Conservatives include Indigenous candidates, and he talks about supporting economic reconciliation — the material, financial side of redressing Canada’s colonial injustices. But some First Nations leaders have called his platform “dangerous” for pitting British Columbians against each other.

Relentless Controversies

Rustad’s biggest weak point may be the controversial things said my members of his team, leading to relentless stories since they’ve been thrust into the spotlight.

Despite his dry, phlegmatic style, the same goes for Rustad himself. He’s said he regretted getting the “so-called” Covid-19 vaccine, and a clip showed him seeming to go along with an activist’s concept of “Nuremberg 2.0” — trials for officials who oversaw pandemic health measures. Rustad apologized and said he “misunderstood” the question.

Rival party staffers gave out BC Conservative-branded tinfoil hats after a candidate’s shared posts described 5G wireless signals as a weapon, according to local media. She was ousted, but another candidate who claimed vaccines can cause a type of AIDS remains part of the caucus.

Another apologized last week for posts including one in 2015 calling Palestinians “inbred walking, talking, breathing time bombs.”

In communities like Metro Vancouver, some of the most diverse in North America, that kind of thing may jeopardize Rustad’s path to power.

But Rustad is also being cheered on by what Harrison described as an “accidental collection of voters who share frustration with the cost of living, the cost of housing, emergency room closures” — which could span from suburban families who judge the economy isn’t working for them to BC’s wealthiest, including billionaire Lululemon Athletica Inc founder Chip Wilson.

If Rustad pulls it off, his unorthodox strategy to turn one of Canada’s progressive strongholds conservative will reverberate with those fighting federal politics in the nation’s capital 3,000 miles away.

Business

Virtue-signalling devotion to reconciliation will not end well

From the Fraser Institute

By Bruce Pardy

In September, the British Columbia Supreme Court threw private property into turmoil. Aboriginal title in Richmond, a suburb of Vancouver, is “prior and senior” to fee simple interests, the court said. That means it trumps the property you have in your house, farm or factory. If the decision holds up on appeal, it would mean private property is not secure anywhere a claim for Aboriginal title is made out.

If you thought things couldn’t get worse, you thought wrong. On Dec. 5, the B.C. Court of Appeal delivered a different kind of upheaval. Gitxaala and Ehattesaht First Nations claimed that B.C.’s mining regime was unlawful because it allowed miners to register claims on Crown land without consulting with them. In a 2-to-1 split decision, the court agreed. The mining permitting regime is inconsistent with the United Nations Declaration on the Rights of Indigenous People (UNDRIP). And B.C. legislation, the court said, has made UNDRIP the law of B.C.

UNDRIP is a declaration of the United Nations General Assembly. It consists of pages and pages of Indigenous rights and entitlements. If UNDRIP is the law in B.C., then Indigenous peoples are entitled to everything—and to have other people pay for it. If you suspect that is an exaggeration, take a spin through UNDRIP for yourself.

Indigenous peoples, it says, “have the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired… to own, use, develop and control, as well as the right to “redress” for these lands, through either “restitution” or “just, fair and equitable compensation.” It says that states “shall consult and cooperate in good faith” in order to “obtain free and informed consent prior to the approval of any project affecting their lands or territories and other resources,” and that they have the right to “autonomy or self-government in matters relating to their internal and local affairs, as well as ways and means for financing their autonomous functions.”

The General Assembly adopted UNDRIP in 2007. At the time, Canada sensibly voted “no,” along with New Zealand, the United States and Australia. Eleven countries abstained. But in 2016, the newly elected Trudeau government reversed Canada’s objection.

UN General Assembly resolutions are not binding in international law. Nor are they enforceable in Canadian courts. But in 2019, NDP Premier John Horgan and his Attorney General David Eby, now the Premier, introduced Bill 41, the Declaration on the Rights of Indigenous Peoples Act (DRIPA). DRIPA proposed to require the B.C. government to “take all measures necessary to ensure the laws of British Columbia are consistent with the Declaration.” The B.C. Legislature unanimously passed the bill. (The Canadian Parliament passed a similar bill in 2021.)

Two years later, the legislature passed an amendment to the B.C. Interpretation Act. Eby, still B.C.’s Attorney General, sponsored the bill. The amendment read, “Every Act and regulation must be construed as being consistent with the Declaration.”

Eby has expressed dismay about the Court of Appeal decision. It “invites further and endless litigation,” he said. “It looked at the clear statements of intent in the legislature and the law, and yet reached dramatically different conclusions about what legislators did when we voted unanimously across party lines” to pass DRIPA. He has promised to amend the legislation.

These are crocodile tears. The majority judgment from the Court of Appeal is not a rogue decision from activist judges making things up and ignoring the law. Not this time, anyway. The court said that B.C. law must be construed as being consistent with UNDRIP—which is what Eby’s 2021 amendment to the Interpretation Act says.

In fact, Eby’s government has been doing everything in its power to champion Aboriginal interests. DRIPA is its mandate. It’s been making covert agreements with specific Aboriginal groups over specific territories. These agreements promise Aboriginal title and/or grant Aboriginal management rights over land use. In April 2024, an agreement with the Haida Council recognized Haida title and jurisdiction over Haida Gwaii, an archipelago off the B.C. coast formerly known as the Queen Charlotte Islands. Eby has said that the agreement is a template for what’s possible “in other places in British Columbia, and also in Canada.” He is putting title and control of B.C. into Aboriginal hands.

But it’s not just David Eby. The Richmond decision from the B.C. Supreme Court had nothing to do with B.C. legislation. It was a predictable result of years of Supreme Court of Canada (SCC) jurisprudence under Section 35 of the Constitution. That section guarantees “existing” Aboriginal and treaty rights as of 1982. But the SCC has since championed, evolved and enlarged those rights. Legislatures can fix their own statutes, but they cannot amend Section 35 or override judicial interpretation, even using the “notwithstanding clause.”

Meanwhile, on yet another track, Aboriginal rights are expanding under the Charter of Rights and Freedoms. On the same day as the B.C. Court of Appeal decision on UNDRIP, the Federal Court released two judgments. The federal government has an actionable duty to Aboriginal groups to provide housing and drinking water, the court declared. Taxpayer funded, of course.

One week later, at the other end of the country, the New Brunswick Court of Appeal weighed in. In a claim made by Wolastoqey First Nation for the western half of the province, the court said that Aboriginal title should not displace fee simple title of private owners. Yet it confirmed that a successful claim would require compensation in lieu of land. Private property owners or taxpayers, take your pick.

Like the proverb says, make yourself into a doormat and someone will walk all over you. Obsequious devotion to reconciliation has become a pathology of Canadian character. It won’t end well.

Business

Vacant Somali Daycares In Viral Videos Are Also Linked To $300 Million ‘Feeding Our Future’ Fraud

From the Daily Caller News Foundation

Multiple Somali daycare centers highlighted in a viral YouTube exposé on alleged fraud in Minnesota have direct ties to a nonprofit at the center of a $300 million scam, the Minnesota Star Tribune reported Thursday.

The now-infamous videos from YouTube influencer Nick Shirley, posted Dec. 26, showed several purported Somali-run daycare centers receiving millions in taxpayer funds despite little evidence that children were actually present at the facilities. Now it turns out that five of the 10 daycare centers Shirley visited operated as meal sites for Feeding Our Future, the Minnesota-based nonprofit implicated in a massive fraud scheme that has already produced dozens of convictions, the outlet reported.

Between 2018 and 2021, those five businesses received nearly $5 million from Feeding Our Future, the outlet reported. While none of the centers in Shirley’s video have been legally accused of wrongdoing, the revelations underscore the sprawling web of fraud engulfing the state. (RELATED: Somalis Reportedly Filled Ohio Strip Mall With Potential Fraudulent Childcare Centers)

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

🚨 Here is the full 42 minutes of my crew and I exposing Minnesota fraud, this might be my most important work yet. We uncovered over $110,000,000 in ONE day. Like it and share it around like wildfire! Its time to hold these corrupt politicians and fraudsters accountable

We ALL… pic.twitter.com/E3Penx2o7a

— Nick shirley (@nickshirleyy) December 26, 2025

Federal prosecutors have charged over 70 individuals — mostly from the Somali community — with stealing more than $300 million from the Federal Child Nutrition Program through Feeding Our Future. During the COVID-19 pandemic, the program funded sites across Minnesota to provide meals to children. Prosecutors say leaders of Feeding Our Future, along with dozens of associates who ran sponsored “meal sites,” submitted false or inflated meal counts to claim reimbursements.

One facility featured in Shirley’s video, the Minnesota Best Childcare Center, received $1.5 million from Feeding Our Future, according to the Minnesota Star Tribune.

Minnesota Best Childcare Center, which has been licensed by the state since 2013, did not respond to the Daily Caller News Foundation’s request for comment.

Other daycares featured in Shirley’s video have been cited dozens of times for rule violations while continuing to receive millions in state funding. The now-infamous Quality “Learing” Center was cited for 121 violations in the past three years, including for failing to report a “death, serious injury, fire or emergency as required,” according to the Star-Tribune.

The paper’s investigation found that six of the facilities featured by Shirley were either closed or employees did not open their doors.

Following that exposé, which has accumulated more than 135 million views on X, the Trump administration announced it would freeze all childcare disbursements to Minnesota while federal officials review how taxpayer dollars have flowed to licensed providers.

The fraud allegations extend beyond childcare, with prosecutors claiming millions in taxpayer funds were also stolen from Minnesota’s Housing Stabilization Services and autism treatment programs. Federal prosecutors also estimate that as much as half of the roughly $18 billion Minnesota has spent since 2018 on 14 Medicaid programs may have been siphoned off by fraudsters.

Even the state’s assisted living program has come under scrutiny, with Republican state Rep. Kristin Robbins warning that individuals connected to the Feeding Our Future scheme continue to receive millions in taxpayer funds.

-

Business1 day ago

Business1 day agoVacant Somali Daycares In Viral Videos Are Also Linked To $300 Million ‘Feeding Our Future’ Fraud

-

Energy1 day ago

Energy1 day agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

Haultain Research1 day ago

Haultain Research1 day agoTrying to Defend Maduro’s Legitimacy

-

International1 day ago

International1 day ago“Captured and flown out”: Trump announces dramatic capture of Maduro

-

International1 day ago

International1 day agoTrump Says U.S. Strike Captured Nicolás Maduro and Wife Cilia Flores; Bondi Says Couple Possessed Machine Guns

-

International1 day ago

International1 day agoU.S. Claims Western Hemispheric Domination, Denies Russia Security Interests On Its Own Border

-

International1 day ago

International1 day agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

International1 day ago

International1 day ago“It’s Not Freedom — It’s the First Step Toward Freedom”