Crime

As Trump 2.0 Scrutinizes Canadian Fentanyl Networks, British Columbia Advances Forfeiture on 14 Properties Linked to Alleged PRC Triad Associate

Vancouver journalist Bob Mackin reported that Paul King Jin, (red shorts and black T-shirt) met with a BC NDP politician at Jin’s boxing gym, which is linked to B.C.’s forfeiture claims. Also at this meeting were members of Beijing’s United Front Work Department groups in Vancouver.

The Pacific coastal metropolis, famous for its gleaming glass towers set against forested mountain peaks, isn’t merely concealing a toxic node of global narco-laundering. It has also become known as the “Dubai of the West” among transnational crime investigators, serving as a key encryption technology hub for various shadowy companies tied to Chinese Triads, Mexican cartels, and Iranian state-sponsored mafias and terror financiers

VANCOUVER, British Columbia — In a long-running legal effort to curb transnational money laundering believed to be fueling North America’s deadly fentanyl trade, the British Columbia Civil Forfeiture Office has secured a procedural victory in its pursuit of 14 Vancouver properties linked to an accused Chinese underworld financier, Paul King Jin.

Jin and his associates in Vancouver and Toronto — tied to “The Company” cartel and the notorious, U.S.-sanctioned Triad leader “Broken Tooth Koi,” according to RCMP sources — have drawn increasing interest from American enforcement and intelligence agencies in recent years.

Despite surmounting a legal hurdle in Jin’s case, Canada’s broader struggle to bring such figures to justice speaks to deep systemic vulnerabilities, enforcement experts say. Meanwhile, the United States grows more impatient with its northern neighbor’s susceptibility to global narcotics trafficking.

David Asher, a senior financial crime investigator in President Trump’s first administration, who recently credited The Bureau’s investigations into fentanyl trafficking networks at a security conference in Vancouver, says Triads in Toronto and Vancouver are “command and control” for laundering warehouses of cash stockpiled across North America by Mexican cartels that distribute toxic opioids for Chinese mafias that provide the precursors.

Citing a July 2024 memo from Asher, CBC reported today that the memo is reportedly now circulating among Trump’s transition team. Asher argues “Canada should be making substantive, systemic changes,” including implementing anti-racketeering laws and sharing intelligence with Washington on Canada-based fentanyl networks, CBC reported.

Asher’s memo does not pull punches.

“The key is to attack Cartel and Triad finances by targeting their complicit financial institutions,” it says, adding there is “massive money laundering” through a specific Canadian bank.

“It appears that almost all leading U.S. banks are complicit in accepting suspected narco cash to purchase real estate from native Communist Chinese investors,” the memo adds.

On paper, the B.C. government’s recent win seems straightforward: In September 2024, the B.C. Supreme Court effectively sided with the Director of Civil Forfeiture, allowing the province to proceed with a case to forfeit roughly $9.5 million in Vancouver-area real estate.

The 14 properties, the government asserts, served as conduits for illicit proceeds — illegal gaming, underground banking, and laundering activities tied to Mr. Jin’s network and, by extension, a web of international criminal enterprises, including Triads and diaspora banking brokers connected to cartels spanning Asia and the Americas.

But this portfolio is only part of the picture. The forfeiture claim notes that after Jin was banned from B.C. casinos, he established illegal gaming houses which, according to official filings, generated more than $32 million in net profit over just four months in 2015. These gambling dens formed another key node in the broader ecosystem of cash-based offenses believed to be driving the surge in dangerous synthetic drugs throughout North America.

The legal drama in B.C.’s latest claim — the fourth forfeiture suit against Jin in three years — began in November 2022. Everwell Knight Limited, a China-incorporated entity registered in Hong Kong that holds mortgages on the 14 contested properties, attempted to have the government’s forfeiture claim dismissed. Everwell argued that the Director of Civil Forfeiture had failed to meet procedural standards. The Vancouver lawyer representing Everwell invoked the Canadian Charter of Rights — a common strategic defense in Canadian money laundering cases.

In April 2023, the Director of Civil Forfeiture responded with an application for judgment by default against Mr. Jin. By failing to file a defense, the Director argued, Mr. Jin effectively conceded key allegations.

This fourth claim also highlights an absurd game of cat and mouse between Jin and the Director.

“Counsel for the Director received a phone call from a lawyer who advised he may be acting for P. Jin with respect to civil forfeiture matters,” the Director’s April 2023 application says. “Since that communication, the Director’s counsel has not received any further communications from that lawyer or from any other lawyer purporting to act for P. Jin in this action.”

The court was asked to deem that Mr. Jin had admitted essential facts, including his true role behind Everwell, YSHJ Investment Holding Ltd., and JYSH Investment Ltd. — entities allegedly held through Jin’s niece as nominee owners.

Everwell, YSHJ Investment Holding Ltd., and JYSH Investment Ltd. have all filed defenses denying any wrongdoing.

Key to B.C.’s case is the allegation that YSHJ and JYSH bought Vancouver properties and soon after, the Hong Kong-based Everwell registered mortgages and assigned rents against the units, suggesting a clever scheme to launder funds via rent and mortgage payments.

“The mortgages held by Everwell against the real property are not legitimate mortgages and were used by the defendants to launder proceeds of crime,” B.C.’s lawsuit says.

But from a broader perspective, B.C.’s procedural win may resemble a Pyrrhic victory. Civil forfeiture often serves as a fallback in Canada because prosecuting sophisticated international money launderers remains daunting. High-profile criminal cases — including the RCMP’s “E-Pirate” probe into the sprawling Richmond, B.C.-based Silver International underground bank, allegedly linked to Mr. Jin and his partner, Jian Jun Zhu — collapsed amid onerous disclosure rules and the immense challenge of translating millions of intercepted communications.

A B.C. special prosecutor’s review of the related “E-Nationalize” investigation, which focused on Mr. Jin’s networks, similarly fell apart. The review cited “considerable dispute” over police-gathered material — including over two million communications needing Chinese translation — and highlighted legislative gaps that make it hard to convict Jin.

Notably, the review acknowledged that running an underground bank like Silver International could be prosecuted as a criminal offense in the U.S. and U.K., but not in Canada.

Civil forfeiture, with its lower burden of proof, can freeze and seize suspicious assets. Yet it does not carry the moral weight or deterrent punch of a criminal sentence. The current case spotlights Jin’s alleged laundering through B.C. casinos and Silver International — the now-defunct underground bank run by Mr. Zhu, who was killed in a 2020 shooting at a Japanese restaurant in Richmond. An RCMP source said that night in the restaurant, senior Toronto-area figures linked to Tse Chi Lop’s “The Company” cartel were present alongside Jin and Zhu, illustrating both the proximity of violence to Jin’s affairs and his apparent ties to Tse’s networks.

According to a report from the Financial Action Task Force, a G7 anti-money laundering initiative, Silver International serviced Asian, Middle Eastern, and Mexican organized crime groups, laundering about $1 billion a year globally. The bank, one of numerous similar outfits in Vancouver and Toronto, was connected to Chinese underground bankers in diaspora communities across Latin America, as well as hundreds of related bank accounts in China, according to the RCMP’s case.

This underscores Vancouver’s role as a nexus in a global scheme that U.S. authorities say directly contributes to the fentanyl crisis ravaging American cities. The Pacific coastal metropolis, famous for its gleaming glass towers set against forested mountain peaks, isn’t merely concealing a toxic node of global narco-laundering. It has also become known as the “Dubai of the West” among transnational crime investigators, serving as a key encryption technology hub for various shadowy companies tied to Chinese Triads, Mexican cartels, and Iranian state-sponsored mafias and terror financiers, as Canada’s case against RCMP intelligence mole Cameron Ortis revealed.

As one senior U.S. law enforcement source familiar with DEA probes into Triad leader Tse Chi Lop — said to control “The Company” network and connected to both Paul Jin and Silver International — explained, “Canada’s lenient laws make it an attractive market.” The source added: “If someone gets caught with a couple of kilos of fentanyl in Canada, the likelihood of facing a 25-year sentence is very low.”

Jin, once targeted by Canada’s most ambitious anti-money laundering efforts, remains unscathed by criminal convictions. Still, Jin’s extensive travels to Mexico, Colombia, and Panama have, according to RCMP sources, led investigators to believe he is leveraging a global network of underground bankers and traffickers. His name surfaces alongside once-dominant figures like Xizhi Li, a Chinese Mexican gangster taken down by the DEA, and Tse Chi Lop, whose arrest in 2021 created a vacuum in major narcotics and money laundering operations.

“Jin has evolved from a local massage parlor manager to someone who has now expanded his business dealings nationally and internationally,” one RCMP source said. “One can surmise that voids are created with the arrests of Li and Tse. And historically speaking, when voids are created, they tend to be filled. The question is: Who is in a position to fill that?”

In recent years Jin was detained and searched by Mexican border officials, the source said. Although he carried nothing substantial beyond a single cannabis gummy and some empty boxes, officials reportedly discovered documents linking him to Vancouver loan-sharking disputes. More tellingly, they found a business card connected to “Broken Tooth Koi,” a Triad leader whose laundering operations stretch from Hong Kong into Canada’s financial systems, as previously documented in filings before the Cullen Commission.

In December 2020 U.S. sanctions highlighted Koi’s links to Beijing.

“Wan Kuok Koi, also commonly known as “Broken Tooth,” is a member of the Communist Party of China’s (CCP) Chinese People’s Political Consultative Conference,” the sanctions say, “and is a leader of the 14K Triad, one of the largest Chinese organized criminal organizations in the world that engages in drug trafficking, illegal gambling, racketeering, human trafficking, and a range of other criminal activities.”

“The other piece that will connect to what you are interested in, is [Paul King Jin] had a business card that connects him to Broken Tooth Koi,” the source said. Asked if this indicated Jin was working with ‘The Company’ — a sophisticated Triad-linked entity moving cash worldwide — the source replied, “That would fit.”

“He seems to have stepped into a leadership role,” the source continued. “He has been heading to Central America a lot, and he is barely home anymore.”

The Bureau has not been able to reach Jin for comment through a Vancouver lawyer that represented him at the Cullen Commission.

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

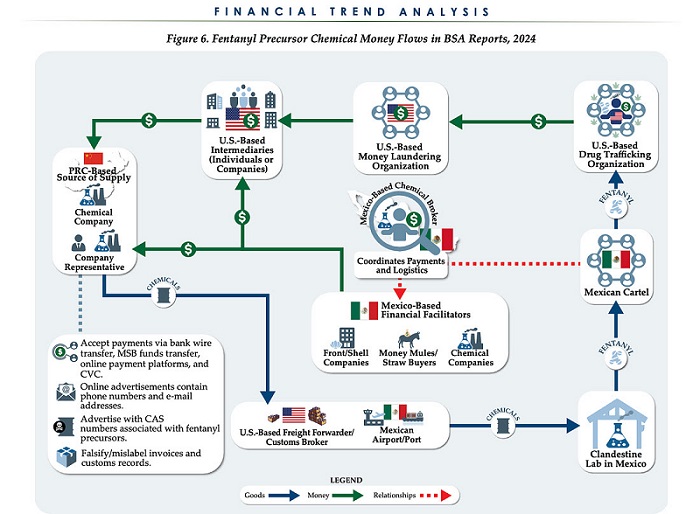

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

Closing information gaps to strengthen Canada’s border security and track fentanyl

By Sean Parker, Dawn Jutla, and Peter Copeland for Inside Policy

To promote better results, we lay out a collaborative approach

Despite exaggerated claims about how much fentanyl is trafficked across the border from Canada to the United States, the reality is that our detection, search, and seizure capacity is extremely limited.

We’re dealing with a “known unknown”: a risk we’re aware of, but don’t yet have the capacity to understand its extent.

What’s more, it may be that the flow of precursor chemicals—ingredients used in the production of fentanyl—is where much of the concern lies. Until we enhance our tracking, search, and seizure capacity, much will remain speculative.

As border security is further scrutinized, and the extent of fentanyl production and trafficking gets brought into sharper focus, the role of the federal government’s Precursor Chemical Risk Management Unit (PCRMU)—announced recently by Health Canada—will become apparent.

Ottawa recently took action to enhance the capabilities of the PCRMU. It says the new unit will “provide better insights into precursor chemicals, distribution channels, and enhanced monitoring and surveillance to enable timely law enforcement action.” The big question is, how will the PCRMU track the precursor drugs entering into Canada that are used to produce fentanyl?

Key players in the import-export ecosystem do not have the right regulatory framework and responsibilities to track and share information, detect suspect activities, and be incentivized to act on it. That’s one of the reasons why we know so little about how much fentanyl is produced and trafficked.

Without proper collaboration with industry, law enforcement, and financial institutions, these tracking efforts are doomed to fail. To promote better results, we lay out a collaborative approach that distributes responsibilities and retools incentives. These measures would enhance information collection capabilities, incentivize system actors to compliance, and better equip law enforcement and border security services for the safety of Canadians.

Trade-off bottleneck: addressing the costs of enhanced screening

To date, it’s been challenging to increase our ability to detect, search, and seize illegal goods trafficked through ports and border crossings. This is due to trade-offs between heightened manual search and seizure efforts at ports of entry, and the economic impacts of these efforts.

In 2024, the Canada Border Services Agency (CBSA) admitted over 93 million travelers. Meanwhile, 5.3 million trucks transported commercial goods into Canada, around 3.6 million shipments arrived via air cargo, nearly 2 million containers were processed at Canadian ports, roughly 1.9 million rail cars carried goods into the country, and about 145.7 million courier shipments crossed the border. The CBSA employs a risk-based approach to border security, utilizing intelligence, behavioral analysis, and random selection to identify individuals or shipments that may warrant additional scrutiny. This triaging process aims to balance effective enforcement with the facilitation of legitimate travel and trade.

Exact percentages of travelers subjected to secondary inspections are not publicly disclosed, but it’s understood that only a small fraction undergo such scrutiny. We don’t learn about the prevalence of these issues through our border screening measures, but in crime reporting data—after it’s too late to avert.

It’s key to have an approach that minimizes time and personnel resources deployed at points of entry. To be effective without being economically disruptive, policymakers, law enforcement, and border security need to strengthen requirements for information gathering, live tracking, and sharing. Legislative and regulatory change to require additional information of buyers and sellers—along with stringent penalties to enforce non-compliance—is a low-cost, logistically efficient way of distributing responsibility for this complex and multifaceted issue. A key concept explored in this paper is strengthening governance controls (“controls”) over fentanyl supply chains through new processes and data digitization, which could aid the PCRMU in their strategic objectives.

Enhanced supply chain controls are needed

When it comes to detailed supply chain knowledge of fentanyl precursor chemicals moving in and out of Canada, regulator knowledge is limited.

That’s why regulatory reform is the backbone of change. It’s necessary to ensure that strategic objectives are met by all accountable stakeholders to protect the supply chain and identify issues. To rectify the issues, solutions can be taken by the PCRMU to obtain and govern a modern fentanyl traceability system/platform (“platform”) that would provide live transparency to regulators.

A fresh set of supply chain controls, integrated into a platform as shown in Fig. 1, could significantly aid the PCRMU in identifying suspicious activities and prioritizing investigations.

Our described system has two distinctive streams: one which leverages a combination of physical controls such as package tampering and altered documentation against a second stream that looks at payment counterparties. Customs agencies, transporters, receivers, and financial institutions would have a hand in ensuring that controls in the platform are working. The platform includes several embedded controls to enhance supply chain oversight. It uses commercially available Vision AI to assess packaging and blockchain cryptography to verify shipment documentation integrity. Shipment weight and quantity are tracked from source to destination to detect diversion, while a four-eyes verification process ensures independent reconciliation by the seller, customs, and receiver. Additionally, payment details are linked to shipments to uncover suspicious financial activity and support investigations by financial institutions and regulators like FINTRAC and FINCEN.

A modern platform securely distributes responsibility in a way that’s cost effective and efficient so as not to overburden any one actor. It also ensures that companies of all sizes can participate, and protects them from exploitation by criminals and reputational damage.

In addition to these technological enhancements and more robust system controls, better collaboration between the key players in the fentanyl supply chain is needed, along with policy changes to incentivize each key fentanyl supply chain stakeholder to adopt the new controls.

Canadian financial institutions: a chance for further scrutiny

Financial institutions (FIs) are usually the first point of contact when a payment is being made by a purchaser to a supplier for precursor chemicals that could be used in the production of fentanyl. It is crucial that they enhance their screening and security processes.

Chemicals may be purchased by wires or via import letters of credit. The latter is the more likely of the two instruments to be used because this ensures that the terms and conditions in the letter of credit are met with proof of shipment prior to payment being released. Payments via wire require less transparency.

Where a buyer pays for precursor chemicals with a wire, it should result in further scrutiny by the financial institution. Requests for supporting documentation including terms and conditions, along with proof of shipment and receipt, should be provided. Under new regulatory policy, buyers would be required to place such supporting documentation on the shared platform.

The less transparent a payment channel is in relation to the supply chain, the more concerning it should be from a risk point of view. Certain payment channels may be leveraged to further mask illicit activity throughout the supply chain. At the onset of the relationship the seller and buyers would link payment information on the platform (payment channel, recipient name, recipient’s bank, date, and payment amount) to each precursor or fentanyl shipment. The supplier, in turn, should record match payment information (payment channel, supplier name, supplier’s bank, date, and payment amount).

Linking payment to physical shipment would enable data analytics to detect irregularities. An irregularity is flagged when the amounts and/or volume of payments far exceed the value of the received goods or vice versa. The system would be able to understand which fentanyl supply chains tend to use a particular set of FIs. This makes it possible to conduct real-time mapping of companies, their fentanyl and precursor shipments and receipts, and the payment institutions they use. With this bigger picture, FIs and law enforcement could connect the dots faster.

Live traceability reporting

Today, suppliers of fentanyl precursors are subject to the Pre-Export Notification Online (PEN Online) database. This database enables governments to monitor international trade in precursor chemicals by sending and receiving pre-export notifications. The system helps prevent the diversion of chemicals used in the illicit manufacture of drugs by allowing authorities to verify the legitimacy of shipments before they occur.

To further strengthen oversight, the platform utilizes immutability technologies—such as blockchain or secure immutable databases—which can be employed to encrypt all shipping documents and securely share them. This presents an auditable form of chain-of-custody and makes any alterations apparent. Customs and buyers would have the capability to verify the authenticity of the originating documents in a way that doesn’t compromise business confidentiality. With the use of these technologies, law enforcement can narrow down their investigations.

An information gap currently exists as the receivers of the shipments don’t share their receipts information with PEN. To strengthen governance on fentanyl supply chains, regulatory policy and legislative changes are needed. The private sector should be mandated to report received quantities of fentanyl or its precursors, as well as suspicious receiving destinations. This could be accomplished on the platform which would embed the receiving process, a reconciliation process of the transaction, the secure upload and sharing of documents, and would be minimally disruptive to business processes.

Additionally, geo-location technology embedded in mobile devices and/or shipments would provide real-time location-based tracking of custody transactions. These geo-controls would ensure accountability across the fentanyl supply chain, in particular where shipments veer off or stop too long on regular shipping routes. Canadian transporters of fentanyl and its precursor chemicals should play an important role in detecting illicit diversion/activities.

Digital labelling

Licensed fentanyl manufacturers could add new unique digital labels to their shipments to get expedited clearance. For example, immutable digital labelling platforms enable tamper-proof digital labels for legitimate fentanyl shipments. This would give pharmacies, doctors, and regulators transparency into the fentanyl’s:

- Chemical composition and concentrations (determining legitimate vs. adulterated versions of the drug)

- Manufacturing facility ID, batch ID, and regulatory compliance status

- Intended buyer authentication (such as licensed pharmaceutical firms or distributors)

Immutable digital labelling platforms offer secure role-based access control. They can display customized data views according to time of day, language, and location. Digital labels could enable international border agencies and law enforcement to receive usable data, allowing legal shipments through faster while triggering closer shipment examinations for those without of a digital label.

International and domestic transporter controls

Transporters act as intermediaries in the supply chain. Their operations could be monitored through a regulatory policy that mandates their participation in the platform for fentanyl and precursor shipments. The platform would support a mobile app interface for participants on-the-move, as well as a web portal and application programming interfaces (APIs) for large-size supply chain participants. Secure scanning of packaging at multiple checkpoints, combined with real-time tracking, would provide an additional layer of protection against fraud, truckers taking bribes, and unauthorized alterations to shipments and documents.

Regulators and law enforcement participation

Technology-based fentanyl controls for suppliers, buyers, and transporters may be reinforced by international customs and law enforcement collaboration on the platform. Both CBSA and law enforcement could log in and view alerts about suspicious activities issued from the FIs, transporters, or receivers. The reporting would allow government personnel to view a breakdown of fentanyl importers, the number of import permit applications, and the amount of fentanyl and its precursors flowing into the country. Responsible regulatory agencies—such as the CBSA and PCRMU—could leverage the reporting to identify hot spots.

The platform would use machine learning to support CBSA personnel in processing an incoming fentanyl or precursor shipment. Machine learning refers to AI algorithms and systems that improve their knowledge with experience. For example, an AI assistant on the traceability system could use machine learning to predict and communicate which import shipments arriving at the border should be passed. It can base these suggestions on criteria like volume, price, origin of raw materials, and origin of material at import point. It can also leverage data from other sources such as buyers, sellers, and banks to make predictions. As an outcome, the shipment may be recommended to pass, flagged as suspicious, or deemed to require an investigation by CBSA.

It’s necessary to keep up to date on new precursor chemicals as the drug is reformulated. Here, Health Canada can play a role, using its new labs and tests—expected as part of the recently announced Canadian Drug Analysis Centre—to provide chemical analysis of seized fentanyl. This would inform which additional chemical supply chains should be tracked in the PCRMU’s collaborative platform, and all stakeholders would widen their scope of review.

These new tools would complement existing cross-border initiatives, including joint U.S.-Canada and U.S.-Mexico crackdowns on illicit drug labs, as well as sovereign efforts. They have the potential to play a vital role in addressing fentanyl trafficking.

A robust, multi-pronged strategy—integrating existing safeguards with a new PCRMU traceability platform—could significantly disrupt the illegal production and distribution of fentanyl. By tracking critical supply chain events and authenticating shipment data, the platform would equip law enforcement and border agencies in Canada, the U.S., and Mexico with timely, actionable intelligence. The human toll demands urgency: from 2017 to 2022, the U.S. averaged 80,000 opioid-related deaths annually, while Canada saw roughly 5,500 per year from 2016 to 2024. In just the first nine months of 2024, Canadian emergency services responded to 28,813 opioid-related overdoses.

Combating this crisis requires more than enforcement. It demands enforceable transparency. Strengthened governance—powered by advanced traceability technology and coordinated public-private collaboration—is essential. This paper outlines key digital controls that can be implemented by global suppliers, Canadian buyers, transporters, customs, and financial institutions. With federal leadership, Canada can spearhead the adoption of proven, homegrown technologies to secure fentanyl supply chains and save lives.

Sean Parker is a compliance leader with well over a decade of experience in financial crime compliance, and a contributor to the Macdonald-Laurier Institute.

Dawn Jutla is the CEO of Peer Ledger, the maker of a traceability platform that embeds new control processes on supply chains, and a professor at the Sobey School of Business.

Peter Copeland is deputy director of domestic policy at the Macdonald-Laurier Institute.

-

International2 days ago

International2 days agoPope Francis has died aged 88

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

Business2 days ago

Business2 days agoCanada Urgently Needs A Watchdog For Government Waste

-

Energy2 days ago

Energy2 days agoIndigenous-led Projects Hold Key To Canada’s Energy Future

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY