Business

As Ottawa meddles with pension funds, Albertans should consider

From the Frontier Centre for Public Policy

Who Should Control Canada’s Pension Wealth?

Ottawa wants to compel large pools of Canadian money to be invested in Canada, instead of allowing investment funds to find the best return for Canadian investors.

Last week, another scandalous and potentially corrupt string of federal activities popped up.

This one has deep implications for pension plans in Canada, including the debate about an Alberta Pension Plan. Mark Carney’s double game of politics and profit enhances the drive to patriate Alberta’s pension wealth.

At issue is a report in the media saying that Brookfield may be looking to raise a $50 billion fund with contributions from Canada’s pension funds and an additional $10 billion from the federal government.

This report has drawn significant attention for several reasons. Toronto-based Brookfield is one of the world’s largest alternative investment management companies, claiming about one trillion in assets under management. Their portfolio spans real estate, renewable energy, infrastructure, and private equity, making them a significant player in domestic and international markets. The magnitude of Brookfield’s investments places them at the forefront of global financial movements, giving considerable weight to any fund they propose to establish.

The second reason is that Finance Minister Chrystia Freeland and Prime Minister Justin Trudeau have voiced their ambitions to boost home-grown investments. One of the government’s strategies includes tapping into Stephen Poloz, the former Governor of the Bank of Canada. Poloz succeeded Mark Carney as the head of the bank. The Liberal government has tasked Poloz with leading a working group to identify “incentives” that would “encourage” institutional investors to keep their capital in Canada.

Moreover, Finance Minister Freeland has suggested implementing new regulations to ensure that more of Canada’s substantial pension fund reserves, which amount to an impressive $1.8 trillion, are allocated toward Canadian ventures. This comes when a staggering 73% of Canadian pension funds are invested abroad.

On its face, a plan to invest more Canadian wealth in Canada might sound reasonable. However, the plan avoids the crucial question of why money experts prefer investing outside Canada. Considering that question, one must consider the Trudeau government’s economic record.

Put differently, Ottawa is looking for ways to compel large pools of Canadian money to be invested in Canada instead of allowing investment funds to find the best return for Canadian investors. Those large cash pools typically belong to hard-working Canadians, such as teachers’ pensions. They would be forced to earn less for their pension money.

Forcing such large sums to remain in Canada would mask the continuous slump in productivity in the Canadian economy.

Given current economic policies and layers of taxation that do not exist elsewhere (such as the unpopular carbon taxes), Canadian companies are less competitive. Forcing pools of money to stay in Canada rather than seeking the best return for their clients offers an artificial boost that makes Ottawa policies seem less harmful.

It is, therefore, a politically motivated move. That level of government intervention historically always results in disastrous consequences. Politics directing traffic for the movement of capital rarely achieves good outcomes. The real issue is sagging productivity.

But that is only half the problem. The other significant issue is ethics.

Prime Minister Trudeau has recently named Mark Carney as his special economic advisor. Carney is the Chair of Asset Management and Head of Transition Investing at Brookfield. The Brookfield website shows Carney is responsible for “developing products for investors.” Carney is also the most mentioned name among people likely to succeed Justin Trudeau as leader of the Liberal Party of Canada.

In short, the man who closely advises the government of Canada on how to compel gargantuan pools of money to be invested in Canada conveniently oversees the development of the “product” for the private Toronto firm, through which that money would be forced to be invested in Canada. Furthermore, the same firm reportedly seeks (read lobbying) from the federal government an infusion of $10 billion for the new fund.

As a Liberal and a potential party leader, given Justin Trudeau’s fortunes, Mark Carney could become prime minister in the immediate future. This means that Carney would benefit from creating new rules forcing investment money to stay in the country in two ways: As a leading man at Brookfield, Carney and the firm stand to make tens of millions from the policy. Second, as a carbon tax enthusiast, once squarely in political office, Carney would benefit from masking the ill, underproductive effects of the radical green agenda and carbon taxes he supports.

When Alberta progressives oppose the desire of many Albertans to patriate Alberta pension funds to the province, they cite concerns that the province might use the funds for political purposes, undermining the maximum return. This is not an outlandish concern, in some respects, given the history of the Alberta Heritage Fund.

However, it is not an exclusive danger inherent to the Alberta government. It does not warrant the presupposition that the federal government is a better steward of Alberta’s pension wealth, as demonstrated by the developments above. All things being equal, and unless human nature is outlawed by federal statute, the risks are the same.

But if something goes wrong with Albertans’ pension wealth, would they rather deal with people in Alberta than people in Ottawa, half a continent away Raising Alberta voices in Ottawa when Ottawa has been bent on doing the opposite of what is good for Albertans has never produced good results or reversed the nefarious effects on Albertans.

Ottawa politicians will do what is best for Laurentians every single time. The history of the Dominion, from the national policy to Crow rates and the National Energy Policy to Carbon Taxes, shows Ottawa policies always favour vote-rich Laurentia first and foremost.

Mark Carney’s product development for Brookfield shows, at worst, that Alberta’s pension wealth is just as much as risk with federal policies driven by political motivations. This one would be doubly bad because it is meant to serve and benefit Carney and his Bay Street friends as much as it is designed to help his future colleagues in Ottawa. And on both counts, Carney would benefit as a financier and politician.

Albertans should take their money and run.

Marco Navarro-Genie is Vice President Research with the Frontier Centre for Public Policy. He is co-author, with Barry Cooper, of COVID-19: The Politics of a Pandemic Moral Panic (2020).

2025 Federal Election

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

-

2025 Federal Election2 days ago

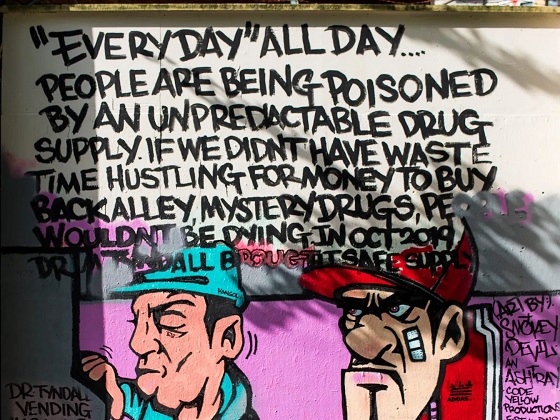

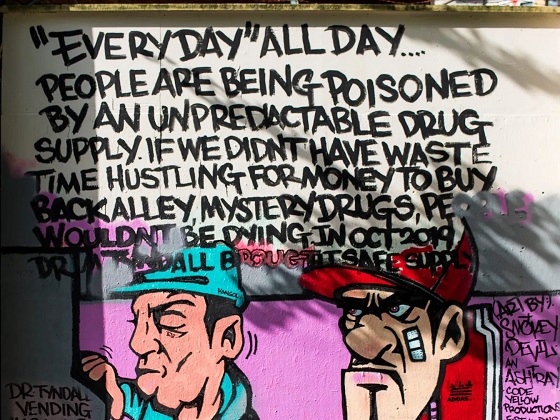

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolls say Canadians will give Trump what he wants, a Carney victory.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe Anhui Convergence: Chinese United Front Network Surfaces in Australian and Canadian Elections

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoPoilievre Campaigning To Build A Canadian Economic Fortress

-

Automotive17 hours ago

Automotive17 hours agoCanadians’ Interest in Buying an EV Falls for Third Year in a Row