Business

As inflation jumps to 3.3 per cent in July, economists say uptick is bad news for BoC

Statistics Canada released its July consumer price index report this morning, with a 3.3 per cent inflation rate. The rise in the pace of growth since June was led by gasoline prices. Gas prices are displayed in Carleton Place, Ont. on Tuesday, May 17, 2022. THE CANADIAN PRESS/Sean Kilpatrick

By Nojoud Al Mallees in Ottawa

Canada’s annual inflation rate rose to 3.3 per cent in July, as economists warn the latest consumer price index report spells bad news for the Bank of Canada.

The uptick in price growth comes after inflation tumbled to 2.8 per cent in June, falling within the Bank of Canada’s target range of between one and three per cent for the first time since March 2021.

“There’s no sense sugar coating this one — it is not a good report for the Bank of Canada,” said BMO chief economist Douglas Porter in a note to clients.

Inflation ticked up last month because gasoline prices fell less dramatically on a year-over-year basis than they did in June, Statistics Canada said.

After a significant run-up in energy prices prompted by the Russian invasion of Ukraine, lower gasoline prices have largely driven the decline in inflation over the last year.

Now, other underlying price pressures need to ease for inflation to fall further. Porter notes gasoline prices are on pace to rise by five per cent in August.

The latest report has raised the odds of a rate hike next month, according to forecasters, despite other signs of economic softening, including rising unemployment.

And while Porter still expects the Bank of Canada to stay on the sidelines, he says “the inflation figures will make it a tougher call.”

Excluding energy prices, the consumer price index decelerated to 4.2 per cent, down from 4.4 per cent in June.

Meanwhile, grocery prices rose 8.5 per cent on an annual basis. The federal agency says prices rose more slowly than June’s 9.1 per cent, largely due to smaller price increases for fruit and bakery goods.

Prices for travel-related services also slowed or declined compared to a year ago. Airfare, for example, was down 12.7 per cent since July 2022.

The Bank of Canada expects inflation to hover around three per cent over the next year, before steadily declining to two per cent by mid-2025.

This longer trajectory back to the inflation target prompted the central bank to raise interest rates again in July, bringing its key rate to 5.0 per cent.

The rapid rise in interest rates has fed into higher mortgage interest costs, which Statistics Canada says continue to be the largest contributor to inflation.

Mortgage interest costs posted another record year-over-year increase in July, rising by 30.6 per cent.

The central bank is hoping households facing higher shelter costs due to rising interest rates to pull back on spending elsewhere and thereby slowing inflation.

The Bank of Canada is set to make its next interest rate decision on Sept. 6.

This report by The Canadian Press was first published Aug. 15, 2023.

Automotive

Major automakers push congress to block California’s 2035 EV mandate

MxM News

MxM News

Quick Hit:

Major automakers are urging Congress to intervene and halt California’s aggressive plan to eliminate gasoline-only vehicles by 2035. With the Biden-era EPA waiver empowering California and 11 other states to enforce the rule, automakers warn of immediate impacts on vehicle availability and consumer choice. The U.S. House is preparing for a critical vote to determine if California’s sweeping environmental mandates will stand.

Key Details:

-

Automakers argue California’s rules will raise prices and limit consumer choices, especially amid high tariffs on auto imports.

-

The House is set to vote this week on repealing the EPA waiver that greenlit California’s mandate.

-

California’s regulations would require 35% of 2026 model year vehicles to be zero-emission, a figure manufacturers say is unrealistic.

Diving Deeper:

The Alliance for Automotive Innovation, representing industry giants such as General Motors, Toyota, Volkswagen, and Hyundai, issued a letter Monday warning Congress about the looming consequences of California’s radical environmental regulations. The automakers stressed that unless Congress acts swiftly, vehicle shipments across the country could be disrupted within months, forcing car companies to artificially limit sales of traditional vehicles to meet electric vehicle quotas.

California’s Air Resources Board rules have already spread to 11 other states—including New York, Massachusetts, and Oregon—together representing roughly 40% of the entire U.S. auto market. Despite repeated concerns from manufacturers, California officials have doubled down, insisting that their measures are essential for meeting lofty greenhouse gas reduction targets and combating smog. However, even some states like Maryland have recognized the impracticality of California’s timeline, opting to delay compliance.

A major legal hurdle complicates the path forward. The Government Accountability Office ruled in March that the EPA waiver issued under former President Joe Biden cannot be revoked under the Congressional Review Act, which requires only a simple Senate majority. This creates uncertainty over whether Congress can truly roll back California’s authority without more complex legislative action.

The House is also gearing up to tackle other elements of California’s environmental regime, including blocking the state from imposing stricter pollution standards on commercial trucks and halting its low-nitrogen oxide emissions regulations for heavy-duty vehicles. These moves reflect growing concerns that California’s progressive regulatory overreach is threatening national commerce and consumer choice.

Under California’s current rules, the state demands that 35% of light-duty vehicles for the 2026 model year be zero-emission, scaling up rapidly to 68% by 2030. Industry experts widely agree that these targets are disconnected from reality, given the current slow pace of electric vehicle adoption among the broader American public, particularly in rural and lower-income areas.

California first unveiled its plan in 2020, aiming to make at least 80% of new cars electric and the remainder plug-in hybrids by 2035. Now, under President Donald Trump’s leadership, the U.S. Transportation Department is working to undo the aggressive fuel economy regulations imposed during former President Joe Biden’s term, offering a much-needed course correction for an auto industry burdened by regulatory overreach.

As Congress debates, the larger question remains: Will America allow one state’s left-wing environmental ideology to dictate terms for the entire country’s auto industry?

Business

Net Zero by 2050: There is no realistic path to affordable and reliable electricity

By Dave Morton of the Canadian Energy Reliability Council.

By Dave Morton of the Canadian Energy Reliability Council.

Maintaining energy diversity is crucial to a truly sustainable future

Canada is on an ambitious path to “decarbonize” its economy by 2050 to deliver on its political commitment to achieve net-zero greenhouse gas (GHG) emissions. Although policy varies across provinces and federally, a default policy of electrification has emerged, and the electricity industry, which in Canada is largely owned by our provincial governments, appears to be on board.

In a November 2023 submission to the federal government, Electricity Canada, an association of major electric generators and suppliers in Canada, stated: “Every credible path to Net Zero by 2050 relies on electrification of other sectors.” In a single generation, then, will clean electricity become the dominant source of energy in Canada? If so, this puts all our energy eggs in one basket. Lost in the debate seem to be considerations of energy diversity and its role in energy system reliability.

What does an electrification strategy mean for Canada? Currently, for every 100 units of energy we consume in Canada, over 40 come to us as liquid fuels like gasoline and diesel, almost 40 as gaseous fuels like natural gas and propane, and a little less than 20 in the form of electrons produced by those fuels as well as by water, uranium, wind, solar and biomass. In British Columbia, for example, the gas system delivered approximately double the energy of the electricity system.

How much electricity will we need? According to a recent Fraser Institute report, a decarbonized electricity grid by 2050 requires a doubling of electricity. This means adding the equivalent of 134 new large hydro projects like BC’s Site C, 18 nuclear facilities like Ontario’s Bruce Power Plant, or installing almost 75,000 large wind turbines on over one million hectares of land, an area nearly 14.5 times the size of the municipality of Calgary.

Is it feasible to achieve a fully decarbonized electricity grid in the next 25 years that will supply much of our energy requirements? There is a real risk of skilled labour and supply chain shortages that may be impossible to overcome, especially as many other countries are also racing towards net-zero by 2050. Even now, shortages of transformers and copper wire are impacting capital projects. The Fraser Institute report looks at the construction challenges and concludes that doing so “is likely impossible within the 2050 timeframe”.

How we get there matters a lot to our energy reliability along the way. As we put more eggs in the basket, our reliability risk increases. Pursuing electrification while not continuing to invest in our existing fossil fuel-based infrastructure risks leaving our homes and industries short of basic energy needs if we miss our electrification targets.

The IEA 2023 Roadmap to Net Zero estimates that technologies not yet available on the market will be needed to deliver 35 percent of emissions reductions needed for net zero in 2050. It comes then as no surprise that many of the technologies needed to grow a green electric grid are not fully mature. While wind and solar, increasingly the new generation source of choice in many jurisdictions, serve as a relatively inexpensive source of electricity and play a key role in meeting expanded demand for electricity, they introduce significant challenges to grid stability and reliability that remain largely unresolved. As most people know, they only produce electricity when the wind blows and the sun shines, thereby requiring a firm back-up source of electricity generation.

Given the unpopularity of fossil fuel generation, the difficulty of building hydro and the reluctance to adopt nuclear in much of Canada, there is little in the way of firm electricity available to provide that backup. Large “utility scale” batteries may help mitigate intermittent electricity production in the short term, but these facilities too are immature. Furthermore, wind, solar and batteries, because of the way they connect to the grid don’t contribute to grid reliability in the same way the previous generation of electric generation does.

Other zero-emitting electricity generation technologies are in various stages of development – for example, Carbon Capture Utilization and Storage (CCUS) fitted to GHG emitting generation facilities can allow gas or even coal to generate firm electricity and along with Small Modular Reactors (SMRs) can provide a firm and flexible source of electricity.

What if everything can’t be electrified? In June 2024, a report commissioned by the federal government concluded that the share of overall energy supplied by electricity will need to roughly triple by 2050, increasing from the current 17 percent to between 40 and 70 percent. In this analysis, then, even a tripling of existing electricity generation, will at best only meet 70 percent of our energy needs by 2050.

Therefore, to ensure the continued supply of reliable energy, non-electrification pathways to net zero are also required. CCUS and SMR technologies currently being developed for producing electricity could potentially be used to provide thermal energy for industrial processes and even building heat; biofuels to replace gasoline, diesel and natural gas; and hydrogen to augment natural gas, along with GHG offsets and various emission trading schemes are similarly

While many of these technologies can and currently do contribute to GHG emission reductions, uncertainties remain relating to their scalability, cost and public acceptance. These uncertainties in all sectors of our energy system leaves us with the question: Is there any credible pathway to reliable net-zero energy by 2050?

Electricity Canada states: “Ensuring reliability, affordability, and sustainability is a balancing act … the energy transition is in large part policy-driven; thus, current policy preferences are uniquely impactful on the way utilities can manage the energy trilemma. The energy trilemma is often referred to colloquially as a three-legged stool, with GHG reductions only one of those legs. But the other two, reliability and affordability, are key to the success of the transition.

Policymakers should urgently consider whether any pathway exists to deliver reliable net-zero energy by 2050. If not, letting the pace of the transition be dictated by only one of those legs guarantees, at best, a wobbly stool. Matching the pace of GHG reductions with achievable measures to maintain energy diversity and reliability at prices that are affordable will be critical to setting us on a truly sustainable pathway to net zero, even if it isn’t achieved by 2050.

Dave Morton, former Chair and CEO of the British Columbia Utilities Commission (BCUC), is with the Canadian Energy Reliability Council.

-

2025 Federal Election1 day ago

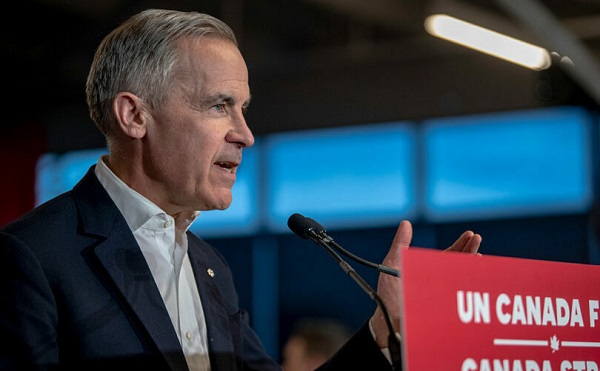

2025 Federal Election1 day agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney: Our Number-One Alberta Separatist

-

International1 day ago

International1 day agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

COVID-1910 hours ago

COVID-1910 hours agoFormer Australian state premier accused of lying about justification for COVID lockdowns

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCanada is squandering the greatest oil opportunity on Earth

-

International21 hours ago

International21 hours agoU.S. Army names new long-range hypersonic weapon ‘Dark Eagle’

-

Business21 hours ago

Business21 hours agoTrump demands free passage for American ships through Panama, Suez