Alberta

Alberta’s financial update one for the ages – Historical investments in savings and debt reduction on the way

Q1 update: Paying down debt and saving for the future

Strong economic activity this year will see Alberta make historic investments in savings and debt reduction.

High revenue forecast for bitumen royalties, other resource revenue and corporate income taxes have increased the province’s forecast surplus to $13.2 billion for 2022-23.

This year’s surplus enables the government to make the largest single-year debt repayment in Alberta’s history, repaying $13.4 billion in debt that comes due this fiscal year. The government will also allocate $5.2 billion to debt coming due in 2023-24.

The government will make the largest ever single-year investment in the Heritage Fund, retaining the fund’s remaining 2021-22 net investment income of $1.2 billion and allocating $1.7 billion, for a total investment of $2.9 billion. This is over and above the $705 million retained for inflation-proofing last year.

“Alberta’s commitment to fiscal discipline and our unrelenting focus on economic growth has helped bring about an extraordinary turnaround in our financial situation. We promised Albertans we would get our fiscal house in order and that’s exactly what we’ve done. Now, we’re paying down debt so future generations won’t have to, saving more for a rainy day, and putting more money in Albertans’ pockets.”

“For too long, governments in Alberta refused to exercise fiscal discipline during boom times. Those days are over. Alberta’s government is making the prudent decision to save and invest surplus revenues so future generations can benefit from the prosperity of today.”

Indexing personal income taxes

The province is fulfilling a commitment made in 2019 to index personal income taxes to inflation, retroactive to the 2022 tax year. The basic personal tax amount is rising to $19,814 and will rise again in 2023.

An additional 80,000 to 95,000 Albertans will pay no provincial personal income tax by 2023, on top of the approximately 1.3 million tax filers who already pay no provincial personal income tax.

Many Albertans will first see the benefit of indexation through lower tax withholdings on their first paycheques of 2023. In addition, since indexation will resume for 2022, Albertans will receive larger refunds or owe less tax when they file their 2022 tax returns in spring 2023. In total, resuming indexation for 2022 and subsequent years will save Albertans an estimated $304 million in 2022-23, $680 million in 2023-24 and $980 million in 2024-25.

Indexing personal income taxes to inflation will contribute further to Alberta’s strong tax advantage: Albertans already pay less in overall taxes, with no PST, no payroll tax and no health premiums.

Alberta’s government has already introduced some of the most generous measures to keep more money in the pockets of Albertans, committing $2.4 billion in relief for rising prices, inflation and cost of living, including:

- Providing $300 in relief for 1.9 million homeowners, business operators and farmers over six months through the Electricity Rebate Program.

- Eliminating the 13-cent-per-litre provincial fuel tax until at least the end of September.

- Helping school authorities cover high fuel costs for buses under the Fuel Price Contingency Program.

- Providing natural gas rebates from October 2022 to March 2023 to shield consumers from natural gas price spikes.

- Maintaining Alberta senior benefits for those over 75 years of age, exempting them from the Federal Old Age Security increase.

Other economic growth indicators

Momentum has picked up in Alberta’s labour market. The province has added 68,200 jobs since the beginning of the year and most industries have surpassed employment levels from early 2020, before the pandemic first took hold of the province. Alberta’s unemployment rate fell to 4.8 per cent, the lowest since early 2015. In response to these positive developments, the province has revised its forecast for employment growth to 5.3 per cent, up from 4.1 per cent at budget. The unemployment rate has also been revised down to 5.9 per cent in 2022 from the budget forecast of 6.6 per cent.

Business output has surged in the province on the back of higher demand and prices. While energy products have led the increase, there have been gains across most industries including chemical and forestry products, food manufacturing and machinery. Merchandise exports have risen more than 60 per cent so far this year, while manufacturing shipments are up over 30 per cent.

Higher energy prices are boosting revenues and spending in the oil and gas sector. Strong drilling activity has lifted crude oil production to 3.6 million barrels per day so far this year and is expected to reach a record high this year. Outside the oil and gas sector, companies are proceeding with investment plans, buoyed by solid corporate profits.

Real gross domestic product (GDP) is expected to grow by 4.9 per cent in 2022. This is down slightly from the budget forecast of 5.4 per cent, reflecting softer expectations for growth in consumer spending and residential investment as a result of higher inflation and interest rates. Even so, real GDP is expected to fully recover from the COVID-19 downturn and surpass the 2014 peak for the first time this year. Private sector forecasters are expecting Alberta to have among the highest economic growth in the country this year and in 2023.

Quick facts

- The surplus for 2022-23 is forecast at $13.2 billion, $12.6 billion more than what was estimated in Budget 2022.

- The revenue forecast for 2022-23 is $75.9 billion, $13.3 billion higher than reported in the budget.

- Non-renewable resource revenue is forecast at $28.4 billion in 2022-23, up $14.6 billion from budget’s $13.8 billion forecast.

- Corporate income taxes are up $2 billion from the budget, with a new forecast of $6.1 billion for 2022-23.

- Revenue from personal income taxes is forecast to be $13.3 billion in 2022-23, down $116 million from budget. Indexation of the personal income tax system, retroactive to Jan. 1, 2022, is forecast to lower revenue by $304 million. This is partially offset by increased revenue from rising primary household income.

- Total expense is forecast at $62.7 billion, up slightly from the $62.1 billion estimated at budget.

- Education is receiving an extra $52 million to support the new teachers agreement and to help school authorities pay for bus fuel.

- $279 million the province received from the federal government for the Site Rehabilitation Program is being spent this year instead of next year.

- $277 million is needed to cover the cost of selling oil due to higher prices and volumes.

- The Capital Plan in 2022-23 has increased by $389 million mainly due to carry-over of unspent funds from last fiscal year and an increase of $78 million for highway expansion.

- Taxpayer-supported debt is forecast at $79.8 billion on March 31, 2023, which is $10.4 billion lower than estimated in the budget.

- The net debt-to-GDP ratio is estimated at 10.3 per cent for the end of the fiscal year.

Alberta

Medical regulator stops short of revoking license of Alberta doctor skeptic of COVID vaccine

From LifeSiteNews

The Democracy Fund has announced that COVID-skeptic Dr. Roger Hodkinson will retain his medical license after a successful appeal against allegations of ‘unprofessional conduct’ by the College of Physicians and Surgeons of Alberta.

A doctor who called for officials to be jailed for being complicit in the “big kill” caused by COVID measures will get to keep his medical license thanks to a ruling by a Canadian medical regulator.

The Democracy Fund (TDF) announced in an April 4 press release that one of its clients, Dr. Roger Hodkinson, will retain his medical license after filing an appeal with the College of Physicians and Surgeons of Alberta (CPSA) over allegations of “unprofessional conduct regarding 17 public statements made in November 2020 and April 2021.”

Hodkinson had routinely argued against the dictates of public health and elected officials and “presented an alternative perspective on COVID-19, including the efficacy of masking and vaccines,” TDF noted.

In 2021, Hodkinson and Dr. Dennis Modry publicly blasted the then-provincial government of Alberta under Premier Jason Kenney for “intimidating” people “into compliance” with COVID-19 lockdowns.

In 2022, Hodkinson said that leaders in Canada and throughout the world have perpetrated the “biggest kill ever in medicine’s history” by coercing people into taking the experimental COVID injections and subjecting them to lengthy lockdowns.

These statements, among others, led the CPSA to claim that Hodkinson had promoted inaccurate or misleading information. “However, following negotiations with lawyers for The Democracy Fund, the CPSA limited its claims to arguing that Dr. Hodkinson’s comments violated the ethical code and extended beyond the scope of a general pathologist.”

Thus, Hodkinson did not “concede that any of his statements were false,” but “acknowledged that his criticisms of other physicians technically breached the Code of Ethics and Professionalism,” the group explained. “He also admitted that he should have clarified that his views were outside the scope of a general pathologist.”

Instead of having his license revoked, TDF stated that Dr. Hodkinson received a “caution” and will have to “complete an online course on influence and advocacy.”

“However, he did not concede that any of his statements were misinformation, nor did the tribunal make such a determination,” noted lawyer Alan Honner.

While Hodkinson received a slap on the wrist, a number of Canadian doctors have faced much harsher sanctions for warning about the experimental vaccines or other COVID protocols such as lockdowns, including the revocation of their medical licenses, as was the case with Dr. Mark Trozzi and others.

Some of Hodkinson’s warnings seem to have been vindicated by the current Alberta government under Premier Danielle Smith, who commissioned Dr. Gary Davidson to investigate the previous administration’s handling of COVID-19.

Davidson’s report, which was made public earlier this year, recommended the immediately halt of the experimental jabs for healthy children and teenagers, citing the risks the shots pose.

Alberta

Province introducing “Patient-Focused Funding Model” to fund acute care in Alberta

Alberta’s government is introducing a new acute care funding model, increasing the accountability, efficiency and volume of high-quality surgical delivery.

Currently, the health care system is primarily funded by a single grant made to Alberta Health Services to deliver health care across the province. This grant has grown by $3.4 billion since 2018-19, and although Alberta performed about 20,000 more surgeries this past year than at that time, this is not good enough. Albertans deserve surgical wait times that don’t just marginally improve but meet the medically recommended wait times for every single patient.

With Acute Care Alberta now fully operational, Alberta’s government is implementing reforms to acute care funding through a patient-focused funding (PFF) model, also known as activity-based funding, which pays hospitals based on the services they provide.

“The current global budgeting model has no incentives to increase volume, no accountability and no cost predictability for taxpayers. By switching to an activity-based funding model, our health care system will have built-in incentives to increase volume with high quality, cost predictability for taxpayers and accountability for all providers. This approach will increase transparency, lower wait times and attract more surgeons – helping deliver better health care for all Albertans, when and where they need it.”

Activity-based funding is based on the number and type of patients treated and the complexity of their care, incentivizing efficiency and ensuring that funding is tied to the actual care provided to patients. This funding model improves transparency, ensuring care is delivered at the right time and place as multiple organizations begin providing health services across the province.

“Exploring innovative ways to allocate funding within our health care system will ensure that Albertans receive the care they need, when they need it most. I am excited to see how this new approach will enhance the delivery of health care in Alberta.”

Patient-focused, or activity-based, funding has been successfully implemented in Australia and many European nations, including Sweden and Norway, to address wait times and access to health care services, and is currently used in both British Columbia and Ontario in various ways.

“It is clear that we need a new approach to manage the costs of delivering health care while ensuring Albertans receive the care they expect and deserve. Patient-focused funding will bring greater accountability to how health care dollars are being spent while also providing an incentive for quality care.”

This transition is part of Acute Care Alberta’s mandate to oversee and arrange for the delivery of acute care services such as surgeries, a role that was historically performed by AHS. With Alberta’s government funding more surgeries than ever, setting a record with 304,595 surgeries completed in 2023-24 and with 310,000 surgeries expected to have been completed in 2024-25, it is crucial that funding models evolve to keep pace with the growing demand and complexity of services.

“With AHS transitioning to a hospital-based services provider, it’s time we are bold and begin to explore how to make our health care system more efficient and manage the cost of care on a per patient basis. The transition to a PFF model will align funding with patient care needs, based on actual service demand and patient needs, reflecting the communities they serve.”

“Covenant Health welcomes a patient-focused approach to acute care funding that drives efficiency, accountability and performance while delivering the highest quality of care and services for all Albertans. As a trusted acute care provider, this model better aligns funding with outcomes and supports our unwavering commitment to patients.”

“Patient-focused hospital financing ties funding to activity. Hospitals are paid for the services they deliver. Efficiency may improve and surgical wait times may decrease. Further, hospital managers may be more accountable towards hospital spending patterns. These features ensure that patients receive quality care of the highest value.”

Leadership at Alberta Health and Acute Care Alberta will review relevant research and the experience of other jurisdictions, engage stakeholders and define and customize patient-focused funding in the Alberta context. This working group will also identify and run a pilot to determine where and how this approach can best be applied and implemented this fiscal year.

Final recommendations will be provided to the minister of health later this year, with implementation of patient-focused funding for select procedures across the system in 2026.

-

Podcasts12 hours ago

Podcasts12 hours agoThe world is changing – Trump’s Tariffs, the US, Canada, and the rest of the world

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberals Replace Candidate Embroiled in Election Interference Scandal with Board Member of School Flagged in Canada’s Election Interference Inquiry

-

Alberta10 hours ago

Alberta10 hours agoProvince introducing “Patient-Focused Funding Model” to fund acute care in Alberta

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPierre Poilievre Declares War on Red Tape and Liberal Decay in Osoyoos

-

Business23 hours ago

Business23 hours agoJury verdict against oil industry worries critics, could drive up energy costs

-

2025 Federal Election12 hours ago

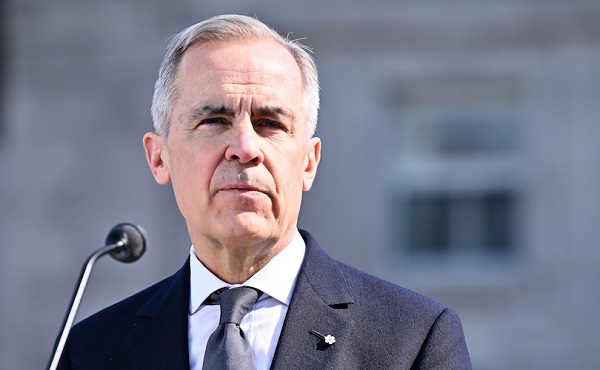

2025 Federal Election12 hours agoMark Carney Comes to B.C. and Delivers a Masterclass in Liberal Arrogance

-

2025 Federal Election11 hours ago

2025 Federal Election11 hours agoPoilievre to invest in recovery, cut off federal funding for opioids and defund drug dens

-

Business11 hours ago

Business11 hours agoTrump threatens additional 50% tariffs on China, urges ‘patience’