Alberta

Writ drops for Alberta provincial election on May 29

United Conservative Party Leader Danielle Smith, centre, speaks at a campaign launch rally in Calgary, on Saturday, April 29, 2023. Smith is expected to call a provincial election during an announcement later this morning in Calgary. THE CANADIAN PRESS/Jeff McIntosh

Calgary

Writs issued for the 2023 Provincial General Election

Alberta’s Chief Electoral Officer, Glen Resler, confirms that Writs were issued today to administer elections across Alberta. The 31st Provincial General Election will be held on May 29, 2023.

Alberta’s Chief Electoral Officer, Glen Resler, confirms that Writs were issued today to administer elections across Alberta. The 31st Provincial General Election will be held on May 29, 2023.

“We are excited to welcome Albertans back to the polls this month,” said Resler. “Returning Officers have been appointed, and we are in the process of recruiting and training nearly 20,000 Election Officers to conduct voting in the 87 electoral divisions across the province.”

Voter Eligibility

Canadian citizens who reside in Alberta and are at least 18 years of age or older on Election Day are eligible to vote in the Provincial General Election.

Voter Registration

Electors may register to vote online at www.voterlink.ab.ca until May 17, 2023, by contacting Elections Alberta or their local returning office before 4:00 p.m. on Saturday, May 20.

Electors can also register to vote at any advance voting location in Alberta or at their assigned voting place on Election Day.

Electors who are already registered to vote at their current address do not need to register again.

Voter Identification

To vote in the 2023 Provincial General Election, electors are required to prove their identity and current address. There are several ways to do this, including:

- Providing one piece of Government-issued photo ID, including the voter’s full name, current address, and a photo.

- Providing two pieces of ID, both containing the voter’s full name and one that lists their current physical address.

- Having another registered elector with identification that resides in their voting area vouch for them.

- Having an authorized signatory complete an attestation form.

More than 50 different types of identification have been authorized by the Chief Electoral Officer to be used as identification to vote.

Key Timelines

Electors have 28 days to vote by Special Ballot beginning today. Special Ballots may be completed in the returning office, picked up by a designate of the elector, or mailed to the elector anywhere in the world. Applications can be submitted online on the Elections Alberta website.

Candidate nominations are now open and end on May 11, 2023, at 2:00 p.m.

Advance voting begins on Tuesday, May 23, 2023, and ends on Saturday, May 27, 2023.

Election Day is Monday, May 29, 2023. All voting places will be open from 9:00 a.m. to 8:00 p.m.

Unofficial results will be available after voting closes on Election Day.

Official results will be announced on June 8, 2023, at 10:00 a.m.

Returning Offices

Returning offices in all electoral divisions open today across Alberta. Returning offices are open on weekdays from 9:00 a.m. to 6:00 p.m., Saturdays from 10:00 a.m. to 4:00 p.m., and on Voting Days from 9:00 a.m. to 8:00 p.m. Returning Office addresses and contact information can be found at: https://elections.ab.ca/

New for 2023, Satellite Offices are also being opened in six geographically large electoral divisions to provide more service options for electors. These include:

- 54 – Cardston-Siksika

- 55 – Central Peace-Notley

- 59 – Drumheller-Stettler

- 60 – Fort McMurray-Lac La Biche

- 77 – Peace River

- 80 – Rimbey-Rocky Mountain House-Sundre

Satellite Offices are open on Tuesdays and Thursdays from 9:00 a.m. to 6:00 p.m., Saturdays from 10:00 a.m. to 2:00 p.m., and on Voting Days from 10:00 a.m. to 8:00 p.m.

For any questions or concerns regarding the provincial election, visit www.elections.ab.ca, call 1-877-422-VOTE, or email [email protected].

Information for media will be available throughout the election period at https://www.elections.ab.ca/

- Information sheets on topics such as Registering to Vote, Voter Identification, Accessible Voting and Tabulators and Voter Assist Terminals.

- Photo and video assets.

- Processes for accessing a voting place on voting days.

Elections Alberta is an independent, non-partisan office of the Legislative Assembly of Alberta responsible for administering provincial elections, by-elections, and referenda.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNeil Young + Carney / Freedom Bros

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

espionage8 hours ago

espionage8 hours agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

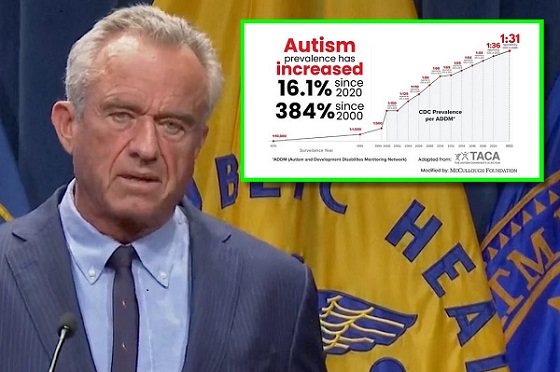

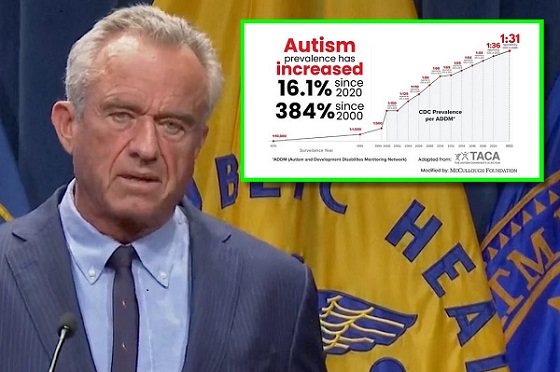

Autism1 day ago

Autism1 day agoRFK Jr. Exposes a Chilling New Autism Reality

-

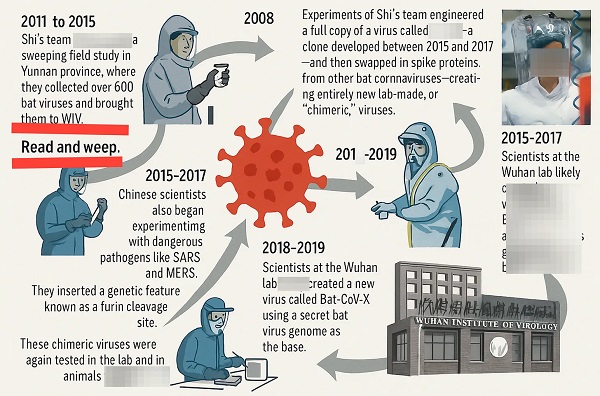

COVID-191 day ago

COVID-191 day agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

Business16 hours ago

Business16 hours agoDOGE Is Ending The ‘Eternal Life’ Of Government