Alberta

Alberta Justice Minister says Feds planning to use RCMP to confiscate firearms starting in PEI

Federal confiscation program: Minister Shandro

Minister of Justice Tyler Shandro issued the following statement on the federal firearms confiscation program:

“Last week, Minister Mendicino admitted that the federal government has still not figured out how to implement their firearms confiscation program.

“This admission comes shortly after the Canadian Association of Chiefs of Police called on the federal government to not to use police services to confiscate firearms.

“Now, media reports have drawn attention to a federal government memo that outlines Minister Mendicino’s plans to confiscate firearms across Canada.

“The memo admits that efforts to find private sector companies to implement the federal firearms confiscation program failed this summer.

“With no private sector companies willing to participate, the memo outlines how the RCMP will first be deployed to Prince Edward Island (PEI), which has been deemed to be an easy ‘low-risk’ target.

“The federal government is treating PEI as a ‘pilot’ that will help them learn on the job as they implement their confiscation plan through trial and error.

“This ‘program’ is expected to cost a billion dollars or more and has supposedly been in the works for three years.

“Despite a mountain of money and years worth of lead time, Ottawa appears to be lost – especially given their latest attack on hunting rifles and shotguns – at minimum, they should proactively extend the amnesty that is currently scheduled to end in October 2023.

“Such a decision, however, would involve showing Canadian firearms owners a measure of decency, something that Minister Mendicino and this federal government is seemingly incapable of.”

—–

Public Safety Canada’s Buyback Program

Overview

The Government of Canada committed to implementing a mandatory buyback program so that the assault-style firearms that became prohibited on May 1, 2020 are safely removed from our communities. Public Services and Procurement Canada’s role is to provide procurement services to Public Safety Canada (PS) to support their implementation of the buyback program.

Mandate

As of May 1, 2020, the Government of Canada has prohibited over 1,500 models of assault-style firearms (ASFs) and certain components of some newly-prohibited firearms. New maximum thresholds for muzzle energy and bore diameter are also in place. Any firearm that exceeds these is now prohibited. A Criminal Code amnesty period is currently in effect to October 30, 2023. The amnesty is designed to protect individuals or businesses who, at the time the prohibition came into force, were in lawful possession of a newly prohibited firearm from criminal liability while they take steps to comply with the law.

The primary intent of the buyback program would be to safely buyback these now prohibited firearms from society, while offering fair compensation to businesses and lawful owners impacted by the prohibition. PSPC is currently examining options for implementation of the buyback program, including the potential of contracting out specific activities.

Key activities

The program approach currently being considered by PS senior management envisages 2 phases, with a pilot in the first phase that would inform the national roll-out of the program:

- phase 1: commence in December 2022 and conclude at the end of the amnesty period. Primarily led by Royal Canadian Mounted Police (RCMP) with support from PS and other government departments. Prince Edward Island (PE) will be used as a pilot and will be the first point of collection based on the smaller number of firearms. As a result, lessons learned, gaps analysis and risk assessment would inform the phase 2 national roll-out

- phase 2: national roll-out is planned for spring 2023 once an information management/information technology (IM/IT) case management system is in place. It will be implemented in collaboration with other government departments, provincial, municipal and territorial governments and potential Industry partners

Public Services and Procurement posted a request for information on July 14, 2022 seeking feedback from industry on potential capacities to support delivery of the buyback program. It closed on August 31, 2022 and with very limited interest from the industry.

Partners and stakeholders

The program owner is Public Safety Canada. They are responsible for the buyback planning and oversight.

Public Services and Procurement Canada has been supporting PS with the buyback program since August 2021 supporting the development of procurement strategies for the delivery of the various potential requirements such as:

- collection and transportation

- professional services

- tracking

- storage solutions

- package inspection

- destruction

- post-destruction recycling

Shared Services Canada will assist with procurement of information technology (IT) solutions and other required IT support, based on its mandate.

The RCMP will start collection of ASFs in December 2022. They are also supporting the buyback program by providing a high level process map or written description of the programmatic phases.

Employment and Social Development Canada may support the buyback program with call-centres and payment solutions for the compensation.

Provincial, municipal and territorial governments are also being engaged to support the implementation and program delivery.

Key considerations

The prohibition applies to all current and future firearm variants that meet the criteria—now, over 1,800 firearms. These firearms can no longer be legally used, sold, or imported.

Currently owners have the option to dispose of their firearm by surrendering it to police, deactivating through an approved business or exporting the firearm with a valid export permit, all without government compensation. The buyback program aims to offer fair compensation to affected owners and businesses.

Work at the officials level is ongoing to develop, design and engage on the program. This includes public consultations on the government’s price list, which was posted on July 28, 2022 on Public Safety’s website and would be used to establish compensation levels for affected firearms.

Alberta

Is Canada’s Federation Fair?

David Clinton

David Clinton

Contrasting the principle of equalization with the execution

Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light.

You’ll need to search long and hard to find a Canadian unwilling to help those less fortunate. And, so long as we identify as members of one nation¹, that feeling stretches from coast to coast.

So the basic principle of Canada’s equalization payments – where poorer provinces receive billions of dollars in special federal payments – is easy to understand. But as you can imagine, it’s not easy to apply the principle in a way that’s fair, and the current methodology has arguably lead to a very strange set of incentives.

According to Department of Finance Canada, eligibility for payments is determined based on your province’s fiscal capacity. Fiscal capacity is a measure of the taxes (income, business, property, and consumption) that a province could raise (based on national average rates) along with revenues from natural resources. The idea, I suppose, is that you’re creating a realistic proxy for a province’s higher personal earnings and consumption and, with greater natural resources revenues, a reduced need to increase income tax rates.

But the devil is in the details, and I think there are some questions worth asking:

- Whichever way you measure fiscal capacity there’ll be both winners and losers, so who gets to decide?

- Should a province that effectively funds more than its “share” get proportionately greater representation for national policy² – or at least not see its policy preferences consistently overruled by its beneficiary provinces?

The problem, of course, is that the decisions that defined equalization were – because of long-standing political conditions – dominated by the region that ended up receiving the most. Had the formula been the best one possible, there would have been little room to complain. But was it?

For example, attaching so much weight to natural resource revenues is just one of many possible approaches – and far from the most obvious. Consider how the profits from natural resources already mostly show up in higher income and corporate tax revenues (including income tax paid by provincial government workers employed by energy-related ministries)?

And who said that such calculations had to be population-based, which clearly benefits Quebec (nine million residents vs around $5 billion in resource income) over Newfoundland (545,000 people vs $1.6 billion) or Alberta (4.2 million people vs $19 billion). While Alberta’s average market income is 20 percent or so higher than Quebec’s, Quebec’s is quite a bit higher than Newfoundland’s. So why should Newfoundland receive only minimal equalization payments?

To illustrate all that, here’s the most recent payment breakdown when measured per-capita:

|

For clarification, the latest per-capita payments to poorer provinces ranged from $3,936 to PEI, $1,553 to Quebec, and $36 to Ontario. Only Saskatchewan, Alberta, and BC received nothing.

And here’s how the total equalization payments (in millions of dollars) have played out over the past decade:

Is energy wealth the right differentiating factor because it’s there through simple dumb luck, morally compelling the fortunate provinces to share their fortune? That would be a really difficult argument to make. For one thing because Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light. Perhaps that stand is correct or perhaps it isn’t. But it’s a stand they probably couldn’t have afforded to take had the equalization calculation been different.

Of course, no formula could possibly please everyone, but punishing the losers with ongoing attacks on the very source of their contributions is guaranteed to inspire resentment. And that could lead to very dark places.

Note: I know this post sounds like it came from a grumpy Albertan. But I assure you that I’ve never even visited the province, instead spending most of my life in Ontario.

Which has admittedly been challenging since the former primer minister infamously described us as a post-national state without an identity.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

Alberta

Big win for Alberta and Canada: Statement from Premier Smith

Premier Danielle Smith issued the following statement on the April 2, 2025 U.S. tariff announcement:

“Today was an important win for Canada and Alberta, as it appears the United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. administration.

“This is precisely what I have been advocating for from the U.S. administration for months.

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including zero per cent tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods.

“There is still work to be done, of course. Unfortunately, tariffs previously announced by the United States on Canadian automobiles, steel and aluminum have not been removed. The efforts of premiers and the federal government should therefore shift towards removing or significantly reducing these remaining tariffs as we go forward and ensuring affected workers across Canada are generously supported until the situation is resolved.

“I again call on all involved in our national advocacy efforts to focus on diplomacy and persuasion while avoiding unnecessary escalation. Clearly, this strategy has been the most effective to this point.

“As it appears the worst of this tariff dispute is behind us (though there is still work to be done), it is my sincere hope that we, as Canadians, can abandon the disastrous policies that have made Canada vulnerable to and overly dependent on the United States, fast-track national resource corridors, get out of the way of provincial resource development and turn our country into an independent economic juggernaut and energy superpower.”

-

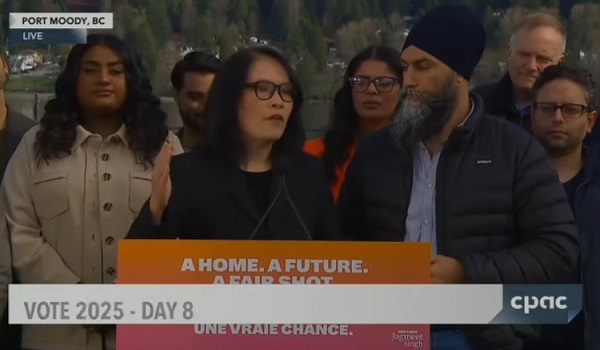

2025 Federal Election1 day ago

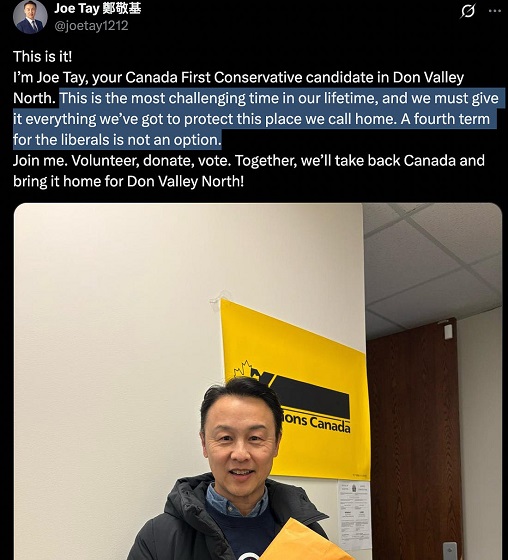

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

International2 days ago

International2 days agoFREE MARINE LE PEN!’: Trump defends French populist against ‘lawfare’ charges

-

Automotive2 days ago

Automotive2 days agoDark Web Tesla Doxxers Used Widely-Popular Parking App Data To Find Targets, Analysis Shows

-

COVID-191 day ago

COVID-191 day agoMaxime Bernier slams Freedom Convoy leaders’ guilty verdict, calls Canada’s justice system ‘corrupt’

-

Business2 days ago

Business2 days agoWill Trump’s ‘Liberation Day’ Tariffs End In Disaster Or Prosperity?

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoChina announces “improvements” to social credit system

-

Carbon Tax1 day ago

Carbon Tax1 day agoThe book the carbon taxers don’t want you to read

-

International1 day ago

International1 day agoGermany launches first permanent foreign troop deployment since WW2