Alberta

Alberta government can deliver tax cut by ending corporate welfare

From the Fraser Institute

By Tegan Hill

In a recent CBC interview, Premier Danielle Smith said she would “love to be able to accelerate our tax cut,” referring to her campaign promise to create a new 8 per cent tax bracket for personal income below $60,000, before adding that her government might not be able to maintain a balanced budget and introduce the cut. Fortunately, there’s a way Smith could achieve both: eliminate corporate welfare.

First, some background on Alberta’s recent tax changes.

In 2015, the provincial NDP government replaced Alberta’s single personal income tax rate of 10 per cent with a five-bracket system including a bottom rate of 10 per cent and a top rate of 15 per cent. Due to this change (and tax changes at the federal level, which increased the top federal income tax rate from 29 per cent to 33 per cent), Albertans faced significantly higher personal income tax rates.

Smith’s proposed tax cut would reduce Alberta’s bottom rate from 10 per cent to 8 per cent and is expected to save Albertans earning $60,000 or more $760 annually. While this change would fail to restore Alberta’s previous tax advantage, it would be a step in the right direction.

But due to fear of incurring a budget deficit, Smith has delayed fully implementing the $1.4 billion tax cut until 2027, contingent on the government being able to maintain a balanced budget.

Which takes us back to corporate welfare.

In 2019, after adjusting for inflation, the Alberta government spent $2.4 billion on subsidies to select businesses and industries. (In 2021, the latest year of available data, it spent $3.3 billion, however the pandemic may have contributed to this number.) And that’s not counting other forms of government handouts such as loan guarantees, direct investment and regulatory privileges for particular firms or industries. Put simply, eliminating corporate welfare would be more than enough to offset Smith’s proposed tax cut, which she promised Albertans in 2023.

Moreover, a significant body of research shows that corporate welfare fails to generate widespread economic benefits. Think of it this way; if businesses that receive subsidies were viable without subsidies, they wouldn’t need government handouts. Moreover, the government must impose higher tax rates on everyone else to pay for these subsidies. Higher taxes discourage productive activity, including business investment, which fuels economic growth. And the higher the rates, the more economic activity they discourage. Put simply, subsidies depress economic activity in some parts of an economy to encourage it in others.

For the same reason, corporate welfare also typically fails to generate new jobs on net. Indeed, while subsidies may create jobs in one specific industry, they pull those jobs away from other sectors that are likely more productive because they don’t need the subsidy.

The Smith government is hesitant to introduce Alberta’s tax cut if it can’t maintain a balanced budget, but if the government eliminates corporate welfare, it can avoid red ink while also fulfilling a promise it made to Alberta workers.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

John Stossel2 days ago

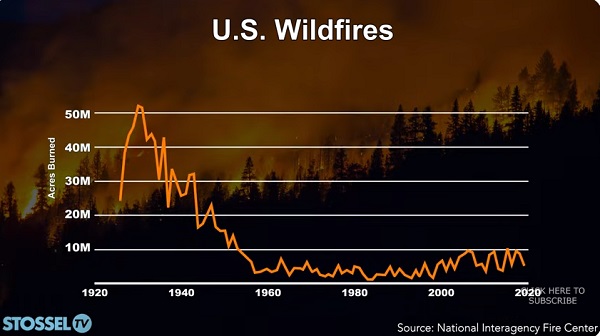

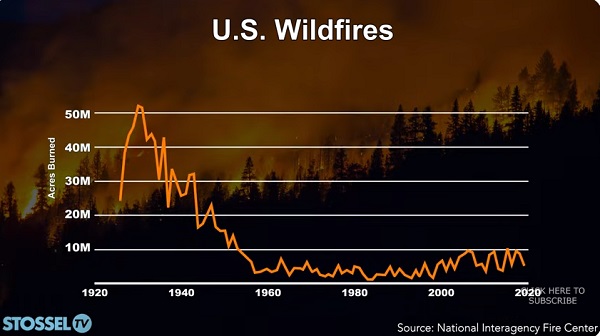

John Stossel2 days agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

2025 Federal Election2 days ago

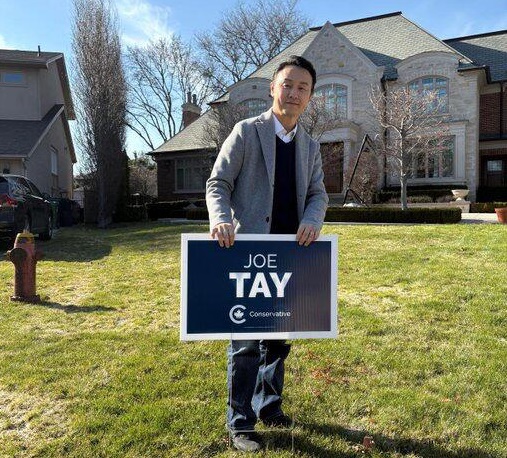

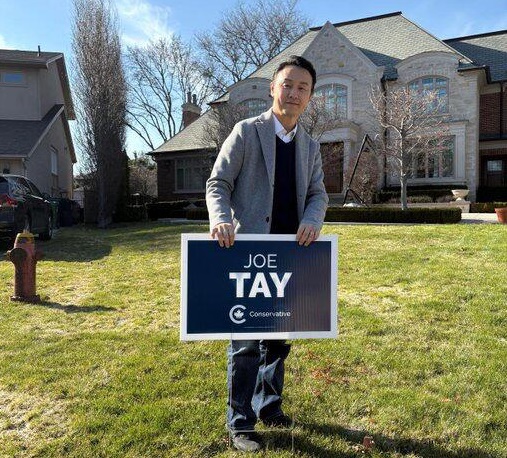

2025 Federal Election2 days agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

International19 hours ago

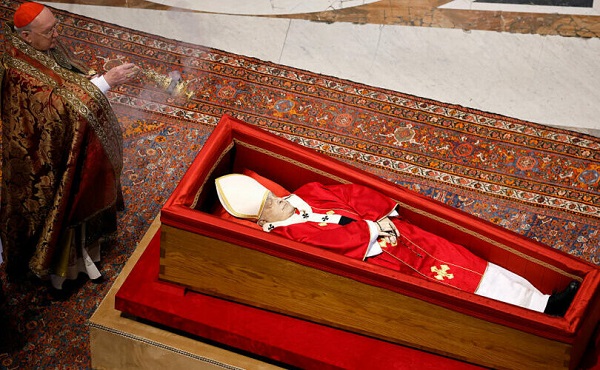

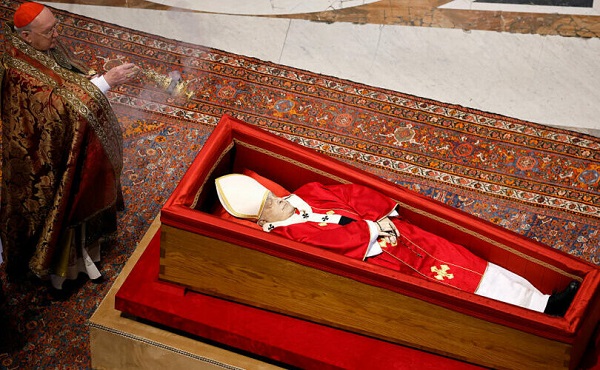

International19 hours agoPope Francis’ body on display at the Vatican until Friday

-

Media2 days ago

Media2 days agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

International1 day ago

International1 day agoNew York Times publishes chilling new justification for assisted suicide

-

conflict14 hours ago

conflict14 hours agoMarco Rubio says US could soon ‘move on’ from Ukraine conflict: ‘This is not our war’

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources