Alberta

Alberta drivers to feel some relief from crushing energy prices

Providing relief for fuel and utility costs

Alberta’s government will stop the collection of the provincial fuel tax to offer Albertans relief from current high fuel prices. Currently, Albertans pay 13 cents per litre in fuel tax. This change will come into effect April 1.

The federal carbon tax rate on gasoline is set to increase again on April 1, from just under nine cents per litre to just over 11 cents per litre.

“We’ve heard Albertans’ concerns about the rising cost of living loud and clear. While the federal government is set to increase the carbon tax April 1, Alberta’s government is taking the opposite approach and stepping up to offer relief. Stopping the provincial fuel tax puts money back in the pockets of Albertans when they need it most.”

“Many Albertans expressed concerns about increasing prices on everyday goods when I consulted with them ahead of this year’s budget. The best thing government can do during inflationary times is to spend less, borrow less and tax less. That’s why today we are introducing new measures to help with the cost of fuel by reducing the provincial fuel tax, providing much-needed relief to everyday Albertans.”

Alberta’s government will also provide $150 electricity rebates to help Albertans pay for the high bills they faced this winter. More than one million homes, farms and businesses are expected to receive a $50 monthly rebate for three months. These retroactive rebates will help defray the high costs that many families and businesses paid in recent months.

Alberta’s government will work with utilities and regulators to determine exact details, including rebate timing. This includes working to have the rebates applied directly to consumers’ bills.

This rebate will combine with the Natural Gas Rebate program announced in Budget 2022 to provide real relief for Albertans.

“Utility prices are in part due to market conditions, and in part due to punishing policies from the former provincial government and the federal government. As our government works hard to responsibly manage system costs, we are also working tirelessly to increase generation investments to bring new supply on to the market. As this long-term work continues, a rebate to help offset these costs for Alberta families and small businesses will help provide support when they need it most.”

Collection of the fuel tax will be paused for:

- gasoline – $0.13 per litre

- diesel – $0.13 per litre

- marked gasoline and marked diesel – $0.04

Because the GST also applies to provincial fuel taxes, the 13-cent reduction will also reduce the GST by 0.65 cents per litre, for total tax savings of about 13.6 cents per litre of gasoline and diesel.

The government will review the collection of the fuel tax on a quarterly basis and, if required, consider reinstating collection in stages, based on the average price of West Texas Intermediate (WTI) over a number of weeks. The government will not start to reinstate collection before July 1.

Alberta’s fuel tax is reported and remitted by refiners and large wholesalers and included in the price Albertans pay at the pump. The government will provide information for stakeholders, including fuel retailers, on the fuel tax pause.

Alberta

Is Canada’s Federation Fair?

David Clinton

David Clinton

Contrasting the principle of equalization with the execution

Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light.

You’ll need to search long and hard to find a Canadian unwilling to help those less fortunate. And, so long as we identify as members of one nation¹, that feeling stretches from coast to coast.

So the basic principle of Canada’s equalization payments – where poorer provinces receive billions of dollars in special federal payments – is easy to understand. But as you can imagine, it’s not easy to apply the principle in a way that’s fair, and the current methodology has arguably lead to a very strange set of incentives.

According to Department of Finance Canada, eligibility for payments is determined based on your province’s fiscal capacity. Fiscal capacity is a measure of the taxes (income, business, property, and consumption) that a province could raise (based on national average rates) along with revenues from natural resources. The idea, I suppose, is that you’re creating a realistic proxy for a province’s higher personal earnings and consumption and, with greater natural resources revenues, a reduced need to increase income tax rates.

But the devil is in the details, and I think there are some questions worth asking:

- Whichever way you measure fiscal capacity there’ll be both winners and losers, so who gets to decide?

- Should a province that effectively funds more than its “share” get proportionately greater representation for national policy² – or at least not see its policy preferences consistently overruled by its beneficiary provinces?

The problem, of course, is that the decisions that defined equalization were – because of long-standing political conditions – dominated by the region that ended up receiving the most. Had the formula been the best one possible, there would have been little room to complain. But was it?

For example, attaching so much weight to natural resource revenues is just one of many possible approaches – and far from the most obvious. Consider how the profits from natural resources already mostly show up in higher income and corporate tax revenues (including income tax paid by provincial government workers employed by energy-related ministries)?

And who said that such calculations had to be population-based, which clearly benefits Quebec (nine million residents vs around $5 billion in resource income) over Newfoundland (545,000 people vs $1.6 billion) or Alberta (4.2 million people vs $19 billion). While Alberta’s average market income is 20 percent or so higher than Quebec’s, Quebec’s is quite a bit higher than Newfoundland’s. So why should Newfoundland receive only minimal equalization payments?

To illustrate all that, here’s the most recent payment breakdown when measured per-capita:

|

For clarification, the latest per-capita payments to poorer provinces ranged from $3,936 to PEI, $1,553 to Quebec, and $36 to Ontario. Only Saskatchewan, Alberta, and BC received nothing.

And here’s how the total equalization payments (in millions of dollars) have played out over the past decade:

Is energy wealth the right differentiating factor because it’s there through simple dumb luck, morally compelling the fortunate provinces to share their fortune? That would be a really difficult argument to make. For one thing because Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light. Perhaps that stand is correct or perhaps it isn’t. But it’s a stand they probably couldn’t have afforded to take had the equalization calculation been different.

Of course, no formula could possibly please everyone, but punishing the losers with ongoing attacks on the very source of their contributions is guaranteed to inspire resentment. And that could lead to very dark places.

Note: I know this post sounds like it came from a grumpy Albertan. But I assure you that I’ve never even visited the province, instead spending most of my life in Ontario.

Which has admittedly been challenging since the former primer minister infamously described us as a post-national state without an identity.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

Alberta

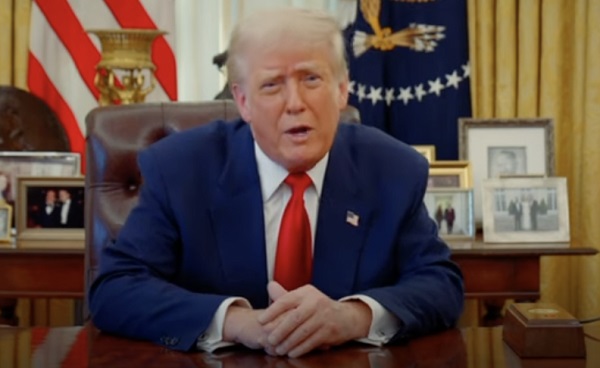

Big win for Alberta and Canada: Statement from Premier Smith

Premier Danielle Smith issued the following statement on the April 2, 2025 U.S. tariff announcement:

“Today was an important win for Canada and Alberta, as it appears the United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. administration.

“This is precisely what I have been advocating for from the U.S. administration for months.

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including zero per cent tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods.

“There is still work to be done, of course. Unfortunately, tariffs previously announced by the United States on Canadian automobiles, steel and aluminum have not been removed. The efforts of premiers and the federal government should therefore shift towards removing or significantly reducing these remaining tariffs as we go forward and ensuring affected workers across Canada are generously supported until the situation is resolved.

“I again call on all involved in our national advocacy efforts to focus on diplomacy and persuasion while avoiding unnecessary escalation. Clearly, this strategy has been the most effective to this point.

“As it appears the worst of this tariff dispute is behind us (though there is still work to be done), it is my sincere hope that we, as Canadians, can abandon the disastrous policies that have made Canada vulnerable to and overly dependent on the United States, fast-track national resource corridors, get out of the way of provincial resource development and turn our country into an independent economic juggernaut and energy superpower.”

-

Automotive1 day ago

Automotive1 day agoTesla Vandals Keep Running Into The Same Problem … Cameras

-

Daily Caller2 days ago

Daily Caller2 days ago‘Drill, Baby, Drill’ Or $50 Oil — Trump Can’t Have Both

-

Banks1 day ago

Banks1 day agoWall Street Clings To Green Coercion As Trump Unleashes American Energy

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLiberals Replace Candidate Embroiled in Election Interference Scandal with Board Member of School Flagged in Canada’s Election Interference Inquiry

-

COVID-191 day ago

COVID-191 day ago5 Stories the Media Buried This Week

-

Alberta24 hours ago

Alberta24 hours agoIs Canada’s Federation Fair?

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoPierre Poilievre Declares War on Red Tape and Liberal Decay in Osoyoos

-

2025 Federal Election1 hour ago

2025 Federal Election1 hour agoMark Carney Comes to B.C. and Delivers a Masterclass in Liberal Arrogance