Uncategorized

Aides: Trump’s wall pledge may not get expected results

WASHINGTON — Three confidants of President Donald Trump, including his departing chief of staff, are indicating that the president’s signature campaign pledge to build a wall along the U.S.-Mexico border would not be fulfilled as advertised.

Trump sparked fervent chants of “Build that wall!” at rallies before and after his election and more recently cited a lack of funding for a border wall as the reason for partially shutting down the government. At times the president has also waved off the idea that the wall could be any kind of barrier.

However, White House chief of staff John Kelly told the Los Angeles Times in an interview published Sunday that Trump abandoned the notion of “a solid concrete wall early on in the administration.”

“To be honest, it’s not a wall,” Kelly said, adding that the mix of technological enhancements and “steel slat” barriers the president now wants along the border resulted from conversations with law enforcement professionals.

Along the same lines, White House

“There may be a wall in some places, there may be steel slats, there may be technological enhancements,” Conway told “Fox News Sunday.” ”But only saying ‘wall or no wall’ is being very disingenuous and turning a complete blind eye to what is a crisis at the border.”

Sen. Lindsey Graham, the South Carolina Republican who is close to the president, emerged from a Sunday lunch at the White House to tell reporters that “the wall has become a metaphor for border security” and referred to “a physical barrier along the border.”

Graham said Trump was “open-minded” about a broader immigration agreement, saying the budget impasse presented an opportunity to address issues beyond the border wall. But a previous attempt to reach a compromise that addressed the status of “Dreamers” — young immigrants brought to the U.S. as children— broke down last year as a result of escalating White House demands.

Graham said he hoped to end the shutdown by offering Democrats incentives to get them to vote for wall funding and told CNN before his lunch with Trump that “there will never be a deal without wall funding.”

Graham proposed to help two groups of immigrants get approval to continue living in the U.S: about 700,000 young “Dreamers” brought into the U.S. illegally as children and about 400,000 people receiving temporary protected status because they are from countries struggling with natural disasters or armed conflicts. He also said the compromise should include changes in federal law to discourage people from trying to enter the U.S. illegally.

“Democrats have a chance here to work with me and others, including the president, to bring legal status to people who have very uncertain lives,” Graham said.

The partial government shutdown began Dec. 22 after Trump bowed to conservative demands that he fight to make good on his vow and secure funding for the wall before Republicans lose control of the House on Wednesday. Democrats have remained committed to blocking the president’s priority, and with neither side engaging in substantive negotiation, the effect of the partial shutdown was set to spread and to extend into the new year.

In August 2015 during his presidential campaign, Trump made his expectations for the border explicitly clear, as he parried criticism from rival Jeb Bush, the former Florida governor.

“Jeb Bush just talked about my border proposal to build a ‘fence,'” he tweeted. “It’s not a fence, Jeb, it’s a WALL, and there’s a BIG difference!”

Trump suggested as much again in a tweet on Sunday: “President and Mrs. Obama built/has a ten foot Wall around their D.C. mansion/compound. I agree, totally necessary for their safety and security. The U.S. needs the same thing, slightly larger version!”

Aside from what constitutes a wall, neither side appeared ready to budge off its negotiating position. The two sides have had little direct contact during the stalemate, and Trump did not ask Republicans, who hold a monopoly on power in Washington until Thursday, to keep Congress in session.

Talks have been at a stalemate for more than a week, after Democrats said the White House offered to accept $2.5 billion for border security. Senate Democratic leader Chuck Schumer told

Conway claimed Sunday that “the president has already compromised” by dropping his request for the wall from $25 billion, and she called on Democrats to return to the negotiating table.

“It is with them,” she said, explaining why Trump was not reaching out to Democrats.

Democrats maintain that they have already presented the White House with three options to end the shutdown, none of which fund the wall, and insist that it’s Trump’s move.

“At this point, it’s clear the White House doesn’t know what they want when it comes to border security,” said Justin Goodman, Schumer’s spokesman. “While one White House official says they’re willing to compromise, another says the president is holding firm at no less than $5 billion for the wall. Meanwhile, the president tweets blaming everyone but himself for a shutdown he called for more than 25 times.”

After

“For those that naively ask why didn’t the Republicans get approval to build the Wall over the last year, it is because IN THE SENATE WE NEED 10 DEMOCRAT VOTES, and they will gives us “NONE” for Border Security!,” he tweeted. “Now we have to do it the hard way, with a Shutdown.”

Democrats have vowed to pass legislation restoring the government as soon as they take control of the House on Thursday, but that won’t accomplish anything unless Trump and the Republican-controlled Senate go along with it.

The shutdown has forced hundreds of thousands of federal workers and contractors to stay home or work without pay.

___

Associated Press writers Lisa Mascaro and Kevin Freking in Washington contributed to this report.

Zeke Miller, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Daily Caller2 days ago

Daily Caller2 days agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Daily Caller2 days ago

Daily Caller2 days agoTwo states designate Muslim group as terrorist

-

International2 days ago

International2 days agoRussia Now Open To Ukraine Joining EU, Officials Briefed On Peace Deal Say

-

Bruce Dowbiggin2 days ago

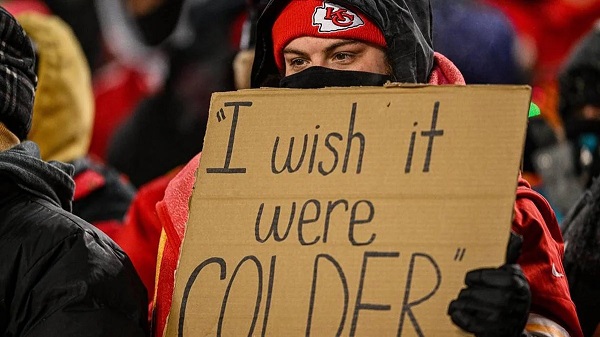

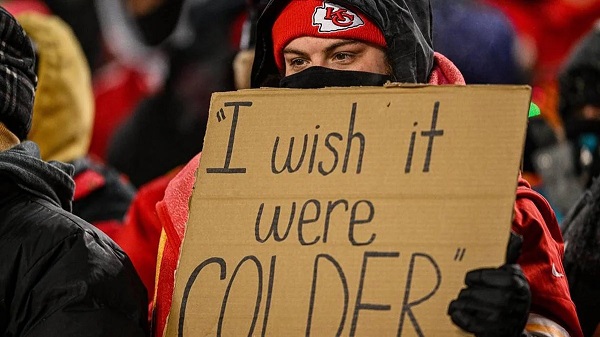

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?