Energy

A Wealth-Creating Way of Reducing Global CO2 Emissions

From the C2C Journal

By Gwyn Morgan

It is Prime Minister Justin Trudeau’s contention there’s no “business case” for exporting Canada’s abundant, inexpensively produced natural gas as LNG. But Canadians might do well to politely decline management consulting advice from a former substitute drama teacher who was born into wealth and has never had to meet a payroll, balance a budget or make a sale. Bluntly stated, someone who has shown no evidence of being able to run the proverbial lemonade stand. And one whose real agenda, the evidence shows, is to strangle the nation’s most productive and wealth-generating industry. With the first LNG ship finally expected to dock at Kitimat, B.C. over the next year and load Canada’s first-ever LNG export cargo, Gwyn Morgan lays out the business and environmental cases for ramping up our LNG exports – and having them count towards Canada’s greenhouse gas reduction targets.

Canadian Energy Centre

Why nation-building Canadian resource projects need Indigenous ownership to succeed

Chief Greg Desjarlais of Frog Lake First Nation signs an agreement in September 2022 whereby 23 First Nations and Métis communities in Alberta will acquire an 11.57 per cent ownership interest in seven Enbridge-operated oil sands pipelines for approximately $1 billion. Photo courtesy Enbridge

From the Canadian Energy Centre

U.S. trade dispute converging with rising tide of Indigenous equity

A consensus is forming in Canada that Indigenous ownership will be key to large-scale, nation-building projects like oil and gas pipelines to diversify exports beyond the United States.

“Indigenous ownership benefits projects by making them more likely to happen and succeed,” said John Desjarlais, executive director of the Indigenous Resource Network.

“This is looked at as not just a means of reconciliation, a means of inclusion or a means of managing risk. I think we’re starting to realize this is really good business,” he said.

“It’s a completely different time than it was 10 years ago, even five years ago. Communities are much more informed, they’re much more engaged, they’re more able and ready to consider things like ownership and investment. That’s a very new thing at this scale.”

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

Canada’s ongoing trade dispute with the United States is converging with a rising tide of Indigenous ownership in resource projects.

“Canada is in a great position to lead, but we need policymakers to remove barriers in developing energy infrastructure. This means creating clear and predictable regulations and processes,” said Colin Gruending, Enbridge’s president of liquids pipelines.

“Indigenous involvement and investment in energy projects should be a major part of this strategy. We see great potential for deeper collaboration and support for government programs – like a more robust federal loan guarantee program – that help Indigenous communities participate in energy development.”

In a statement to the Canadian Energy Centre, the Alberta Indigenous Opportunities Corporation (AIOC) – which has backstopped more than 40 communities in energy project ownership agreements with a total value of over $725 million – highlighted the importance of seizing the moment:

“The time is now. Canada has a chance to rethink how we build and invest in infrastructure,” said AIOC CEO Chana Martineau.

“Indigenous partnerships are key to making true nation-building projects happen by ensuring critical infrastructure is built in a way that is competitive, inclusive and beneficial for all Canadians. Indigenous Nations are essential partners in the country’s economic future.”

Key to this will be provincial and federal programs such as loan guarantees to reduce the risk for Indigenous groups and industry participants.

“There are a number of instruments that would facilitate ownership that we’ve seen grow and develop…such as the loan guarantee programs, which provide affordable access to capital for communities to invest,” Desjarlais said.

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Outside Alberta, there are now Indigenous loan guarantee programs federally and in Saskatchewan. A program in British Columbia is in development.

The Indigenous Resource Network highlights a partnership between Enbridge and the Willow Lake Métis Nation that led to a land purchase of a nearby campground the band plans to turn into a tourist destination.

“Tourism provides an opportunity for Willow Lake to tell its story and the story of the Métis. That is as important to our elders as the economic considerations,” Willow Lake chief financial officer Michael Robert told the Canadian Energy Centre.

The AIOC reiterates the importance of Indigenous project ownership in a call to action for all parties:

“It is essential that Indigenous communities have access to large-scale capital to support this critical development. With the right financial tools, we can build a more resilient, self-sufficient and prosperous economy together. This cannot wait any longer.”

In an open letter to the leaders of all four federal political parties, the CEOs of 14 of Canada’s largest oil and gas producers and pipeline operators highlighted the need for the federal government to step up its participation in a changing public mood surrounding the construction of resource projects:

“The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development,” they wrote.

For Desjarlais, it is critical that communities ultimately make their own decisions about resource project ownership.

“We absolutely have to respect that communities want to self-determine and choose how they want to invest, choose how they manage a lot of the risk and how they mitigate it. And, of course, how they pursue the rewards that come from major project investment,” he said.

Daily Caller

AI Needs Natural Gas To Survive

From the Daily Caller News Foundation

By David Blackmon

As recent studies project a big rise in power generation demand from the big datacenters that are proliferating around the United States, the big question continues to focus in on what forms of generation will rise to meet the new demand. Most datacenters have plans to initially interconnect into local power grids, but the sheer magnitude of their energy needs threatens to outstrip the ability of grid managers to expand supply fast enough.

This hunger for more affordable, 24/7 baseload capacity is leading to a variety of proposed solutions, including President Donald Trump’s new executive orders focused on reviving the nation’s coal industry, scheduled to be signed Tuesday afternoon. But efforts to restart the permitting of new coal-fired power plants in the US will require additional policy changes, efforts which will take time and could ultimately fail. In the meantime, datacenter developers find themselves having to delay construction and completion dates until firm power supply can be secured.

Datacenters specific to AI technology require ever-increasing power loads. For instance, a single AI query can consume nearly ten times the power of a traditional internet search, and projections suggest that U.S. data center electricity consumption could double or even triple by 2030, rising from about 4-5% of total U.S. electricity today to as much as 9-12%. Globally, data centers could see usage climb from around 536 terawatt-hours (TWh) in 2025 to over 1,000 TWh by 2030. In January, a report from the American Security Project estimated that datacenters could consume about 12% of all U.S. power supply.

Obviously, the situation calls for innovative solutions. A pair of big players in the natural gas industry, Liberty Energy and Range Resources, announced on April 8 plans to diversify into the power generation business with the development of a major new natural gas power plant to be located in the Pittsburgh area. Partnering with Imperial Land Corporation (ILC), Liberty and Range will locate the major power generation plant in the Fort Cherry Development District, a Class A industrial park being developed by ILC.

“The strategic collaboration between Liberty, ILC, and Range will focus on a dedicated power generation facility tailored to meet the energy demands of data centers, industrial facilities, and other high-energy-use businesses in Pennsylvania,” the companies said in a joint release.

Plans for this new natural gas power project follows closely on the heels of the March 22 announcement for plans to transform the largest coal-fired power plant in Pennsylvania, the Homer City generating station, into a new gas-fired facility. The planned revitalized plant would house 7 natural gas turbines with a combined capacity of 4.5 GW, enough power 3 million homes.

Both the Homer City station and the Fort Cherry plant will use gas produced out of the Appalachia region’s massive Marcellus Shale formation, the most prolific gas basin in North America. But plans like these by gas companies to invest in their own products for power needs aren’t isolated to Pennsylvania.

In late January, big Permian Basin oil and gas producer Diamondback Energy told investors that it is seeking equity partners to develop a major gas-fired plan on its own acreage in the region. The facility would primarily supply electricity to data centers, which are expected to proliferate in Texas due to the AI boom, while also providing power for Diamondback’s own field operations. This dual-purpose approach could lower the company’s power costs and create a new revenue stream by selling excess electricity.

Prospects for expansion of gas generation in the U.S. received a big boost in January when GE Vernova announced plans for a $600 million expansion of its manufacturing capacity for gas turbines and other products in the U.S. GE Vernova is the main supplier of turbines for U.S. power generation needs. The company plans to build 37 gas power turbines in 2025, with a potential increase to over 70 by 2027, to meet rising energy demands.

The bottom line on these and other recent events is this: Natural gas is quickly becoming the power generation fuel of choice to feed the needs of the expanding datacenter industry through 2035, and potentially beyond. Given that reality, the smart thing to do for these and other companies in the natural gas business is to put down big bets on themselves.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

illegal immigration2 days ago

illegal immigration2 days agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

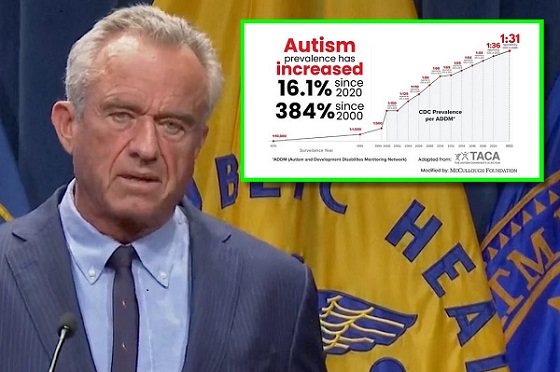

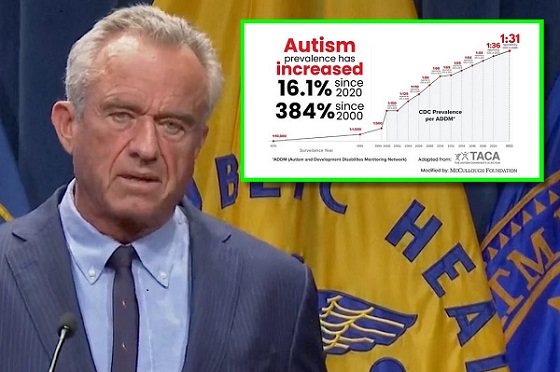

Autism20 hours ago

Autism20 hours agoRFK Jr. Exposes a Chilling New Autism Reality

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

International19 hours ago

International19 hours agoUK Supreme Court rules ‘woman’ means biological female

-

Education2 days ago

Education2 days agoSchools should focus on falling math and reading skills—not environmental activism

-

Health19 hours ago

Health19 hours agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May