Alberta

25 facts about the Canadian oil and gas industry in 2023: Facts 6 to 10

From the Canadian Energy Centre

One of the things that really makes us Albertans, and Canadians is what we do and how we do it. It’s taking humanity a while to figure it out, but we seem to be grasping just how important access to energy is to our success. This makes it important that we all know at least a little about the industry that drives Canadians and especially Albertans as we make our way in the world.

The Canadian Energy Centre has compiled a list of 25 (very, extremely) interesting facts about the oil and gas industry in Canada. Over the 5 days we will post all 25 amazing facts, 5 at a time. Here are facts 6 to 10.

The Canadian Energy Centre’s 2023 reference guide to the latest research on Canada’s oil and gas industry

The following summary facts and data were drawn from 30 Fact Sheets and Research Briefs and various Research Snapshots that the Canadian Energy Centre released in 2023. For sources and methodology and for additional data and information, the original reports are available at the research portal on the Canadian Energy Centre website: canadianenergycentre.ca.

6. Alberta among top provincial spenders on environmental protection

Industries are not alone in spending money on environmental protection; provincial governments do as well. Total provincial government spending on environmental protection between 2008 and 2021 was nearly $143.5 billion. In 2021, Alberta spent $22.6 billion or 15.7 per cent of all provincial expenditures on the environment, while its proportion of the national population was 11.6 per cent.

Source: Statistics Canada, Tables 10-10-0005-01 and 17-10-0005-01; and authors’ calculations

Economics of the Oil and Gas Sector

7. Revenue contribution from the oil and gas sector: $578.7 billion between 2000 and 2021

The gross revenue contribution to federal, provincial, and municipal governments received exclusively from the oil and gas sector was $578.7 billion between 2000 and 2021, an average of $26.3 billion per year. The $578.7 billion figure includes $461.6 billion in direct provincial revenues, $99.6 billion in direct federal revenues, and $17.3 billion in indirect federal, provincial, and municipal taxes.

Sources: Statistics Canada, 2022 (a, b, c, d), Statistics Canada 2023 (a,b), and CAPP, 2022

8. Projected government revenues from Canada’s oil sands sector: US$231 billion from 2023 to 2032

Government revenues from Canada’s oil sands sector (which includes provincial royalties and federal and provincial corporate taxes) are expected to rise from US$17.1 billion in 2023 to US$28.7 billion in 2032—nearly US$231 billion cumulatively—assuming the price of oil is a flat US$80 per barrel. Both projections would be about 20 per cent more in Canadian dollars at the current exchange rate.

Source: Derived from Rystad Energy

9. Projected capex from Canadian oil sands sector: nearly US$113 billion over the next decade

Capex from the Canadian oil sands sector is projected to reach US$112.7 billion over the next decade. Assuming a flat US$80 per barrel for the price of oil, oil sands sector capex is expected to rise from US$10.1 billion in 2023 to US$14.2 billion in 2032. Those projections would be about 20 per cent more in Canadian dollars at the current exchange rate.

Source: Derived from Rystad Energy

10. Canadian overall upstream oil sector supply costs have declined over 35% since 2015

The cost of supply for the Canadian upstream oil sector is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, taxes, and earn a specified return on investment. Supply costs indicate whether the upstream oil sector is economically viable.

Supply costs within Canada’s upstream oil sector declined significantly between 2015 and 2022. At the end of 2015, the Canadian upstream oil sector’s weighted average breakeven price was nearly US$76.00 per barrel of Brent. By the end of 2022, that weighted average breakeven price was US$49.09 per barrel of Brent, a decline of US$26.91 per barrel, or over 35 per cent since 2015. This number incorporates different phases of oil production including producing, under development, and discovery.

Source: Derived from Rystad Energy

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue. This research brief is a compilation of previous Fact Sheets and Research Briefs released by the centre in 2023. Sources can be accessed in the previously released reports. All percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using the original data sources.

About the author

This CEC Research Brief was compiled by Ven Venkatachalam, Director of Research at the Canadian Energy Centre.

Acknowledgements

The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer for the review of this paper.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

COVID-192 days ago

COVID-192 days agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHow Canada’s Mainstream Media Lost the Public Trust

-

Media1 day ago

Media1 day agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

2025 Federal Election2 days ago

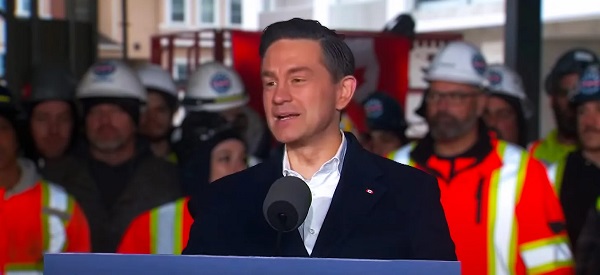

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

International17 hours ago

International17 hours agoNew York Times publishes chilling new justification for assisted suicide

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPOLL: Canadians want spending cuts