Business

DOGE on the job: How Elon Musk and Vivek Ramaswamy caused the looming government shutdown

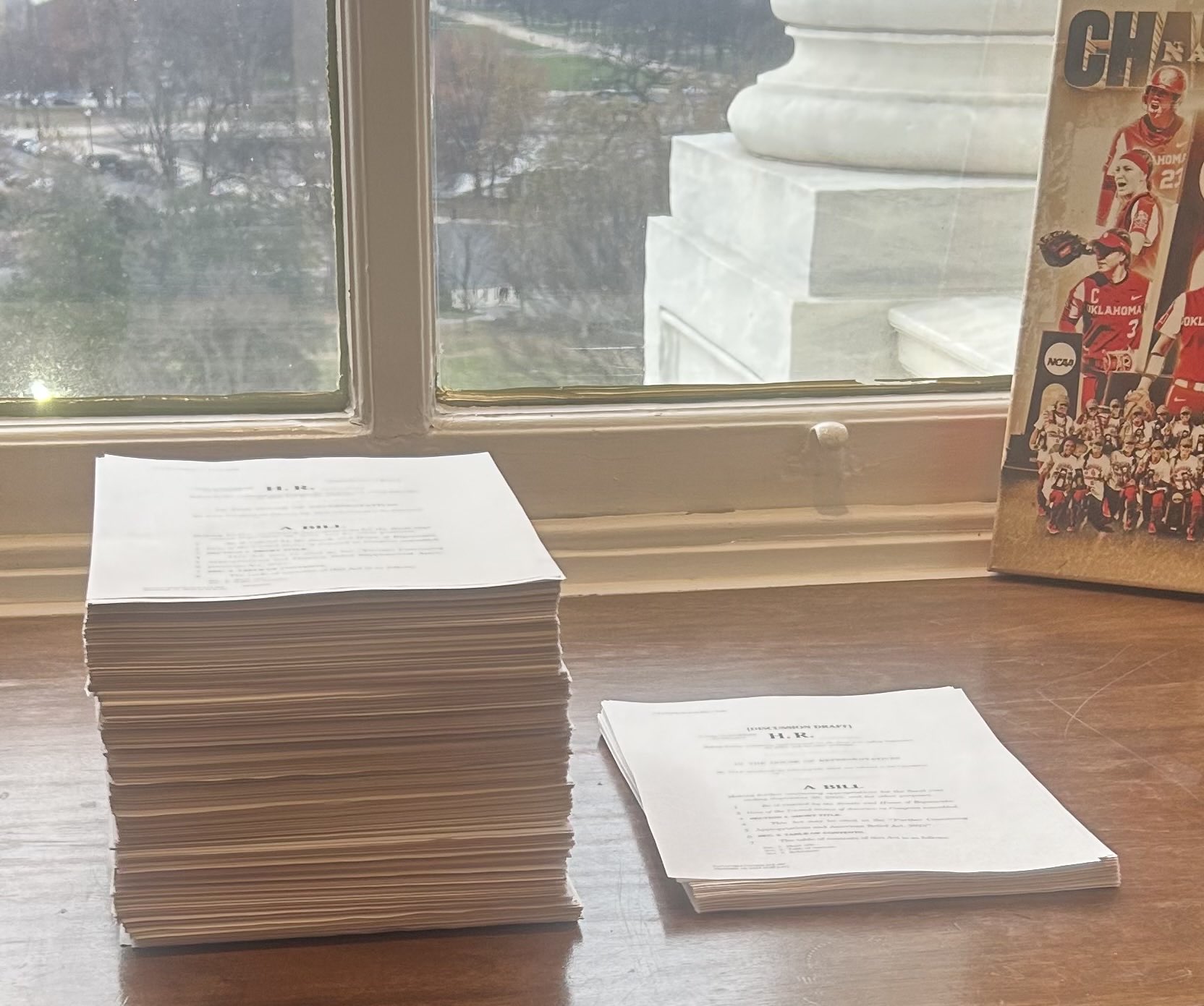

Legislators had 24 hours to read through 1,547 pages. Ramaswamy read them. Musk presented an alternative. The process collapsed.

Elon Musk and Vivek Ramaswamy are flexing their muscles even before President Elect Donald Trump’s inauguration, spiking a bipartisan spending bill. The bill was introduced on Tuesday with voting scheduled for Wednesday. Legislators were under massive pressure to approve of the spending bill or risk a government shut down. Problem is, the bill was over 1,500 pages long!

Chances are, the bill would have passed and in the ensuing weeks as details became known the public would have been outraged by all the extra plans to spend / waste taxpayer dollars. Legislators would have apologized by saying they simply had no time to read everything and they were desperate to avoid a shut down.

That’s where the new DOGE comes in. First Ramaswamy somehow read the bill and posted a video to TikTok and X to inform voters what they were going to be paying for in this new bill.

@vivekramaswamy Congress wants to waste your money without telling you, make sure that doesn’t happen

From MXMNews

The newly formed Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy, successfully campaigned to halt the bipartisan continuing resolution (CR) in Congress. Musk and Ramaswamy took to X, rallying conservatives against the 1,547-page stopgap funding measure they argue is riddled with wasteful spending and unnecessary policy provisions.

Musk, a billionaire entrepreneur and vocal advocate for government reform, characterized the bill as a “pork-barrel” monstrosity. “Unless @DOGE ends the careers of deceitful, pork-barrel politicians, the waste and corruption will never stop,” Musk posted on X, adding that lawmakers who support the bill should be “voted out in two years.”

Meanwhile, Ramaswamy, a former Republican presidential candidate and DOGE co-chair, proposed an alternative to the bulky spending bill. Sharing a draft of his one-page resolution, he described it as a minimalist approach that avoids exacerbating historical spending excesses. “This is what a clean CR looks like,” he wrote, emphasizing the need for fiscal restraint.

Musk and Ramaswamy posted this to X.

Shorter = better. This bill is only 116 pages, instead of 1,500+ pages. Took a LOT less time to read. Glad to see the following garbage from yesterday’s bill removed in the current version: – Congressional pay raise/health benefits – 17 miscellaneous commerce bills – Random new pandemic policies, like funding for “biocontainment research laboratories” – Renewal of the “Global Engagement Center,” a key player in the federal censorship state

In record time, the public was informed, politicians were influenced by outraged taxpayers, and politicians blamed each other for a faulty bill and were forced to go back to the drawing board.

It’s all explained very well in this video presentation from Kaizen Asiedu, a Harvard graduate in philosophy who makes videos informing Americans about complicated political matters.

Friday’s deadline to avoid a government shutdown looms. Musk posted on X that a shutdown would be “infinitely better than passing a horrible bill.” His DOGE partner Vivek Ramaswamy urged Americans to contact their representatives to “stop the steal of your tax dollars.”

And President-elect Donald Trump posted this: “If Democrats threaten to shut down the government unless we give them everything they want, then CALL THEIR BLUFF,”.

Should the spending bill fail, it will mark a significant victory for DOGE and a potential turning point in efforts to reform Washington’s spending habits.

Business

The world is no longer buying a transition to “something else” without defining what that is

From Resource Works

Even Bill Gates has shifted his stance, acknowledging that renewables alone can’t sustain a modern energy system — a reality still driving decisions in Canada.

You know the world has shifted when the New York Times, long a pulpit for hydrocarbon shame, starts publishing passages like this:

“Changes in policy matter, but the shift is also guided by the practical lessons that companies, governments and societies have learned about the difficulties in shifting from a world that runs on fossil fuels to something else.”

For years, the Times and much of the English-language press clung to a comfortable catechism: 100 per cent renewables were just around the corner, the end of hydrocarbons was preordained, and anyone who pointed to physics or economics was treated as some combination of backward, compromised or dangerous. But now the evidence has grown too big to ignore.

Across Europe, the retreat to energy realism is unmistakable. TotalEnergies is spending €5.1 billion on gas-fired plants in Britain, Italy, France, Ireland and the Netherlands because wind and solar can’t meet demand on their own. Shell is walking away from marquee offshore wind projects because the economics do not work. Italy and Greece are fast-tracking new gas development after years of prohibitions. Europe is rediscovering what modern economies require: firm, dispatchable power and secure domestic supply.

Meanwhile, Canada continues to tell itself a different story — and British Columbia most of all.

A new Fraser Institute study from Jock Finlayson and Karen Graham uses Statistics Canada’s own environmental goods and services and clean-tech accounts to quantify what Canada’s “clean economy” actually is, not what political speeches claim it could be.

The numbers are clear:

- The clean economy is 3.0–3.6 per cent of GDP.

- It accounts for about 2 per cent of employment.

- It has grown, but not faster than the economy overall.

- And its two largest components are hydroelectricity and waste management — mature legacy sectors, not shiny new clean-tech champions.

Despite $158 billion in federal “green” spending since 2014, Canada’s clean economy has not become the unstoppable engine of prosperity that policymakers have promised. Finlayson and Graham’s analysis casts serious doubt on the explosive-growth scenarios embraced by many politicians and commentators.

What’s striking is how mainstream this realism has become. Even Bill Gates, whose philanthropic footprint helped popularize much of the early clean-tech optimism, now says bluntly that the world had “no chance” of hitting its climate targets on the backs of renewables alone. His message is simple: the system is too big, the physics too hard, and the intermittency problem too unforgiving. Wind and solar will grow, but without firm power — nuclear, natural gas with carbon management, next-generation grid technologies — the transition collapses under its own weight. When the world’s most influential climate philanthropist says the story we’ve been sold isn’t technically possible, it should give policymakers pause.

And this is where the British Columbia story becomes astonishing.

It would be one thing if the result was dramatic reductions in emissions. The provincial government remains locked into the CleanBC architecture despite a record of consistently missed targets.

Since the staunchest defenders of CleanBC are not much bothered by the lack of meaningful GHG reductions, a reasonable person is left wondering whether there is some other motivation. Meanwhile, Victoria’s own numbers a couple of years ago projected an annual GDP hit of courtesy CleanBC of roughly $11 billion.

But here is the part that would make any objective analyst blink: when I recently flagged my interest in presenting my research to the CleanBC review panel, I discovered that the “reviewers” were, in fact, two of the key architects of the very program being reviewed. They were effectively asked to judge their own work.

You can imagine what they told us.

What I saw in that room was not an evidence-driven assessment of performance. It was a high-handed, fact-light defence of an ideological commitment. When we presented data showing that doctrinaire renewables-only thinking was failing both the economy and the environment, the reception was dismissive and incurious. It was the opposite of what a serious policy review looks like.

Meanwhile our hydro-based electricity system is facing historic challenges: long term droughts, soaring demand, unanswered questions about how growth will be powered especially in the crucial Northwest BC region, and continuing insistence that providers of reliable and relatively clean natural gas are to be frustrated at every turn.

Elsewhere, the price of change increasingly includes being able to explain how you were going to accomplish the things that you promise.

And yes — in some places it will take time for the tide of energy unreality to recede. But that doesn’t mean we shouldn’t be improving our systems, reducing emissions, and investing in technologies that genuinely work. It simply means we must stop pretending politics can overrule physics.

Europe has learned this lesson the hard way. Global energy companies are reorganizing around a 50-50 world of firm natural gas and renewables — the model many experts have been signalling for years. Even the New York Times now describes this shift with a note of astonishment.

British Columbia, meanwhile, remains committed to its own storyline even as the ground shifts beneath it. This isn’t about who wins the argument — it’s about government staying locked on its most basic duty: safeguarding the incomes and stability of the families who depend on a functioning energy system.

Resource Works News

Business

High-speed rail between Toronto and Quebec City a costly boondoggle for Canadian taxpayers

“It’s a good a bet that high-speed rail between Toronto and Quebec City isn’t even among the top 1,000 priorities for most Canadians.”

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for borrowing billions more for high-speed rail between Toronto and Quebec City.

“Canadians need help paying for basics, they don’t need another massive bill from the government for a project that only benefits one corner of the country,” said Franco Terrazzano, CTF Federal Director. “It’s a good a bet that high-speed rail between Toronto and Quebec City isn’t even among the top 1,000 priorities for most Canadians.

“High-speed rail will be another costly taxpayer boondoggle.”

The federal government announced today that the first portion of the high-speed rail line will be built between Ottawa and Montreal with constructing starting in 2029. The entire high-speed rail line is expected to go between Toronto and Quebec City.

The federal Crown corporation tasked with overseeing the project “estimated that the full line will cost between $60 billion and $90 billion, which would be funded by a mix of government money and private investment,” the Globe and Mail reported.

The government already owns a railway company, VIA Rail. The government gave VIA Rail $1.9 billion over the last five years to cover its operating losses, according to the Crown corporation’s annual report.

The federal government is borrowing about $78 billion this year. The federal debt will reach $1.35 trillion by the end of this year. Debt interest charges will cost taxpayers $55.6 billion this year, which is more than the federal government will send to the provinces in health transfers ($54.7 billion) or collect through the GST ($54.4 billion).

“The government is up to its eyeballs in debt and is already spending hundreds of millions of dollars bailing out its current train company, the last thing taxpayers need is to pay higher debt interest charges for a new government train boondoggle,” Terrazzano said. “Instead of borrowing billions more for pet projects, Carney needs to focus on making life more affordable and paying down the debt.”

-

Business2 days ago

Business2 days agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoOttawa’s New Hate Law Goes Too Far

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCarney Hears A Who: Here Comes The Grinch

-

Fraser Institute1 day ago

Fraser Institute1 day agoClaims about ‘unmarked graves’ don’t withstand scrutiny

-

Business2 days ago

Business2 days agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

National2 days ago

National2 days agoCanada’s free speech record is cracking under pressure

-

Energy1 day ago

Energy1 day agoMeet REEF — the massive new export engine Canadians have never heard of

-

Digital ID1 day ago

Digital ID1 day agoCanada considers creating national ID system using digital passports for domestic use