Business

Does Income Inequality Matter?

Super-high income taxes don’t increase government revenues. But can taxes be “smart”?

Reducing poverty and its harms is among the most urgent responsibilities of any modern government. But despite the claims of some activists, this particular problem has no obvious and easy solution. I’m going to suggest that targeting income inequality in particular is a waste of time.

First of all, income in Canada is actually not all that unequal. Income inequality is often measured by the Gini Coefficient. A Gini score of zero would represent total income equality, where everyone earns exactly the same amount. A score of one (or, sometimes, 100) represents perfect inequality, meaning one person has all the income, and everyone else has none.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Statistics Canada data shows changes to the Gini Coefficient in Canada between 1976 and 2022:

Relatively speaking, those numbers are quite low and – when you ignore the weird COVID years – they also haven’t changed much since 1976. For comparison, the U.S. Gini coefficient in 2023 was 0.47, while (Communist!) China’s was 0.465 – both significantly higher than ours. The worst and best scores are, respectively, claimed by South Africa (.63) and Norway (.23).

But the real reason that talking about income inequality is an unnecessary distraction, is because there’s nothing you can do about it.

As I pointed out in a recent article, the 2 percent of Canadians whose assessed taxable incomes are above $250,000 contribute nearly 30 percent of all personal income tax revenue. They’re already clearly – and for the most part willingly – carrying far more than their share.

Ok. But why not slap the super-rich with a 90 percent marginal income tax? Well that’s been tried. The Beatles even recorded an angry song about it. But as far as I can tell, such taxes have always led to decreasing tax revenues. That’s because the people you’re targeting will either decide to earn less or simply move their businesses and assets to more tax-friendly countries – that often come with the added bonus of good weather.

If you’d ask me for my opinion, I’d say that the federal government could easily free up billions of dollars to address poverty by cutting waste. And a good first step in that direction would involve sharply decreasing the size of our bloated civil service.

How those extra funds could be better spent in a way that actually helps the poor isn’t a simple question. And it’s something you’d definitely want to get right on the first shot. Not to mention that some problems just can be solved with more money.

But in the unlikely event that you did find an expensive solution AND money freed up by new government efficiencies wasn’t enough, one might consider an intelligently designed wealth tax. Wealth taxes – which can take the form of property and estate taxes – have been used for centuries. The catch is that, if they’re poorly designed, they can be destructive. Just imagine a tax on real estate worth more than a million dollars that ends up wiping out seniors counting on the value of their homes to fund their retirements.

An OECD report from a few years back identifies a long list of developed countries whose wealth taxes largely failed to deliver significant revenue boosts. Those included Spain, Austria, Denmark, and Germany.

Norway, with a wealth tax worth as much as 1.5 percent of net wealth, was one of the report’s few success stories. But even they now seem to be having serious problems with compliance. Apparently, rich and industrious Norwegians are leaving the country in such high numbers that the government has imposed a punitive exit tax. I’m sure that’ll work out just great. (The Free Press recently published a piece on Norway’s problem.)

Nevertheless, if there is a universe where the words “smart” and “tax” can happily co-exist in a single sentence, then it’s more likely to work when you also find a way to include “wealth”, “balanced”, and “focused”.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

If you enjoy The Audit, share it with your friends and earn rewards when they subscribe.

Banks

TD Bank Account Closures Expose Chinese Hybrid Warfare Threat

From the Frontier Centre for Public Policy

Scott McGregor warns that Chinese hybrid warfare is no longer hypothetical—it’s unfolding in Canada now. TD Bank’s closure of CCP-linked accounts highlights the rising infiltration of financial interests. From cyberattacks to guanxi-driven influence, Canada’s institutions face a systemic threat. As banks sound the alarm, Ottawa dithers. McGregor calls for urgent, whole-of-society action before foreign interference further erodes our sovereignty.

Chinese hybrid warfare isn’t coming. It’s here. And Canada’s response has been dangerously complacent

The recent revelation by The Globe and Mail that TD Bank has closed accounts linked to pro-China groups—including those associated with former Liberal MP Han Dong—should not be dismissed as routine risk management. Rather, it is a visible sign of a much deeper and more insidious campaign: a hybrid war being waged by the Chinese Communist Party (CCP) across Canada’s political, economic and digital spheres.

TD Bank’s move—reportedly driven by “reputational risk” and concerns over foreign interference—marks a rare, public signal from the private sector. Politically exposed persons (PEPs), a term used in banking and intelligence circles to denote individuals vulnerable to corruption or manipulation, were reportedly among those flagged. When a leading Canadian bank takes action while the government remains hesitant, it suggests the threat is no longer theoretical. It is here.

Hybrid warfare refers to the use of non-military tools—such as cyberattacks, financial manipulation, political influence and disinformation—to erode a nation’s sovereignty and resilience from within. In The Mosaic Effect: How the Chinese Communist Party Started a Hybrid War in America’s Backyard, co-authored with Ina Mitchell, we detailed how the CCP has developed a complex and opaque architecture of influence within Canadian institutions. What we’re seeing now is the slow unravelling of that system, one bank record at a time.

Financial manipulation is a key component of this strategy. CCP-linked actors often use opaque payment systems—such as WeChat Pay, UnionPay or cryptocurrency—to move money outside traditional compliance structures. These platforms facilitate the unchecked flow of funds into Canadian sectors like real estate, academia and infrastructure, many of which are tied to national security and economic competitiveness.

Layered into this is China’s corporate-social credit system. While framed as a financial scoring tool, it also functions as a mechanism of political control, compelling Chinese firms and individuals—even abroad—to align with party objectives. In this context, there is no such thing as a genuinely independent Chinese company.

Complementing these structural tools is guanxi—a Chinese system of interpersonal networks and mutual obligations. Though rooted in trust, guanxi can be repurposed to quietly influence decision-makers, bypass oversight and secure insider deals. In the wrong hands, it becomes an informal channel of foreign control.

Meanwhile, Canada continues to face escalating cyberattacks linked to the Chinese state. These operations have targeted government agencies and private firms, stealing sensitive data, compromising infrastructure and undermining public confidence. These are not isolated intrusions—they are part of a broader effort to weaken Canada’s digital, economic and democratic institutions.

The TD Bank decision should be seen as a bellwether. Financial institutions are increasingly on the front lines of this undeclared conflict. Their actions raise an urgent question: if private-sector actors recognize the risk, why hasn’t the federal government acted more decisively?

The issue of Chinese interference has made headlines in recent years, from allegations of election meddling to intimidation of diaspora communities. TD’s decision adds a new financial layer to this growing concern.

Canada cannot afford to respond with fragmented, reactive policies. What’s needed is a whole-of-society response: new legislation to address foreign interference, strengthened compliance frameworks in finance and technology, and a clear-eyed recognition that hybrid warfare is already being waged on Canadian soil.

The CCP’s strategy is long-term, multidimensional and calculated. It blends political leverage, economic subversion, transnational organized crime and cyber operations. Canada must respond with equal sophistication, coordination and resolve.

The mosaic of influence isn’t forming. It’s already here. Recognizing the full picture is no longer optional. Canadians must demand transparency, accountability and action before more of our institutions fall under foreign control.

Scott McGregor is a defence and intelligence veteran, co-author of The Mosaic Effect: How the Chinese Communist Party Started a Hybrid War in America’s Backyard, and the managing partner of Close Hold Intelligence Consulting Ltd. He is a senior security adviser to the Council on Countering Hybrid Warfare and a former intelligence adviser to the RCMP and the B.C. Attorney General. He writes for the Frontier Centre for Public Policy.

Automotive

Major automakers push congress to block California’s 2035 EV mandate

MxM News

MxM News

Quick Hit:

Major automakers are urging Congress to intervene and halt California’s aggressive plan to eliminate gasoline-only vehicles by 2035. With the Biden-era EPA waiver empowering California and 11 other states to enforce the rule, automakers warn of immediate impacts on vehicle availability and consumer choice. The U.S. House is preparing for a critical vote to determine if California’s sweeping environmental mandates will stand.

Key Details:

-

Automakers argue California’s rules will raise prices and limit consumer choices, especially amid high tariffs on auto imports.

-

The House is set to vote this week on repealing the EPA waiver that greenlit California’s mandate.

-

California’s regulations would require 35% of 2026 model year vehicles to be zero-emission, a figure manufacturers say is unrealistic.

Diving Deeper:

The Alliance for Automotive Innovation, representing industry giants such as General Motors, Toyota, Volkswagen, and Hyundai, issued a letter Monday warning Congress about the looming consequences of California’s radical environmental regulations. The automakers stressed that unless Congress acts swiftly, vehicle shipments across the country could be disrupted within months, forcing car companies to artificially limit sales of traditional vehicles to meet electric vehicle quotas.

California’s Air Resources Board rules have already spread to 11 other states—including New York, Massachusetts, and Oregon—together representing roughly 40% of the entire U.S. auto market. Despite repeated concerns from manufacturers, California officials have doubled down, insisting that their measures are essential for meeting lofty greenhouse gas reduction targets and combating smog. However, even some states like Maryland have recognized the impracticality of California’s timeline, opting to delay compliance.

A major legal hurdle complicates the path forward. The Government Accountability Office ruled in March that the EPA waiver issued under former President Joe Biden cannot be revoked under the Congressional Review Act, which requires only a simple Senate majority. This creates uncertainty over whether Congress can truly roll back California’s authority without more complex legislative action.

The House is also gearing up to tackle other elements of California’s environmental regime, including blocking the state from imposing stricter pollution standards on commercial trucks and halting its low-nitrogen oxide emissions regulations for heavy-duty vehicles. These moves reflect growing concerns that California’s progressive regulatory overreach is threatening national commerce and consumer choice.

Under California’s current rules, the state demands that 35% of light-duty vehicles for the 2026 model year be zero-emission, scaling up rapidly to 68% by 2030. Industry experts widely agree that these targets are disconnected from reality, given the current slow pace of electric vehicle adoption among the broader American public, particularly in rural and lower-income areas.

California first unveiled its plan in 2020, aiming to make at least 80% of new cars electric and the remainder plug-in hybrids by 2035. Now, under President Donald Trump’s leadership, the U.S. Transportation Department is working to undo the aggressive fuel economy regulations imposed during former President Joe Biden’s term, offering a much-needed course correction for an auto industry burdened by regulatory overreach.

As Congress debates, the larger question remains: Will America allow one state’s left-wing environmental ideology to dictate terms for the entire country’s auto industry?

-

Alberta11 hours ago

Alberta11 hours agoPremier Danielle Smith responds to election of Liberal government

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada is squandering the greatest oil opportunity on Earth

-

International2 days ago

International2 days agoU.S. Army names new long-range hypersonic weapon ‘Dark Eagle’

-

Business1 day ago

Business1 day agoNet Zero by 2050: There is no realistic path to affordable and reliable electricity

-

Business1 day ago

Business1 day agoOttawa’s Plastics Registry A Waste Of Time And Money

-

Addictions1 day ago

Addictions1 day agoFour new studies show link between heavy cannabis use, serious health risks

-

Dan McTeague2 days ago

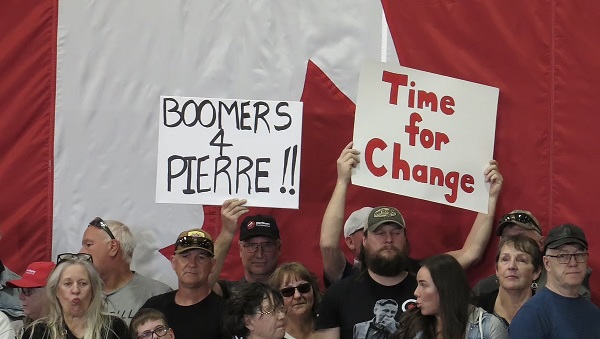

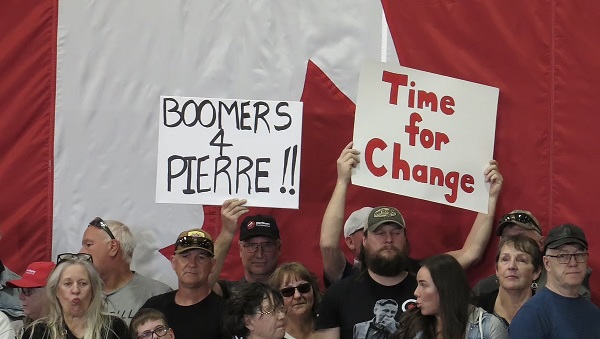

Dan McTeague2 days agoMy fellow boomers, Carney’s ‘Green’ obsessions are bad for all of us!

-

Business2 days ago

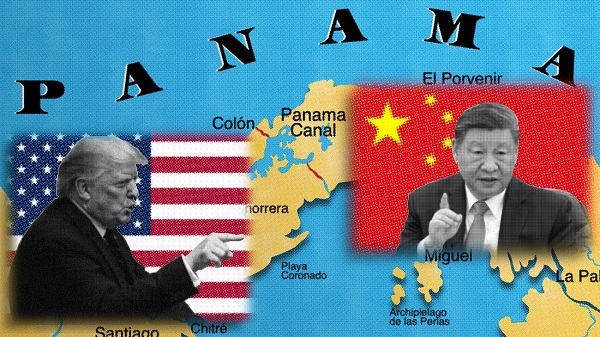

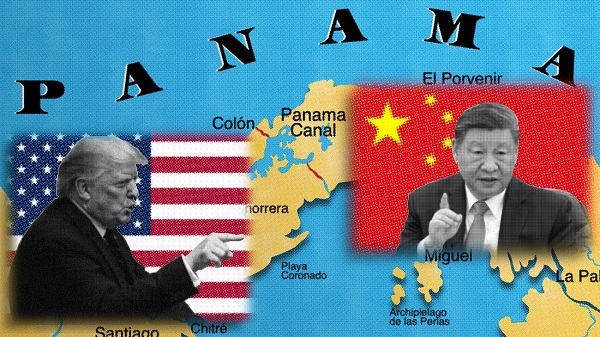

Business2 days agoTrump demands free passage for American ships through Panama, Suez