Alberta

Diploma exams set to 20% for 2022-23 school year

As students continue to address pandemic-related learning challenges, diploma exam weighting will be reduced to 20 per cent this school year.

Over the course of the pandemic, the government has responded to feedback from education system partners and made adjustments to the administration of diploma exams as required.

In response to feedback from students, parents and education partners about learning loss and well-being issues as a result of the pandemic, the government is taking a measured approach in transitioning the weighting of diploma exams over time. The weighting will return to 30 per cent in the 2023-24 school year.

“Since June of this year, I have met with over 40 public, separate and francophone school authorities and many other stakeholders and listened to their perspectives. Changing the weight of diploma exams will reduce the burden on students while still giving them valuable exam writing experience. We’re making this temporary change to place less of a burden on students and improve their mental health.”

Diploma exams are key to maintaining fairness and high standards for all students, no matter where they learn in Alberta. However, the government also recognizes the unprecedented challenges students faced in the 2020-21 and 2021-22 school years.

While Alberta’s government previously announced new literacy and numeracy assessments to support students in grades 1-3 who are struggling, the government also recognizes that senior high students are facing post-pandemic challenges, and the change in diploma exam weighting will benefit those students directly.

This decision also reflects the learnings from the Child and Youth Well-Being Panel Report and the recent findings in an Alberta School Councils Association survey of parents, which both recognized the learning loss students have experienced.

“The CASS board of directors supports the ministry’s transitional approach to returning diploma exam weighting to pre-pandemic levels. This decision is reflective of a recommendation an ad hoc committee of CASS made during the pandemic and takes a balanced approach between a return to normal and meeting the social and emotional needs of students.”

“The pandemic impacted all students and their learning in many complex ways, requiring a variety of additional supports to ensure their success. The minister’s acknowledgement of this, and the desire to reduce the mental health burden on students required to write diploma exams this year, is also important to their success. The Alberta School Councils’ Association (ASCA) appreciates the recognition that a transitional return to traditional diploma exam weighting will help to improve students’ mental health while giving them valuable exam writing experience.”

“ASBA is pleased that the government has reviewed high school diploma exam weighting as boards continue to focus on addressing student learning and mental health challenges. This will assist in relieving additional pressures while boards prioritize success of all students.”

Quick facts

- Diploma exams are normally administered in November, January, April, June and August.

- In 2015, the government reduced diploma exam weighting from 50 to 30 per cent, giving greater value to course work through the year and each teacher’s ability to assess a broad range of student knowledge and skills.

- In spring 2020, diploma exams were cancelled in April and June because students were learning from home for the last few months of the school year. They were successfully administered in August of that year.

- During the 2020-21 school year, all diploma exams were optional.

- For the 2021-22 school year, the government cancelled January diploma exams, and all remaining diploma exams for the year were weighted at 10 per cent.

- Alberta Education works with experienced teachers to develop diploma exams. The government publishes various resources, including previous diploma exam questions and guides, for students. These resources are available on alberta.ca.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Business2 days ago

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

espionage2 days ago

espionage2 days agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Energy2 days ago

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

Opinion2 days ago

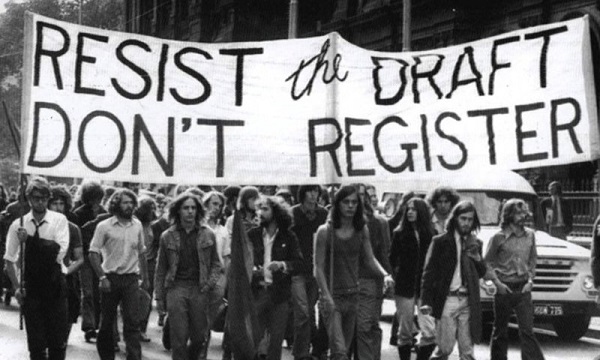

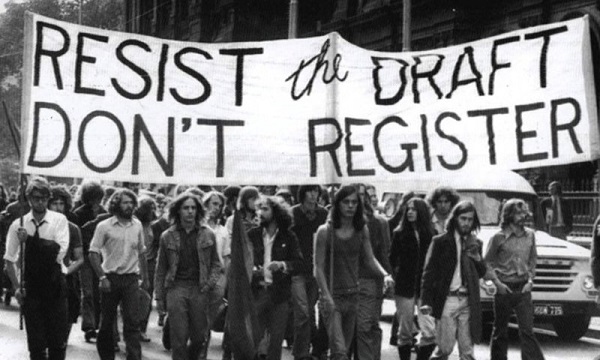

Opinion2 days agoLeft Turn: How Viet Nam War Resisters Changed Canada’s Political Compass