Energy

Dig, Baby, Dig: Making Coal Great Again. A Convincing Case for Coal

From the Daily Caller News Foundation

By Gordon Tomb

Has the time come to make coal great again? Maybe.

“Coal is cheap and far less profitable to export than to burn domestically. so, let’s burn it here,” says Steve Milloy, a veteran observer of the energy industry who served on the Environmental Protection Agency (EPA) transition team for the first Trump administration. “It will provide an abundance of affordable and reliable electricity while helping coal communities thrive for the long term.”

The U.S. coal industry has been in a long decline since at least President Barack Obama’s regulatory “war on coal” initiated 15 years ago. At the same time, natural gas became more competitive with coal as a power-plant fuel when new hydrofracturing techniques lowered the price of the former.

In Pennsylvania, a state with prodigious amounts of both fuels, natural gas has all but replaced coal for electric generation. Between 2001 and 2021, gas’ share of power production rose from 2% to 52% as coal’s dropped from 57% to 12%, according to the U.S. Energy Information Administration. Last year, Pennsylvania’s largest coal-fired power plant shut down under the pressures of regulations and economics after spending nearly $1 billion on pollution controls in the preceding decade.

Nationally, between 2013 and 2023, domestic coal production declined by more than 30% and industry employment by more than 40%.

While the first Trump administration provided somewhat of a respite from federal hostility toward fossil fuels in general and coal in particular, President Joe Biden revived Obama’s viciously negative stance on hydrocarbons while promoting weather-dependent wind and solar energy. This absurdity has wrecked livelihoods and made the power grid more prone to blackouts.

Fortunately, the second Trump administration will be exponentially more friendly toward development of fossil fuels. High on the list is increasing exports of liquefied natural gas (LNG). “[T]he next four years could prime the liquefied natural gas (LNG) markets for a golden era,” says market analyst Rystad Energy. “[T]he returning president’s expected policies are likely to accelerate U.S. LNG infrastructure expansion through deregulation and faster permitting…”

All of which is in line with Milloy’s formulation of energy policy. We should “export our gas to Europe and Asia, places that will pay six times more than it sells for in the U.S.” says Milloy, publisher of JunkScience.com and author of books on regulatory overreach, fearmongering and corruption. “Let’s reopen mothballed coal plants, build new coal plants…”

Accompanying rising expectations of easing regulatory obstacles for natural gas is hope that coal can clear daunting environmental hurdles put in place by “green” zealots.

For one thing, the obnoxiously irrational EPA rule defining carbon dioxide — a byproduct of combustion — as a pollutant is destined for the dustbin of destructive policy as common sense and honest science are reestablished among regulators.

Moreover, clean-coal technology makes the burning of the fuel, well, clean. China and India have more than 100 ultra-super critical coal-fired plants that employ high pressures and temperatures to achieve extraordinary efficiencies and minimal pollution. Yet, the United States, which originated the technology more than a decade ago, has only one such facility — the John W. Turk plant in Arkansas.

The point is the United States is underutilizing both coal and the best technology for its use. At the current rate of consumption, the nation’s 250 billion tons of recoverable coal is enough for more than 200 years.

So, if more natural gas winds up being exported as LNG at higher prices, might not coal be an economical — and logical — alternative?

Nuclear power is another possibility, but not for a while. Even with a crash development program and political will aplenty, it is likely to take decades for nuclear reactors to be deployed sufficiently to carry the bulk of the nation’s power load. Barriers range from the need to sort out competing nuclear technologies to regulatory lethargy —if not misfeasance — to financing needs in the many billions and a dearth of qualified engineers.

The last big U.S. reactors to go into operation — units 3 and 4 of Georgia Power’s Vogtle plant — took more than a decade to build and went $17 billion over budget.

“The regulatory environment is better, but it still costs too much and takes too long to get new reactors approved,” writes long-time nuclear enthusiast Robert Bryce.

Can anybody say, “Dig, baby, dig?”

Gordon Tomb is a senior advisor with the CO2 Coalition, Fairfax, Virginia, and once drove coal trucks.

Automotive

Politicians should be honest about environmental pros and cons of electric vehicles

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

According to Steven Guilbeault, former environment minister under Justin Trudeau and former member of Prime Minister Carney’s cabinet, “Switching to an electric vehicle is one of the most impactful things Canadians can do to help fight climate change.”

And the Carney government has only paused Trudeau’s electric vehicle (EV) sales mandate to conduct a “review” of the policy, despite industry pressure to scrap the policy altogether.

So clearly, according to policymakers in Ottawa, EVs are essentially “zero emission” and thus good for environment.

But is that true?

Clearly, EVs have some environmental advantages over traditional gasoline-powered vehicles. Unlike cars with engines that directly burn fossil fuels, EVs do not produce tailpipe emissions of pollutants such as nitrogen dioxide and carbon monoxide, and do not release greenhouse gases (GHGs) such as carbon dioxide. These benefits are real. But when you consider the entire lifecycle of an EV, the picture becomes much more complicated.

Unlike traditional gasoline-powered vehicles, battery-powered EVs and plug-in hybrids generate most of their GHG emissions before the vehicles roll off the assembly line. Compared with conventional gas-powered cars, EVs typically require more fossil fuel energy to manufacture, largely because to produce EVs batteries, producers require a variety of mined materials including cobalt, graphite, lithium, manganese and nickel, which all take lots of energy to extract and process. Once these raw materials are mined, processed and transported across often vast distances to manufacturing sites, they must be assembled into battery packs. Consequently, the manufacturing process of an EV—from the initial mining of materials to final assembly—produces twice the quantity of GHGs (on average) as the manufacturing process for a comparable gas-powered car.

Once an EV is on the road, its carbon footprint depends on how the electricity used to charge its battery is generated. According to a report from the Canada Energy Regulator (the federal agency responsible for overseeing oil, gas and electric utilities), in British Columbia, Manitoba, Quebec and Ontario, electricity is largely produced from low- or even zero-carbon sources such as hydro, so EVs in these provinces have a low level of “indirect” emissions.

However, in other provinces—particularly Alberta, Saskatchewan and Nova Scotia—electricity generation is more heavily reliant on fossil fuels such as coal and natural gas, so EVs produce much higher indirect emissions. And according to research from the University of Toronto, in coal-dependent U.S. states such as West Virginia, an EV can emit about 6 per cent more GHG emissions over its entire lifetime—from initial mining, manufacturing and charging to eventual disposal—than a gas-powered vehicle of the same size. This means that in regions with especially coal-dependent energy grids, EVs could impose more climate costs than benefits. Put simply, for an EV to help meaningfully reduce emissions while on the road, its electricity must come from low-carbon electricity sources—something that does not happen in certain areas of Canada and the United States.

Finally, even after an EV is off the road, it continues to produce emissions, mainly because of the battery. EV batteries contain components that are energy-intensive to extract but also notoriously challenging to recycle. While EV battery recycling technologies are still emerging, approximately 5 per cent of lithium-ion batteries, which are commonly used in EVs, are actually recycled worldwide. This means that most new EVs feature batteries with no recycled components—further weakening the environmental benefit of EVs.

So what’s the final analysis? The technology continues to evolve and therefore the calculations will continue to change. But right now, while electric vehicles clearly help reduce tailpipe emissions, they’re not necessarily “zero emission” vehicles. And after you consider the full lifecycle—manufacturing, charging, scrapping—a more accurate picture of their environmental impact comes into view.

Energy

Canada’s future prosperity runs through the northwest coast

From Resource Works

A strategic gateway to the world

Tucked into the north coast of B.C. is the deepest natural harbour in North America and the port with the shortest travel times to Asia.

With growing capacity for exports including agricultural products, lumber, plastic pellets, propane and butane, it’s no wonder the Port of Prince Rupert often comes up as a potential new global gateway for oil from Alberta, said CEO Shaun Stevenson.

Thanks to its location and natural advantages, the port can efficiently move a wide range of commodities, he said.

That could include oil, if not for the federal tanker ban in northern B.C.’s coastal waters.

“Notwithstanding the moratorium that was put in place, when you look at the attributes of the Port of Prince Rupert, there’s arguably no safer place in Canada to do it,” Stevenson said.

“I think that speaks to the need to build trust and confidence that it can be done safely, with protection of environmental risks. You can’t talk about the economic opportunity before you address safety and environmental protection.”

Safe transit at Prince Rupert

About a 16-hour drive from Vancouver, the Port of Prince Rupert’s terminals are one to two sailing days closer to Asia than other West Coast ports.

The entrance to the inner harbour is wider than the length of three Canadian football fields.

The water is 35 metres deep — about the height of a 10-storey building — compared to 22 metres at Los Angeles and 16 metres at Seattle.

Shipmasters spend two hours navigating into the port with local pilot guides, compared to four hours at Vancouver and eight at Seattle.

“We’ve got wide open, very simple shipping lanes. It’s not moving through complex navigational channels into the site,” Stevenson said.

A port on the rise

The Prince Rupert Port Authority says it has entered a new era of expansion, strengthening Canada’s economic security.

The port estimates it anchors about $60 billion of Canada’s annual global trade today. Even without adding oil exports, Stevenson said that figure could grow to $100 billion.

“We need better access to the huge and growing Asian market,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute.

“Prince Rupert seems purpose-built for that.”

Roughly $3 billion in new infrastructure is already taking shape, including the $750 million rail-to-container CANXPORT transloading complex for bulk commodities like specialty agricultural products, lumber and plastic pellets.

Canadian propane goes global

A centrepiece of new development is the $1.35-billion Ridley Energy Export Facility — the port’s third propane terminal since 2019.

“Prince Rupert is already emerging as a globally significant gateway for propane exports to Asia,” Exner-Pirot said.

Thanks to shipments from Prince Rupert, Canadian propane – primarily from Alberta – has gone global, no longer confined to U.S. markets.

More than 45 per cent of Canada’s propane exports now reach destinations outside the United States, according to the Canada Energy Regulator.

“Twenty-five per cent of Japan’s propane imports come through Prince Rupert, and just shy of 15 per cent of Korea’s imports. It’s created a lift on every barrel produced in Western Canada,” Stevenson said.

“When we look at natural gas liquids, propane and butane, we think there’s an opportunity for Canada via Prince Rupert becoming the trading benchmark for the Asia-Pacific region.”

That would give Canadian production an enduring competitive advantage when serving key markets in Asia, he said.

Deep connection to Alberta

The Port of Prince Rupert has been a key export hub for Alberta commodities for more than four decades.

Through the Alberta Heritage Savings Trust Fund, the province invested $134 million — roughly half the total cost — to build the Prince Rupert Grain Terminal, which opened in 1985.

The largest grain terminal on the West Coast, it primarily handles wheat, barley, and canola from the prairies.

Today, the connection to Alberta remains strong.

In 2022, $3.8 billion worth of Alberta exports — mainly propane, agricultural products and wood pulp — were shipped through the Port of Prince Rupert, according to the province’s Ministry of Transportation and Economic Corridors.

In 2024, Alberta awarded a $250,000 grant to the Prince Rupert Port Authority to lead discussions on expanding transportation links with the province’s Industrial Heartland region near Edmonton.

Handling some of the world’s biggest vessels

The Port of Prince Rupert could safely handle oil tankers, including Very Large Crude Carriers (VLCCs), Stevenson said.

“We would have the capacity both in water depth and access and egress to the port that could handle Aframax, Suezmax and even VLCCs,” he said.

“We don’t have terminal capacity to handle oil at this point, but there’s certainly terminal capacities within the port complex that could be either expanded or diversified in their capability.”

Market access lessons from TMX

Like propane, Canada’s oil exports have gained traction in Asia, thanks to the expanded Trans Mountain pipeline and the Westridge Marine Terminal near Vancouver — about 1,600 kilometres south of Prince Rupert, where there is no oil tanker ban.

The Trans Mountain expansion project included the largest expansion of ocean oil spill response in Canadian history, doubling capacity of the West Coast Marine Response Corporation.

The Canada Energy Regulator (CER) reports that Canadian oil exports to Asia more than tripled after the expanded pipeline and terminal went into service in May 2024.

As a result, the price for Canadian oil has gone up.

The gap between Western Canadian Select (WCS) and West Texas Intermediate (WTI) has narrowed to about $12 per barrel this year, compared to $19 per barrel in 2023, according to GLJ Petroleum Consultants.

Each additional dollar earned per barrel adds about $280 million in annual government royalties and tax revenues, according to economist Peter Tertzakian.

The road ahead

There are likely several potential sites for a new West Coast oil terminal, Stevenson said.

“A pipeline is going to find its way to tidewater based upon the safest and most efficient route,” he said.

“The terminal part is relatively straightforward, whether it’s in Prince Rupert or somewhere else.”

Under Canada’s Marine Act, the Port of Prince Rupert’s mandate is to enable trade, Stevenson said.

“If Canada’s trade objectives include moving oil off the West Coast, we’re here to enable it, presuming that the project has a mandate,” he said.

“If we see the basis of a project like this, we would ensure that it’s done to the best possible standard.”

This article originally appeared in Canadian Energy Centre

Resource Works News

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

espionage14 hours ago

espionage14 hours agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Focal Points5 hours ago

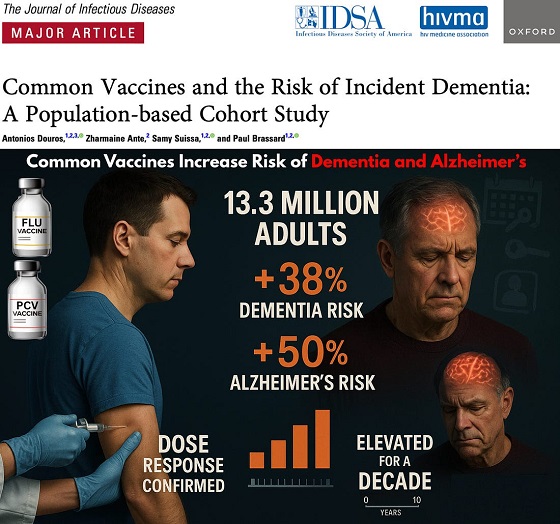

Focal Points5 hours agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Opinion23 hours ago

Opinion23 hours agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Agriculture24 hours ago

Agriculture24 hours agoCanada’s air quality among the best in the world

-

Business12 hours ago

Business12 hours agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Health3 hours ago

Health3 hours agoThe Data That Doesn’t Exist

-

Economy13 hours ago

Economy13 hours agoAffordable housing out of reach everywhere in Canada