Alberta

Did you win? Cash and Cars Lottery winners released today.

The names of all prize winners will be listed on the Cash and Cars Lottery website at cashandcarslottery.ca beginning today.

Cash and Cars Lottery Draws

Alberta (October 22, 2019)- “It’s donating with a chance to win, so it’s a win-win”.

That’s how Lawrence Chang of Leduc described his win when told his lucky ticket number 700737009 had just won him the Alberta Cancer Foundation You Win 50 draw. His half was $900,000 cash.

Anica Hicks of Calgary had a similar comment when told that she had just won the third grand prize in the Alberta Cancer Foundation Cash and Cars Lottery. She had the choice of a $270,000 annuity of $4,500 a month for 60 months or $250,000 cash. She decided to take the $250,000 cash.

“It’s important to give back to charity, so we buy tickets for all the lotteries,” she said. Her winning ticket number was 302164004.

Winners for the Cash and Cars Lottery 2,675 prizes worth $3.8 million and the You Win 50 were drawn in Calgary today.

A lucky Edmonton man won the lottery’s first grand prize package that includes a Kimberley Homes furnished show home in Edmonton, a 2019 Honda Civic Hatch Sport CVT and $10,000 cash. Joseph Andrews was holding ticket number 106617001. His prize is worth more than $1 million.

A lucky Edmonton man won the lottery’s first grand prize package that includes a Kimberley Homes furnished show home in Edmonton, a 2019 Honda Civic Hatch Sport CVT and $10,000 cash. Joseph Andrews was holding ticket number 106617001. His prize is worth more than $1 million.

A Brooks man is now the recipient of the lottery’s second grand prize package in Calgary. Lyle Conners now owns a Truman furnished Brownstone in Calgary’s University District, a 2019 Honda CRV LX AWD and $10,000 cash, all worth a total of more than $800,000. Mr. Connors was holding lucky ticket number 207280001.

A Brooks man is now the recipient of the lottery’s second grand prize package in Calgary. Lyle Conners now owns a Truman furnished Brownstone in Calgary’s University District, a 2019 Honda CRV LX AWD and $10,000 cash, all worth a total of more than $800,000. Mr. Connors was holding lucky ticket number 207280001.

The annual lottery supports the Alberta Cancer Foundation, which is the official fundraising partner for all 17 Alberta Health Services cancer centres in the province, including the Tom Baker Cancer Centre in Calgary and the Cross Cancer Institute in Edmonton. Funds raised from the lottery allow the Alberta Cancer Foundation to strategically invest in breakthrough cancer research, clinical trials and enhanced care initiatives at all cancer centres in the province. The lottery makes life better for Albertans and their families facing cancer.

Other major lottery winners are:

- 2019 BMW X3 xDrive 30i -JUNE OLESKY of Calgary Ticket #205511002

- 2019 Infinity QX60 -CORI WILLIAMS of Spruce Grove Ticket #402203003

- 2019 Ram 1500 Tradesman Crew Cab 4X4 -GARRY HOLMEN of Bentley Ticket #400284009 (Garry and Denise have been buying a ticket every year since 2007. She is a cancer survivor).

- 2019 Hyundai Santa Fe Ultimate 2.0T AWD-DAVID MCGARRY of Redcliff Ticket #102898001

- 2019 Mini Cooper Countryman All4-RYAN AND JACKIE GARDNER of Peace River Ticket #111805001

- 2019 Toyota RAV4 XLE-BRIAN AHORNER of Airdrie Ticket #400374008 (He says he buys tickets every year to help the foundation. He has family members who passed away with cancer.)

- 2019 Acura ILX Premium -CAROL BEAUPRE of Edmonton Ticket #303020002 (She says she always buys tickets to support the foundation and says she knows a number of people impacted by cancer, including her mother. She said she was thrilled to win. It made her year.)

The names of all prize winners will be listed on the Cash and Cars Lottery website at cashandcarslottery.ca beginning today.

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election2 days ago

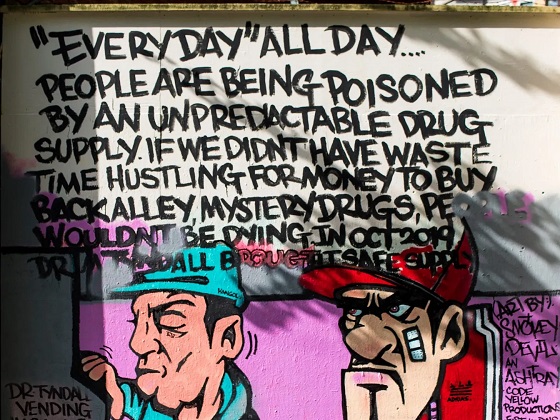

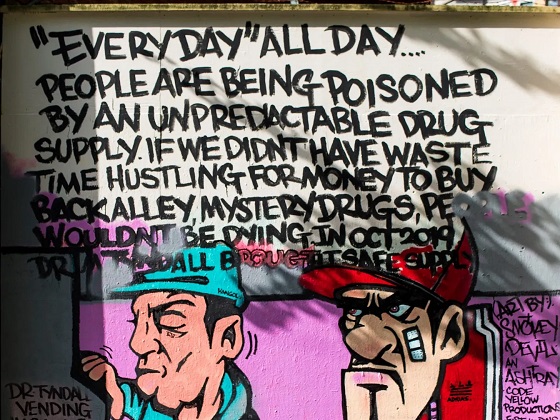

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolls say Canadians will give Trump what he wants, a Carney victory.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre’s Conservatives promise to repeal policy allowing male criminals in female jails

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTrump Has Driven Canadians Crazy. This Is How Crazy.