Alberta

Danielle Smith slams Trudeau’s carbon tax exemption for Atlantic Canada and not rest of country

From LifeSiteNews

‘As a Canadian, do you feel it is fair to continue paying the carbon tax on home heating when some places are now exempt?’ the Alberta premier asked.

Alberta Premier Danielle Smith chided Prime Minister Justin Trudeau as being unfair in not applying “tax fairness” for Albertans and all Canadians after Trudeau announced a pause on the carbon tax for home heating oil but only for Atlantic Canada.

“If you’re going to have a federal government asserting that they have to have this power so that everybody is treated equally, then they don’t treat everyone equally. It seems to me that that’s something that should go back to the court and ask them whether or not they want to reconsider whether this is an appropriate use of the federal powers,” Smith said recently at a press conference.

“I would rather the federal government accept that if this is a painful tax coming into winter for Atlantic Canadians, it’s a painful tax going into the winter for everyone and just make sure that he does the right thing and takes the tax off for all types of home heating and every province,” Smith said.

As a Canadian, do you feel it is fair to continue paying the carbon tax on home heating when some places are now exempt?

Comment below 👇 pic.twitter.com/9jHEp9cFpK

— Danielle Smith (@ABDanielleSmith) November 2, 2023

Smith has been fighting a prolonged battle with the Liberal federal government of Trudeau, who has gone on the attack against Alberta’s oil and gas industry through the implementation of ideologically charged laws, including the punitive carbon tax.

Trudeau, however, has given breaks to some parts of the country on the carbon tax for home heating fuels but not others.

He recently announced that he was pausing the collection of the carbon tax on home heating oil in for three years, but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per litre. Most Canadians, however, heat their homes with clean-burning natural gas, a fuel that will not be exempted from the carbon tax.

Trudeau’s announcement came amid dismal polling numbers showing his government will be defeated in a landslide by the Conservative Party come the next election.

This resulted in federal Conservative Party (CPC) leader Pierre Poilievre daring Trudeau to call a “carbon tax” election so Canadians can decide for themselves if they want a government for or against a tax that has caused home heating bills to double in some provinces.

Recent political challenges against the carbon tax have failed. Recently, a CPC motion calling for the carbon tax to be paused for all Canadians failed to pass after the Liberal and Bloc Quebecois MPs voted against it. This motion interestingly had support from the New Democratic Party (NDP) but that was not enough to get it passed.

Canadian premiers come together to demand carbon tax pause for all provinces

Trudeau’s latest offering of a three-year pause on the carbon tax in Atlantic Canada has caused a major rift with oil and gas-rich western provinces, notably Alberta and Saskatchewan, and even Manitoba, which has a new NDP government.

This prompted all premiers of Canada to come together to call on the Trudeau government to extend the carbon tax fuel pause to all Canadians.

“All this is doing is causing unfairness, making life less affordable, and really harming the most vulnerable as we get into the winter season,” Smith said today about most provinces being left out of the carbon tax pause.

Going one step further, on November 10, Five Canadian premiers from coast to coast banded together to demand Trudeau drop the carbon tax for home heating for all Canadian provinces, saying his policy of giving one region a tax break over another have caused “divisions” in Canada.

After Trudeau announced a special tax break for Atlantic Canada, Saskatchewan Premier Scott Moe said his province will stop collecting a federal carbon tax on natural gas used to heat homes on January 1, 2024, unless it gets a similar tax break as the Atlantic Canadian provinces.

Alberta has repeatedly promised to place the interests of their people above the Trudeau government’s “unconstitutional” demands while consistently reminding the federal government that their infrastructures and economies depend upon oil, gas, and coal.

As for Smith has fought back, and recently tore a page off a heckler’s fantasy suggestion of a solar and wind battery-powered future after she stepped into the lion’s den to advocate for oil and gas at a conference hosted by a pro-climate change think tank.

Smith has said she will be looking into whether a Supreme Court challenge on the carbon tax is in order. She noted, however, that as Alberta has a deregulated energy industry, unlike Saskatchewan, she is not able to stop collecting the federal carbon tax.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

The Trudeau government has also defied a recent Supreme Court ruling and will push ahead with its net-zero emission regulations.

Canada’s Supreme Court recently ruled that the federal government’s “no more pipelines” legislation is mostly unconstitutional after a long legal battle with the province of Alberta, where the Conservative government opposes the radical climate change agenda.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

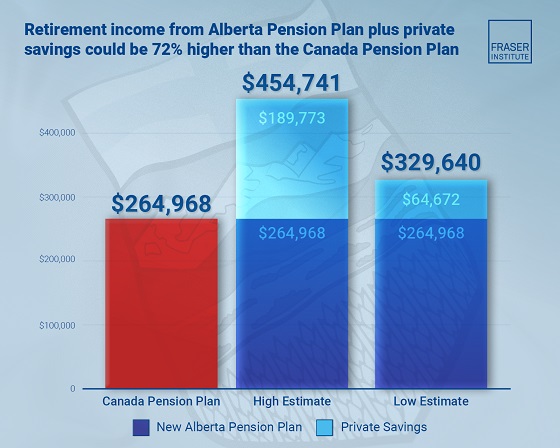

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again