Business

Cut Corporate Income Taxes massively to increase growth, prosperity

From the Frontier Centre for Public Policy

By Ian Madsen

The federal Liberal government’s current budget proposal to increase the inclusion rate for capital gains tax was met with justifiable criticism and opposition – primarily from business groups. There is another corporate income tax increase looming. A 2018 corporate tax reduction, intended to make Canada less uncompetitive versus the 2017-enacted tax reform and cut in the United States (which came into effect fully in 2018), is set to expire starting this year.

According to a study by University of Calgary’s School of Public Policy’s Trevor Tombe, Canada’s corporate income tax rate on new investments will jump from 13.7% to 17% by 2027. Even worse, for Canada’s high-value-added manufacturing sector, taxation will triple. For a nation that is having a hard time, encouraging both domestic or foreign investors to invest in new plant, equipment and related goods and services, to reverse meagre productivity growth – as noted by the Bank of Canada – this development is beyond questionable.

This rise will hinder future improvement in incomes and the standard of living – making it a serious issue. It should be obvious to policymakers that increasing income tax on businesses and investment should be avoided. The legislation to make the 2018 provisions permanent is, alarmingly, not urgent to politicians seeking to appease certain types of class warfare-cheering voters.

There is at least one policy that could make Canada more attractive to business, investors, and hard-pressed ordinary citizens. It would be, dramatically and substantially, slash corporate income taxes – plus make paying taxes easier, as Magna Corporation founder Frank Stronach has suggested. It may surprise some Canadians, but, Ottawa’s take from corporate income taxes is a relatively small, but fast rising proportion of federal overall revenue: 21%, in fiscal 2022-23, according to Ottawa, up from 13% in fiscal 2000-21 notes the OECD.

This may seem ‘just fine’: let companies pay the taxes and reduce the tax burden on ordinary people. However, what actually happens is that every corporate expense, including taxes, reduces cash flow. The money remaining could either be reinvested or paid out as dividends to owners. A reminder: owners are founding families; pension fund beneficiaries (employees, citizens); and ordinary individuals.

As to reinvesting available funds, the less there are, the less capital investment can occur. Investment is required to replace existing equipment, or add new equipment, devices, software and vehicles for businesses. This not only keeps companies competitive, but also makes employees more productive. This, in turn, makes the whole economy more profitable, thereby increasing taxes paid to governments.

As for the dubious reason for the tax hike, gaining more revenue – recent experience in the United States is instructive. The 2017 Tax Cut and Jobs Act reduced corporate income tax from 39% of pre-tax income to 21%. The result: U.S. federal corporate income tax revenue rose 25% from 2017 to fiscal 2021. Capital investment rose dramatically too, by 20%, a key goal of many Canadian policymakers.

Taxes should be cut, enabling productivity improvement and bringing a future prosperity that we all yearn for. It would also keep us internationally competitive. We are currently mediocre, being around a 25% rate (OECD).

Canada has a hard time attracting investors. Now, our trading partners are leaving us in the dust.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy

Business

Canadians love Nordic-style social programs as long as someone else pays for them

This article supplied by Troy Media.

By Pat Murphy

By Pat Murphy

Generous social programs come with trade-offs. Pretending otherwise is political fiction

Nordic societies fund their own benefits through taxes and cost-sharing. Canadians expect someone to foot the bill

Like Donald Trump, one of my favourite words starts with the letter “T.” But where Trump likes the word “tariff,” my choice is “trade-off.” Virtually everything in life is a trade-off, and we’d all be much better off if we instinctively understood that.

Think about it.

If you yield to the immediate pleasure of spending all your money on whatever catches your fancy, you’ll wind up broke. If you regularly enjoy drinking to excess, be prepared to pay the unpleasant price of hangovers and maybe worse. If you don’t bother to acquire some marketable skill or credential, don’t be surprised if your employment prospects are limited. If you succumb to the allure of fooling around, you may well lose your marriage. And so on.

Failing to understand trade-offs also extends into political life. Take, for instance, the current fashion for anti-capitalist democratic socialism. Pushed to explain their vision, proponents will often make reference to the Nordic countries. But they exhibit little or no understanding of how these societies actually work.

As American economist Deirdre Nansen McCloskey notes, “Sweden is pretty much as ‘capitalistic’ as is the United States. If ‘socialism’ means government ownership of the means of production, which is the classic definition, Sweden never qualified.” The central planning/government ownership model isn’t the Swedish way.

What the Nordics do have, however, is a robust social safety net. And it’s useful to look at how they pay for it.

J.P. Morgan’s Michael Cembalest is a man who knows his way around data. He puts it this way: “Copy the Nordic model if you like, but understand that it entails a lot of capitalism and pro-business policies, a lot of taxation on middle-class spending and wages, minimal reliance on corporate taxation and plenty of co-pays and deductibles in its health care system.”

For instance, take the kind of taxes that are often derided as undesirably regressive—sales taxes, social security taxes and payroll taxes. In Sweden, they account for a whopping 27 per cent of gross domestic product. And some 15 per cent of health expenditures are out of pocket.

Charles Lane—formerly with the Washington Post, now with The Free Press—is another who pulls no punches: “Nordic countries are generous, but they are not stupid. They understand there is no such thing as ‘free’ health care, and that requiring patients to have at least some skin in the game, in the form of cost-sharing, helps contain costs.”

In effect, Nordic societies have made an internal bargain. Ordinary people are prepared to fork over large chunks of their own money in return for a comprehensive social safety net. They’re not expecting the good stuff to come to them without a personal cost.

Scandinavians obviously understand the concept of trade-offs, a dimension that seems to be absent from much of the North American discussion. Instead of Nordic-style pragmatism, spending ideas on this side of the Atlantic are floated on the premise of having someone else pay. And the electorally prized middle class is to be protected at all costs.

In the aftermath of Zohran Mamdami’s New York City win, journalist Kevin Williamson had a sobering reality check: “Class warfare isn’t how they roll in Scandinavia. Oslo is a terrific place to be a billionaire—Copenhagen and Stockholm, too … what’s radically different about the Scandinavians is not how they tax the very high-income but how they tax the middle.”

Taxation propensities aside, Nordic societies are different from the United States and Canada.

Denmark, for instance, is very much a “high-trust” society, defined as a place “where interpersonal trust is relatively high and ethical values are strongly shared.” It’s often been said that it works the way it does because it’s full of Danes, which is broadly true—albeit less so than it was 40 years ago.

Denmark, though, has no interest in multiculturalism as we’ve come to know it. Although governed from the centre-left, there’s no state-sponsored focus on systemic discrimination or diversity representation. Instead, the emphasis is on social cohesion and conformity. If you want to create a society like Denmark, it helps to understand the dynamics that make it work.

Reality intrudes on all sorts of other issues. For example, there’s the way in which public discourse is disfigured on the question of climate change and the need to pursue aggressive net-zero policies.

Asked in the abstract, people are generally favourable, which is then touted as evidence of strong public support. But when subsequently asked how much they’re personally prepared to pay to accomplish these ambitious goals, the answer is often little or nothing.

If there’s one maxim we should be taught from childhood, it’s this: there are no panaceas, only trade-offs.

Troy Media columnist Pat Murphy casts a history buff’s eye at the goings-on in our world. Never cynical – well, perhaps a little bit.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta can’t fix its deficits with oil money: Lennie Kaplan

This article supplied by Troy Media.

Alberta is banking on oil to erase rising deficits, but the province’s budget can’t hold without major fiscal changes

Alberta is heading for a fiscal cliff, and no amount of oil revenue will save it this time.

The province is facing ballooning deficits, rising debt and an addiction to resource revenues that rise and fall with global markets. As Budget 2026 consultations begin, the government is gambling on oil prices to balance the books again. That gamble is failing. Alberta is already staring down multibillion-dollar shortfalls.

I estimate the province will run deficits of $7.7 billion in 2025-26, $8.8 billion in 2026-27 and $7.5 billion in 2027-28. If nothing changes, debt will climb from $85.2 billion to $112.3 billion in just three years. That is an increase of more than $27 billion, and it is entirely avoidable.

These numbers come from my latest fiscal analysis, completed at the end of October. I used conservative assumptions: oil prices at US$62 to US$67 per barrel over the next three years. Expenses are expected to keep growing faster than inflation and population. I also requested Alberta’s five-year internal fiscal projections through access to information but Treasury Board and Finance refused to release them. Those forecasts exist, but Albertans have not been allowed to see them.

Alberta has been running structural deficits for years, even during boom times. That is because it spends more than it brings in, counting on oil royalties to fill the gap. No other province leans this hard on non-renewable resource revenue. It is volatile. It is risky. And it is getting worse.

That is what makes Premier Danielle Smith’s recent Financial Post column so striking. She effectively admitted that any path to a balanced budget depends on doubling Alberta’s oil production by 2035. That is not a plan. It is a fantasy. It relies on global markets, pipeline expansions and long-term forecasts that rarely hold. It puts taxpayers on the hook for a commodity cycle the province does not control.

I have long supported Alberta’s oil and gas industry. But I will call out any government that leans on inflated projections to justify bad fiscal choices.

Just three years ago, Alberta needed oil at US$70 to balance the budget. Now it needs US$74 in 2025-26, US$76.35 in 2026-27 and US$77.50 in 2027-28. That bar keeps rising. A single US$1 drop in the oil price will soon cost Alberta $750 million a year. By the end of the decade, that figure could reach $1 billion. That is not a cushion. It is a cliff edge.

Even if the government had pulled in $13 billion per year in oil revenue over the last four years, it still would have run deficits. The real problem is spending. Since 2021, operating spending, excluding COVID-19 relief, has jumped by $15.5 billion, or 31 per cent. That is nearly eight per cent per year. For comparison, during the last four years under premiers Ed Stelmach and Alison Redford, spending went up 6.9 per cent annually.

This is not a revenue problem. It is a spending problem, papered over with oil booms. Pretending Alberta can keep expanding health care, education and social services on the back of unpredictable oil money is reckless. Do we really want our schools and hospitals held hostage to oil prices and OPEC?

The solution was laid out decades ago. Oil royalties should be saved off the top, not dumped into general revenue. That is what Premier Peter Lougheed understood when he created the Alberta Heritage Savings Trust Fund in 1976. It is what Premier Ralph Klein did when he cut spending and paid down debt in the 1990s. Alberta used to treat oil as a bonus. Now it treats it as a crutch.

With debt climbing and deficits baked in, Alberta is out of time. I have previously laid out detailed solutions. But here is where the government should start.

First, transparency. Albertans deserve a full three-year fiscal update by the end of November. That includes real numbers on revenue, expenses, debt and deficits. The government must also reinstate the legal requirement for a mid-year economic and fiscal report. No more hiding the ball.

Second, a real plan. Not projections based on hope, but a balanced three-year budget that can survive oil prices dropping below forecast. That plan should be part of Budget 2026 consultations.

Third, long-term discipline. Alberta needs a fiscal sustainability framework, backed by a public long-term report released before year-end.

Because if this government will not take responsibility, the next oil shock will.

Lennie Kaplan is a former senior manager in the fiscal and economic policy division of Alberta’s Ministry of Treasury Board and Finance, where, among other duties, he examined best practices in fiscal frameworks, program reviews and savings strategies for non-renewable resource revenues. In 2012, he won a Corporate Values Award in TB&F for his work on Alberta’s fiscal framework review. In 2019, Mr. Kaplan served as executive director to the MacKinnon Panel on Alberta’s finances—a government-appointed panel tasked with reviewing Alberta’s spending and recommending reforms.

-

Alberta21 hours ago

Alberta21 hours agoFrom Underdog to Top Broodmare

-

Alberta2 days ago

Alberta2 days agoAlberta and Ottawa ink landmark energy agreement

-

International2 days ago

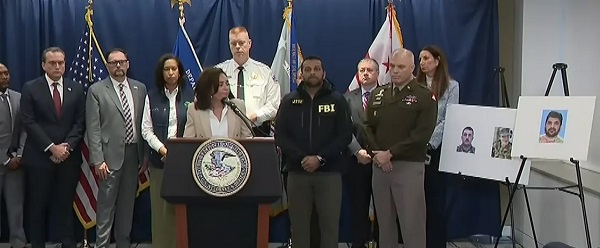

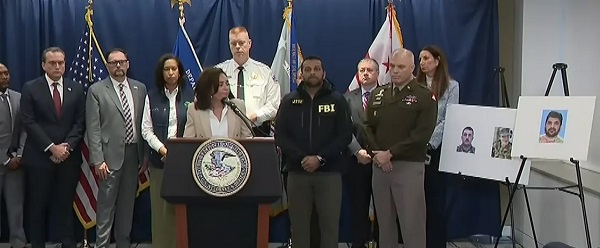

International2 days agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax2 days ago

Carbon Tax2 days agoCanadian energy policies undermine a century of North American integration

-

International2 days ago

International2 days agoIdentities of wounded Guardsmen, each newly sworn in

-

COVID-191 day ago

COVID-191 day agoCanadian government seeking to destroy Freedom Convoy leader, taking Big Red from Chris Barber

-

Alberta2 days ago

Alberta2 days agoWest Coast Pipeline MOU: A good first step, but project dead on arrival without Eby’s assent

-

Energy2 days ago

Energy2 days agoPoilievre says West Coast Pipeline MOU is no guarantee