Business

Craziest examples of government waste – Taxpayer Waste Watch

News release from the Canadian Taxpayers Federation

The feds are spending millions of your tax dollars trying to “green” their offices. Then the government is spending millions more of your tax dollars flying battalions of bureaucrats and politicians around the world.

Here’s a crazy idea: the government could save you money, and cut down on emissions, by skipping out on a couple taxpayer-funded international conferences.

Plus, we’ve compiled the craziest examples of government waste in one video. You’re going to love the video, but hate the waste.

All that and more in this week’s Taxpayer Waste Watch. Enjoy.

Franco.

Bank of Canada fixes with its left hand, what it breaks with its right

They say hypocrites are the kind of people who will cut down a tree, only to stand on the stump and give a speech about the importance of protecting forests.

Someone should get the fat cats at the Bank of Canada on the horn and let them know about that particular definition.

In recent years, the Bank of Canada dumped millions of your tax dollars into a green initiative aimed at lowering its carbon footprint.

Meanwhile, at the exact same time, its executives have been racking up frequent flyer miles while globetrotting to exotic, far-flung locales.

Burning through jet fuel and your tax dollars in the process.

Since 2020, the Bank of Canada dropped $4.1 million on its “greening the bank” initiative, a multi-year effort to measure and reduce its carbon footprint.

More than $1 million has been spent on internal program costs, alongside $950,000 on external consultants and studies, and $2.1 million on green investments.

On top of the greening the bank initiative, the Bank of Canada also signed a contract with the Delphi Group for up to $300,000.

The Delphi Group is a consulting firm “specializing in climate change, sustainability and ESG,” according to its website.

Six staff from the Delphi Group will aid the Bank of Canada’s “annual quantification of its GHG inventory,” according to records obtained by the CTF.

But if the Bank of Canada is looking for ways to lower its carbon footprint, it doesn’t need to spend millions hiring consultants.

All it has to do is look at its executives’ expense reports.

In 2023, Bank of Canada executives racked up $535,000 in travel expenses.

Bank executives took dozens of trips to exotic destinations, including Portugal, Japan, Greece, France, Sweden, Germany, India, Peru, the West Indies and Switzerland.

Bank Governor Tiff Macklem racked up $179,000 in travel expenses alone.

Macklem took 26 separate trips, including four visits to Switzerland, two to Sweden, two to India and one each to Morocco, Portugal, Japan and the Caymen Islands.

So first you’re forced to pay for first-class airfare so bank executives can jet set around the globe to attend conferences and give speeches.

And then you’re forced to pay for millions in consultant fees because the big brains at the central bank are confused why their carbon footprint is so high.

Needless to say, if they can’t crack that puzzle, then it’s little wonder why inflation has run rampant while ravaging the paycheques of taxpayers like you.

But don’t worry, folks.

If the bank runs out of your cash to blow on all these vacations – erm, sorry, we mean “work trips” – we’re sure they’ll just fire up the money printer to cover the costs.

Franco’s note: Any time we write about the Bank of Canada I need to mention this:

The Bank of Canada has one job: keep inflation low and around two per cent. Bank of Canada bureaucrats got $20 million in bonuses in 2022 while it hiked interest rates seven times and inflation reached a 40-year high.

This should go without saying, but bonuses are for people who do a good job, not people who fail at their one and only job.

Trudeau wants to spend your money on…

Every year, the federal government tables main and supplementary estimate documents that detail how your money will be allocated to fund government programs.

But with all the shenanigans currently holding up the House of Commons, the Trudeau government is worried they may not be able to fund these government schemes.

It’s a good bet Prime Minister Justin Trudeau and his minions will claim a vote is needed to make sure struggling Canadians get the help they need.

But the CTF read through the entirety of the recently-released Supplementary Estimates report to see what sort of spending the feds are actually proposing:

- $970 million to cover pay raises for bureaucrats

- $4.5 million for government advertising

- $46 million for the 2026 FIFA Men’s World Cup

- $20 million for Diversity, Equity and Inclusion at the Canada Media Fund

- $200,000 for Prime Minister Justin Trudeau’s plan to plant two billion trees

- $45 million for the gun confiscation scheme

- $6.9 million for pro-carbon tax ads

- $5.5 million for the Toronto Film Festival

- $3.4 million for settlements related to the Phoenix payroll fiasco

Does any of that sound like necessary government spending to you?

VIDEO: Craziest government waste

We’ve said it time and time again.

You pay too much tax because the government wastes too much money.

Don’t believe us? Then watch (and share) the video below.

CTF Federal Director Franco Terrazzano brings the receipts on some of the craziest government waste that’s out of Ottawa in recent years.

If you’re looking for more reading on taxpayer issues, we’ve got you covered.

Canada’s EV gamble looks even more foolish with Trump retaking the White House: https://torontosun.com/

Government employees scored $150M in standby pay last year: https://torontosun.com/

Saskatoon spent more than $300,000 to name new bus system: https://www.taxpayer.

Confirms $523K Rush Orders: https://www.

Trudeau’s bureaucracy boom: Salaries and spending spiralling out of control: https://www.

Premier Holt’s carbon tax flip-flop: https://tj.news/

Internet

US government gave $22 million to nonprofit teaching teens about sex toys: report

From LifeSiteNews

The Center for Innovative Public Health Research’s website suggests teenage girls make their ‘own decisions’ about sex and not let their parents know if they don’t want to.

For almost a decade, the U.S. government funded a group that actively works to teach kids how to use sex toys and then keep them hidden from their parents to the tune of $22 million.

According to investigative reporter Hannah Grossman at the Manhattan Institute, The Center for Innovative Public Health Research (CIPHR) has been educating minors about sex toys with public funds.

Records show that the millions given to the group since 2016, according to its website, go toward “health education programs” that “promote positive human development.”

However, the actual contents of the programs, as can be seen from comments from CIPHR CEO Michele Ybarra, seem to suggest that its idea of “human” development is skewed toward radical sex education doctrine.

In 2017, CIPHR launched Girl2Girl, which is funded by federal money to promote “sex-ed program just for teen girls who are into girls.” Its website lets users, who are girls between ages 14 and 16, sign up for “daily text messages … about things like sex with girls and boys.”

The actual content of some of the messages is very concerning. Its website notes that some of the texts talk about “lube and sex toys” as well as “the different types of sex and ways to increase pleasure.”

The website actively calls upon teenage girls to make their “own decisions” and not let their parents know if they don’t want to.

Grossman shared a video clip on X of Ybarra explaining how they educate minors about the use of “sex toys” and dealing with their parents if they are found out.

The clip, from a 2022 Brown University webinar, shows Ybarra telling researchers how to prepare “young person(s)” for her research.

She said if they are doing “focus groups,” she will ask them, “Okay, so what happens if somebody comes into the room and sees words like penis and sex toys on your screen — on your computer screen or on your phone? What if it’s your mom?’”

In 2023, CIPHR launched Transcendent Health, which is a sex-education program for minors who are gender confused. This initiative received $1.3 million of federal grant money that expired last month.

Grossman observed that the federal government “should not fund programs that send sexually explicit messages to minors and encourage them to conceal these communications from parents.”

She noted that in order to protect children and “prevent further harm,” U.S. President Donald Trump’s Department of Health and Human Services “should immediately cancel CIPHR’s active contract and deny its future grant applications.”

“By doing so, the Trump administration can send a clear message: Taxpayers will no longer foot the bill for perverted ‘research’ projects,” she noted.

The Trump administration has thus far, through the Department of Government Efficiency (DOGE), exposed billions in government waste and fraud. Many such uses of taxpayer dollars are currently under review by the administration, including pro-abortion and pro-censorship activity through USAID, “Diversity, Equity, and Inclusion and neo-Marxist class warfare propaganda” through the National Science Foundation, and billions to left-wing “green energy” nonprofits through the Environmental Protection Agency.

Business

Canadian Police Raid Sophisticated Vancouver Fentanyl Labs, But Insist Millions of Pills Not Destined for U.S.

Sam Cooper

Sam Cooper

Mounties say labs outfitted with high-grade chemistry equipment and a trained chemist reveal transnational crime groups are advancing in technical sophistication and drug production capacity

Amid a growing trade war between Washington and Beijing, Canada—targeted alongside Mexico and China for special tariffs related to Chinese fentanyl supply chains—has dismantled a sophisticated network of fentanyl labs across British Columbia and arrested an academic lab chemist, the RCMP said Thursday.

At a press conference in Vancouver, senior investigators stood behind seized lab equipment and fentanyl supplies, telling reporters the operation had prevented millions of potentially lethal pills from reaching the streets.

“This interdiction has prevented several million potentially lethal doses of fentanyl from being produced and distributed across Canada,” said Cpl. Arash Seyed. But the presence of commercial-grade laboratory equipment at each of the sites—paired with the arrest of a suspect believed to have formal training in chemistry—signals an evolution in the capabilities of organized crime networks, with “progressively enhanced scientific and technical expertise among transnational organized crime groups involved in the production and distribution of illicit drugs,” Seyed added.

This investigation is ongoing, while the seized drugs, precursor chemicals, and other evidence continue to be processed, police said.

Recent Canadian data confirms the country has become an exporter of fentanyl, and experts identify British Columbia as the epicenter of clandestine labs supplied by Chinese precursors and linked to Mexican cartel distributors upstream.

In a statement that appears politically responsive to the evolving Trump trade threats, Assistant Commissioner David Teboul said, “There continues to be no evidence, in this case and others, that these labs are producing fentanyl for exportation into the United States.”

In late March, during coordinated raids across the suburban municipalities of Pitt Meadows, Mission, Aldergrove, Langley, and Richmond, investigators took down three clandestine fentanyl production sites.

The labs were described by the RCMP as “equipped with specialized chemical processing equipment often found in academic and professional research facilities.” Photos released by authorities show stainless steel reaction vessels, industrial filters, and what appear to be commercial-scale tablet presses and drying trays—pointing to mass production capabilities.

The takedown comes as Canada finds itself in the crosshairs of intensifying geopolitical tension.

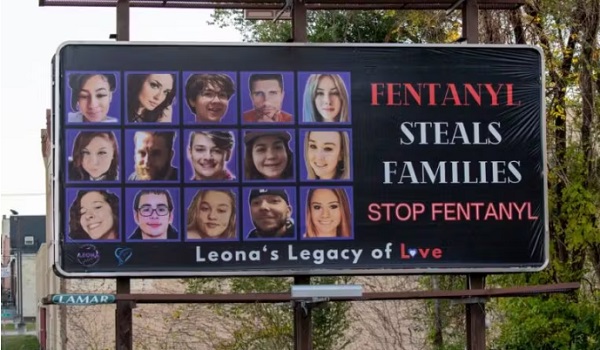

Fentanyl remains the leading cause of drug-related deaths in Canada, with toxic supply chains increasingly linked to hybrid transnational networks involving Chinese chemical brokers and domestic Canadian producers.

RCMP said the sprawling B.C. lab probe was launched in the summer of 2023, with teams initiating an investigation into the importation of unregulated chemicals and commercial laboratory equipment that could be used for synthesizing illicit drugs including fentanyl, MDMA, and GHB.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

-

Also Interesting1 day ago

Also Interesting1 day agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Also Interesting2 days ago

Also Interesting2 days agoExploring Wildrobin Technological Advancements in Live Dealer Games

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFifty Shades of Mark Carney

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

Justice2 days ago

Justice2 days agoCanadian government sued for forcing women to share spaces with ‘transgender’ male prisoners

-

Business1 day ago

Business1 day agoStocks soar after Trump suspends tariffs