Community

Councils Salary Increase, nothing to see here. ?? Move along please.

I have been doing some research regarding council pay and the purpose of the 1/3rd tax deduction… Please bear with me on this post as it is a little lengthy.

The First screenshot is from the Council Compensation & Benefits form. It specifically outlines that the compensation is deemed to be an “allowance” for expenses that are incidental to the discharge of their duties and is, therefore, not taxable. This tax credit allowance ads up to a $5801.50 to the councillors pay check that they would not otherwise recieve. (Photo 3). Some background. Council has proposed to increase their salary by a whopping 13.48% and the Mayors salary by 18.65% to cover the elimination of this tax credit. Council believes the additional taxes they will have to pay should be covered by the taxpayers. Just a side note, I have done what I can with the limited data that I could collect from the city, If i have made any errors in my research I welcome the corrections.

Lets be clear: this tax break is for EXPENSES. The purpose of this tax break is not to provide a salary relief but rather to be used for expenses that are not receipted. Now, that could be fair if not for the fact that councillors already have a expense budget (photo two) which is the budget and Expenditure Summary that each councillor recieves. Let me ask you, if the councillors have $5801.50 of tax relief specifically because they have expenses yet they also have a budget specficially for expenses then something is wrong here. There is a system in place that allows councillors to double dip and councillors have done nothing about it!

The purpose of the Councillors budget – expenses

The purpose of the 1/3rd tax deduction – expenses

Councillor Handley is correct when she says the exemption was to make up for public officials not charging for some of their expenses, however she says she doesn’t submit an expense claim unless she drives out of town for a meeting… Why? You have a budget, why not use your budget for legitimate expenses? That way we can track the expenses and keep council accountable. The 1/3rd tax exemption for “expenses” is clearly a roundabout way that council does not have to be accountable. And you can tell by all of their responses that council wants to hold on to the slush fund so they can continue to not be accountable.

Beyond that Mayor Veer’s statement that “councils take-home salary would stay the same”(after the 13/18% increase) prove once and for all that this tax deduction which had a specific purpose was in fact being used as a personal slush fund rather than being used as an legitimate expense account. “The take home salary would stay the same” Veer said. Remember, the purpose of this tax credit is not actually supposed to be part of the take home salary. It is separate. I’ll say it again: it’s specific purpose, according to the government’s own documents (document # 1201862), is for expenses not salary.

I will also add that, as a business owner, this would never fly. If I claimed that I had $5801.50 worth of expenses that I could not prove with receipts the CRA would laugh and laugh and laugh and then promptly fine me and charge me interest on everything I should have been paying in the first place. This is not how business operates and our government officials should be held to the same, if not a greater, standard. Red Deerians clearly feel the same as the Red Deer Advocates poll currently shows over 92% of people don’t buy what council is selling here. (picture 4)

So what do we do Red Deer?

-Council says this tax credit removal is a salary decrease. This has been proven wrong by the Government’s own documents.

-Council already has an expense budget where they should be claiming all items, nothing should be “hidden”.

-Red Deerians greatly disagree with this move by council.

My proposal is simple

1. The tax credit should have been removed years ago and should continue to be removed.

2. The salary “adjustment” should not go ahead as the 1/3rd tax break was not supposed to be part of the salary.

3. NEW* All incidental expenses should be submitted as part of their base budget.

4. NEW* All receipts that are submitted NEED to be provided online. This is standard for both the provincial and federal government and it is an absolute disgrace that the municipalities think they don’t need to be held accountable in this way.

5. NEW* I have always said that If I were elected to council I would NEVER vote a salary increase for myself as it is simply unethical. I propose the current council always votes for the next council’s salary. That way you are never voting for your own salary in your own term and the electorate has the option of kicking you out if you make a mockery of the system.

The Canadian Taxpayers Federation is a reputable organization that had been successfully advocating for lower taxes, less waste and accountable govt for 3 decades. I am pleased that they saw some flaws in this situation and made a recommendation to have citizen councils set wages for civic politicians. The fact the CTF made a comment in the Red Deer Advocates article is a big signal that council has no leg to stand on here and I hope they take this situation seriously.

What to watch for going forward.

Council may bow to public pressure here but increase their base budget and add perks such as a housing allowance, vehicle allowance, clothing allowance etc etc… Watch closely to see if they try to get this money out of taxpayers through roundabout methods…

Lastly, let us remember that every person who submits their papers to run for councillor does so on their own cognition, recognizing the roles, responsibilities and renumeration that they will receive if they are successful in their election bid. Every Councillor knew these changes were coming. This was not a surprise but rather a long overdue needed change to ensure that all expenses are accounted for.

Please join with me to and tell council to do the right thing. No to this salary increase.

Community

Support local healthcare while winning amazing prizes!

|

|

|

|

|

|

Community

SPARC Caring Adult Nominations now open!

Check out this powerful video, “Be a Mr. Jensen,” shared by Andy Jacks. It highlights the impact of seeing youth as solutions, not problems. Mr. Jensen’s patience and focus on strengths gave this child hope and success.

👉 Be a Mr. Jensen: https://buff.ly/8Z9dOxf

Do you know a Mr. Jensen? Nominate a caring adult in your child’s life who embodies the spirit of Mr. Jensen. Whether it’s a coach, teacher, mentor, or someone special, share how they contribute to youth development. 👉 Nominate Here: https://buff.ly/tJsuJej

Nominate someone who makes a positive impact in the live s of children and youth. Every child has a gift – let’s celebrate the caring adults who help them shine! SPARC Red Deer will recognize the first 50 nominees. 💖🎉 #CaringAdults #BeAMrJensen #SeePotentialNotProblems #SPARCRedDeer

s of children and youth. Every child has a gift – let’s celebrate the caring adults who help them shine! SPARC Red Deer will recognize the first 50 nominees. 💖🎉 #CaringAdults #BeAMrJensen #SeePotentialNotProblems #SPARCRedDeer

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Autism1 day ago

Autism1 day agoAutism Rates Reach Unprecedented Highs: 1 in 12 Boys at Age 4 in California, 1 in 31 Nationally

-

Health1 day ago

Health1 day agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

Education2 days ago

Education2 days agoSchools should focus on falling math and reading grades—not environmental activism

-

2025 Federal Election2 days ago

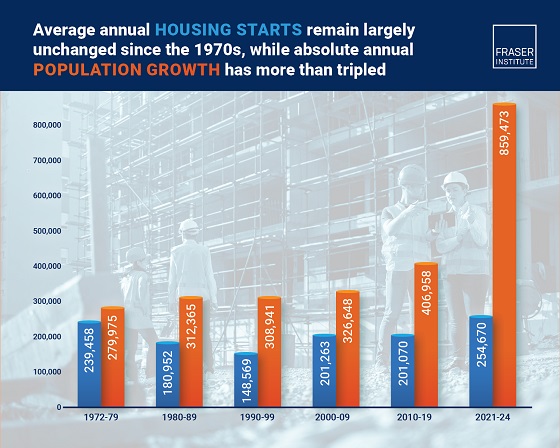

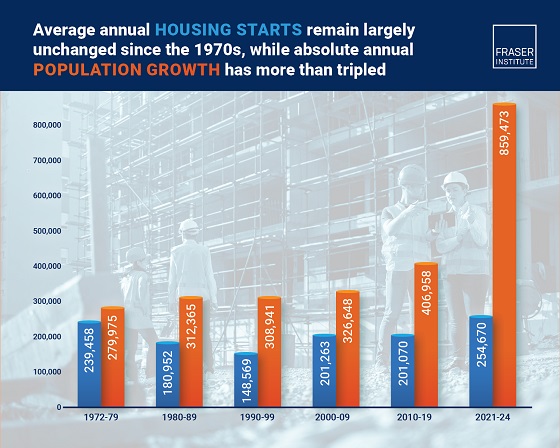

2025 Federal Election2 days agoHousing starts unchanged since 1970s, while Canadian population growth has more than tripled

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoGlobal Warming Policies Hurt the Poor

-

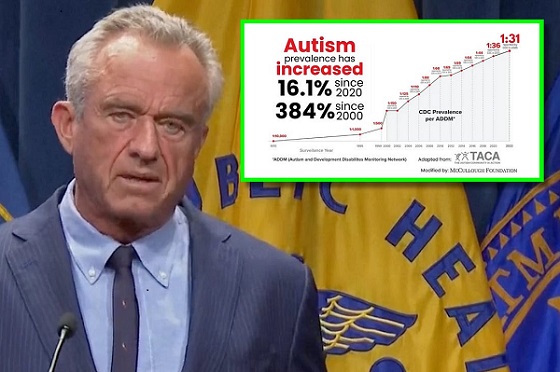

Autism21 hours ago

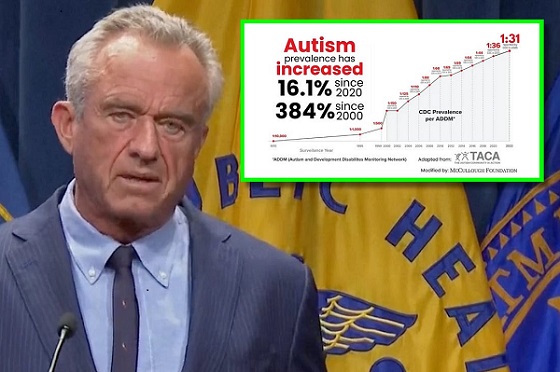

Autism21 hours agoRFK Jr. Exposes a Chilling New Autism Reality