Canadian Energy Centre

Coastal GasLink completion key to unlocking Canadian natural gas for the world

Construction underway on the Coastal GasLink pipeline, which will transport natural gas from northeast BC to the LNG Canada terminal in Kitimat. Photograph courtesy of Coastal GasLink

From the Canadian Energy Centre

By Cody CionaOnce the pipeline is in service, 17 of the twenty First Nations along the pipeline route have signed an agreement for the option to buy a 10 per cent stake

Canada’s natural gas industry has made a major step forward in efforts to export much needed supply to energy-hungry markets in Asia.

The key is the completion of the Coastal GasLink pipeline at the end of 2023.

The project, nearly 12 years in the making, is Canada’s only natural gas export pipeline to the west coast.

It will deliver supply to the port of Kitimat, about 1,400 kilometres northwest of Vancouver. There it will be supercooled and turned into the lowest carbon liquefied natural gas (LNG) in the world and shipped across to global customers from the export facility. That facility is expected to begin operations next year.

It is estimated that the two projects could reduce between 60 to 90 million tonnes of global emissions per year by replacing coal-fired power in Asia

“Coastal GasLink reached mechanical completion in early November 2023 ahead of schedule and is ready to deliver natural gas to LNG Canada’s facility, which will depend on their own commissioning process,” said Natasha Westover, manager of external relations for TC Energy

“Which means, sustainably produced LNG could be shipped to global markets by 2025, via this world-class, safety-leading pipeline.”

The project continues momentum for economic reconciliation with Indigenous communities, with Coastal GasLink set to become one of Canada’s largest infrastructure projects with Indigenous ownership.

Once the pipeline is in service, 17 of the twenty First Nations along the pipeline route have signed an agreement for the option to buy a 10 per cent stake.

“The opportunity was made available to all 20 Indigenous communities holding existing agreements with Coastal GasLink and is an important step on the path to true partnership through equity ownership in the project,” Westover said.

The ownership stakes are in addition to numerous agreements and contracts reached with Indigenous communities along Coastal GasLink’s path. In all, the project spent $1.8 billion with Indigenous and local businesses.

According to TC Energy, the project created more than 25,700 full-time equivalent jobs and took 55 million hours to complete. The project generated $3.2 billion to B.C.’s GDP, some $331 million in tax revenue, and $3.95 billion in spending with B.C. businesses and suppliers.

As well, during construction, Coastal GasLink and TC Energy spent over $13 million in community investments and sponsorships to support local and Indigenous community initiatives.

Once operating, it is estimated that over $26 million in annual tax revenue will be generated for communities along the pipeline’s path. Even with construction coming to an end, local communities will continue to see economic spinoffs. More than $42 million is expected to be generated each year through local economic activity.

“These accomplishments mark the end of the project’s five-year construction phase, during which time our workers, contractors, Indigenous and local communities collaborated to complete Canada’s first pipeline to the west coast in 70 years,” Westover said.

Work will now continue on environmental reclamation and preparing communities and workers for the start of operations.

“Coastal GasLink looks forward to continuing to be a part of the local community as we prepare for safe operations for decades to come,” Westover said.

Alberta

Alberta’s massive oil and gas reserves keep growing – here’s why

From the Canadian Energy Centre

Q&A with Mike Verney, executive vice-president, McDaniel & Associates

New analysis commissioned by the Alberta Energy Regulator has increased the province’s natural gas reserves by 440 per cent, bumping Canada into the global top 10.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

The report was conducted by Calgary-based consultancy McDaniel & Associates. Executive vice-president Mike Verney explains what it means.

CEC: What are “reserves” and why do they matter?

Verney: Reserves are commercial quantities of oil and gas to be recovered in the future. They are key indicators of future production potential.

For companies, that’s a way of representing the future value of their operations. And for countries, it’s important to showcase the runway they have in terms of the future of their oil and gas.

Some countries that have exploited a lot of their resource in the past have low reserves remaining. Canada is in a position where we still have a lot of meat on the bone in terms of those remaining quantities.

CEC: How long has it been since Alberta’s oil and gas reserves were comprehensively assessed?

Verney: Our understanding is the last fully comprehensive review was over a decade ago.

CEC: Does improvement in technology and innovation increase reserves?

Verney: Technological advancements and innovation play a crucial role in increasing reserves. New technologies such as advanced drilling techniques (e.g., hydraulic fracturing, horizontal drilling), enhanced seismic imaging and improved extraction methods enable companies to discover and access previously inaccessible reserves.

As these reserves get developed, the evolution of technology helps companies develop them better and better every year.

CEC: Why have Alberta’s natural gas reserves increased?

Verney: Most importantly, hydraulic fracturing has unlocked material volume, and that’s one of the principal reasons why the new gas estimate is so much higher than what it was in the past.

The performance of the wells that are being drilled has also gotten better since the last comprehensive study.

The Montney competes with every American tight oil and gas play, so we’re recognizing the future potential of that with the gas reserves that are being assigned.

In addition, operators continue to expand the footprint of the Alberta Deep Basin.

CEC: Why have Alberta’s oil reserves increased?

Verney: We discovered over two billion barrels of oil reserves associated with multilateral wells, which is a new technology. In a multilateral well, you drill one vertical well to get to the zone and then once you hit the zone you drill multiple legs off of that one vertical spot. It has been a very positive game-changer.

Performance in the oil sands since the last comprehensive update has also gone better than expected. We’ve got 22 thermal oil sands projects that are operating, and in general, expectations in terms of recovery are higher than they were a decade ago.

Oil sands production has grown substantially in the past decade, up 70 per cent, from two million to 3.4 million barrels per day. The growth of several projects has increased confidence in the commercial viability of developing additional lands.

CEC: What are the implications of Alberta’s reserves in terms of the province’s position as a world energy supplier?

Verney: We’re seeing LNG take off in the United States, and we’re seeing lots of demand from data centers. Our estimate is that North America will need at least 30 billion cubic feet per day of more gas supply in the next few years, based on everything that’s been announced. That is a very material number, considering the United States’ total natural gas production is a little over 100 billion cubic feet per day.

In terms of oil, since the shale revolution in 2008 there’s been massive growth from North America, and the rest of the world hasn’t grown oil production. We’re now seeing that the tight plays in the U.S. aren’t infinite and are showing signs of plateauing.

Specifically, when we look at the United States’ largest oil play, the Permian, it has essentially been flat at 5.5 million barrels per day since December 2023. Flat production from the Permian is contrary to the previous decade, where we saw tight oil production grow by half a million barrels per day per year.

Oil demand has gone up by about a million barrels a day per year for the past several decades, and at this point we do expect that to continue, at the very least in the near term.

Given the growing demand for oil and the stagnation in supply growth since the shale revolution, it’s expected that Alberta’s oil sands reserves will become increasingly critical. As global oil demand continues to rise, and with limited growth in production from other sources, oil sands reserves will be relied upon more heavily.

Canadian Energy Centre

Experts urge caution with Canadian energy in response to Trump tariffs

From The Canadian Energy Centre

By Will Gibson

‘We want Americans to stand up for our supply’

A lawyer by training, Gary Mar is also a keen student of history. And he recommends Canadians look at what happened when past U.S. administrations imposed tariffs on imports before jumping to add costs to Canadian energy.

“President Richard Nixon imposed a 10 per cent tariff in 1971 and withdrew it after a few months because it caused so much pain for American consumers,” says Mar, CEO of the Canada West Foundation, who served as Alberta’s trade representative in Washington from 2007 to 2011.

“Canadians and their governments need to be patient. Any tariffs on energy will be passed on to consumers in the United States. We shouldn’t let the president off the hook for raising the price to American drivers by putting more duties on energy we export,” he says.

“We want Americans to stand up for our supply, not displace the anger with President Trump for raising prices with anger towards Canadians.”

A major U.S. supplier

The U.S. imports more than four million barrels of oil per day from Canada, or about one out of every five barrels the country consumes. Most Canadian imports are destined for refineries in the U.S. Midwest including Illinois, Indiana, Michigan and Ohio.

About 99 per cent of natural gas imports into the United States also come from Canada. Natural gas imports flow primarily to Idaho, North Dakota, Minnesota and Montana, according to the U.S. Energy Information Administration.

Trump tariffs

Nixon put tariffs in place in an attempt to weaken the U.S. dollar against foreign currencies and strengthen U.S. exports.

Mar, who served as cabinet minister in the Klein and Stelmach governments from 1993 to 2007, sees Trump’s tariffs as aimed to repatriate manufacturing and jobs to America.

“President Trump made this explicitly clear…if you want to sell manufactured goods in the United States, you need to move your factories here,” says Mar.

“But Canadian oil and natural gas are key inputs that help U.S. manufacturing. We ship the products or partially refined products that support manufacturing of finished products in the United States. Tariffs will raise those costs for U.S. manufacturers and ultimately American consumers.”

A divisive rerun of the National Energy Program?

Mar’s former cabinet colleague Ted Morton agrees Canada needs to exercise patience and caution in any response to U.S. tariffs.

Morton, who served as an Alberta cabinet minister from 2006 to 2012, strongly disagrees with the idea of placing countervailing tariffs on energy exports to the United States. Morton casts it as a divisive rerun of then Prime Minister Pierre Trudeau’s controversial National Energy Program in the early 1980s.

Energy export tariffs “would be an attempt to revive Liberal Party support from disillusioned voters in Ontario and Quebec,” he says.

“The biggest loser in Trump’s new tariff war will be Ontario due to the integration of the auto sector between the U.S. and Canada. It’s simple political arithmetic. Ottawa could collect $4 or $5 billion by taxing energy exports in western Canada and send that money to prop up struggling industries in Ontario and Quebec,” Morton says.

“Ontario and Quebec combined have a total of 199 MPs, more than enough to form a majority government. It’s the ‘screw the West and take the rest’ strategy. It’s how the Liberals won the 1980 federal election, and they could try it again.”

Legal and constitutional precedents

And while imposing export tariffs on Canadian energy could be politically popular in central Canada, Morton suggests the action would not withstand a legal challenge thanks to legal and constitutional precedents set by former Alberta Premier Peter Lougheed.

“Peter Lougheed left future Alberta premiers with some very effective legal weapons. His government successfully challenged the constitutionality of Trudeau’s export tax on natural gas. He then teamed up with the other western premiers to negotiate a new constitutional amendment that affirms provincial jurisdiction over the development and conservation of natural resources,” Morton says.

“Premier Danielle Smith should win any constitutional challenge if the federal government tries to impose an export tariff on oil or natural gas.”

Morton, like Mar, also counselled patience in responding to tariffs because “Trump’s tariffs on Canadian energy will punish American consumers more than Canadians.”

The national interest

David Yager, who has studied and analyzed energy policy for more than 40 years, agrees tariffs on energy have the potential to drive a wedge between Alberta and the rest of the country in the same way the National Energy Program did.

“The dynamic definition of national interest is what I struggle with. Going back several decades, it was in the national interest to get oil and gas across Canada so there was a drive to build pipelines east and west,” says Yager, a consultant who also serves as a special advisor to Premier Smith.

“Today, the national interest has flipped again, and energy exports are now a source of revenue to save the ‘real’ Canada, which is central Canada. It’s the same kind of logic that has seen the emissions cap on oil and gas as well as the carbon tax.”

If Canada wants to retaliate, Yager recommends putting a duty on the 1.7 billion cubic feet of natural gas imported by Ontario and Quebec from the northeastern United States.

“That would be the appropriate tit for tat response,” Yager says.

“You could build a nice pool of capital and clobber U.S. producers without driving a wedge between Alberta and the rest of the country.”

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Addictions1 day ago

Addictions1 day agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Alberta1 day ago

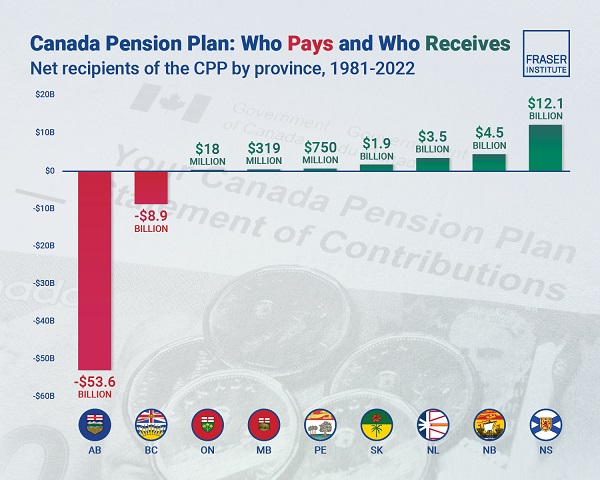

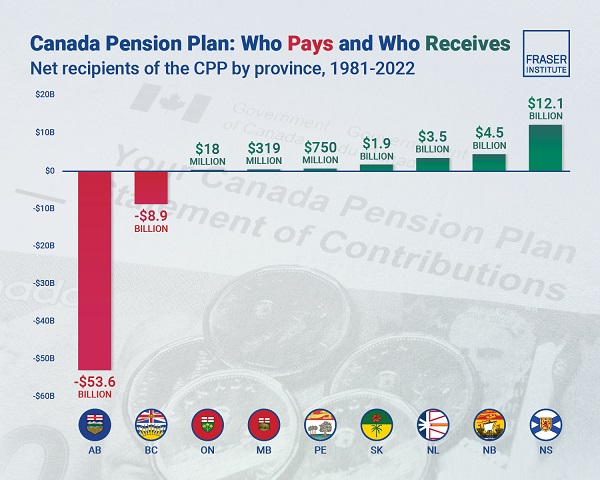

Alberta1 day agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Automotive2 days ago

Automotive2 days agoTrump announces 25% tariff on foreign automobiles as reciprocal tariffs loom

-

Energy1 day ago

Energy1 day agoEnergy, climate, and economics — A smarter path for Canada

-

Also Interesting23 hours ago

Also Interesting23 hours agoThe bizarre story of Taro Tsujimoto