Business

CMHC dished out $30 million in bonuses in 2024

By Ryan Thorpe

The Canada Mortgage and Housing Corporation rubberstamped $30.8 million in bonuses in 2024, according to government records obtained by the Canadian Taxpayers Federation.

That pushes total bonuses at the CMHC up to $132 million since the beginning of 2020.

“Why are Canada’s housing bureaucrats showering themselves with bonuses when countless Canadians can’t afford homes?” said Franco Terrazzano, CTF Federal Director. “Canadians need more homes, not more highly paid pencil pushers rubberstamping bonuses for each other.”

A total of 2,398 CMHC staff (91 per cent of its employees) took $30.8 million in bonuses in 2024 – for an average of $12,865 each.

The records show that 12 CMHC executives took a combined $1 million in bonuses last year – for an average of $83,859 each.

The CMHC also issued 2,190 pay raises to staff in 2024, costing taxpayers $9.3 million. No employees took a pay cut, according to the records.

The CMHC has repeatedly claimed it’s “driven by one goal: housing affordability for all.”

In 2024, the Royal Bank of Canada said it was the “toughest time ever to afford a home.”

Last year, polling from Ipsos found 72 per cent of Canadians who do not own a home say “they have given up on ever owning” one.

Eighty per cent of respondents to that poll also said home ownership in Canada is now “only for the rich.”

The Canadian Real Estate Association, in its latest housing outlook report, predicted the average home price will “climb by 4.7 per cent on an annual basis to $722,221 in 2025.”

“The CMHC’s c-suite deserve pink slips more than huge bonuses,” Terrazzano said. “The federal government must stop rewarding failure with taxpayer-funded bonuses.”

Undeserved bonuses are a longstanding tradition in Ottawa.

The federal government has awarded $1.5 billion in bonuses since 2015, despite the fact that “less than 50 per cent of [performance] targets are consistently met within the same year,” according to the Parliamentary Budget Officer.

Business

Beef is becoming a luxury item in Canada

This article supplied by Troy Media.

By Sylvain Charlebois

By Sylvain Charlebois

Canadian beef prices have surged due to a shrinking cattle herd, high transportation costs, and potential market collusion

With summer weather settling in, Canadians are returning to a familiar ritual—ring up the barbecue. But as they approach the meat counter, many are faced with shockingly high prices. This year, the meat aisle has become a case study in supply-side economics and market dysfunction, leaving

consumers to wonder how this all came to be.

Since January, according to Statistics Canada, beef prices have surged dramatically. Striploin is up 34.2 per cent, top sirloin 33.7 per cent, and rib cuts nearly 12 per cent. Pork rib cuts and chicken breasts have each risen 5.9 per cent, while even meatless burger patties are 6.8 per cent more

expensive. Beef has led the way in these increases, and its dominance in the price hikes is striking. What’s particularly concerning is that it’s not just one cut of beef—virtually every option has seen a dramatic jump, putting pressure on Canadian consumers who were already grappling with rising food costs.

The cause behind these increases lies in Canada’s shrinking beef cow inventory, now at just 3.38 million head—the lowest since 1989. This represents a 1.2 per cent drop from last year, but it signals much more than a cyclical decline. Many cattle producers, facing an increasingly volatile market, are choosing to exit the industry while prices are favourable. Others are opting to reinvest in less risky sectors or even shift entirely to crop production, leaving the beef industry in a precarious state. In short, Canada’s beef industry is retreating, and with that retreat comes rising prices, fewer available cattle, and growing uncertainty.

South of the border, the U.S. is seeing a similar trend, but far less severe. According to the United States Department of Agriculture, the

American beef cow herd declined by just 0.5 per cent to 27.9 million head. This relatively modest drop, coupled with less disruption in their production practices, has resulted in more stable prices.

Over the past year, U.S. boneless sirloin steak rose 5.7 per cent, compared to a staggering 22 per cent in Canada. Ground beef saw a 10.8 per cent increase in the U.S., but 23 per cent in Canada. The price difference between the two countries is stark, and Canadians are feeling the inflationary pressure much more acutely.

There are several factors contributing to the price hikes: Canada’s vast geography, high transportation costs, a limited number of federally licensed beef processors, carbon pricing, and higher labour costs. Carbon pricing, in particular, has added a burden to sectors like beef production, where transportation costs are high. Regulations and logistical inefficiencies add to the costs, driving up prices for retailers and, ultimately, consumers.

This combination of factors is having a compounding effect on the price of beef, making it increasingly out of reach for many.

But there’s another possibility we can’t ignore: potential collusion within the industry. In Canada, a small number of large processors control much of the beef supply, which gives them significant influence over prices. The U.S. government has taken strong action against price-fixing among major meat packers like JBS, Tyson Foods, Cargill, and National Beef, leading to multimillion-dollar settlements. In Canada, however, the Competition Bureau has remained largely silent on similar concerns, allowing the possibility of price-fixing to persist unchecked. Perhaps it’s time for Canada to follow the U.S. lead and ensure the beef industry is held accountable for its actions.

The consequences of these rising costs are already evident. According to IBISWorld, Canadian per capita beef consumption fell by 7.1 per cent in 2023 and is expected to drop another 2.1 per cent in 2024. This isn’t merely a shift in dietary preferences—this is a structural change in consumer behaviour. Beef is becoming increasingly viewed as a luxury item, with many budget-conscious households turning to ground beef as a more affordable option. For many Canadians, beef is no longer a staple food but rather an occasional indulgence, reserved for special occasions or holiday meals.

This shift is unfortunate. Beef remains one of the most natural, sustainable sources of protein available to Canadians. Ranchers and processors have made significant strides in improving environmental stewardship, animal welfare, and food safety, often without recognition. Beef is not only nutritionally dense but also supports rural economies and provides a level of traceability few other protein sources can offer.

For many Canadian families, a summer steak on the grill is becoming more of a splurge than a staple. While Canadians will continue to enjoy beef, the frequency and volume of consumption will likely diminish.

Barbecue season hasn’t disappeared, but for many, it’s starting to look a little different: more sausages, more chicken, and fewer striploins. A shame, really, for a product that offers so much more than just taste.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Banks

Liberal border bill could usher in cashless economy by outlawing cash payments

From LifeSiteNews

Bill C-2 has raised concerns from legal organizations that warn it could lead to a cashless economy in Canada by banning cash payments over $10,000.

The Liberals’ proposed border legislation may quietly usher in a cashless economy by banning cash payments.

On June 3, the Liberal Party introduced Bill C-2 to strengthen border security and outlaw cash payments over $10,000. Legal organizations have since warned that this is the first step to a cashless economy and digital ID system in Canada.

“Part 11 amends the Proceeds of Crime (Money Laundering) and Terrorist Financing Act to prohibit certain entities from accepting cash deposits from third parties and certain persons or entities from accepting cash payments, donations or deposits of $10,000 or more,” the legislation proposes.

While the bill purports to strengthen border security and restore Canada-U.S. relations, many have warned that government regulation of cash payments is a slippery slope.

In a June 4 X post, the Justice Centre for Constitutional Freedoms (JCCF) warned that “If Bill C-2 passes, it will become a Criminal Code offence for businesses, professionals, and charities to accept cash donations, deposits, or payments of $10,000 or more. Even if the $10,000 payment or donation is broken down into several smaller cash transactions, it will still be a crime for a business or charity to receive it.”

The JCCF pointed out that while cash payments of $10,000 are not common for Canadians, the government can easily reduce “the legal amount to $5,000, then $1,000, then $100, and eventually nothing.”

“Restricting the use of cash is a dangerous step towards tyranny and totalitarianism,” the organization warned. “Cash gives citizens privacy, autonomy, and freedom from surveillance by government and by banks, credit card companies, and other corporations.”

“If we cherish our privacy, we need to defend our freedom to choose cash, in the amount of our choosing,” it continued. “This includes, for example, our right to pay $10,000 cash for a car, or to donate $10,000 (or more) to a charity.”

“Law enforcement already has the tools to fight crime,” JCCF declared. “Perhaps they need a bigger budget to hire more people, or perhaps they need to use existing tools more effectively. In a free society, violating our right to use cash is not the answer.”

A move to restrict Canadians’ use of cash is especially concerning as citizens already saw what a Liberal government will do to those who oppose its narrative during the 2022 Freedom Convoy.

In winter 2022, the Liberal government, under former Prime Minister Justin Trudeau, froze the bank accounts of those who donated to the Freedom Convoy, which featured thousands of Canadians camping in front of Parliament to protest COVID mandates.

Similarly, Liberal Prime Minister Mark Carney’s move to restrict Canadians is hardly surprising considering his close ties to the World Economic Forum and push for digital currency.

In a 2021 article, the National Post noted that “since the advent of the COVID pandemic, Carney has been front and centre in the promotion of a political agenda known as the ‘Great Reset,’ or the ‘Green New Deal,’ or ‘Building Back Better.’

“Carney’s Brave New World will be one of severely constrained choice, less flying, less meat, more inconvenience and more poverty,” the outlet continued.

In light of Carney’s new leadership over Canadians, many are sounding alarm over his distinctly anti-freedom ideas.

Exposing Mark Carney:

“Should sex be up for sale” 😮

“Should there be a market for the right to have children?” 🤯 pic.twitter.com/Q4hftgGIMc

— Mario Zelaya (@mario4thenorth) March 21, 2025

Carney, whose ties to globalist groups have had Conservative Party leader Pierre Poilievre call him the World Economic Forum’s “golden boy”. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil in an effort to reduce costs for some Canadians.

Carney, who as reported by LifeSiteNews, has admitted he is an “elitist” and a “globalist.” Just recently, he criticized U.S. President Donald Trump for targeting woke ideology and has vowed to promote “inclusiveness” in Canada.

Carney also said that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan.

-

International2 days ago

International2 days agoMusk claims Trump is named in Epstein files after Trump says Elon went ‘CRAZY’

-

Crime2 days ago

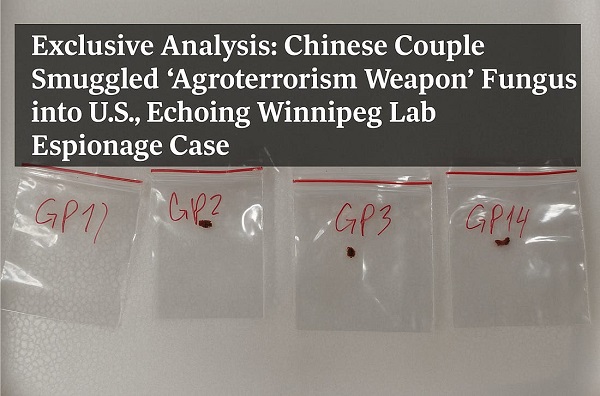

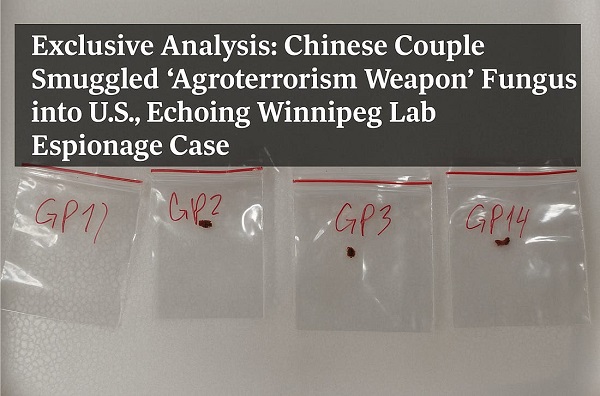

Crime2 days agoExclusive Analysis: Chinese Couple Smuggled ‘Agroterrorism Weapon’ Fungus into U.S., Echoing Winnipeg Lab Ebola Espionage Case

-

Marchant Crane Centrium2 days ago

Marchant Crane Centrium2 days agoMarchant Crane Centrium Unveiled at Westerner Park

-

Daily Caller2 days ago

Daily Caller2 days agoScott Jennings Dunks Head In Trash Can Upon Mention Of Trump-Musk Feud

-

COVID-192 days ago

COVID-192 days agoCOVID-censured doctor says Liberals targeted him because he made government look bad

-

Health2 days ago

Health2 days agoAnnouncing our $10,000 Second Chance Early Bird Winner!

-

Business2 days ago

Business2 days agoBank of Canada Flags Challenges Amid Absence of Federal Budget

-

International2 days ago

International2 days agoTrump, Musk feud explodes on social media