Business

Claiming the Carbon Tax is Not Inflationary Defies Belief – So Do Media Reports About Inflation

From EnergyNow.ca

By Jim Warren

Back in March 2019, the average price for a pound of lean ground beef at five major chain grocery outlets in Regina was $4.71. In September 2024 lean ground at the five big chain outlets averaged $7.90 — a 68% increase over the past five years… these price increases are a far cry from the official statistic for accumulated inflation of 21% over the same period.

Kudos to the Canadian Trucking Alliance (CTA). They have provided us with some valuable insight into the inflationary effects of Canada’s carbon tax.

This past August, the CTA published a brief to the federal government which among other things called for a moratorium on the carbon tax for diesel fuel.

In commenting on the brief, CTA president Stephen Laskowski said, “The carbon tax on diesel fuel is currently having zero impact on the environment and is only serving to needlessly drive up costs for every good purchased by Canadian families and businesses. The carbon tax needs to be repealed from diesel fuel until viable propulsion alternatives are available for the industry and the Canadian supply chain to choose from.”

The CTA estimates that as of 2024 the carbon tax on diesel adds an extra cost for long-haul truck operators of $15,000 to $20,000 or around 6% of per truck in annual operating costs. The brief to government claims a small trucking business with five trucks, “is seeing between $75,000 and $100,000 in extra costs due to the carbon tax.”

Obviously, truckers striving to remain solvent will be doing their utmost to pass carbon tax costs on to their customers. If the cost of the tax can’t be recouped by some trucking companies, we can bet there will be fewer of them operating over the coming years. As Laskowksi said, the carbon tax increased the cost of virtually every product transported by truck—which means pretty well every physical good consumers purchase.

In light of the political beating the Liberals have been taking over the carbon tax, the Trudeau government has taken a tiny feeble step toward relieving the pressure on businesses. In October 2024 federal finance minister Chrystia Freeland announced the government’s intention to provide carbon tax rebates to businesses with fewer than 500 employees. That means many of Canada’s trucking companies will be eligible to recoup some of the carbon tax they have been paying since fiscal 2019-2020. Freeland says the cheques will be in the mail this December.

It sounds okay until you look at the fine print.

The payments will not reflect the amount of fuel a business uses or how much carbon tax it has paid over the past five years. The rebates will be based on the number of people a company employs and will be paid only in provinces where the federal fuel charge applies. An accounting business with 10 employees will receive the same carbon tax rebate as a small trucking business with 10 employees. A CBC news report pulled the following example from Freeland’s press release, “A business in Ontario with 10 employees can expect to receive $4,010…”

Freeland boasted, “These are real, significant sums of money. They’re going to make a big difference to Canadian small business.”

Freeland’s statement is patently false when it comes to trucking companies.

Let’s say that the 10 employee business is a long-haul trucking company based in Ontario. After paying the carbon tax on five or more trucks for five years, the business would receive a paltry $4,010 rebate. That light dusting of sugar won’t make the carbon tax any more palatable to the trucking industry. According to the CTA’s estimates, if the 10 employee long-haul trucking firm had just five trucks the carbon tax will have cost it approximately $400,000 in operating costs over the past five years.

Carbon tax costs are not the only inflation related frustration affecting Canadians. The way the federal government and its friends in the media describe inflation presents people with a warped view of what is happening to the cost of living. Media reports on inflation rarely reflect the lived experience of people trying to pay the mortgage, feed their families and drive to work.

Governments, and their media apologists, in both Canada and the US have been taking victory laps over the past year because the rate of inflation has decreased. It’s as though people have nothing to worry about because the cost of living this year isn’t increasing as fast as it was last year. Changes in the inflation rate may be important for statistical purposes but they don’t reflect reality for people who have been coping with increases in inflation over several years. Most people measure the difficulties caused by inflation by comparing how much more things cost today than they did three to five years ago. The figure regular civilians, as opposed to statisticians, use to assess increases in the cost of living is accumulated inflation. However, we still need to be cautious about the accumulated inflation rate that we get when using government data.

If we calculate the rate of accumulated inflation based on official annualized inflation rates from 2019 up to the midpoint of 2024. The accumulated increase over that five year period is around 21%. And, it is true that this number better reflects people’s perception of inflation than a statistical comparison indicating the rate of inflation fell from 3.9 % in 2023 to 2.61% by the mid-point of 2024. The problem is the 21% number still does not accurately reflect increases in the cost of many necessary goods and services that are impacting households. This is why according to political polls voters in Canada and the US aren’t buying government propaganda when it comes to inflation.

The economy, and by extension, the high cost of living was a major issue in the recent US federal election campaign. The Democrats did not do themselves any favours claiming Bidenomics had wrestled inflation to the ground simply because it wasn’t increasing as fast as it was a year ago. A large number of voters in the US embraced former US president Lyndon Johnson’s maxim, “Don’t piss on my leg and tell me it’s raining.”

But wait, it gets worse. The basket of goods and services the Canadian government uses to calculate the cost of living index and the inflation rate fails to identify high increases in the prices for specific household essentials including many grocery staples. Similarly, official calculations for statistically weighted national average consumption of various products used to calculate the Consumer Price Index are skewed in favour of big urban centres. Montreal, Toronto and Vancouver are over represented. There is no way that the average annual consumption of gasoline for a household in downtown Montreal comes anywhere close to the amount used in most of Canada where public transit is scarce and distances are great. The result is the official accumulated inflation rate fails to show what many people are experiencing in most regions of the country.

Here is a good example of how published statistics don’t reflect the inflation shock that consumers experience at the grocery store. Back in March 2019, the average price for a pound of lean ground beef at five major chain grocery outlets in Regina was $4.71. In September 2024 lean ground at the five big chain outlets averaged $7.90 — a 68% increase over the past five years. The price of rib eye steak increased by even more. Rib eyes averaged $14.91 per pound at the five stores in Regina in March 2019. This September, the average price for rib eye steak was $29.40 – a 97% increase over five years. Obviously, these price increases are a far cry from the official statistic for accumulated inflation of 21% over the same period. (FYI: the data presented here was derived from Beef Business magazine published by the Saskatchewan Stock Growers Association. Each bimonthly edition of Beef Business features a retail beef price check)

Assuming we can find similar rates of accumulated inflation for other staples like dairy products and fresh vegetables it’s no wonder smart shoppers have been incensed over what’s going on with grocery prices and the cost of living (not to mention price increases for fuel, rents house prices and mortgage interest). Consumers have discovered today’s prices of $6.50 for a four litre jug of milk and $7.00 for a pound of butter aren’t going to be reduced simply because the rate of inflation has decreased form 3.69% to 2.61% over the past year. Using history as our guide, with the exception of rare periods of deflation such as the depression of the 1930s, it is unlikely we’ll see the price increases of the past few years come down other than for sales or loss leader strategies. And, while a 72 cent dollar might boost sales for some of our exports, it will add more than 25% to the cost of imported fruit and vegetables this winter,

Furthermore, the impacts of inflation are being more severely felt by Canadians today than they would have been a decade ago. This is because our per capita national income (using GDP as a proxy for national income) has been shrinking since 2014. That was the year oil prices fell into an eight year depression and the last full year before Justin Trudeau became Prime minister.

According to a 2024 Fraser Institute Bulletin authored by Alex Whelan, Milagros Placios and Lawrence Shembri, “Canadians have been getting poorer relative to residents of other countries in the OECD [a club of mostly rich countries]. From 2002 to 2014, Canadian income growth, as measured by GDP per capita, roughly kept pace with the rest of the OECD. From 2014 to 2022, however, Canada’s position declined sharply, ranking third lowest among 30 countries for average growth over the period.”

Canada’s per capita GDP/national income for 2024 is projected to be $54,866.05. According Whelan, Placios and Shembri, that is lower than per capita national income in the US, UK, New Zealand and Austrailia.

Only one US state, Mississippi, the poorest state in the union, has a per capita GDP/national income less than Canada’s. Mississippi’s total is $53,061. Other states considered poor by US standards such as Alabama and Arkansas have higher per capita GDPs than Canada. On average, Canadians have increasingly less money with which to buy more expensive goods and services.

The challenges Canadians have faced as a result of the high cost of living have coincided with the eight plus years that Justin Trudeau has been prime minister. The decline in per capita national income also occurred under Trudeau’s watch—in conjunction with Liberal policies designed to stifle growth in Canada’s petroleum and natural gas industries. What did the Trudeau Liberals think would happen to growth in per capita national income after they handcuffed our single most important export industry?

In the final analysis it’s a tossup. Do we have an inflation problem or is inflation just a symptom of our Trudeau problem?

Business

Sanctuary State Told To Cut Spending On Hotel Stays For Migrants As Costs Expected To Hit $1 Billion

From the Daily Caller News Foundation

By Jason Hopkins

A state commission is encouraging Massachusetts to cut costs on emergency shelter services for migrants and other families by spending less on expensive hotels.

The emergency shelter system in Massachusetts housing migrant families and others experiencing homelessness is expected to spend over $1 billion in fiscal year 2025, according to a state commission report investigating the matter. The report comes as Massachusetts, a sanctuary state that limits cooperation with federal immigration authorities, is continuing to experience financial hardship over the border crisis and an influx of migrants into their communities.

The draft report proposed spending less on the most expensive accommodations for migrants — which would include hotels and motels. Prior reports have found that housing migrants in hotels or motels in the state can be as costly as $300 per night.

“Since the EA shelter system reached capacity at 7,500 families last year, approximately 50% of families have been in hotels and motels across the state,” the report stated. “The Commission recommends limiting reliance on hotels and motels to best serve families and increase the financial and operational efficiency of the system, while recognizing that hotels and motels may be a last-resort option for surge capacity at times of rapid changes in demand.”

“Data suggests that hotels and motels are the most expensive type of shelter in the EA system,” the report concluded. It also noted that the state’s shelter caseload and system costs have skyrocketed to “unsustainable levels” since 2022.

The immigration crisis taking place under the Biden-Harris administration has hit Massachusetts particularly hard. Roughly 355,000 illegal migrants and other inadmissible foreign nationals live in the state, and approximately 50,000 have arrived since 2021, according to the Center for Immigration Studies.

Democrat Gov. Maura Healey, in her efforts to clamp down on the state’s crisis, has publicly called on illegal immigrants to not go to Massachusetts, offered plane tickets for them to leave, and has asked residents to take in migrant families. The state has also experienced a rising number of deportation cases as illegal migrants continue to flock there.

Despite the growing pains with mass illegal immigration, the governor has remained steadfast in her opposition to President-elect Donald Trump’s plans for an immigration crackdown, and she confirmed that her state’s law enforcement would “absolutely not” help with mass deportation efforts. The entire state of Massachusetts is considered a sanctuary for illegal migrants for its laws limiting cooperation with Immigration and Customs Enforcement (ICE) agents.

The state legislature appropriated $639 million to the emergency assistance shelter system for fiscal year 2025, according to the report. However, expense projections are expected to hit $1.094 billion – leaving a shortfall of roughly $455 million for the fiscal year.

Business

Taxpayers spent $15 million on Fauci’s private security, chauffeur after he left government

From LifeSiteNews

By Matt Lamb

“Our country is $33 trillion in debt. Taxpayers shouldn’t be paying for Dr. Fauci’s security detail, especially when Fauci was one of the highest-paid federal employees in the U.S”

American taxpayers spent at least $15 million on security and a private driver for Dr. Anthony Fauci after he left his government job.

Open the Books obtained “memorandum of understanding” covering January 4, 2023 through September 20, 2024 along with independent journalist Jordan Schachtel.

The government watchdog group said it is seeking information on if the contract is still in force. Fauci retired at the end of 2022.

The highest-paid federal employee, Fauci left the government after decades of work. For almost two years, if not longer, taxpayers spent money so he could have a private driver. This despite the fact that Fauci has an estimated net worth of $11 million and continues to profit off his experience in the government, including writing a book and speaking at events.

The exact specifics of the agreement are new. However, Republicans have previously criticized the special arrangement, after it came to light last year that Fauci continued to receive perks despite ostensibly retiring.

“When I discovered that Dr. Fauci still had a taxpayer-funded driver and personal guards after he stepped down, I felt that it was another example of Washington bureaucrats putting themselves above the American people,” Congressman Dale Strong said last year. He introduced legislation to end the special agreement.

“Our country is $33 trillion in debt. Taxpayers shouldn’t be paying for Dr. Fauci’s security detail, especially when Fauci was one of the highest-paid federal employees in the U.S,” Strong said.

The special deal comes after Fauci botched the handling of COVID-19, including by downplaying concerns it leaked from a lab in China. He also made misleading statements about the National Institutes of Health and its connection to a controversial lab in Wuhan, China.

He also made incorrect, and incredibly damaging, statements to the American public about the need for widespread lockdowns and other social restrictions and claimed that the COVID shots were both “safe” and “effective” against the spread of the virus. Faced with criticism, Fauci claimed that the attacks on him were really assaults on “science.”

As Open the Books reminds readers:

But his detractors recall a government official who led the fight to implement years-long draconian restrictions upon the American people, which devastated the fabric of U.S. society, greatly harmed the economy and caused all kinds of additional negative repercussions – including widespread learning loss among America’s youth. Fauci was never shy to advocate for lockdowns, social distancing, school closures, business closures, mask mandates, and vaccine passports from his powerful federal perch during the COVID-19 pandemic.

Senator Rand Paul, a frequent critic of Fauci, criticized Fauci’s taxpayer-funded arrangement.

“No more $ for the guy who funded dangerous research in Wuhan.,” he wrote on X (formerly Twitter).

Open the Books spokesman Christopher Neefus said the NIH has a “pattern of obfuscation when it comes to the NIH’s financial arrangements.”

“Whether it’s Dr. Fauci’s contract and full compensation, or the NIH’s multibillion-dollar royalty complex, we’ve been working for years to get full transparency,” Neefus told National Review.

Fauci’s support for the shot included going door-to-door with D.C. Mayor Muriel Bowser to browbeat residents into taking the jabs.

A PBS profile showed Bowser, who broke her own forced masking rules, going door-to-door with a crowd of people inquiring about their personal choices concerning shots.

“They need a push, a push, and a drag,” Mayor Bowser says in one clip, to Fauci’s approval, as LifeSiteNews previously reported.

Fauci, who retired at the end of December 2022, can be seen on the documentary criticizing Republican states and the people in those states in particular who declined to take the abortion-tainted jab.

“[Red states] are going to keep the outbreak smoldering in the country [because they won’t get jabbed],” he tells Bowser, who is part of the canvassing crowd. The video is from June 2021. “It’s so crazy. They’re not doing it because they say they don’t want to. They’re Republicans. They don’t like being told what to do. We need to break that.”

-

Also Interesting2 days ago

Also Interesting2 days agoPopular Casino Games at 1Red

-

National2 days ago

National2 days agoLiberals, NDP admit closed-door meetings took place in attempt to delay Canada’s next election

-

Digital Currency1 day ago

Digital Currency1 day agoConservatives urge Canadians to reject mandatory digital IDs proposed by Liberal gov’t

-

National2 days ago

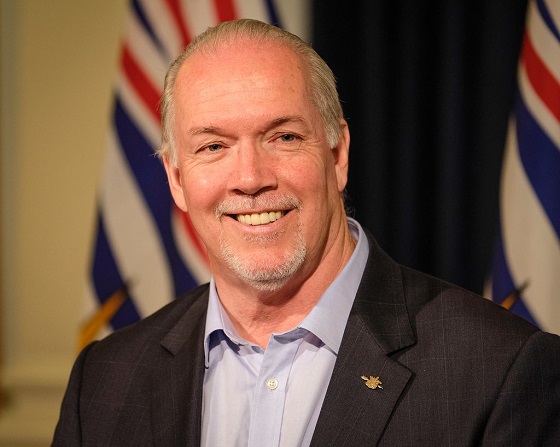

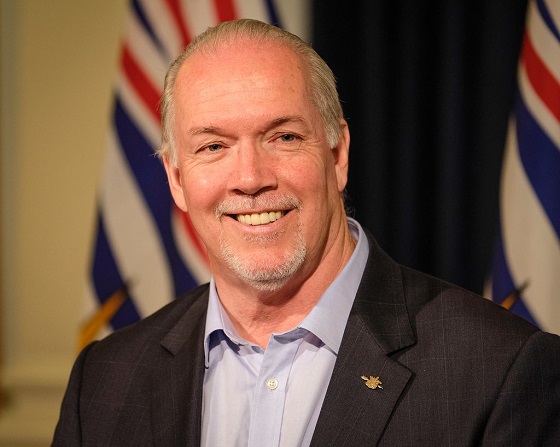

National2 days agoFormer BC Premier John Horgan passes away at 65

-

COVID-192 days ago

COVID-192 days agoBlue Cross Blue Shield forced to pay $12 million to Catholic worker fired for refusing COVID shots

-

DEI2 days ago

DEI2 days agoTMU Medical School Sacrifices Academic Merit to Pursue Intolerance

-

Business2 days ago

Business2 days agoA tale of two countries – Drill, Baby, Drill vs Cap, Baby, Cap

-

Business2 days ago

Business2 days agoEnergy Giant Wins Appeal In Landmark Lawsuit Blaming Company For Climate Change