Business

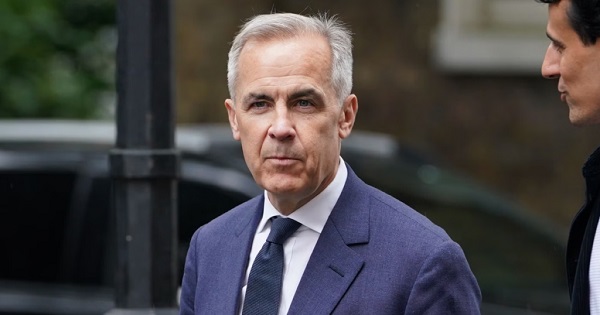

Carney’s carbon madness

Dan McTeague

Dan McTeague

Well, we are in quite the pickle.

In nine plus years as prime minister, Justin Trudeau has waged a multi-front war on the consumption and production of hydrocarbon energy, and, with that, on our economy, our quality of life, and our cost of living.

Trudeau zealously pursued and implemented anti-energy policies, most infamously the consumer Carbon Tax, but let’s not forget his so-called ”Clean Fuel” regulations; his Industrial Carbon Tax; his proposed emissions caps; his Electric Vehicle subsidies and mandates; Bill C-59, which bans businesses from touting the environmental positives of their work if it doesn’t meet a government-approved standard; and various other pieces of legislation which make the construction of new pipelines nearly impossible and significantly reduces our ability to sell our oil and gas overseas.

Every one of these policies can be traced back to the pernicious Net Zero ideology which informs them, and in which Trudeau and his bosom buddies — Gerald Butts, Steven Guilbeault, Mark Carney, etc — remain true believers.

And yet, despite those policies contributing to his party’s collapsing poll numbers and Trudeau’s unceremonious ouster, the Liberals are on the verge of naming as his replacement Mark Carney, one of the very Trudeau consiglieri who got us into this mess in the first place!

Now, Carney is currently doing everything in his power to downplay and dance around those aspects of his career which voters might find objectionable. He’s making quite a habit of it, in fact. And on the energy file, he’s being especially misleading, walking back his long-time support of the Carbon Tax — he’s said it has “served a purpose up until now” — and claiming that he intends to repeal it, while finding other ways to “make polluters pay.”

This is nonsense. In fact, Carney is a Carbon Tax superfan, and, if you listen to him closely, his actual critique of the Trudeau tax isn’t that it has made it more expensive to heat our homes, gas up our cars, and pay for our groceries (which it has.) It’s that it is too visible to voters. His vow to “make polluters pay” means, in fact, that he intends to “beef up” Trudeau’s less discussed Industrial Carbon Tax, targeting businesses, which will ultimately pass the cost down to consumers.

He’s even discussed enacting a Carbon tariff, which would apply to trade with countries which don’t adopt the onerous Net Zero policies which he wants to force on Canada.

That’s just who Mark Carney is.

And, unfortunately, Donald Trump’s tariff threats have provoked a “rally round the flag” sentiment, enabling the Liberals to close the polling gap with the Conservatives, with some polls currently showing them neck-and-neck. Which is to say, there is a possibility that, whenever we get around to having an election, anti-American animus could keep the Liberals in power, and propel Carney to the top job in our government.

This is, in a word, madness.

Let us not forget that it was the Liberals’ policies — especially their assault on our “golden goose,” the natural resource sector — which left us in such a precarious fiscal state that Trudeau felt the need to fly to Mar-a-Lago and tell the newly elected president that a tariff would “kill” our economy. That’s what provoked Trump’s “51st state” crack in the first place.

Access to U.S. markets will always be important for Canadian prosperity — they, by leaps and bounds, are our largest trading partner, after all — but without the Net Zero nonsense, we could have been an energy superpower, providing an alternative source of oil and natural gas for those countries leary about relying for energy on less-environmentally conscious, human-rights-abusing petrostates. We could have filled the void created by Russia, when they made themselves a pariah state in Europe by invading Ukraine.

In short, we might have been set up to negotiate with the Trump Administration from a position of strength. Instead, we’re proposing to double-down on Net Zero, pledging allegiance to a program which will make us less competitive and more likely to be steamrolled by major powers, including the U.S. but also (and less frequently mentioned) China.

Talk about cutting off your nose to spite your face! And all in the name of nationalism.

Here’s hoping we wise up and change course while there’s still time. Because, in the words of America’s greatest philosopher, Yogi Berra, “It’s getting late early.”

Dan McTeague is President of Canadians for Affordable Energy.

Support Dan’s Work to Keep Canadian Energy Affordable!

Canadians for Affordable Energy is run by Dan McTeague, former MP and founder of Gas Wizard. We stand up and fight for more affordable energy.

Business

It Took Trump To Get Canada Serious About Free Trade With Itself

From the Frontier Centre for Public Policy

By Lee Harding

Trump’s protectionism has jolted Canada into finally beginning to tear down interprovincial trade barriers

The threat of Donald Trump’s tariffs and the potential collapse of North American free trade have prompted Canada to look inward. With international trade under pressure, the country is—at last—taking meaningful steps to improve trade within its borders.

Canada’s Constitution gives provinces control over many key economic levers. While Ottawa manages international trade, the provinces regulate licensing, certification and procurement rules. These fragmented regulations have long acted as internal trade barriers, forcing companies and professionals to navigate duplicate approval processes when operating across provincial lines.

These restrictions increase costs, delay projects and limit job opportunities for businesses and workers. For consumers, they mean higher prices and fewer choices. Economists estimate that these barriers hold back up to $200 billion of Canada’s economy annually, roughly eight per cent of the country’s GDP.

Ironically, it wasn’t until after Canada signed the North American Free Trade Agreement that it began to address domestic trade restrictions. In 1994, the first ministers signed the Agreement on Internal Trade (AIT), committing to equal treatment of bidders on provincial and municipal contracts. Subsequent regional agreements, such as Alberta and British Columbia’s Trade, Investment and Labour Mobility Agreement in 2007, and the New West Partnership that followed, expanded cooperation to include broader credential recognition and enforceable dispute resolution.

In 2017, the Canadian Free Trade Agreement (CFTA) replaced the AIT to streamline trade among provinces and territories. While more ambitious in scope, the CFTA’s effectiveness has been limited by a patchwork of exemptions and slow implementation.

Now, however, Trump’s protectionism has reignited momentum to fix the problem. In recent months, provincial and territorial labour market ministers met with their federal counterpart to strengthen the CFTA. Their goal: to remove longstanding barriers and unlock the full potential of Canada’s internal market.

According to a March 5 CFTA press release, five governments have agreed to eliminate 40 exemptions they previously claimed for themselves. A June 1 deadline has been set to produce an action plan for nationwide mutual recognition of professional credentials. Ministers are also working on the mutual recognition of consumer goods, excluding food, so that if a product is approved for sale in one province, it can be sold anywhere in Canada without added red tape.

Ontario Premier Doug Ford has signalled that his province won’t wait for consensus. Ontario is dropping all its CFTA exemptions, allowing medical professionals to begin practising while awaiting registration with provincial regulators.

Ontario has partnered with Nova Scotia and New Brunswick to implement mutual recognition of goods, services and registered workers. These provinces have also enabled direct-to-consumer alcohol sales, letting individuals purchase alcohol directly from producers for personal consumption.

A joint CFTA statement says other provinces intend to follow suit, except Prince Edward Island and Newfoundland and Labrador.

These developments are long overdue. Confederation happened more than 150 years ago, and prohibition ended more than a century ago, yet Canadians still face barriers when trying to buy a bottle of wine from another province or find work across a provincial line.

Perhaps now, Canada will finally become the economic union it was always meant to be. Few would thank Donald Trump, but without his tariffs, this renewed urgency to break down internal trade barriers might never have emerged.

Lee Harding is a research fellow with the Frontier Centre for Public Policy.

2025 Federal Election

Carney’s budget is worse than Trudeau’s

Liberal Leader Mark Carney is planning to borrow more money than former prime minister Justin Trudeau.

That’s an odd plan for a former banker because the federal government is already spending more on debt interest payments than it spends on health-care transfers to the provinces.

Let’s take a deeper look at Carney’s plan.

Carney says that his government would “spend less, invest more.”

At first glance, that might sound better than the previous decade of massive deficits and increasing debt, but does that sound like a real change?

Because if you open a thesaurus, you’ll find that “spend” and “invest” are synonyms, they mean the same thing.

And Carney’s platform shows it. Carney plans to increase government spending by $130 billion. He plans to increase the federal debt by $225 billion over the next four years. That’s about $100 billion more than Trudeau was planning borrow over the same period, according to the most recent Fall Economic Statement.

Carney is planning to waste $5.6 billion more on debt interest charges than Trudeau. Interest charges already cost taxpayers more than $1 billion per week.

The platform claims that Carney will run a budget surplus in 2028, but that’s nonsense. Because once you include the $48 billion of spending in Carney’s “capital” budget, the tiny surplus disappears, and taxpayers are stuck with more debt.

And that’s despite planning to take even more money from Canadians in years ahead. Carney’s platform shows that his carbon tariff, another carbon tax on Canadians, will cost taxpayers $500 million.

The bottom line is that government spending, no matter what pile it is put into, is just government spending. And when the government spends too much, that means it must borrow more money, and taxpayers have to pay the interest payments on that irresponsible borrowing.

Canadians don’t even believe that Carney can follow through on his watered-down plan. A majority of Canadians are skeptical that Carney will balance the operational budget in three years, according to Leger polling.

All Carney’s plan means for Canadians is more borrowing and higher debt. And taxpayers can’t afford anymore debt.

When the Liberals were first elected the debt was $616 billion. It’s projected to reach almost $1.3 trillion by the end of the year, that means the debt has more than doubled in the last decade.

Every single Canadian’s individual share of the federal debt averages about $30,000.

Interest charges on the debt are costing taxpayers $53.7 billion this year. That’s more than the government takes in GST from Canadians. That means every time you go to the grocery store, fill up your car with gas, or buy almost anything else, all that federal sales tax you pay isn’t being used for anything but paying for the government’s poor financial decisions.

Creative accounting is not the solution to get the government’s fiscal house in order. It’s spending cuts. And Carney even says this.

“The federal government has been spending too much,” said Carney. He then went on to acknowledge the huge spending growth of the government over the last decade and the ballooning of the federal bureaucracy. A serious plan to balance the budget and pay down debt includes cutting spending and slashing bureaucracy.

But the Conservatives aren’t off the hook here either. Conservative Leader Pierre Poilievre has said that he will balance the budget “as soon as possible,” but hasn’t told taxpayers when that is.

More debt today means higher taxes tomorrow. That’s because every dollar borrowed by the federal government must be paid back plus interest. Any party that says it wants to make life more affordable also needs a plan to start paying back the debt.

Taxpayers need a government that will commit to balancing the budget for real and start paying back debt, not one that is continuing to pile on debt and waste billions on interest charges.

-

2025 Federal Election5 hours ago

2025 Federal Election5 hours agoThe Federal Brief That Should Sink Carney

-

2025 Federal Election7 hours ago

2025 Federal Election7 hours agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election10 hours ago

2025 Federal Election10 hours agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

John Stossel6 hours ago

John Stossel6 hours agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

COVID-198 hours ago

COVID-198 hours agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre’s Conservatives promise to repeal policy allowing male criminals in female jails

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy