Alberta

Canadians not feeling great about personal finances… Even worse in Alberta

From MNP Canada

According to the latest MNP Consumer Debt Index being released today, Albertans are finding themselves with a lot less wiggle room in household budgets each month. The amount of money left over after paying all their bills and debt obligations has reached its lowest level since tracking began. Even though the Bank of Canada is expected to keep interest rates stable this week, six in ten in the province say they are more concerned about their ability to repay their debts than they used to be.

MNP Consumer Debt Index Update: Albertans finding themselves with a lot less money each month, six in ten concerned their ability to repay their debts

Stable interest rates are a cold comfort to those already having a difficult time making ends meet

Even though the Bank of Canada has stated that it will keep interest rates stable until next year, six in ten (58%) Albertans say they are more concerned about their ability to repay their debts than they used to be. The concern could be the result of steeply declining wiggle room in household budgets. After paying all their current bills and debt obligations, Albertans say they are, on average, left with $459 at the end of the month, a drop of $209 since June and the lowest level since tracking began in February 2016. Half (49%, +5 pts) say they are left with less than $200 including three in ten (34%) who say they already don’t make enough money to cover all their bills and debt obligations each month (+9 pts).

The findings are part of the latest MNP Consumer Debt Index conducted quarterly by Ipsos. Now in its tenth wave, the Index tracks Canadians’ attitudes about their consumer debt and their perception of their ability to meet their monthly payment obligations.

Average Finances Left at Month-End

Image Caption: Albertans were asked: Thinking about the amount of after-tax income you make each month compared to the amount of your bills and debt obligations each month, how much is left over? In other words, how much wiggle room do you have before you wouldn’t be able to pay all your bills and debt payments each month?

“There has been a marked decline in the amount of wiggle room that households have in Alberta. says Donna Carson, a Licensed Insolvency Trustee with MNP LTD, the country’s largest personal insolvency practice. “Family budgets are being strained by everyday expenses which means many aren’t putting anything away for rainy day savings and that puts them at risk. It is most often unexpected expenses that force people to take on more debt they can’t afford and that begins a cycle of increasing servicing costs, and eventual default.”

It’s no surprise that with less in the bank at month-end, Albertans’ ability to cope with unexpected expenses has been shaken. Seven in ten (70%) are not confident in their ability to cope with life-changing events – such as a divorce, unexpected auto repairs, loss of employment or the death of a family member – without increasing their debt.

“A job loss or an unexpected expense are most devastating for people who already have a large amount of debt. Our research continues to show just how vulnerable Alberta households are to inevitable life events like a car repair,” says Carson who recommends having at least three to six months of expenses saved in case of emergencies.

Albertans may have fewer dollars left at month-end to buffer them from sudden expenses but, somewhat surprisingly, they are growing generally far more positive about their personal financial situations than those in other provinces. According to the index, one quarter (25%) say that their debt situation is better than it was a year ago (+6 pts) and one in three (32%) say that it is better than five years ago (+7 pts). In addition to being optimistic about the present, there has been a significant increase in the proportion who feel more positive about the future. Four in ten (44%) expect that their debt situation a year from now will be better, a jump of 19 points. Six in ten (58%) believe that it will be better five years from now (+13 pts).

“The current holding pattern on interest rates and increasing economic optimism in the province could be giving Albertans a sense of relief about their finances. Still, the fact remains that many Albertans are deeply indebted and most don’t have a clear path to repayment,” says Carson pointing to evidence from the research showing that many may intend to take on more credit to make ends meet over the next year.

Just about half (48%) of Albertans say they don’t think that they will be able to cover all their living and family expenses for the next 12 months without going further into debt, a one-point decrease since June. Furthermore, just under half (49%) are confident they won’t have any debt in retirement, a one-point increase.

“Some may have resigned themselves to being in debt for life. Interest rates may remain stable but there are many already struggling to make ends meet at the current rate,” says Carson.

A large portion of Albertans (53%) are concerned about how rising interest rates will impact their financial situation, up one point since June. Fifty-two per cent agree that if interest rates go up much more, they are afraid they will be in financial trouble (-4 pts). Finally, a third (35%) are still concerned that rising interest rates could move them towards bankruptcy (-7 pts).

“The single biggest mistake people make is taking on more debt to try and deal with debt. Even if you are swimming in credit card debt, with a line of credit, a mortgage, a car loan or all of the above, you can get help to design a debt relief strategy,” says Carson.

MNP LTD offers free consultations with Licensed Insolvency Trustees to help individuals understand their debt relief options. Licensed Insolvency Trustees are the only government-regulated debt professionals who offer a full range of debt relief options and can guarantee legal protection from creditors through consumer proposals and bankruptcies.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians. Visit www.MNPdebt.ca/CDI to learn more.

The latest data, representing the tenth wave of the MNP Consumer Debt Index, was compiled by Ipsos on behalf of MNP LTD between September 4 and September 9, 2019. For this survey, a sample of 2,002 Canadians aged 18 years and over was interviewed. The precision of online polls is measured using a credibility interval. In this case, the results are accurate to within +2.5 percentage points, 19 times out of 20, of what the results would have been had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

Alberta

Alberta can’t fix its deficits with oil money: Lennie Kaplan

This article supplied by Troy Media.

Alberta is banking on oil to erase rising deficits, but the province’s budget can’t hold without major fiscal changes

Alberta is heading for a fiscal cliff, and no amount of oil revenue will save it this time.

The province is facing ballooning deficits, rising debt and an addiction to resource revenues that rise and fall with global markets. As Budget 2026 consultations begin, the government is gambling on oil prices to balance the books again. That gamble is failing. Alberta is already staring down multibillion-dollar shortfalls.

I estimate the province will run deficits of $7.7 billion in 2025-26, $8.8 billion in 2026-27 and $7.5 billion in 2027-28. If nothing changes, debt will climb from $85.2 billion to $112.3 billion in just three years. That is an increase of more than $27 billion, and it is entirely avoidable.

These numbers come from my latest fiscal analysis, completed at the end of October. I used conservative assumptions: oil prices at US$62 to US$67 per barrel over the next three years. Expenses are expected to keep growing faster than inflation and population. I also requested Alberta’s five-year internal fiscal projections through access to information but Treasury Board and Finance refused to release them. Those forecasts exist, but Albertans have not been allowed to see them.

Alberta has been running structural deficits for years, even during boom times. That is because it spends more than it brings in, counting on oil royalties to fill the gap. No other province leans this hard on non-renewable resource revenue. It is volatile. It is risky. And it is getting worse.

That is what makes Premier Danielle Smith’s recent Financial Post column so striking. She effectively admitted that any path to a balanced budget depends on doubling Alberta’s oil production by 2035. That is not a plan. It is a fantasy. It relies on global markets, pipeline expansions and long-term forecasts that rarely hold. It puts taxpayers on the hook for a commodity cycle the province does not control.

I have long supported Alberta’s oil and gas industry. But I will call out any government that leans on inflated projections to justify bad fiscal choices.

Just three years ago, Alberta needed oil at US$70 to balance the budget. Now it needs US$74 in 2025-26, US$76.35 in 2026-27 and US$77.50 in 2027-28. That bar keeps rising. A single US$1 drop in the oil price will soon cost Alberta $750 million a year. By the end of the decade, that figure could reach $1 billion. That is not a cushion. It is a cliff edge.

Even if the government had pulled in $13 billion per year in oil revenue over the last four years, it still would have run deficits. The real problem is spending. Since 2021, operating spending, excluding COVID-19 relief, has jumped by $15.5 billion, or 31 per cent. That is nearly eight per cent per year. For comparison, during the last four years under premiers Ed Stelmach and Alison Redford, spending went up 6.9 per cent annually.

This is not a revenue problem. It is a spending problem, papered over with oil booms. Pretending Alberta can keep expanding health care, education and social services on the back of unpredictable oil money is reckless. Do we really want our schools and hospitals held hostage to oil prices and OPEC?

The solution was laid out decades ago. Oil royalties should be saved off the top, not dumped into general revenue. That is what Premier Peter Lougheed understood when he created the Alberta Heritage Savings Trust Fund in 1976. It is what Premier Ralph Klein did when he cut spending and paid down debt in the 1990s. Alberta used to treat oil as a bonus. Now it treats it as a crutch.

With debt climbing and deficits baked in, Alberta is out of time. I have previously laid out detailed solutions. But here is where the government should start.

First, transparency. Albertans deserve a full three-year fiscal update by the end of November. That includes real numbers on revenue, expenses, debt and deficits. The government must also reinstate the legal requirement for a mid-year economic and fiscal report. No more hiding the ball.

Second, a real plan. Not projections based on hope, but a balanced three-year budget that can survive oil prices dropping below forecast. That plan should be part of Budget 2026 consultations.

Third, long-term discipline. Alberta needs a fiscal sustainability framework, backed by a public long-term report released before year-end.

Because if this government will not take responsibility, the next oil shock will.

Lennie Kaplan is a former senior manager in the fiscal and economic policy division of Alberta’s Ministry of Treasury Board and Finance, where, among other duties, he examined best practices in fiscal frameworks, program reviews and savings strategies for non-renewable resource revenues. In 2012, he won a Corporate Values Award in TB&F for his work on Alberta’s fiscal framework review. In 2019, Mr. Kaplan served as executive director to the MacKinnon Panel on Alberta’s finances—a government-appointed panel tasked with reviewing Alberta’s spending and recommending reforms.

Alberta

IEA peak-oil reversal gives Alberta long-term leverage

This article supplied by Troy Media.

The peak-oil narrative has collapsed, and the IEA’s U-turn marks a major strategic win for Alberta

After years of confidently predicting that global oil demand was on the verge of collapsing, the International Energy Agency (IEA) has now reversed course—a stunning retreat that shatters the peak-oil narrative and rewrites the outlook for oil-producing regions such as Alberta.

For years, analysts warned that an oil glut was coming. Suddenly, the tide has turned. The Paris-based IEA, the world’s most influential energy forecasting body, is stepping back from its long-held view that peak oil demand is just around the corner.

The IEA reversal is a strategic boost for Alberta and a political complication for Ottawa, which now has to reconcile its climate commitments with a global outlook that no longer supports a rapid decline in fossil fuel use or the doomsday narrative Ottawa has relied on to advance its climate agenda.

Alberta’s economy remains tied to long-term global demand for reliable, conventional energy. The province produces roughly 80 per cent of Canada’s oil and depends on resource revenues to fund a significant share of its provincial budget. The sector also plays a central role in the national economy, supporting hundreds of thousands of jobs and contributing close to 10 per cent of Canada’s GDP when related industries are included.

That reality stands in sharp contrast to Ottawa. Prime Minister Mark Carney has long championed net-zero timelines, ESG frameworks and tighter climate policy, and has repeatedly signalled that expanding long-term oil production is not part of his economic vision. The new IEA outlook bolsters Alberta’s position far more than it aligns with his government’s preferred direction.

Globally, the shift is even clearer. The IEA’s latest World Energy Outlook, released on Nov. 12, makes the reversal unmistakable. Under existing policies and regulations, global demand for oil and natural gas will continue to rise well past this decade and could keep climbing until 2050. Demand reaches 105 million barrels per day in 2035 and 113 million barrels per day in 2050, up from 100 million barrels per day last year, a direct contradiction of years of claims that the world was on the cusp of phasing out fossil fuels.

A key factor is the slowing pace of electric vehicle adoption, driven by weakening policy support outside China and Europe. The IEA now expects the share of electric vehicles in global car sales to plateau after 2035. In many countries, subsidies are being reduced, purchase incentives are ending and charging-infrastructure goals are slipping. Without coercive policy intervention, electric vehicle adoption will not accelerate fast enough to meaningfully cut oil demand.

The IEA’s own outlook now shows it wasn’t merely off in its forecasts; it repeatedly projected that oil demand was in rapid decline, despite evidence to the contrary. Just last year, IEA executive director Fatih Birol told the Financial Times that we were witnessing “the beginning of the end of the fossil fuel era.” The new outlook directly contradicts that claim.

The political landscape also matters. U.S. President Donald Trump’s return to the White House shifted global expectations. The United States withdrew from the Paris Agreement, reversed Biden-era climate measures and embraced an expansion of domestic oil and gas production. As the world’s largest economy and the IEA’s largest contributor, the U.S. carries significant weight, and other countries, including Canada and the United Kingdom, have taken steps to shore up energy security by keeping existing fossil-fuel capacity online while navigating their longer-term transition plans.

The IEA also warns that the world is likely to miss its goal of limiting temperature increases to 1.5 °C over pre-industrial levels. During the Biden years, the IAE maintained that reaching net-zero by mid-century required ending investment in new oil, gas and coal projects. That stance has now faded. Its updated position concedes that demand will not fall quickly enough to meet those targets.

Investment banks are also adjusting. A Bloomberg report citing Goldman Sachs analysts projects global oil demand could rise to 113 million barrels per day by 2040, compared with 103.5 million barrels per day in 2024, Irina Slav wrote for Oilprice.com. Goldman cites slow progress on net-zero policies, infrastructure challenges for wind and solar and weaker electric vehicle adoption.

“We do not assume major breakthroughs in low-carbon technology,” Sachs’ analysts wrote. “Even for peaking road oil demand, we expect a long plateau after 2030.” That implies a stable, not shrinking, market for oil.

OPEC, long insisting that peak demand is nowhere in sight, feels vindicated. “We hope … we have passed the peak in the misguided notion of ‘peak oil’,” the organization said last Wednesday after the outlook’s release.

Oil is set to remain at the centre of global energy demand for years to come, and for Alberta, Canada’s energy capital, the IEA’s course correction offers renewed certainty in a world that had been prematurely writing off its future.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta15 hours ago

Alberta15 hours agoFrom Underdog to Top Broodmare

-

Alberta2 days ago

Alberta2 days agoAlberta and Ottawa ink landmark energy agreement

-

International2 days ago

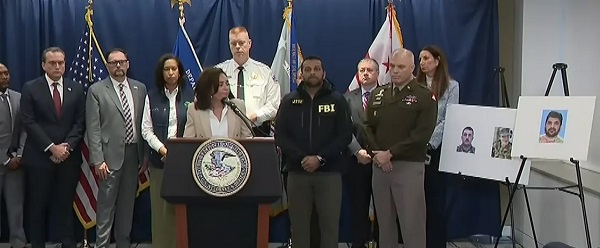

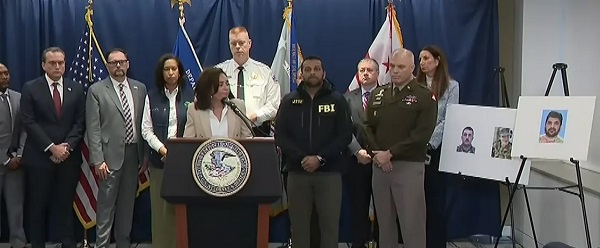

International2 days agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax2 days ago

Carbon Tax2 days agoCanadian energy policies undermine a century of North American integration

-

International2 days ago

International2 days agoIdentities of wounded Guardsmen, each newly sworn in

-

Alberta2 days ago

Alberta2 days agoWest Coast Pipeline MOU: A good first step, but project dead on arrival without Eby’s assent

-

Energy2 days ago

Energy2 days agoPoilievre says West Coast Pipeline MOU is no guarantee

-

COVID-191 day ago

COVID-191 day agoCanadian government seeking to destroy Freedom Convoy leader, taking Big Red from Chris Barber