Economy

Canadians face serious economic costs due to health-care wait times

From the Fraser Institute

Not only does Canada pay the most for health care (as a share of its economy) among high-income countries with universal health care (after adjusting for differences in the age structure of the population), it also has some of the fewest medical resources and the worst access to timely medical care.

We hear a lot about how much money we must spend to simply maintain the status quo in health care, with billions of new dollars from Ottawa just to keep the same system afloat.

The irony, of course, is that maintaining the status quo imposes some of the harshest costs on Canadians. Last year, Canadians could expect to wait an average of 13.1 weeks to receive treatment after receiving a specialist consultation. Not only was this wait more than two times longer than in 1993, it resulted in an estimated 1.2 million procedures being waited for across the country.

And at one month longer than the wait doctors consider reasonable, these delays are not benign. In fact, they can produce devastating physical and psychological consequences.

While it may be tempting to blame our current predicament on the aftereffects of the pandemic, in reality, long waits were the norm long before COVID. In fact, in 2019 the wait between a specialist consultation and receiving care was nearly two and a half weeks less than today, and the number of procedures being waited for (1.1 million) was slightly less than the number today (1.2 million).

In addition to the physical and psychological costs of waiting, there are also serious economic costs. According to a new study, wait times for non-emergency treatment in 2023 cost Canadians $3.5 billion in lost wages and productivity, or $2,871 per person waiting for a procedure. For perspective, this is more than double the cost in 2004 (inflation-adjusted). After we account for patient leisure time outside of work, the estimate for 2023 increases to $10.6 billion or $8,730 per person waiting.

Some advocates of the status quo suggest these costs are necessary to maintain our universal health-care system but international evidence indicates the opposite. In fact, not only does Canada pay the most for health care (as a share of its economy) among high-income countries with universal health care (after adjusting for differences in the age structure of the population), it also has some of the fewest medical resources and the worst access to timely medical care.

What do other higher-performing universal health-care systems do differently?

To varying degrees, they embrace the private sector as a partner. For example, Australia now delivers the majority of non-emergency surgeries and care through private hospitals, while frequently outperforming Canada and spending less than we do (as a share of the economy).

Here at home, we’ve seen what real reform, which embraces the private sector, can do. In Saskatchewan between 2010 and 2014, the government contracted out publicly-financed procedures to private clinics, which helped lower the province’s wait times from some of the longest in the country (26.5 weeks in 2010) to some of the shortest (14.2 weeks in 2014). Quebec, which has consistently “low” wait times, in recent years has contracted out one in six day-surgeries to private clinics.

Despite objections from defenders of today’s unworkable status quo, there’s in fact a way to improve Canada’s health-care system while preserving its universality. However, until we’re willing to pursue that path, wait times and their associated costs will continue to burden Canadian patients and their loved ones.

Author:

2025 Federal Election

The High Cost Of Continued Western Canadian Alienation

From EnergyNow.Ca

By Jim Warren

Energy Issues Carney Must Commit to if He Truly Cares About National Cohesion and be Different From Trudeau

If the stars fail to align in the majority of Western Canada’s favour and voters from Central Canada and the Maritimes re-elect a Liberal government on April 28, it will stand as a tragic rejection of the aspirations of the oil producing provinces and a threat to national cohesion.

As of today Mark Carney has not clearly and unequivocally promised to tear down the Liberal policy wall blocking growth in oil and gas exports. Yes, he recently claimed to favour energy corridors, but just two weeks earlier he backtracked on a similar commitment.

There are some promises Carney hopefully won’t honour. He has pledged to impose punitive emissions taxes on Canadian industry. But that’s supposedly alright because Carney has liberally sprinkled that promise with pixie dust. This will magically ensure any associated increases in the cost of living will disappear. Liberal wizardry will similarly vaporize any harm Carbon Tax 2.0 might do to the competitive capacity of Canadian exporters.

Carney has as also promised to impose border taxes on imports from countries that lack the Liberals’ zeal for saving the planet. These are not supposed to raise Canadians’ cost of living by much, but if they do we can take pride in doing our part to save the planet. We can feel good about ourselves while shopping for groceries we can’t afford to buy.

There is ample bad news in what Carney has promised to do. No less disturbing is what he has not agreed to do. Oil and gas sector leaders have been telling Carney what needs to be done, but that doesn’t mean he’s been listening.

The Build Canada Now action plan announced last week by western energy industry leaders lays out a concise five-point plan for growing the oil and gas sector. If Mark Carney wants to convince his more skeptical detractors that he is truly concerned about Canadian prosperity, he should consider getting a tattoo that celebrates the five points.

Yet, if he got onside with the five points and could be trusted, would it not be a step in the right direction? Sure, but it would also be great if unicorns were real.

The purpose of the Build Canada Now action plan couldn’t be much more clearly and concisely stated. “For the oil and natural gas sector to expand and energy infrastructure to be built, Canada’s federal political leaders can create an environment that will:

1. Simplify regulation. The federal government’s Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and simplified. Regulatory processes need to be streamlined, and decisions need to withstand judicial challenges.

2. Commit to firm deadlines for project approvals. The federal government needs to reduce regulatory timelines so that major projects are approved within 6 months of application.

3. Grow production. The federal government’s unlegislated cap on emissions must be eliminated to allow the sector to reach its full potential.

4. Attract investment. The federal carbon levy on large emitters is not globally cost competitive and should be repealed to allow provincial governments to set more suitable carbon regulations.

5. Incent Indigenous co-investment opportunities. The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development.”

As they say the devil is often in the details. But it would be an error to complicate the message with too much detail in the context of an election campaign. We want to avoid sacrificing the good on behalf of the perfect. The plan needs to be readily understandable to voters and the media. We live in the age of the ten second sound bite so the plan has to be something that can be communicated succinctly.

Nevertheless, there is much more to be done. If Carney hopes to feel welcome in large sections of the west he needs to back away from many of promises he’s already made. And there are many Liberal policies besides Bill C-69 and C-48 that need to be rescinded or significantly modified.

Liberal imposed limitations on free speech have to go. In a free society publicizing the improvements oil and gas companies are making on behalf of environmental protection should not be a crime.

There is a morass of emissions reduction regulations, mandates, targets and deadlines that need to be rethought and/or rescinded. These include measures like the emissions cap, the clean electricity standard, EV mandates and carbon taxes. Similarly, plans for imposing restrictions on industries besides oil and gas, such as agriculture, need to be dropped. These include mandatory reductions in the use of nitrogen fertilizer and attacks (thus far only rhetorical) on cattle ranching.

A good starting point for addressing these issues would be meaningful federal-provincial negotiations. But that won’t work if the Liberals allow Quebec to veto energy projects that are in the national interest. If Quebec insists on being obstructive, the producing provinces in the west will insist that its equalization welfare be reduced or cancelled.

Virtually all of the Liberal policy measures noted above are inflationary and reduce the profitability and competitive capacity of our exporters. Adding to Canada’s already high cost of living on behalf of overly zealous, unachievable emissions reduction goals is unnecessary as well as socially unacceptable.

We probably all have our own policy change preferences. One of my personal favourites would require the federal government to cease funding environmental organizations that disrupt energy projects with unlawful protests and file frivolous slap suits to block pipelines.

Admittedly, it is a rare thing to have all of one’s policy preferences satisfied in a democracy. And it is wise to stick to a short wish list during a federal election campaign. Putting some of the foregoing issues on the back burner is okay provided we don’t forget them there.

But what if few or any of the oil and gas producing provinces’ demands are accepted by Carney and he still manages to become prime minister?

We are currently confronted by a dangerous level of geopolitical uncertainty. The prospects of a global trade war and its effects on an export-reliant country like Canada are daunting to say the least.

Dividing the country further by once again stifling the legitimate aspirations of the majority of people in Alberta and Saskatchewan will not be helpful. (I could add voters from the northeast and interior of B.C., and southwestern Manitoba to the club of the seriously disgruntled.)

Economy

Support For National Pipelines And LNG Projects Gain Momentum, Even In Quebec

From the Frontier Centre for Public Policy

Public opinion on pipelines has shifted. Will Ottawa seize the moment for energy security or let politics stall progress?

The ongoing threats posed by U.S. tariffs on the Canadian economy have caused many Canadians to reconsider the need for national oil pipelines and other major resource projects.

The United States is Canada’s most significant trading partner, and the two countries have enjoyed over a century of peaceful commerce and good relations. However, the onset of tariffs and increasingly hostile rhetoric has made Canadians realize they should not be taking these good relations for granted.

Traditional opposition to energy development has given way to a renewed focus on energy security and domestic self-reliance. Over the last decade, Canadian energy producers have sought to build pipelines to move oil from landlocked Alberta to tidewater, aiming to reduce reliance on U.S. markets and expand exports internationally. Canada’s dependence on the U.S. for energy exports has long affected the prices it can obtain.

One province where this shift is becoming evident is Quebec. Historically, Quebec politicians and environmental interests have vehemently opposed oil and gas development. With an abundance of hydroelectric power, imported oil and gas, and little fossil fuel production, the province has had fewer economic incentives to support the industry.

However, recent polling suggests attitudes are changing. A SOM-La Presse poll from late February found that about 60 per cent of Quebec residents support reviving the Energy East pipeline project, while 61 per cent favour restarting the GNL Quebec natural gas pipeline project, a proposed LNG facility near Saguenay that would export liquefied natural gas to global markets. While support for these projects remains stronger in other parts of the country, this represents a substantial shift in Quebec.

Yet, despite this change, Quebec politicians at both the provincial and federal levels remain out of step with public opinion. The Montreal Economic Institute, a non-partisan think tank, has documented this disconnect for years. There are two key reasons for it: Quebec politicians tend to reflect the perspectives of a Montreal-based Laurentian elite rather than broader provincial sentiment, and entrenched interests such as Hydro-Québec benefit from limiting competition under the guise of environmental concerns.

Not only have Quebec politicians misrepresented public opinion, but they have also claimed to speak for the entire province on energy issues. Premier François Legault and Bloc Québécois Leader Yves-François Blanchet have argued that pipeline projects lack “social licence” from Quebecers.

However, the reality is that the federal government does not need any special license to build oil and gas infrastructure that crosses provincial borders. Under the Constitution, only the federal Parliament has jurisdiction over national pipeline and energy projects.

Despite this authority, no federal government has been willing to impose such a project on a province. Quebec’s history of resisting federal intervention makes this a politically delicate issue. There is also a broader electoral consideration: while it is possible to form a federal government without winning Quebec, its many seats make it a crucial battleground. In a bilingual country, a government that claims to speak for all Canadians benefits from having a presence in Quebec.

Ottawa could impose a national pipeline, but it doesn’t have to. New polling data from Quebec and across Canada suggest Canadians increasingly support projects that enhance energy security and reduce reliance on the United States. The federal government needs to stop speaking only to politicians—especially in Quebec—and take its case directly to the people.

With a federal election on the horizon, politicians of all parties should put national pipelines and natural gas projects on the ballot.

Joseph Quesnel is a senior research fellow with the Frontier Centre for Public Policy.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s Cap on Alberta Energy Costing Canada Billions

-

Community1 day ago

Community1 day agoSPARC Caring Adult Nominations now open!

-

2025 Federal Election2 days ago

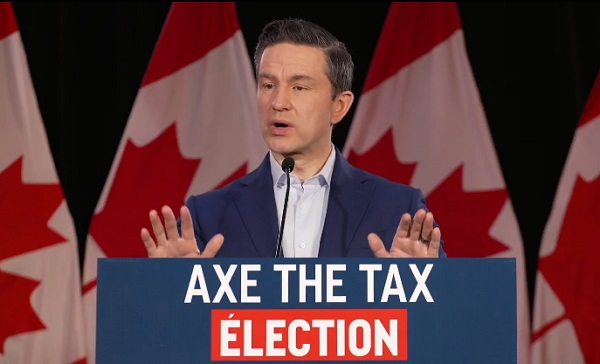

2025 Federal Election2 days agoManufacturers Endorse Pierre Poilievre for Prime Minister

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre’s big tax cut helps working Canadians

-

Business1 day ago

Business1 day agoPossible Criminal Charges for US Institute for Peace Officials who barricade office in effort to thwart DOGE

-

Business1 day ago

Business1 day ago28 energy leaders call for eliminating ALL energy subsidies—even ones they benefit from

-

International2 days ago

International2 days agoPope Francis appears frail as he returns to Vatican following 38-day hospital stay

-

Sports1 day ago

Sports1 day agoWHL Expands To Penticton, Launches Franchise Application Process For Chilliwack