Business

Canadian Taxpayer Federation calls on Ottawa to rescind recent Carbon Tax hike

From the Canadian Taxpayer Federation

Ottawa’s carbon tax hike out of step with global reality

by Aaron Wudrick, Federal Director and Franco Terrazzano, Alberta Director

(This column originally appeared in the Financial Post)

Prime Minister Justin Trudeau has chosen to make life more expensive by increasing the federal carbon tax by 50 per cent amidst the COVID-19 economic and health crisis. Meanwhile, governments around the world are moving in the opposite direction because hiking taxes during a global pandemic is a bad idea.

Provinces have already tapped the breaks on their own carbon tax hikes. British Columbia Premier John Horgan announced that he would not be going forward with his planned April 1 carbon tax hike. Instead of mirroring the federal carbon tax hike, Newfoundland and Labrador is maintaining its tax at $20 per tonne. The price of carbon allowances in the Quebec-California cap and trade system have also fallen due to COVID-19 and the current macroeconomic realities.

The European Union’s cap and trade scheme, which applies to 30 countries, has also seen its carbon tax rate drop significantly. For most of 2019 and early 2020, EU carbon prices traded around €25 per tonne before nosediving to around €15 per tonne in March. The EU’s cap and trade carbon tax rate has fallen 32 per cent below its 2020 peak, according to the most recent data available on the ICAP Allowance Price Explorer. While the tax rate has increased since bottoming out, S&P Global Platts Analytics forecasts the COVID-19 shock keeping downward pressure on the cap and trade market.

Other counties are providing further carbon tax relief. The Norwegian government reduced its carbon tax rate on natural gas and liquified petroleum gas to zeroand will keep the rates below the pre-coronavirus level until 2024. Norway also deferred payments on various fuel taxes until June 18.

Estonia Finance Minister Martin Helme formally called for his country to consider leaving the EU’s cap and trade carbon tax system to provide relief. The prime minister later announced that Estonia would not seek to leave the EU’s carbon tax system, but the Estonian government lowered the excise tax on electricity to the minimum allowed by the EU and lowered its excise tax on diesel, light and heavy fuel oil, shale oil and natural gas.

“Due to the economic downturn, both people’s incomes and the revenue of companies are declining, but daily household expenses such as electricity or gas bills still need to be paid. To better cope with them, we are reducing excise duty rates on gas and electricity for two years,” Helme explained.

Outside of the EU, the United Kingdom is saving its taxpayers between £15 and £20 million per year by walking back its plan to increase its carbon tax top-up, New Zealand’s cap and trade tax rate has fallen by more than 20 per cent this year and South Africa pushed back carbon tax payments by three months.

It’s worth noting that it’s unlikely Canada’s carbon tax will have any meaningful impact on global emissions. Only 45 countries (out of 195 countries worldwide) are covered by a carbon tax, and only 15.6 per cent of total emissions are covered by these carbon taxes, according to the World Bank. Furthermore, about half of the emissions covered by carbon taxes are priced below US$10/tCO2e – significantly lower than Canada’s federal rate and too low to make a difference.

With Canada only accounting for 1.5 per cent of global emissions, it’s easy to understand Trudeau’s acknowledgement that, “even if Canada stopped everything tomorrow, and the other countries didn’t have any solutions, it wouldn’t make a big difference.”

Now more than ever, Canadian taxpayers need relief. With carbon tax burdens declining around the globe during the COVID-19 crisis, walking back the recent carbon tax hike should be a no-brainer for our federal government.

Province of Alberta replies to Joe Biden’s promise to cancel Keystone XL

2025 Federal Election

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

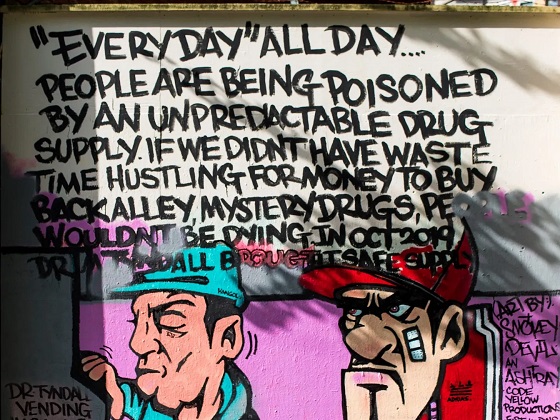

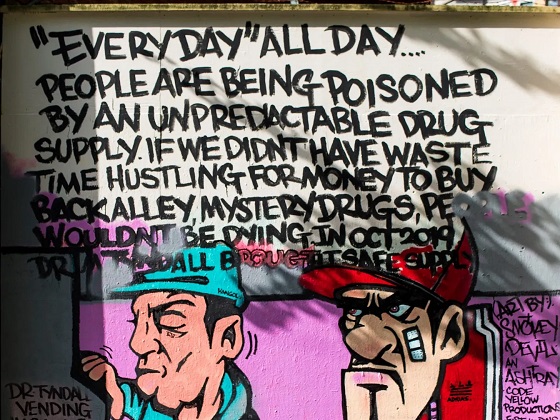

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolls say Canadians will give Trump what he wants, a Carney victory.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre’s Conservatives promise to repeal policy allowing male criminals in female jails

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTrump Has Driven Canadians Crazy. This Is How Crazy.