Automotive

Canadian tariffs on Chinese EVs should look like the United States’, not Europe’s

From the Macdonald Laurier Institute

By Heather Exner-Pirot

It is clear that China’s green manufacturing subsidies are not merely levers to promote their domestic economy at the expense of their competitors, but part of a larger strategic plan to control parts of the global energy and transportation system.

China is now, beyond a doubt, engaged in dumping and subsidizing a range of clean technologies to manipulate global markets. The remaining question is: How should Canada respond?

The Finance Minister’s consultations on China’s unfair trade practices in electric vehicles is welcome, if belated. Canada should closely follow the United States’ lead on this matter, and evaluate the extent to which other Chinese products, from lithium-ion batteries to battery components, should also be sanctioned.

The New Trio

A key plank of China’s economic growth strategy is manufacturing and exporting the “new trio”: solar photovoltaics, lithium-ion batteries, and electric vehicles. These are high value-add, export-oriented products that China is hoping can compensate for domestic economic weakness driven by a property market crisis, poor demographics, and insufficient consumer demand.

To solidify its role in green technology manufacturing, the Chinese government has provided enormous industrial subsidies to its firms; far higher than those of western nations. According to analysis by Germany’s Kiel Institute, the industrial subsidies in China are at least three to four times – or even up to nine times – higher than in the major EU and OECD countries.

Washington-based think tank CSIS conservatively estimates industrial subsidies in China were at least 1.73 percent of GDP in 2019. This is equivalent to more than USD $248 billion at nominal exchange rates and USD $407 billion at purchasing power parity exchange rates – higher than China’s defense spending in the same year.

On top of state subsidies, Chinese green technology manufacturing companies also benefit from preferential access to critical mineral supply chains (many aspects of which China dominates and manipulates the global market), weak labour and environmental standards, and economic espionage (including stealing technology from western firms and using Chinese-made products to gather intelligence from their western consumers). This green tech espionage includes Chinese-made electric vehicles which are widely suspected of collecting users’ data and sending it back to China in ways that violate their privacy and security.

It is clear that China’s green manufacturing subsidies are not merely levers to promote their domestic economy at the expense of their competitors, but part of a larger strategic plan to control parts of the global energy and transportation system.

European and American Response

In response to these blatantly egregious practices, both the European Commission and United States have recently announced tariffs on Chinese-made electric vehicles.

The European Commission announced their tariffs on July 4, 2024, following a nine-month anti-subsidy investigation. Individual duties were applied to three prominent Chinese producers: BYD (17.4%); Geely (19.9%); and SAIC (37.6%).

Other Battery Electric Vehicle (BEV) producers in China, which cooperated in the investigation but were not sampled, are subject to a 20.8% duty. Non-cooperating companies are subject to a 37.6% duty.

The United States policy was announced on May 14, 2024, and is both more comprehensive and more punitive than the European Commission’s. It covers not only electric vehicles, which face an increase in tariffs from the previous 25% to 100% as of August 1, 2024, but lithium-ion batteries (from a 7.5% to 25% tariff) and battery parts (from a 7.5% to 25% tariff). Natural graphite and permanent magnets will also face a tariff of 25%, starting in 2026.

Canada’s Response

Minister Freeland’s determination that Canada “does not become a dumping ground” for subsidized Chinese-made EVs, and commitment that Canada “will not stand” for China’s unfair trade practices, is very welcome.

To that end, Canada’s tariff policy on Chinese-made EVs should closely match the United States’, rather than Europe’s.

Canada’s auto industry is highly integrated with the United States, and our EV and battery supply chain, to the extent consumers will demand them, will be no different. Official Washington is seized with the threat China poses to the liberal world order and their position atop the global hierarchy. The United States will have little tolerance for Canada as a back door for Chinese-made EVs and battery parts. The growth and penetration of Chinese-made EV imports in Canada from 2022 to 2023 – an increase of 2500% year over year, now representing 25% of our imported EVs – shows that this is not a theoretical problem, but an existing one.

A soft touch on Chinese EV tariffs would likely create worse economic consequences for Canada in the North American context – in terms of impact to our domestic auto manufacturing industry, extensive battery supply chain investments, and CUSMA renegotiations – than it would confront from China, though these may indeed be painful.

For all these reasons, Canada should extend tariffs to lithium-ion batteries and battery parts as well, as the United States has done. This is fully with precedent. Canada has already applied extensive duties to Chinese-made photovoltaics and wind towers, and has put heavy investment restrictions on Chinese ownership of critical minerals production and miners in Canada.

Long-term Thinking

Free trade is a cornerstone of the liberal world order. It has improved the material well-being of billions of people. Restrictions on trade should not be taken lightly.

But Chinese dumping, subsidies, and market manipulation mean that the global market is not free for many critical minerals, EVs, solar panels, wind towers, lithium-ion batteries, and other green technology components. Canada cannot ignore that fact for a perceived short-term gain from cheaper products.

Just as Europe learned that relying on Russia for cheap natural gas was expensive, relying on China for our energy transition will not move Canada to a lower carbon energy system easier, faster or cheaper. It will impose different costs that Canadians will pay in a multitude of ways.

This may disappoint those that prioritize renewables and EV deployment over national security and domestic economic growth. The good news is that Canada has good options that satisfy climate goals as well. Canada is rich in oil, gas, uranium, and water. We are independent in fossil fuels, nuclear and hydroelectric energy. Let us build on those strengths and invest in green technologies that leverage them, including carbon capture, utilization and storage (CCUS), third and fourth generation nuclear reactors, pumped storage hydropower, and hydrogen.

Canada needs to focus on decarbonization efforts in areas in which we can both be energy independent and protect Canadian consumers and workers from unfair trade practices. To do this, Canada should apply appropriately punitive anti-dumping subsides on Chinese-made EVs, lithium-ion batteries, and battery parts.

Heather Exner-Pirot is director of energy, natural resources and environment at the Macdonald-Laurier Institute.

Automotive

Power Struggle: Governments start quietly backing away from EV mandates

From Resource Works

Barry Penner doesn’t posture – he brings evidence. And lately, the evidence has been catching up fast to what he’s been saying for months.

Penner, chair of the Energy Futures Institute and a former B.C. environment minister and attorney-general, walked me through polling that showed a decisive pattern: declining support for electric-vehicle mandates, rising opposition, and growing intensity among those pushing back.

That was before the political landscape started shifting beneath our feet.

In the weeks since our conversation, the B.C. government has begun retreating from its hardline EV stance, softening requirements and signalling more flexibility. At the same time, Ottawa has opened the door to revising its own rules, acknowledging what the market and motorists have been signalling for some time.

Penner didn’t need insider whispers to see this coming. He had the data.

Barry Penner, Chair of the Energy Futures Institute

B.C.’s mandate remains the most aggressive in North America: 26 per cent ZEV sales by 2026, 90 per cent by 2030, and 100 per cent by 2035. Yet recent sales paint a different picture. Only 13 per cent of new vehicles sold in June were electric. “Which means 87 per cent weren’t,” Penner notes. “People had the option. And 87 per cent chose a non-electric.”

Meanwhile, Quebec has already adjusted its mandate to give partial credit for hybrids. Polling shows 76 per cent of British Columbians want the same. The trouble? “There’s a long waiting list to get one,” Penner says.

Cost, charging access and range remain the top barriers for consumers. And with rebates shrinking or disappearing altogether, the gap between policy ambition and practical reality is now impossible for governments to ignore.

Penner’s advice is simple, and increasingly unavoidable: “Recognition of reality is in order.”

- Now watch Barry Penner’s full video interview with Stewart Muir on Power Struggle here:

Automotive

The high price of green virtue

By Jerome Gessaroli for Inside Policy

Reducing transportation emissions is a worthy goal, but policy must be guided by evidence, not ideology.

In the next few years, the average new vehicle in British Columbia could reach $80,000, not because of inflation, but largely because of provincial and federal climate policy. By forcing zero-emission-vehicle (ZEV) targets faster than the market can afford, both governments risk turning climate ambition into an affordability crisis.

EVs are part of the solution, but mandates that outpace market acceptance risk creating real-world challenges, ranging from cold-weather travel to sparse rural charging to the cost and inconvenience for drivers without home charging. As Victoria and Ottawa review their ZEV policies, the goal is to match ambition with evidence.

Introduced in 2019, BC’s mandate was meant to accelerate electrification and cut emissions from light-duty vehicles. In 2023, however, it became far more stringent, setting the most aggressive ZEV targets in North America. What began as a plan to boost ZEV adoption has now become policy orthodoxy. By 2030, automakers must ensure that 90 per cent of new light-duty vehicles sold in BC are zero-emission, regardless of what consumers want or can afford. The evidence suggests this approach is out of step with market realities.

The province isn’t alone in pursuing EV mandates, but its pace is unmatched. British Columbia, Quebec, and the federal government are the only ones in Canada with such rules. BC’s targets rise much faster than California’s, the jurisdiction that usually sets the bar on green-vehicle policy, though all have the same goal of making every new vehicle zero-emission by 2035.

According to Canadian Black Book, 2025 model EVs are about $17,800 more expensive than gas-powered vehicles. However, ever since Ottawa and BC removed EV purchase incentives, sales have fallen and have not yet recovered. Actual demand in BC sits near 16 per cent of new vehicle sales, well below the 26 per cent mandate for 2026. To close that gap, automakers may have to pay steep penalties or cut back on gas-vehicle sales to meet government goals.

The mandate also allows domestic automakers to meet their targets by purchasing credits from companies, such as Tesla, which hold surplus credits, transferring millions of dollars out of the country simply to comply with provincial rules. But even that workaround is not sustainable. As both federal and provincial mandates tighten, credit supplies will shrink and costs will rise, leaving automakers more likely to limit gas-vehicle sales.

It may be climate policy in intent, but in reality, it acts like a luxury tax on mobility. Higher new-vehicle prices are pushing consumers toward used cars, inflating second-hand prices, and keeping older, higher-emitting vehicles on the road longer. Lower-income and rural households are hit hardest, a perverse outcome for a policy meant to reduce emissions.

Infrastructure is another obstacle. Charging-station expansion and grid upgrades remain far behind what is needed to support mass electrification. Estimates suggest powering BC’s future EV fleet alone could require the electricity output of almost two additional Site C dams by 2040. In rural and northern regions, where distances are long and winters are harsh, drivers are understandably reluctant to switch. Beyond infrastructure, changing market and policy conditions now pose additional risks to Canada’s EV goals.

Major automakers have delayed or cancelled new EV models and battery-plant investments. The United States has scaled back or reversed federal and state EV targets and reoriented subsidies toward domestic manufacturing. These shifts are likely to slow EV model availability and investment across North America, pushing both British Columbia and Ottawa to reconsider how realistic their own targets are in more challenging market conditions.

Meanwhile, many Canadians are feeling the strain of record living costs. Recent polling by Abacus Data and Ipsos shows that most Canadians view rising living costs as the country’s most pressing challenge, with many saying the situation is worsening. In that climate, pressing ahead with aggressive mandates despite affordability concerns appears driven more by green ideology than by evidence. Consumers are not rejecting EVs. They are rejecting unrealistic timelines and unaffordable expectations.

Reducing transportation emissions is a worthy goal, but policy must be guided by evidence, not ideology. When targets become detached from real-world conditions, ideology replaces judgment. Pushing too hard risks backlash that can undo the very progress we are trying to achieve.

Neither British Columbia nor the federal government needs to abandon its clean-transportation objectives, but both need to adjust them. That means setting targets that match realistic adoption rates, as EVs become more affordable and capable, and allowing more flexible compliance based on emissions reductions rather than vehicle type. In simple terms, the goal should be cutting emissions, not forcing people to buy a specific type of car. These steps would align ambition with reality and ensure that environmental progress strengthens, rather than undermines, public trust.

With both Ottawa and Victoria reviewing their EV mandates, their next moves will show whether Canadian climate policy is driven by evidence or by ideology. Adjusting targets to reflect real-world affordability and adoption rates would signal pragmatism and strengthen public trust in the country’s clean-energy transition.

Jerome Gessaroli is a senior fellow at the Macdonald-Laurier Institute and leads the Sound Economic Policy Project at the BC Institute of British Columbia

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIntegration Or Indignation: Whose Strategy Worked Best Against Trump?

-

Health2 days ago

Health2 days agoNews RFK Jr.’s vaccine committee to vote on ending Hepatitis B shot recommendation for newborns

-

International2 days ago

International2 days agoFBI may have finally nabbed the Jan. 6 pipe bomber

-

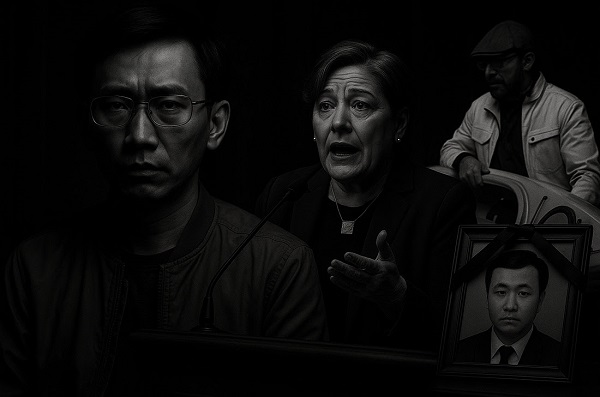

espionage2 days ago

espionage2 days agoDigital messages reportedly allege Chinese police targeted dissident who died suspiciously near Vancouver

-

Health2 days ago

Health2 days ago23,000+ Canadians died waiting for health care in one year as Liberals pushed euthanasia

-

MAiD2 days ago

MAiD2 days ago101-year-old woman chooses assisted suicide — press treats her death as a social good

-

Business2 days ago

Business2 days agoCarney’s Toronto cabinet meetings cost $530,000

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI is accelerating the porn crisis as kids create, consume explicit deepfake images of classmates