Fraser Institute

Canadian generosity hits lowest point in 20 years

From the Fraser Institute

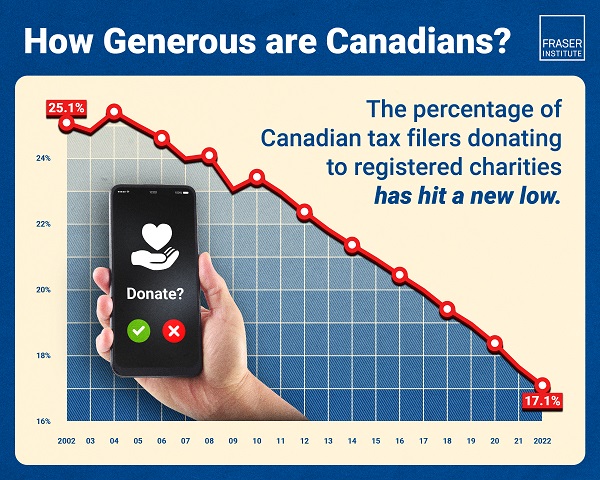

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2024 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2022 tax year—just 17.1 per cent—is the lowest proportion of Canadians donating since at least 2002.

Canadians’ generosity peaked at 25.4 per cent of tax-filersdonating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.61 per cent of income in 2002 to 0.50 per cent of income in 2022.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (19.3 per cent) during the 2022 tax year while New Brunswick had the lowest (14.7 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec donated the lowest (0.26 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

NOTE: Table based on 2022 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2024 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (19.3%) during the 2022 tax year while New Brunswick had the lowest (14.7%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec donated the lowest (0.26%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 22.4% in 2012 to 17.1% in 2022.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2012 to 0.50% in 2022.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

Alberta

Schools should go back to basics to mitigate effects of AI

From the Fraser Institute

Odds are, you can’t tell whether this sentence was written by AI. Schools across Canada face the same problem. And happily, some are finding simple solutions.

Manitoba’s Division Scolaire Franco-Manitobaine recently issued new guidelines for teachers, to only assign optional homework and reading in grades Kindergarten to six, and limit homework in grades seven to 12. The reason? The proliferation of generative artificial intelligence (AI) chatbots such as ChatGPT make it very difficult for teachers, juggling a heavy workload, to discern genuine student work from AI-generated text. In fact, according to Division superintendent Alain Laberge, “Most of the [after-school assignment] submissions, we find, are coming from AI, to be quite honest.”

This problem isn’t limited to Manitoba, of course.

Two provincial doors down, in Alberta, new data analysis revealed that high school report card grades are rising while scores on provincewide assessments are not—particularly since 2022, the year ChatGPT was released. Report cards account for take-home work, while standardized tests are written in person, in the presence of teaching staff.

Specifically, from 2016 to 2019, the average standardized test score in Alberta across a range of subjects was 64 while the report card grade was 73.3—or 9.3 percentage points higher). From 2022 and 2024, the gap increased to 12.5 percentage points. (Data for 2020 and 2021 are unavailable due to COVID school closures.)

In lieu of take-home work, the Division Scolaire Franco-Manitobaine recommends nightly reading for students, which is a great idea. Having students read nightly doesn’t cost schools a dime but it’s strongly associated with improving academic outcomes.

According to a Programme for International Student Assessment (PISA) analysis of 174,000 student scores across 32 countries, the connection between daily reading and literacy was “moderately strong and meaningful,” and reading engagement affects reading achievement more than the socioeconomic status, gender or family structure of students.

All of this points to an undeniable shift in education—that is, teachers are losing a once-valuable tool (homework) and shifting more work back into the classroom. And while new technologies will continue to change the education landscape in heretofore unknown ways, one time-tested winning strategy is to go back to basics.

And some of “the basics” have slipped rapidly away. Some college students in elite universities arrive on campus never having read an entire book. Many university professors bemoan the newfound inability of students to write essays or deconstruct basic story components. Canada’s average PISA scores—a test of 15-year-olds in math, reading and science—have plummeted. In math, student test scores have dropped 35 points—the PISA equivalent of nearly two years of lost learning—in the last two decades. In reading, students have fallen about one year behind while science scores dropped moderately.

The decline in Canadian student achievement predates the widespread access of generative AI, but AI complicates the problem. Again, the solution needn’t be costly or complicated. There’s a reason why many tech CEOs famously send their children to screen-free schools. If technology is too tempting, in or outside of class, students should write with a pencil and paper. If ChatGPT is too hard to detect (and we know it is, because even AI often can’t accurately detect AI), in-class essays and assignments make sense.

And crucially, standardized tests provide the most reliable equitable measure of student progress, and if properly monitored, they’re AI-proof. Yet standardized testing is on the wane in Canada, thanks to long-standing attacks from teacher unions and other opponents, and despite broad support from parents. Now more than ever, parents and educators require reliable data to access the ability of students. Standardized testing varies widely among the provinces, but parents in every province should demand a strong standardized testing regime.

AI may be here to stay and it may play a large role in the future of education. But if schools deprive students of the ability to read books, structure clear sentences, correspond organically with other humans and complete their own work, they will do students no favours. The best way to ensure kids are “future ready”—to borrow a phrase oft-used to justify seesawing educational tech trends—is to school them in the basics.

Business

State of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

From the Fraser Institute

By Ben Cherniavsky and Jock Finlayson

Initial public offerings down 94% since 2010, reflecting country’s economic stagnation

Canadian equity markets are flashing red lights reflective of the larger stagnation, lack of productivity growth and lacklustre innovation of the

country’s economy, with the number of publicly listed companies down 32.7 per cent and initial public offerings down 92.5 per cent since 2010, finds a new report published Friday by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Even though the value of the companies trading on Canada’s stock exchanges has risen substantially over time, there has been an alarming decrease in the number of companies listed on the exchanges as well as the number of companies choosing to go public,” said Ben Cherniavsky, co-author of Canada’s Shrinking Stock Market: Causes and Implications for Future Economic Growth.

The study finds that over the past 15 years, the number of companies listed on Canada’s two stock markets (the TSX and the TSXV) has fallen from 3,141 in 2010 to 2,114 in 2024—a 32.7 per cent decline.

Similarly, the number of new public stock listings (IPOs) on the two Canadian exchanges has also plummeted from 67 in 2010 to just four in 2024, and only three the year before.

Previous research has shown that well-functioning, diverse public stock markets are significant contributors to economic growth, higher productivity and innovation by supplying financing (i.e. money) to the business sector to enable growth and ongoing investments.

At the same time, the study also finds an explosion of investment in what’s known as private equity in Canada, increasing assets under management from $21.7 billion (US) in 2010 to over $93.1 billion (US) in 2024.

“The shift to private equity has enormous implications for average investors, since it’s difficult if not impossible for average investors to access private equity funds for their savings and investments,” explained Cherniavsky.

Crucially, the study makes several recommendations to revitalize Canada’s stagnant capital markets, including reforming Canada’s complicated regulatory regime for listed companies, scaling back corporate disclosure requirements, and pursuing policy changes geared to improving Canada’s lacklustre performance on business investment, productivity growth, and new business formation.

“Public equity markets play a vital role in raising capital for the business sector to expand, and they also provide an accessible and low-cost way for Canadians to invest in the commercial success of domestic businesses,” said Jock Finlayson, a senior fellow with the Fraser Institute and study co-author.

“Policymakers and all Canadians should be concerned by the alarming decline in the number of publicly traded companies in Canada, which risks economic stagnation and lower living standards ahead.”

Canada’s Shrinking Stock Market: Causes and Implications for Future Economic Growth

- Public equity markets are an important part of the wider financial system.

- Since the early 2000s, the number of public companies has fallen in many countries, including Canada. In 2008, for instance, Canada had 3,520 publicly traded companies on its two exchanges, compared to 2,114 in 2024.

- This trend reflects [1] the impact of mergers and acquisitions, [2] greater access to private capital, [3] increasing regulatory and governance costs facing publicly traded businesses, and [4] the growth of index investing.

- Canada’s poor business climate, including many years of lacklustre business investment and little or no productivity growth, has also contributed to the decline in stock exchange listings.

- The number of new public stock listings (IPOs) on Canadian exchanges has plummeted: between 2008 and 2013, the average was 47 per year, but this dropped to 16 between 2014 and 2024, with only 5 new listings recorded in 2024.

- At the same time, the value of private equity in Canada has skyrocketed from $12.8 billion in 2008 to $93.2 billion in 2024. These trends are concerning, as most Canadians cannot easily access private equity investment vehicles, so their domestic investment options are shrinking.

- The growth of index investing is contributing to the decline in public listings, particularly among smaller companies. In 2008, there were 1,232 listed companies on the TSX Composite and 84 exchange-traded funds; in 2024, there were only 709 listed companies on the TSX and 1,052 exchange-traded funds.

- The trends discussed in this study are also important because Canada has relied more heavily than other jurisdictions on public equity markets to finance domestic businesses.

- Revitalizing Canada’s stagnant stock markets requires policy reforms, particularly regulatory changes to reduce costs to issuers and policies to improve the conditions for private-sector investment and business growth.

-

Censorship Industrial Complex15 hours ago

Censorship Industrial Complex15 hours agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Automotive20 hours ago

Automotive20 hours agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Great Reset18 hours ago

Great Reset18 hours agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Daily Caller16 hours ago

Daily Caller16 hours agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Alberta17 hours ago

Alberta17 hours agoSchools should go back to basics to mitigate effects of AI

-

Daily Caller2 days ago

Daily Caller2 days ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

Crime2 days ago

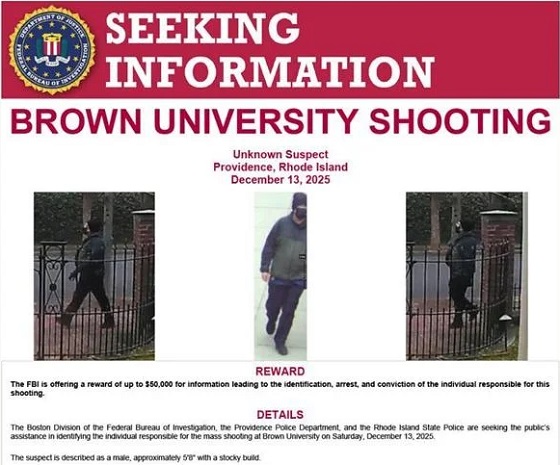

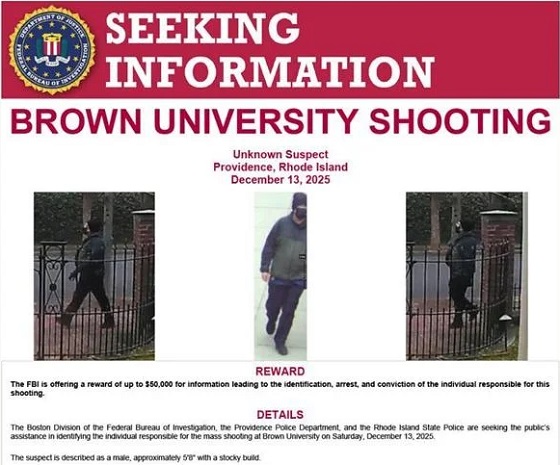

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers