Business

Canadian commission suggests more gov’t money for mainstream media to fight ‘misinformation’

From LifeSiteNews

Foreign Interference Commission Justice Marie-Josée Hogue recommended in her final report on election interference that additional taxpayer money be pumped into legacy media outlets that are already receiving billions from the government to make sure news is ‘trustworthy and of good quality.’

The Foreign Interference Commission in one of its many recommendations suggested that the Canadian government hand out millions of additional dollars to legacy media outlets for combating supposed “misinformation and disinformation.”

The suggestion to pump up legacy media with more taxpayer money was made by Foreign Interference Commission Justice Marie-Josée Hogue in her final report on election interference that was released last week. It was one of 51 recommendations from her investigation into election meddling in Canada’s 2019 and 2021 federal elections.

Hogue’s 44th recommendation reads that the federal government, which already spends billions to support legacy media, “should pursue discussions with media organizations and the public around modernizing media funding and economic models to support professional media, including local and foreign language media, while preserving media independence and neutrality.”

According to Houge, “Traditional journalism is struggling,” and because of this “Media organizations are facing financial challenges as citizens turn away from mainstream media, and towards social media or non-traditional platforms that may, for a variety of reasons, be more susceptible to misinformation and disinformation.”

Houge noted that she was on board with a Department of Canadian Heritage witness who testified at a commission hearing that Canadian media should be supported to make sure news is “trustworthy and of good quality.”

“I share their concern about Canada’s professional media. Canada must have a press that is strong and free,” Hogue said.

“It is crucial to have credible and reliable sources of information to counterbalance misinformation and disinformation,” she added.

As reported by LifeSiteNews, the final report from the Foreign Interference Commission concluded that operatives from the Chinese Communist Party (CCP) may have had a hand in helping to elect a handful of MPs in the 2019 and 2021 Canadian federal elections.

Hogue urged in her January 28 final report that Canada “remain vigilant because the threat of foreign interference is real,” but stopped short of saying CCP interference was influential enough to tilt the outcomes of the elections.

When it comes to legacy media in Canada, the government of Prime Minister Justin Trudeau announced that it will spend millions more propping up the mostly state-funded Canadian Broadcasting Corporation (CBC).

This extra funding comes despite the fact the Department of Canadian Heritage has admitted payouts to the CBC are not sufficient to keep legacy media outlets running.

There have been many cases where the CBC has appeared to push ideological content, including the creation of pro-LGBT material for kids, tacitly endorsing the gender mutilation of children, promoting euthanasia, and even seeming to justify the burning of mostly Catholic churches throughout the country.

Furthermore, in October, Canadian Heritage Minister Pascale St-Onge’s department admitted that federally funded media outlets buy “social cohesion.”

Alberta

Falling resource revenue fuels Alberta government’s red ink

From the Fraser Institute

By Tegan Hill

According to this week’s fiscal update, amid falling oil prices, the Alberta government will run a projected $6.4 billion budget deficit in 2025/26—higher than the $5.2 billion deficit projected earlier this year and a massive swing from the $8.3 billion surplus recorded in 2024/25.

Overall, that’s a $14.8 billion deterioration in Alberta’s budgetary balance year over year. Resource revenue, including oil and gas royalties, comprises 44.5 per cent of that decline, falling by a projected $6.6 billion.

Albertans shouldn’t be surprised—the good times never last forever. It’s all part of the boom-and-bust cycle where the Alberta government enjoys budget surpluses when resource revenue is high, but inevitably falls back into deficits when resource revenue declines. Indeed, if resource revenue was at the same level as last year, Alberta’s budget would be balanced.

Instead, the Alberta government will return to a period of debt accumulation with projected net debt (total debt minus financial assets) reaching $42.0 billion this fiscal year. That comes with real costs for Albertans in the form of high debt interest payments ($3.0 billion) and potentially higher taxes in the future. That’s why Albertans need a new path forward. The key? Saving during good times to prepare for the bad.

The Smith government has made some strides in this direction by saving a share of budget surpluses, recorded over the last few years, in the Heritage Fund (Alberta’s long-term savings fund). But long-term savings is different than a designated rainy-day account to deal with short-term volatility.

Here’s how it’d work. The provincial government should determine a stable amount of resource revenue to be included in the budget annually. Any resource revenue above that amount would be automatically deposited in the rainy-day account to be withdrawn to support the budget (i.e. maintain that stable amount) in years when resource revenue falls below that set amount.

It wouldn’t be Alberta’s first rainy-day account. Back in 2003, the province established the Alberta Sustainability Fund (ASF), which was intended to operate this way. Unfortunately, it was based in statutory law, which meant the Alberta government could unilaterally change the rules governing the fund. Consequently, by 2007 nearly all resource revenue was used for annual spending. The rainy-day account was eventually drained and eliminated entirely in 2013. This time, the government should make the fund’s rules constitutional, which would make them much more difficult to change or ignore in the future.

According to this week’s fiscal update, the Alberta government’s resource revenue rollercoaster has turned from boom to bust. A rainy-day account would improve predictability and stability in the future by mitigating the impact of volatile resource revenue on the budget.

Business

Higher carbon taxes in pipeline MOU are a bad deal for taxpayers

The Canadian Taxpayers Federation is criticizing the Memorandum of Understanding between the federal and Alberta governments for including higher carbon taxes.

“Hidden carbon taxes will make it harder for Canadian businesses to compete and will push Canadian entrepreneurs to shift production south of the border,” said Franco Terrazzano, CTF Federal Director. “Politicians should not be forcing carbon taxes on Canadians with the hope that maybe one day we will get a major project built.

“Politicians should be scrapping all carbon taxes.”

The federal and Alberta governments released a memorandum of understanding. It includes an agreement that the industrial carbon tax “will ramp up to a minimum effective credit price of $130/tonne.”

“It means more than a six times increase in the industrial price on carbon,” Prime Minister Mark Carney said while speaking to the press today.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

A Leger poll shows 70 per cent of Canadians believe businesses pass most or some of the cost of the industrial carbon tax on to consumers. Meanwhile, just nine per cent believe businesses pay most of the cost.

“It doesn’t matter what politicians label their carbon taxes, all carbon taxes make life more expensive and don’t work,” Terrazzano said. “Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive.

“The hidden carbon tax on business is the worst of all worlds: Higher prices and fewer Canadian jobs.”

-

Alberta5 hours ago

Alberta5 hours agoFrom Underdog to Top Broodmare

-

Banks2 days ago

Banks2 days agoThe Bill Designed to Kill Canada’s Fossil Fuel Sector

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International1 day ago

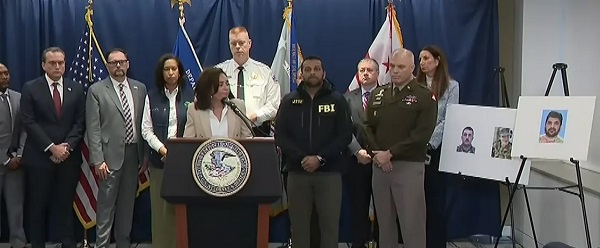

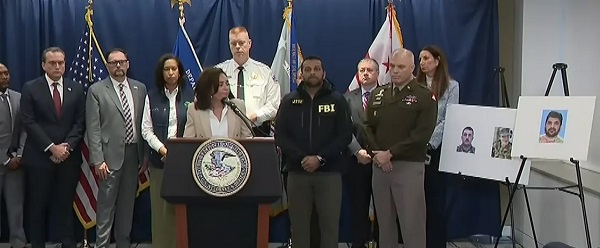

International1 day agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in