Fraser Institute

Canada’s median health-care wait time hits 30 weeks—longest ever recorded

From the Fraser Institute

By Mackenzie Moir and Bacchus Barua

Canadian patients in 2024 waited longer than ever for medical treatment, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“While most Canadians understand that wait times are a major problem, we’ve now reached an unprecedented and unfortunate milestone for delayed access to care,” said Bacchus Barua, director of health policy studies at the Fraser Institute and co-author of Waiting Your Turn: Wait Times for Health Care in Canada, 2024.

The annual study, based on a survey of physicians across Canada, this year reports a median wait time of 30 weeks from referral by a general practitioner (i.e. family doctor) to consultation with a specialist to treatment, for procedures across 12 medical specialties including several types of surgery.

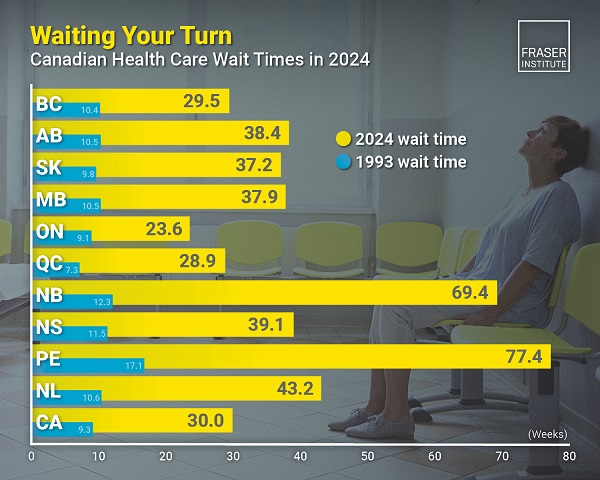

This year’s median wait (30 weeks) is the longest ever recorded—longer than the 27.7 weeks in 2023 and the 20.9 weeks in 2019 (before the pandemic), and 222 per cent longer than the 9.3 weeks in 1993 when the Fraser Institute began tracking wait times. Among the provinces, Ontario recorded the shortest median wait time (23.6 weeks, up from 21.6 weeks in 2023) while Prince Edward Island recorded the longest (77.4 weeks—although data for P.E.I. should be interpreted with caution due to fewer survey responses compared to other provinces).

Among the various specialties, national median wait times were longest for orthopedic surgery (57.5 weeks) and neurosurgery (46.2 weeks), and shortest for radiation (4.5 weeks) and medical oncology treatments (4.7 weeks). For diagnostic technologies, wait times were longest for CT scans (8.1 weeks), MRIs (16.2 weeks) and ultrasounds (5.2 weeks).

“Long wait times can result in increased suffering for patients, lost productivity at work, a decreased quality of life, and in the worst cases, disability or death,” said Mackenzie Moir, senior policy analyst at the Fraser Institute and study co-author.

Median wait times by province (in weeks)

- In 2024, physicians across Canada reported a median wait time of 30.0 weeks between a referral from a GP and receipt of treatment. Up from 27.7 in 2023.

- This is 222% longer than the 9.3 week wait Canadian patients could expect in 1993.

- Ontario reported the shortest total wait (23.6 weeks), followed by Quebec (28.9 weeks) and British Columbia (29.5 weeks).

- Patients waited longest in Prince Edward Island (77.4 weeks), New Brunswick (69.4 weeks) and Newfoundland and Labrador (43.2 weeks).

- Patients waited the longest for Orthopaedic Surgery (57.5 weeks) and Neurosurgery (46.2 weeks).

- By contrast, patients faced shorter waits for Radiation Oncology (4.5 weeks) and Medical Oncology (4.7 weeks).

- The national 30 week total wait is comprised of two segments. Referral by a GP to consultation with a specialist: 15.0 weeks. Consultation with a specialist to receipt of treatment: 15.0 weeks.

- More than 1900 responses were received across 12 specialties and 10 provinces.

- After seeing a specialist, Canadian patients waited 6.3 weeks longer than what physicians consider to be clinically reasonable (8.6 weeks).

- Across 10 provinces, the study estimated that patients in Canada were waiting for 1.5 million procedures in 2024.

- Patients also suffered considerable delays for diagnostic technology: 8.1 weeks for CT scans, 16.2 weeks for MRI scans, and 5.2 weeks for Ultrasound.

Mackenzie Moir

2025 Federal Election

Does Canada Need a DOGE?

From the Fraser Institute

By Philip Cross

The legions of Canadians wanting to see government spending shrink probably look enviously at how Elon Musk’s Department of Government Efficiency (DOGE) is slashing some government programs in the United States, even if DOGE’s non-surgical chainsaw approach is controversial, to say the least.

Some problems are common to cutting any government’s spending. Ironclad job security for union employees with seniority means cuts are skewed disproportionately to junior staff still on probation, with the regrettable side effect of denying an injection of fresh blood into a sclerotic workforce. Cutting employees and not programs makes it easier for higher staffing to resume: as documented by Carleton University Professor Ian Lee in How Ottawa Spends, even prolonged bouts of austerity do not derail government spending from long-term trend of higher growth. Across the board cuts do not allow for the surgical removal of redundant or inefficient programs and poor performing employees.

Canada has some unique problems with federal government spending. Savoie documents how 41 per cent of federal civil servants are located in Ottawa, versus 16 per cent in Washington and 19 per cent in London, despite Canada having the most decentralized federation in the G7. The concentration in Ottawa partly reflects the exceptional influence exerted by central agencies on all departments. As well, University of Cambridge Professor Dennis Grube found Canada’s civil service was the most resistant to public scrutiny and the most risk adverse in a comparative study of public servants in the U.S., the United Kingdom, Australia, New Zealand and Canada.

Canada’s federal employees are among the most expensive anywhere. The average civil servant costs taxpayers $146,500 a year including all salary, benefits and costs such as computers and training. Multiplying this average cost by 366,316 federal employees yields a total labour bill of $53.7 billion, not including other spending such as $17.8 billion on consultants. All the recent increase in the ranks of the civil service happened in Justin Trudeau’s tenure, expanding 38.5 per cent after Stephen Harper had cut them 9 per cent between 2010 and 2015 in his determination to balance the budget.

While the cost of government employees has risen sharply, the services they provide to the public are dwindling as government spending increasingly is devoted to managing its unwieldy and bloated bureaucracy. As Savoie observes, unions like to paint civil servants as providing essential services such as food inspectors and rescue workers, when in reality most are involved in a vast web of “policy, coordination, liaison, and performance evaluation units.” The fastest growing occupations in the federal government are in administrative services and program administration, whose share of jobs rose from 25.1 per cent in 2010 to 31.9 per cent in 2023 according to the latest report from the Treasury Board.

A chronic problem is the fierce defense offered by public service unions in “protecting non-performers and insulating the public sector from effective outside scrutiny” as Savoie wrote. The refusal to acknowledge and root out non-performers depresses the morale of the average civil servant who’s unfairly tarred with the reputation of a minority. It also motivates the across-the-board chainsaw approach of DOGE, which critics then decry as not discriminating between good and bad employees. The latter could easily be targeted by senior managers, who know exactly who the non-performers are but cannot be bothered with the years of documentation and bureaucratic headaches needed to get rid of them. The cost of poor performers is substantial; if even 10 per cent of the civil service was eliminated as redundant non-performers, the government would save $5.4 billion a year. Potential savings are likely well over $10 billion.

The federal government potentially has enormous leverage in negotiating civil service pay and getting rid of non-performers, because it can unilaterally change the federal pension plan without negotiating with public-sector unions. The federal pension plan is so generous that it’s referred to as the “golden handcuffs” that tie employees to their jobs irrespective of their pay or working conditions. To protect their lucrative pensions, unions inevitably would be willing to make concessions that substantially lower the burden on Canada’s taxpayers and still improve morale within the civil service.

2025 Federal Election

Fixing Canada’s immigration system should be next government’s top priority

From the Fraser Institute

Whichever party forms government after the April 28 election must put Canada’s broken immigration system at the top of the to-do list.

This country has one of the world’s lowest fertility rates. Were it not for immigration, our population would soon start to decline, just as it’s declining in dozens of other low-fertility countries around the world.

To avoid the social and economic tensions of an aging and declining population, the federal government should re-establish an immigration system that combines a high intake with strictly enforced regulations. Once Canadians see that program in place and working, public support for immigration should return.

Canada’s total fertility rate (the number of children, on average, a woman will have in her lifetime) has been declining, with the odd blip here and there, since the 1960s. In 1972, it fell below the replacement rate of 2.1.

According to Statistics Canada, the country’s fertility rate fell to a record low of 1.26 in 2023. That puts us in the company of other lowest-low fertility countries such as Italy (1.21), Japan (1.26) and South Korea (0.82).

Those three countries are all losing population. But Canada’s population continues to grow, with immigrants replacing the babies who aren’t born. The problem is that, in the years that followed the COVID-19 lockdowns, the population grew too much.

The Liberal government was unhappy that the pandemic had forced Canada to restrict immigration and concerned about post-pandemic labour shortages. To compensate, Ottawa set a target of 500,000 new permanent residents for 2025, double the already-high intake of about 250,000 a year that had served as a benchmark for the Conservative government of Stephen Harper and the Liberal governments of Paul Martin and Jean Chrétien.

Ottawa also loosened restrictions on temporary foreign worker permits and the admission of foreign students to colleges and universities. Both populations quickly exploded.

Employers preferred hiring workers from overseas rather than paying higher wages for native-born workers. Community colleges swelled their ranks with international students who were also issued work permits. Private colleges—Immigration Minister Marc Miller called them “puppy mills”—sprang up that offered no real education at all.

At the same time, the number of asylum claimants in Canada skyrocketed due to troubles overseas and relaxed entry procedures, reaching a total of 457,285 in 2024.

On January 1 of this year, Statistics Canada estimated that there were more than three million temporary residents in the country, pushing Canada’s population up above 41.5 million.

Their presence worsened housing shortages, suppressed wages and increased unemployment among younger workers. The public became alarmed at the huge influx of foreign residents.

For the first time in a quarter century, according to an Environics poll, a majority of Canadians believed there were too many immigrants coming into Canada.

Some may argue that the solution to Canada’s demographic challenges lie in adopting family-friendly policies that encourage couples to have children. But while governments improve parental supports and filter policies through a family-friendly lens—for example, houses with backyards are more family-friendly than high-rise towers—no government has been able to reverse declining fertility back up to the replacement rate of 2.1.

The steps to repairing Canada’s immigration mess lie in returning to first principles.

According to Statistics Canada, there were about 300,000 international students at postsecondary institutions when the Liberals came to power in 2015. Let’s return to those levels.

The temporary foreign worker program should be toughened up. The government recently implemented stricter Labour Market Impact Assessments, but even stricter rules may be needed to ensure that foreign workers are only brought in when local labour markets cannot meet employer needs, while paying workers a living wage.

New legislation should ensure that only asylum claimants who can demonstrate they are at risk of persecution or other harm in their home country are given refuge in Canada, and that the process for assessing claims is fair, swift and final. If necessary, the government should consider employing the Constitution’s notwithstanding clause to protect such legislation from court challenges.

Finally, the government should admit fewer permanent residents under the family reunification stream and more from the economic stream. And the total admitted should be kept to around 1 per cent of the total population. That would still permit an extremely robust intake of about 450,000 new Canadians each year.

Restoring public confidence in Canada’s immigration system will take much longer than it took to undermine that confidence. But there can be no higher priority for the federal government. The country’s demographic future is at stake.

-

Also Interesting2 days ago

Also Interesting2 days agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

Justice2 days ago

Justice2 days agoCanadian government sued for forcing women to share spaces with ‘transgender’ male prisoners

-

Business1 day ago

Business1 day agoStocks soar after Trump suspends tariffs

-

COVID-191 day ago

COVID-191 day agoBiden Admin concealed report on earliest COVID cases from 2019

-

MAiD2 days ago

MAiD2 days agoDisability rights panel calls out Canada, US states pushing euthanasia on sick patients

-

Alberta2 days ago

Alberta2 days agoAlberta takes big step towards shorter wait times and higher quality health care

-

Business2 days ago

Business2 days agoTrump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate

-

COVID-192 days ago

COVID-192 days agoRandy Hillier wins appeal in Charter challenge to Covid lockdowns