Banks

Canada is preparing to launch ‘open banking.’ Here’s what that means

From LifeSiteNews

By David James

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The Canadian government is setting the stage to bring in what is termed “open banking.”

It is described as a “secure way” for customers to share their financial data with financial technology companies (fintechs or fintech apps). The holders of the account do not have to provide their online banking usernames and passwords. Instead, the data is shared by the customer’s bank with the fintech company, or app, through an online channel.

Open banking is often contrasted with what is called screen scraping, which is when the third party is provided with the online banking username and password, enabling them to log in directly to the bank account as if they were the customer.

Open banking has been adopted by 68 countries, including the United Kingdom and Australia. The U.S. Congress passed the necessary legislation to set it up in 2010, but it was not until last October that the Consumer Financial Protection Bureau (CFPB) issued a proposed rule necessary for implementation.

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The greatest peril is fraudulent account linking: unauthorized connections between customer accounts and third-party applications. This can be done by linking the victim’s financial account to an app controlled by the fraudster, allowing unauthorized access to the person’s funds. Or, the fraudster’s financial account can be linked to a victim’s third-party app, allowing scammers to transfer funds into their account. Substantial sums of money can be stolen before the victim becomes aware of the breach.

Such risks are commonplace in the digital banking environment. For instance, in Australia, according to the Australian Bureau of Statistics, credit card fraud affected 8.7 per cent of the population in 2022-23. The average amount stolen, however, was only $A200 and only 18 per cent had more than $A1000 taken. With open banking, if there is a breach, any sums stolen are likely to be much larger.

Neither is there any reason to think open banking is completely secure just because customers do not reveal their username and password. The Australian Banking Association warned that, after cyberattacks on the government medical insurer Medibank and telco Optus, “the engagement of a third party standing in the shoes of the customer … introduces a range of new risks for which banks may need to develop specific scam, fraud and cyber mitigation tools.”

According to research by financial advisory company Konsentus, the adoption of open banking has been strongest in Asia. In the U.S., customers have a strong attraction to credit cards and the rewards on offer. That is expected to represent a big barrier to take up. In Britain participation has “plateaued,” according to The Open Banking Impact Report (OBI report).

What are the advantages of open banking? According to the OBI report open banking has become a “critical component of cloud accounting” in Britain, which is helping smaller businesses track their financial positions more accurately. It is claimed that giving more entities access to customers’ financial data also increases competition.

Open banking is supposedly more efficient. The fintech company Gocardless contends that: “bank-to-bank payments are fully integrated and use a digital pull-based mechanism, where the merchant requests payment. In contrast, manual bank payments or card payments require the customer to send the payment to the business. Bank-to-bank payments tend to have lower failure rates compared to credit/debit card methods. Thus, businesses spend less time chasing missed payments.”

Another more doubtful claim is that open banking will make things easier for lenders. Abhigyan Shrivastava, leader in banking and technology transformation for Bendigo and Adelaide Bank writes that open banking is: “set to have a significant impact on lending transformation in Australia… with increased competition, personalized lending products, and more efficient lending processes.”

There is little reason, however, to think that better exposure to borrowers’ data will make any difference to lending practices. It will still be a matter of borrowers being able to provide enough collateral to qualify for a loan and to demonstrate they have sufficient income to pay the interest. In other words, banking as usual.

What is most likely is that the benefits of the initiative will primarily go to the banks and financial technology companies. That these entities argue, unconvincingly, that open banking is more “customer-centric” rouses the suspicion that ordinary customers will ultimately gain little.

Banks

Bank of Canada Slashes Interest Rates as Trade War Wreaks Havoc

With businesses cutting jobs, inflation rising, and consumer confidence collapsing, the BoC scrambles to contain the damage

The Bank of Canada just cut interest rates again, this time by 25 basis points, bringing the rate down to 2.75%. On the surface, that might sound like good news—lower rates usually mean cheaper borrowing, easier access to credit, and in theory, more money flowing into the economy. But let’s be clear about what’s actually happening here. The Canadian economy isn’t growing because of strong fundamentals or responsible fiscal policy. The Bank of Canada is slashing rates because the Trudeau—sorry, Carney—government has utterly mismanaged this country’s economic future. And now, with the U.S. slapping tariffs on Canadian goods and our government responding with knee-jerk retaliatory tariffs, the central bank is in full-blown damage control.

Governor Tiff Macklem didn’t mince words at his press conference. “The Canadian economy ended 2024 in good shape,” he insisted, before immediately admitting that “pervasive uncertainty created by continuously changing U.S. tariff threats have shaken business and consumer confidence.” In other words, the economy was doing fine—until reality set in. And that reality is simple: a trade war with our largest trading partner is economic suicide, yet the Canadian government has charged headlong into one.

Macklem tried to explain the Bank’s thinking. He pointed out that while inflation has remained close to the BoC’s 2% target, it’s expected to rise to 2.5% in March thanks to the expiry of a temporary GST holiday. That’s right—Canadians are about to get slammed with higher prices on top of already sky-high costs for groceries, gas, and basic necessities. But that’s not even the worst part. Macklem admitted that while inflation will go up, consumer spending and business investment are both set to drop as a result of this economic uncertainty. Businesses are pulling back on hiring. They’re delaying investment. They’re scared. And rightly so.

A BoC survey released alongside the rate decision shows that 40% of businesses plan to cut back on hiring, particularly in manufacturing, mining, and oil and gas—precisely the industries that were already hammered by Ottawa’s obsession with green energy and ESG policies. As Macklem put it, “Canadians are more worried about their job security and financial health as a result of trade tensions, and they intend to spend more cautiously.” In other words, this is self-inflicted. The government could have pursued a different approach. It could have worked with the U.S. to de-escalate trade tensions. Instead, Mark Carney—an unelected, Davos-approved globalist—is running the show, doubling down on tariffs that will raise prices for Canadians while doing absolutely nothing to change U.S. policy.

The worst part is that the Bank of Canada is completely cornered. It can’t provide forward guidance on future rate decisions because, as Macklem admitted, it has no idea what’s going to happen next. “We are focused on assessing the upward pressure on inflation from tariffs and a weaker dollar, and the downward pressure from weaker domestic demand,” he said. That’s central banker-speak for: We’re guessing, and we hope we don’t screw this up. And if inflation does spiral out of control, the BoC could be forced to raise rates instead of cutting them.

At the heart of this mess is a government that has spent years inflating the size of the state while crushing private sector growth. Macklem admitted that consumer and business confidence has been “sharply affected” by recent developments. That’s putting it mildly. The Canadian dollar has dropped nearly 5% since January, making everything imported from the U.S. more expensive. Meanwhile, Ottawa has responded to U.S. tariffs with a tit-for-tat strategy, placing nearly $30 billion in retaliatory tariffs on American goods. The BoC is now forced to clean up the wreckage, but it’s like trying to put out a fire with a garden hose.

And what about unemployment? Macklem dodged giving a direct forecast, but he didn’t exactly sound optimistic. “We expect the first quarter to be weaker,” he said. “If household demand, if business investment remains restrained in the second quarter, and you’ll likely see weakness in exports, you could see an even weaker second quarter.” That’s code for job losses. It’s already happening. The hiring freezes, the canceled investments—those translate into real layoffs, real pay cuts, real suffering for Canadian families.

Meanwhile, inflation expectations are rising. And once those expectations set in, they become nearly impossible to undo. Macklem was careful in his wording, but the meaning was clear: “Some prices are going to go up. We can’t change that. What we particularly don’t want to see is that first round of price increases have knock-on effects, causing other prices to go up… becoming generalized and ongoing inflation.” Translation: We know this is going to hurt Canadians, we just hope it doesn’t spiral out of control.

If this sounds familiar, that’s because it is. The same policymakers who told you that inflation was “transitory” in 2021 and then jacked up rates at record speed are now telling you that trade war-driven inflation will be “temporary.” But remember this: the BoC is only reacting to the mess created by politicians. The real blame lies with the people in charge. And now, that’s Mark Carney.

Macklem refused to comment on Carney’s role as prime minister, insisting that the BoC remains “independent” from politics. That’s cute. But the damage is already done. Ottawa picked a fight with the U.S. and now the BoC is left trying to prevent a full-scale economic downturn. The problem is, monetary policy can’t fix bad leadership. Canadians are the ones who will pay the price.

Banks

“Trade-Based Money Laundering IS THE FENTANYL CRISIS”: Sources expose Chinese-Mexican-Canadian Crime Convergence

Prime Minister Justin Trudeau attends a dinner at the home of a United Front Work Department leader in Vancouver.

‘That famous picture of Trudeau at a Vancouver dinner with all those Chinese guys—They’re all in there’: Source on United Front money laundering suspects surveilled by US Agency

VANCOUVER and TORONTO — As debate rages over President Donald Trump’s disruptive tariffs on Canada, Mexico, and China—whether they represent a genuine war on fentanyl deaths tied to each nation’s role in the deadly supply chain, or merely a pretext for U.S. trade dominance—multiple Canadian and U.S. government sources have stepped forward to highlight a factor they believe North American citizens aren’t grasping amid Trump’s political rhetoric.

They point to the staggering scale and sophistication of trade-based money laundering orchestrated by Chinese Triads in Canada and Mexican cartels. This is a predominant concern in Canada, alongside revelations of so-called fentanyl superlabs hidden in rural areas, yet easily supplied by Canadian transportation hubs—shipping, rail, and trucking networks saturated with organized crime. These sources insist this little-understood form of criminal money laundering not only fuels fentanyl trafficking—ultimately linked to a complicit Beijing—but directly finances drug shipments initiated by Chinese networks in Toronto and Vancouver, sending fentanyl, methamphetamine, and cocaine across the Mexican border into California, specifically to trucking hubs around Los Angeles.

According to the primary source—a Canadian expert familiar with what they classify as an intricate trilateral partnership between Chinese Triads, the Chinese Communist Party’s United Front foreign influence networks, and Latin American cartels—these economic networks have effectively infiltrated multiple industries and commodities markets on Canada’s and Mexico’s west coasts, using them to conceal and amplify proceeds from fentanyl transactions.

In 2023, Canada’s financial watchdog, Fintrac, reported that Chinese networks had evolved beyond traditional casino-based laundering methods in Vancouver and Toronto, now mastering laundering through Canadian banks, law offices, real estate, and diaspora-based fraud networks. Yet according to The Bureau’s criminal intelligence source, these same networks—operating alongside the Sinaloa Cartel—also traffic in a range of commodities, from poached wildlife and agricultural staples like avocados and limes to rare Chinese delicacies such as geoduck, a phallic-shaped clam prized in hot pot and believed to have aphrodisiac properties.

The same source contends that while Canadian government agencies—including the RCMP, Fintrac, CBSA, and CSIS—understand the key players in the fentanyl trade, systemic issues within Canadian policing and prosecution allow these networks to operate with near impunity:

“The RCMP knows they have no framework within the Criminal Code, no resources, and no support from prosecution services. They just have no ability. And this whole thing with Trudeau saying that only 43 kilos of fentanyl—less than one percent—is coming from Canada is such a joke. It’s the interweaving of trade-based money laundering—if the public knew, it would blow their minds. I believe the U.S. government and Trump know it, and that’s why he’s doing what he’s doing.”

Put another way, what this expert and others argue is that the drug and trade wars engulfing the United States and China are not polarities—they are a single, intertwined conflict, with trade-based money laundering as the critical convergence. And the growing concern—that Canadian and Mexican governments might be benefiting from this illicit trade, perhaps even to the point of complicity—cannot be entirely dismissed.

The exposure of Canada’s prime minister to money laundering networks presents a layer of intrigue and troubling optics, likely recognized in Washington, according to four sources across Canada.

The primary source for this story—reinforcing explosive claims by other Canadian police experts in a recent investigation by The Bureau—provided specific new details, identifying major money laundering networks in Vancouver of concern to U.S. authorities. Among them were high-profile suspects openly acknowledged at a fundraising event attended by Prime Minister Justin Trudeau.

Specifically, the source identified Chinese individuals who had entered Canada on a private jet flagged by a U.S. government agency, which asked the RCMP to surveil them in Vancouver. These suspects were linked to a commercial real estate investor in Vancouver with direct ties to Beijing, and to organized crime figures connected to Beijing’s United Front in Canada.

The gates of an RCMP targeted property in Richmond, British Columbia.

The same individuals, notorious in elite Canadian enforcement circles, appeared in suspicious transaction reports and were central to a sweeping police intelligence investigation into vulnerabilities in Canada’s banking system. This investigation, known as Project Athena, was a major anti-gang initiative examining reports from Canada’s financial intelligence agency, Fintrac. Project Athena emerged after the collapse of its predecessor case, E-Pirate—reportedly Canada’s largest-ever drug money laundering probe—which targeted Chinese underground bankers in Vancouver and Toronto linked to the Sam Gor network, a Chinese syndicate dominated by the 14K, Big Circle, and Sun Yee On Triads.

As part of Project Athena, investigators uncovered a single money service bureau in Hong Kong that moved CAD $973 million over three years, primarily through Canadian banks. Several United Front and Triad-linked suspects from earlier investigations were tied to these transactions.

“That famous picture of Trudeau at a Vancouver dinner with all those Chinese guys—the ones we all know from various media reports? They’re all in there. They’re all in there moving money around,” the source said. “And this was just one money service bureau. Nearly a billion dollars in three years. So how many others are there?”

|

Paul King Jin and a number of Toronto and Vancouver-based Sam Gor associates targeted in the E-Pirate probe survived a 2020 gang execution in a Richmond sushi diner; Jin’s alleged underground banking partner Jian Jun Zhu was shot to death.

Buttressing their case, the source pointed to a remarkable cache of technical evidence seized from an underground casino in Richmond, just south of Vancouver, detailing the complexity of trade-based money laundering.

The evidence came from a mid-level Chinese Triad operative working for one of the underground banking bosses exposed in the RCMP’s E-Pirate probe of Sam Gor’s casino money-laundry networks.

In this subsequent investigation into Richmond-based underground casinos, investigators uncovered over 1,000 messages—texts, videos, and calls—confirming what Canadian authorities had long suspected and what American intelligence had warned about: the convergence of Triads and Mexican cartels.

In a microcosm, a mid-level Sam Gor agent in Vancouver and their Mexican cartel counterpart, coordinating major transborder narcotics and money laundering schemes, exemplified how Chinese and Mexican transnational networks dominate North American fentanyl trafficking.

Beyond coded drug negotiations, the messages revealed a broad trafficking scheme involving food and various commodities. As the law enforcement source explained, Triads and cartels exploit these commodities to launder illicit profits, amass market share, and tighten their grip on global supply chains.

The conversations demonstrated how narcotics could be smuggled across the border into California as easily as fresh produce or seafood was funneled into international markets.

“It was stunning, absolutely stunning to see coded drug talk, of course, all of that, the usual stuff that we expected to see—how they were going to get it shipped over the border in Mexico, that they had the ability to deliver into the Los Angeles area just north of Los Angeles,” the Canadian expert recalled. “And they would pick it up at these huge truck stops and they would specify in detail which vehicle. But what was equally stunning, was the fact that these two guys were also involved in a wide array of other items, consumer goods, everything from avocados to limes to geoduck clams to lobster, to anything that made a buck and allowed them to launder funds and to move capital through the system. They were trade-based money laundering experts.”

It was similar to the phenomenon seen domestically with Hells Angels in Vancouver infiltrating trucking and construction—but now expanded internationally via cartels and Triads, triangulating trade between China, Mexico, and Canada, the source argued.

The Triads and cartels use false invoicing and front companies, trade-money laundering experts say, securing meth and fentanyl shipments into the United States in exchange for sending legal commodities to Mexico or China. Drug shipments are often concealed within legitimate and counterfeit goods manufactured in China.

“And so they start taking over industries. That’s why your price of limes is what it is today—because the cartels have cornered the market, trying to put those drug proceeds somewhere. So let’s start buying up commodities and controlling sectors. And that’s what this case was. It confirmed everything we had received and heard from the FBI and DEA in bulletins for many years.”

The source added that while this particular cache of communications involved methamphetamine and cocaine—referred to as “glass” and “girls” in coded narco communications—it did not directly pertain to fentanyl. However, the Triad operator and the Mexican cartel associate appeared to broach the subject, at which point the cartel operative redirected the Canada-based Triad to another handler in Mexico.

“The cartel guy he was speaking with on this particular phone was the one handling coke and meth,” the source said. “So it’s like, ‘Hey, I’m interested in this.’ ‘Oh, I don’t deal with that. That’s my associate. You’ll have to go through someone else.’ They segment it. It’s just such a tapestry—but we’re still asleep at the wheel here.”

|

Prime Minister Justin Trudeau attends a dinner at the home of a United Front Work Department leader in Vancouver.

Disclosing the stunning connections and scale of Triad influence on Canada’s West Coast, the source said the “underling” whose device was seized—revealing hundreds of money laundering and drug transaction deals between the Triad and a Mexican cartel—was working for one of the targets in the E-Pirate investigation, a Vancouver underground banking boss.

That same boss was tracked by the RCMP in another shocking and illustrative incident involving two Chinese airline pilots passing through Vancouver who were caught smuggling bear-paw parts. Like any other travelers, the Chinese pilots underwent standard security checks and were found carrying contraband poached in Canada. Parts from bears—and even massive polar bear mounts harvested from northern Canada—are sold for significant profits to Chinese buyers, the expert explained.

In this case, when the Chinese pilots were released from jail, the individual who arrived to collect them was an underling of the E-Pirate underground banking boss—a major figure in Chinese organized crime in North America. This individual is also said to be responsible for the large-scale export of luxury vehicles from Vancouver to China, the Canadian expert said.

“We found out that a hundred-thousand-dollar Mercedes here in Vancouver is worth between three and five times that overseas. So there’s your money laundering right there.”

The process operates much like the drug-cash laundering schemes identified by U.S. experts, including former Trump administration senior investigator David Asher. Asher contends that the Department of Justice’s $3 billion USD TD Bank money laundering prosecution exposed how Chinese international students—under the direction of China’s United Front Work Department cells—were tasked with collecting and depositing drug cash into bank accounts, transforming illicit funds into real estate mortgages for powerful Chinese criminals operating behind the scenes.

A similar system using Chinese students operates in Vancouver’s luxury vehicle market and drug cash collection networks, a Canadian expert said, describing it as a “diversification” of narco-laundering.

“So imagine moving a hundred thousand dollars’ worth of capital here and walking away with a $400,000 net profit overseas,” the expert explained. “It’s perfect. Then you buy the chemicals, ship them to Mexico, make the meth, make the fentanyl, and move the product north through the States or by other routes. But that’s the part people are just not connecting and are not willing to contemplate.

“We’ve got to embrace the complexity of it all. Every conceivable way you can think of to move product—that’s what they’re doing. Land, sea, air. Because just like a good corporation or investor diversifies their financial portfolio to limit risk, the same logic applies to fentanyl trafficking.”

Meanwhile, Eastern Canadian counterparts agreed. One source—who could not be identified but has expertise in Canadian mortgage regulations and private due diligence on mortgage lending fraud—provided industry-based insight into the players involved in the RCMP’s Project Athena investigation and related Fintrac reports. These reports examined 48,000 pandemic-era banking transactions within the Chinese diaspora, involving Canadian banks and ‘money mule’ accounts—often fronted by Chinese students—used to fund fraudulent mortgages with funds wired from Hong Kong and China.

The industry source estimated that systemic fraud plagues the Greater Toronto real estate market. According to this source, up to 20 percent of home purchases involve fraudulent mortgage applications.

“I am the street-level witness of how banks finance criminal activity. Extrapolating my findings, the amount of money embedded in Canadian housing is enough to make one weep,” they said, estimating that more than CAD $1 trillion may have been laundered through Toronto real estate in this manner over the past 12 years.

|

This Greater Toronto mansion was associated with the same Sam Gor Triad networks and United Front operatives active in Vancouver, police and intelligence sources say.

The source affirmed that their knowledge aligns with Fintrac’s findings on underground banking and diaspora lending, noting that beyond the Chinese migrant community, industry experts have identified similar investment and lending schemes within the Indian diaspora. Meanwhile, several Eastern Canadian police sources familiar with Fintrac’s findings on Chinese diaspora money flows—as well as large-scale vehicle theft and trade-based money laundering investigations—said they also believe Greater Toronto is a key money laundering and drug transport hub for the Triad-Cartel nexus, a concern Washington has expressed deep alarm over.

“One thing that isn’t being talked about on this side of the border in this recent activity is the pervasiveness of money laundering and its links to all of the criminality,” one police source said.

Another expert suggested that Greater Toronto could be the largest drug-trafficking market by volume in North America, adding that diaspora-based crime groups exert significant influence over all modes of transportation across Ontario, including air traffic. “So you have a few hundred more officers driving up and down the border routes now?” they said, chuckling derisively.

A U.S. government expert criticized Canada’s government and media—particularly reporting from The Globe and Mail that echoes Prime Minister Trudeau’s seizure data arguments—for failing to grasp the scale of fentanyl and illicit trade, calling the country’s focus on relatively small seizure data misleading.

This expert aligned with Canadian federal law enforcement officials who point to highly sophisticated, trade-based money laundering schemes linking Mexican cartels and Chinese Triad networks operating in Vancouver and Toronto. These networks, the U.S. expert explained, facilitate the cross-border flow of methamphetamine, cocaine, and fentanyl, using multi-commodity trade-based money laundering transactions to disguise their profits.

They suggested that Canada either lacks a full understanding of the issue or is failing to take U.S. concerns seriously. By not adopting a more forthright stance—particularly in assessing the scale of money laundering linked to illicit drugs and organized crime—they believe Canada is ultimately undermining its own interests. Meanwhile, U.S. authorities, they asserted, have a clearer and more comprehensive picture of the problem.

This could explain why, following his unexpected victory in the November 2024 election, President Donald Trump swiftly threatened tariffs on Canada and Mexico—a move that puzzled and stunned most observers.

Two Canadian sources suggested the decision was influenced, at least in part, by a bipartisan congressional report on fentanyl released in December.

“It’s certainly one of the most pressing and high-profile developments in the crisis,” one source said.

The congressional working group behind the report spent months expanding on the Select Committee’s bipartisan investigation, which, for the first time, documented how the Chinese Communist Party directly subsidizes the production of fentanyl precursors and analogues.

Lawmakers are now advancing three bipartisan bills aimed at bolstering law enforcement, expanding sanctions against Chinese-backed entities involved in drug trafficking, and imposing financial penalties on organizations that fail to enforce transparency measures to curb illicit drug flows.

“For too long, China has profited from the destruction of American lives, and the fentanyl crisis they are fueling knows no borders,” said Representative Dan Newhouse, chairman of the congressional working group. “As we continue fighting the immediate threat this drug poses, we are also going after the CCP and its central role in subsidizing, producing, and exporting the precursors that drive this epidemic.”

In response to Trump’s formal imposition of tariffs on Tuesday, Canada’s Finance Ministry issued a statement emphasizing the country’s efforts to combat fentanyl smuggling. “Less than 1 percent of fentanyl and illegal crossings into the United States come from Canada, yet the government launched a $1.3 billion border plan with new choppers, boots on the ground, more coordination, and increased resources to stop the flow of fentanyl,” the statement read.

That same day, U.S. Senator Jeanne Shaheen, ranking member of the Senate Foreign Relations Committee, issued a sharp rebuke of Trump’s economic policies following his joint address to Congress.

“President Trump’s address this evening laid bare a cynical and profoundly dangerous approach to America’s global leadership,” Shaheen said. “His 25 percent tariffs on Mexico and Canada—our closest trading partners—threaten to unravel decades of economic cooperation and will inevitably result in economic consequences for American workers and businesses.”

But a Canadian expert dismissed Canada’s efforts as insufficient.

“If you really want to do something lasting here—I mean, I don’t want to sound like I’m pro-Trump in that sense—but you’d have to have a leader in this country willing to crack open the Charter and the criminal code and make radical changes,” the expert said. “This is stuff Canada should have addressed 25 years ago. But through successive liberal governments, we’ve allowed it to continue, and now we’re caught with our pants down.

“If we think we can just start throwing numbers at this and that’ll fix it, that’s a mistake,” the expert continued. “The problem is the framework in Canada—it has made this attractive. The police know what’s going on, but they don’t have the tools to prosecute and disincentivize this. Trump knows this. Imagine it from his perspective: He’s surrounded by weaklings exploiting and killing Americans. He’s not wrong.”

Underscoring the paralysis of Canada’s federal police under the current legal framework, the source reiterated that a broken prosecutorial system not only fails to secure charges against entrenched Chinese and Mexican criminal networks but refuses to even consider cases.

“This is what happens when you’ve got such a decayed system—whether it’s the Charter of Rights, the Criminal Code, the prosecution services, or just the broader demoralization of policing, compounded by chronic resourcing issues for years,” the primary source for this story said. “They just go for the easy stuff. Anything complex—they don’t touch it. I don’t think they’ve tackled a serious file since the E-Pirate case collapsed. The prosecution service basically said, ‘Look, we’re dealing with the same resourcing issues. Don’t send us these complex files. We can’t handle anything with more than three names listed in your report.’”

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Please support a public interest startup. We break international stories and this requires elite expertise, time and legal costs.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

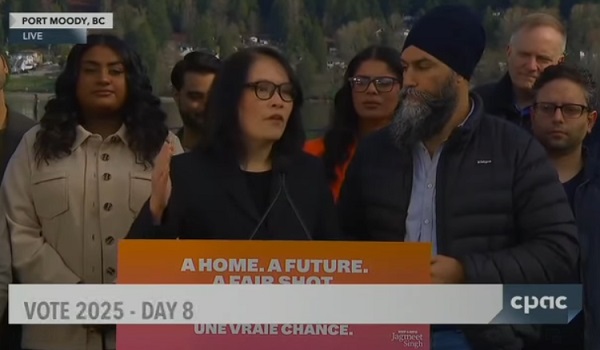

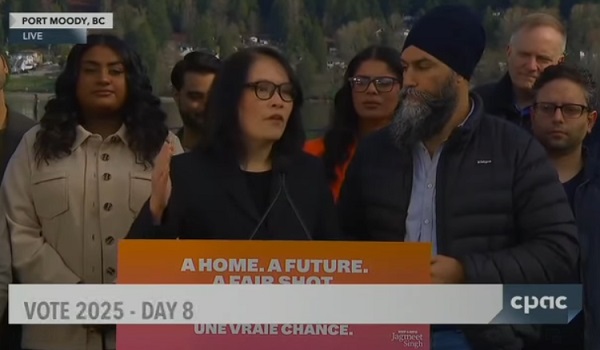

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure