Business

“You Have To Take The Emotion Out Of Investing” – Are You Considering Buying In?

Are you? You may not be the only one. We have seen stock markets like the Toronto Stock Exchange take major hits over the past two months due to the effects of Covid-19 taking its toll on almost every industry. With some recent rises in markets continuing to build investor confidence, we are still left in the unknown for why this is happening. Living through a historically unprecedented time uncovers a long list of questions and concerns for our livelihood as individuals, quality of life for the future, and how best to navigate through this time. I’m sure during the Irish potato famine in 1845-1849, there were many people asking – what’s going on with all the potatoes?

In a survey undertaken by the group “500 Startups” based in Silicon Valley, surveyed a group of investors to report on how they have been affected by the pandemic. The investor group consisted of venture capitalists, angel investors, corporate venture investors, and family office investors. The report showed 83% having their investment activity and plans be affected by Covid-19. As seen in the chart below, 62.6% of the group feel that startups and early-stage investors will be feeling the effects of the pandemic for 1-2 years. Their advice to startups during this time is to simply decrease costs and to increase their runway for how long they can stay in business.

Data taken from 500 Startups report on The Impact of COVID-19 on the Early-Stage Investment Climate

We spoke with Kevin Skinner, an investment advisor for Servus Wealth Strategies, who gave us some insight and knowledge pertaining to open concerns for novice investors who may be seeking to enter the market or simply are in the dark for what to with their holdings. Kevin has been working in the financial services industry for over a decade and is a top investment advisor in their St. Abert branch.

Considering what we have seen so far in stock markets, Is it a good time for new long term investors to buy now or continue to wait?

Striving away from the idea that fortune-tellers exist within trading, which is not true, a good education on markets is always a good pre-market investment of your own time. In regards to those looking to be a long term investor, he mentions:

“If you’re a long term investor the adage is that it’s always the best time…so question number one has to be, can you afford to invest the money right now…the second question is, what else can you do with this money. If you have $10,000 in the bank and $10,000 in credit card debt, always better to pay off the debt than you are investing that money.”

We want our money working for us right? Having a solid grasp of how your money is working for you may allow you to make a better-educated investment without adding any financial risk. The idea that there are smoke signals in the market to tell you it is the right time to invest, he mentions:

“If it was that easy, I would be sitting on my private island somewhere enjoying the world…It really is about investing correctly and investing to your plan. If your plan is to have the money for the long term, You need to have an understanding of your risks and your comfort.”

What if I have money to invest right now, should I wait for the bottom line?

Kevin advised the dollar cost average tool to take the emotion out of investing. With so much volatility in the market, we revisit the concept that fortune-tellers exist to tell other investors when to buy; there is no way to fully identify the risks. To ensure you’re getting good value for your money, Kevin offers an example of the dollar cost average approach:

“Take your pool of money, call it $12,000. You invest $1,000 a month in a particular fund. You catch the market as it wobbles, so you don’t necessarily buy it all at the bottom, you’re definitely not buying it all at the top. You’re averaging your cost date and to get a good value for what you’re buying.”

Do you have an opinion on panic selling at a loss?

Straight out of the gate, Kevin is a firm believer that anything that involves the word “panic” is never a good thing. Investopedia’s definition of panic selling refers to the sudden, wide-scale selling of a security or securities by a large number of investors, causing a sharp decline in price. We have seen this as a result of the COVID-19 pandemic. Panic selling can be directly related to having an emotional connection to your investment, but to ensure the doom and gloom doesn’t get the better of you, having an objective view allows you to stay logical and stick to your plan. Kevin mentions:

“you have to do whatever you can to pull that emotion back out. Panic selling immediately is focused on the emotional side of it. You have to remove the emotion from investing.”

Not as easy as it sounds right? We are going through an emotionally ramped up time during this pandemic, not to mention dealing with all the other unknown realities of how our economy will bounce back or when the non-essential business will be reopened. Kevin recommends choosing places to move your investments to take the panic out.

“You don’t call a realtor when your house is on fire. That’s where we’re at in the market right now, we know the house is on fire. We don’t know how long it’s going to last, how bad it’s going to be, or what it’s going to look like when it’s put out.”

Can you offer any comment on the fear of more lows, or what are the key indicators that we should be aware of?

We have seen stocks rise over the past week due to economic stimulus measures and the actions being taken to gradually reopen global economies. Experienced investors are forward-thinking individuals, they take into consideration the risk-reward for having objective optimism in certain industries. Kevin encourages to take the view that the rises we have seen are temporary for now, he mentions:

“Know that there’s another drop coming. Know that we don’t know how bad it’s going to be. And we don’t know how long the recovery is going to take. which is why we’re saying it’s going to be 2021 at least before the flooding of the market recovers”

We are expecting a long and slow road to recovery, but finding the bottom line can be almost impossible. Ask yourself, what happens to market optimism if a vaccine is made available tomorrow? Does that mean the market will become flooded with investors? It is impossible to know; by choosing a trusted investment advisor they can assist with taking the emotion out of your investments, and you can lean on their knowledge of markets to offer that objective optimism. For individual investors, it is useful to be aware of the activity in that sector to aid in growing your confidence, or the counter, it may give you key information to avoid a bad buy right now.

How have you been navigating through this time?

Kevin is one of many continuing to work from home during this period of self-isolation. With any new environment carries challenges. He is thankful for Servus Credit Union for the support he has received and the efforts put forward by the whole team. He has been spending some time in the welcomed sunshine playing sports with his 12-year-old son in his driveway.

What has Servus Credit Union been proactively doing to support its customers right now?

Servus Credit Union released their response to COVID-19, issuing kind words to their members that they are here for them during this time. Their CEO, Garth Warner also released a personal letter to all of their members speaking on behalf of the team doing everything they can do to support their members. Kevin mentions:

“Our members are truly members, they’re all owners. Everyone who deals with the credit union holds a piece of the credit union. Right now we’re trying to keep our whole business, our owners, and our members afloat…so whatever we do, is what’s best for us as an organization which means it’s also what’s best for our members”

What are you personally looking forward to after this period of self-isolation?

“I coach sports. Of course every kid’s sport is canceled right now. We lost the end of our sports seasons for the winter, we’re going to miss the beginning of our sports season for the spring. And that’s what I miss most is getting outside with the kids and just having fun.”

If you would like to learn more about Servus Credit Union, Servus Wealth Strategies or Kevin Skinner, visit their website or social links below.

Facebook Twitter LinkedIn Instagram YouTube

For more stories, visit Todayville Calgary

Alberta

Emissions Reduction Alberta offering financial boost for the next transformative drilling idea

From the Canadian Energy Centre

$35-million Alberta challenge targets next-gen drilling opportunities

‘All transformative ideas are really eligible’

Forget the old image of a straight vertical oil and gas well.

In Western Canada, engineers now steer wells for kilometres underground with remarkable precision, tapping vast energy resources from a single spot on the surface.

The sector is continually evolving as operators pursue next-generation drilling technologies that lower costs while opening new opportunities and reducing environmental impacts.

But many promising innovations never reach the market because of high development costs and limited opportunities for real-world testing, according to Emissions Reduction Alberta (ERA).

That’s why ERA is launching the Drilling Technology Challenge, which will invest up to $35 million to advance new drilling and subsurface technologies.

“The focus isn’t just on drilling, it’s about building our future economy, helping reduce emissions, creating new industries and making sure we remain a responsible leader in energy development for decades to come,” said ERA CEO Justin Riemer.

And it’s not just about oil and gas. ERA says emerging technologies can unlock new resource opportunities such as geothermal energy, deep geological CO₂ storage and critical minerals extraction.

“Alberta’s wealth comes from our natural resources, most of which are extracted through drilling and other subsurface technologies,” said Gurpreet Lail, CEO of Enserva, which represents energy service companies.

ERA funding for the challenge will range from $250,000 to $8 million per project.

Eligible technologies include advanced drilling systems, downhole tools and sensors; AI-enabled automation and optimization; low-impact rigs and fluids; geothermal and critical mineral drilling applications; and supporting infrastructure like mobile labs and simulation platforms.

“All transformative ideas are really eligible for this call,” Riemer said, noting that AI-based technologies are likely to play a growing role.

“I think what we’re seeing is that the wells of the future are going to be guided by smart sensors and real-time data. You’re going to have a lot of AI-driven controls that help operators make instant decisions and avoid problems.”

Applications for the Drilling Technology Challenge close January 29, 2026.

armed forces

Global Military Industrial Complex Has Never Had It So Good, New Report Finds

From the Daily Caller News Foundation

The global war business scored record revenues in 2024 amid multiple protracted proxy conflicts across the world, according to a new industry analysis released on Monday.

The top 100 arms manufacturers in the world raked in $679 billion in revenue in 2024, up 5.9% from the year prior, according to a new Stockholm International Peace Research Institute (SIPRI) study. The figure marks the highest ever revenue for manufacturers recorded by SIPRI as the group credits major conflicts for supplying the large appetite for arms around the world.

“The rise in the total arms revenues of the Top 100 in 2024 was mostly due to overall increases in the arms revenues of companies based in Europe and the United States,” SIPRI said in their report. “There were year-on-year increases in all the geographical areas covered by the ranking apart from Asia and Oceania, which saw a slight decrease, largely as a result of a notable drop in the total arms revenues of Chinese companies.”

Notably, Chinese arms manufacturers saw a large drop in reported revenues, declining 10% from 2023 to 2024, according to SIPRI. Just off China’s shores, Japan’s arms industry saw the largest single year-over-year increase in revenue of all regions measured, jumping 40% from 2023 to 2024.

American companies dominate the top of the list, which measures individual companies’ revenue, with Lockheed Martin taking the top spot with $64,650,000,000 of arms revenue in 2024, according to the report. Raytheon Technologies, Northrop Grumman and BAE Systems follow shortly after in revenue,

The Czechoslovak Group recorded the single largest jump in year-on-year revenue from 2023 to 2024, increasing its haul by 193%, according to SIPRI. The increase is largely driven by their crucial role in supplying arms and ammunition to Ukraine.

The Pentagon contracted one of the group’s subsidiaries in August to build a new ammo plant in the U.S. to replenish artillery shell stockpiles drained by U.S. aid to Ukraine.

“In 2024 the growing demand for military equipment around the world, primarily linked to rising geopolitical tensions, accelerated the increase in total Top 100 arms revenues seen in 2023,” the report reads. “More than three quarters of companies in the Top 100 (77 companies) increased their arms revenues in 2024, with 42 reporting at least double-digit percentage growth.”

-

Energy1 day ago

Energy1 day agoCanadians will soon be versed in massive West Coast LPG mega-project

-

Alberta2 days ago

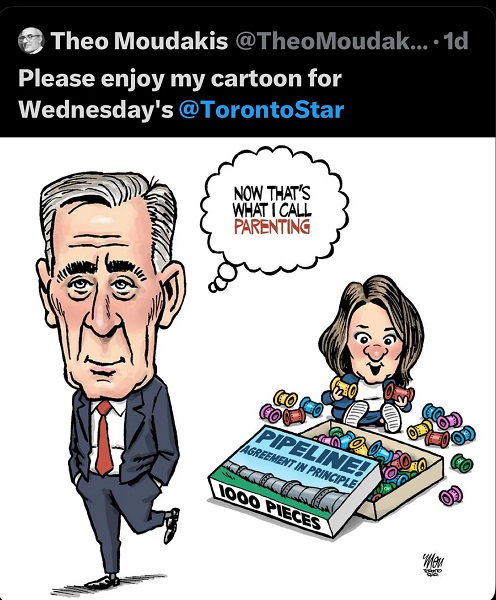

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

Alberta2 days ago

Alberta2 days agoNet Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

-

Food2 days ago

Food2 days agoCanada Still Serves Up Food Dyes The FDA Has Banned

-

Addictions2 days ago

Addictions2 days agoManitoba Is Doubling Down On A Failed Drug Policy

-

COVID-192 days ago

COVID-192 days agoFDA says COVID shots ‘killed’ at least 10 children, promises new vaccine safeguards

-

Daily Caller1 day ago

Daily Caller1 day agoTom Homan Predicts Deportation Of Most Third World Migrants Over Risks From Screening Docs

-

National17 hours ago

National17 hours agoMedia bound to pay the price for selling their freedom to (selectively) offend