Alberta

Writer opposing Free Alberta Strategy in national article confuses chartered banks with financial institutions

From the Free Alberta Strategy Team

In a new article published in the federal-government-funded “The Conversation” publication, Robert L. Ascah, a researcher at the also-federal-government-funded Parkland Institute, attempts to lay the hatchet to the Free Alberta Strategy.

In his piece, entitled “What the Free Alberta Strategy gets wrong about Canada’s banking system,” Mr. Ascah argues that the Alberta Independent Banking Act that is proposed in the Free Alberta Strategy report is unconstitutional because banking is an entirely federal area of jurisdiction.

Here is the key quote from Mr. Ascah:

“The Free Alberta Strategy, however, purports to allow Alberta to incorporate and regulate banks, which is clearly unconstitutional. There’s no mention that this proposal is beyond the powers of the provincial legislature.”

But, as so often seems to happen, this latest Free Alberta Strategy critic clearly doesn’t appear to have read – or taken the time to understand – what the Free Alberta Strategy is actually proposing.

While it’s true that “chartered banks” are federally regulated, that doesn’t mean that any type or form of “banking”, as the term is colloquially used, must be federally regulated.

Credit unions, for example, offer “banking” services, while not being “chartered banks” that are federally regulated.

This definition, while technical, is the crux of the issue.

And while we admit that this is very technical, when you’re talking about writing laws, technicalities matter a lot.

To be clear, here is the exact proposal from the Free Alberta Strategy report itself:

1. Expanding the number of provincially regulated financial institutions and credit unions;

2. Promoting private ownership of these new financial institutions; and

3. Mandating that all provincially regulated financial institutions and credit unions (including ATB) remain compliant with the Alberta Sovereignty Act as it relates to the non-enforcement of federal laws and court decisions deemed to infringe unduly on Alberta’s provincial jurisdiction.

You will note, very clearly, that this proposal in our Free Alberta Strategy report talks about “provincially regulated financial institutions” not “chartered banks”.

This is because the authors of the strategy understand (unlike Mr. Ascah, apparently) that while “chartered banks” must be regulated by the federal government, “financial institutions” can be regulated by the provincial government.

This is exactly why our Free Alberta Strategy report suggests modelling any new “banks” in Alberta on ATB Financial (previously known as Alberta Treasury Branches), which is a long-standing Alberta financial institution.

(Note: Although ATB is a crown corporation, our proposal envisages privately owned and operated financial institutions, not more government-owned and operated financial institutions. Just in case anyone was worried we were suddenly advocating for bigger government!)

Just as Alberta’s credit unions are not “chartered banks” and so are not federally regulated, ATB Financial is not a “chartered bank”, and so it is not regulated by the federal government.

ATB Financial is a “financial institution” that is provincially regulated by the Alberta government under the ATB Financial Act.

This is precisely what the Free Alberta Strategy report proposes – an increase in the number of provincially regulated financial institutions in Alberta.

We can clearly see then that, despite the claim by Mr. Ascah that provincial regulation of banking is unconstitutional, the mere existence of ATB is proof that our proposal is, in fact, constitutional.

The remainder of Mr. Ascah’s article goes on to argue that if Alberta unconstitutionally incorporated its own new “chartered banks”, the federal government would cut those banks off from being able to transfer funds to other banks in Canada, making them impractical for the public to use.

Maybe it’s true that the federal government would cut off any unauthorized provincial “chartered banks” from payment mechanisms.

But, given no one is proposing Alberta incorporate its own new “chartered banks”, this entire second half of the article is an irrelevant straw man argument.

Again, the Free Alberta Strategy proposes to incorporate new provincially regulated financial institutions, like ATB.

And, in case you haven’t noticed, ATB has not been cut off from being able to transfer funds to other banks by the federal government, because – shock – the existence of ATB is perfectly constitutional.

The real question then, is whether or not the first half of Mr. Ascah’s article, where he claims we are proposing to do something unconstitutional, is simply a misunderstanding, or a deliberately misleading diatribe.

Either way, such a fundamental error really makes you wonder why the Parkland Institute would allow the article to be published at all!

Are Parkland Institute staff no longer expected to read the thing they are publicly criticizing anymore?

Are The Conversation editors no longer expected to check whether their authors have their facts straight?

Perhaps the oddest part of this whole situation is that the Parkland Institute, where Mr. Ascah works, has previously written about the benefits of having an Alberta-based, Alberta-regulated financial institution!

They did so in a report that goes into detail explaining the difference between federally regulated chartered banks and provincially regulated financial institutions!

Even stranger still – which Parkland Institute researcher do you think it was who wrote this report?

Yes, you guessed it, it was Robert L. Ascah!

It gets worse…

Once upon a time, Mr. Ascah worked at Alberta Treasury, the government department that is responsible for regulating ATB.

Then, after he worked at Alberta Treasury, Mr. Ascah went to work at ATB itself, where he was responsible for government relations, strategic planning, and economic research.

That’s right folks…

Our Free Alberta Strategy critic, who attacked us by claiming that provincially regulated financial institutions are unconstitutional, actually worked as a senior executive at both the organization he claims is unconstitutional, and the organization that is supposed to regulate the thing that he claims is unconstitutional.

We must either believe, then:

- That Mr. Ascah, who has written about the benefits of provincially-regulated financial institutions, has worked for a provincially-regulated financial institution, and has worked for the organization that regulates provincially-regulated financial institutions, is somehow entirely unaware that provincially-regulated financial institutions are legal.

Or, we must believe:

- That Mr. Ascah perfectly understands that provincially-regulated financial institutions are legal and that that is how ATB is established, but that it’s somehow, all of a sudden, now beneficial for him to pretend that he doesn’t, and that anyone suggesting other financial institutions be regulated in that way is suggesting something “unconstitutional”.

How could it possibly be beneficial for Mr. Ascah to pretend that this idea is unconstitutional all of a sudden, I hear you ask?

Well, the answer to that question is actually the least confusing part of his article.

Contained right at the bottom of the article, under “Disclosure statement” (and conveniently excluded from most re-publications of the piece by the media) are 9 little words:

“Robert (Bob) L. Ascah is affiliated with Alberta NDP.”

Of course, affiliated with is a little bit of an understatement in this case.

Mr. Ascah has donated thousands of dollars to the Alberta NDP for many years, while several of his Parkland Institute colleagues are actually running as Alberta NDP candidates in the 2023 Alberta election!

Now, as a non-partisan organization, we generally try to avoid pointing out the political affiliations of individual people.

As an organization, we base our support for ideas on whether the ideas are good or not, rather than on who is proposing them.

But, in this case, we’re not criticizing the person proposing the ideas, but the lack of independence and the conflict of interest inherent in a situation where federal-government-funded researchers are published by federal-government-funded websites and re-printed by federal-government-funded newspapers.

Unfortunately, in a world where government-funded academics get government funding to write government propaganda published in government-funded media, there’s really no incentive to cover the truth anymore.

As to why the federal government would want to fund researchers to write propaganda for them, and fund media outlets to publish it for them, we’ll leave that one to you to answer!

In the end, this is exactly why we need more independent research and independent distribution of ideas in our society.

The Free Alberta Strategy jealously guards our independence.

That’s why we never accept any money or resources from any government, regardless of political stripe.

But that’s also why we need your help.

We need your help so that we can continue to do research and analysis on ways in which Alberta can fight back, such as the Sovereignty Act.

We need your help to further our work to protect Alberta’s interests from a hostile and divisive federal government in Ottawa.

We need your help to grow our supporter, activist, and volunteer network across our great province.

We need your help to share our work with like-minded friends and family in order to get the word out to as many members of the public as possible.

If you’re ready to help, click here:

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

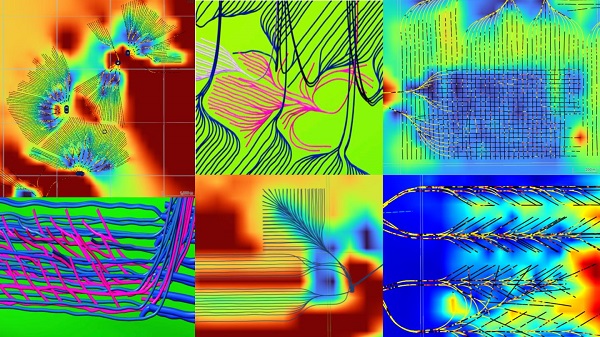

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Health1 day ago

Health1 day agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Opinion20 hours ago

Opinion20 hours agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Business2 days ago

Business2 days agoI Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

-

Carbon Tax1 day ago

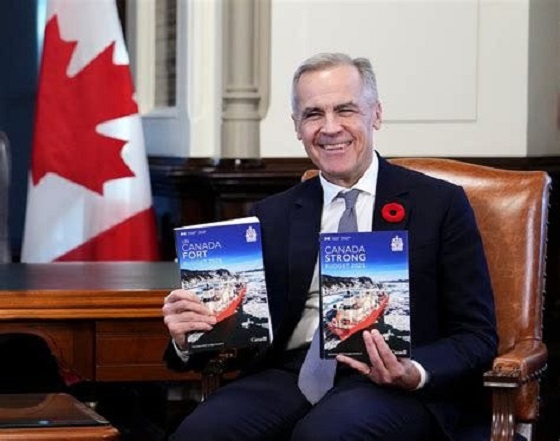

Carbon Tax1 day agoCarney fails to undo Trudeau’s devastating energy policies

-

Business1 day ago

Business1 day agoBudget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

-

International1 day ago

International1 day agoCanada’s lost decade in foreign policy

-

armed forces1 day ago

armed forces1 day agoCanada At Risk Of Losing Control Of Its Northern Territories

-

Business2 days ago

Business2 days agoLarge-scale energy investments remain a pipe dream