Energy

What does a Trump presidency means for Canadian energy?

From Resource Works

Heather-Exner Pirot of the Business Council of Canada and the Macdonald-Laurier Institute spoke with Resource Works about the transition to Donald Trump’s energy policy, hopes for Keystone XL’s revival, EVs, and more.

Do you think it is accurate to say that Trump’s energy policy will be the complete opposite of Joe Biden’s? Or will it be more nuanced than that?

It’s more nuanced than that. US oil and gas production did grow under Biden, as it did under Obama. It’s actually at record levels right now. The US is producing the most oil and gas per day that any nation has ever produced in the history of the world.

That said, the federal government in the US has imposed relatively little control over production. In the absence of restrictive emissions and climate policies that we have in Canada, most of the oil production decisions have been made based on market forces. With prices where they’re at currently, there’s not a lot of shareholder appetite to grow that significantly.

The few areas you can expect change: leasing more federal lands and off shore areas for oil and gas development; rescinding the pause in LNG export permits; eliminating the new methane fee; and removing Biden’s ambitious vehicle fuel efficiency standards, which would subsequently maintain gas demand.

I would say on nuclear energy, there won’t be a reversal, as that file has earned bipartisan support. If anything, a Trump Admin would push regulators to approve SMRs models and projects faster. They want more of all kinds of energy.

Is Keystone XL a dead letter, or is there enough planning and infrastructure still in-place to restart that project?

I haven’t heard any appetite in the private sector to restart that in the short term. I know Alberta is pushing it. I do think it makes sense for North American energy security – energy dominance, as the Trump Admin calls – and I believe there is a market for more Canadian oil in the USA; it makes economic sense. But it’s still looked at as too politically risky for investors.

To have it move forward I think you would need some government support to derisk it. A TMX model, even. And clear evidence of social license and bipartisan support so it can survive the next election on both sides of the border.

Frankly, Northern Gateway is the better project for Canada to restart, under a Conservative government.

Keystone XL was cancelled by Biden prior to the invasion of Ukraine in 2022. Do you think that the reshoring/friendshoring of the energy supply is a far bigger priority now?

It absolutely is a bigger priority. But it’s also a smaller threat. You need to appreciate that North America has become much more energy independent and secure than it has ever been. Both US and Canada are producing at record levels. Combined, we now produce more than the Middle East (41 million boe/d vs 38 million boe/d). And Canada has taken a growing share of US imports (now 60%) even as their import levels have declined.

But there are two risks on the horizon: the first is that oil is a non renewable resource and the US is expected to reach a peak in shale oil production in the next few years. No one wants to go back to the days when OPEC + had dominant market power. I think there will be a lot of demand for Canadian oil to fill the gap left by any decline in US oil production. And Norway’s production is expected to peak imminently as well.

The second is the need from our allies for LNG. Europe is still dependent on Russia for natural gas, energy demand is growing in Asia, and high industrial energy costs are weighing on both. More and cheaper LNG from North America is highly important for the energy security of our allies, and thus the western alliance as it faces a challenge from Russia, China and Iran.

Canada has little choice but to follow the US lead on many issues such as EVs and tariffs on China. Regarding energy policy, does Canada’s relative strength in the oil and gas sector give it a stronger hand when it comes to having an independent energy policy?

I don’t think we want an independent energy policy. I would argue we both benefit from alignment and interdependence. And we’ve built up that interdependence on the infrastructure side over decades: pipelines, refineries, transmission, everything.

That interdependence gives us a stronger hand in other areas of the economy. Any tariffs on Canadian energy would absolutely not be in American’s interests in terms of their energy dominance agenda. Trump wants to drop energy costs, not hike them.

I think we can leverage tariff exemptions in energy to other sectors, such as manufacturing, which is more vulnerable. But you have to make the case for why that makes sense for US, not just Canada. And that’s because we need as much industrial capacity in the west as we can muster to counter China and Russia. America First is fine, but this is not the time for America Alone.

Do you see provinces like Alberta and Saskatchewan being more on-side with the US than the federal government when it comes to energy?

Of course. The North American capital that is threatening their economic interests is not Washington DC; it’s Ottawa.

I think you are seeing some recognition – much belated and fast on the heels of an emissions cap that could shut in over 2 million boe of production! – that what makes Canada important to the United States and in the world is our oil and gas and uranium and critical minerals and agricultural products.

We’ve spent almost a decade constraining those sectors. There is no doubt a Trump Admin will be complicated, but at the very least it’s clarified how important those sectors are to our soft and hard power.

It’s not too late for Canada to flex its muscles on the world stage and use its resources to advance our national interests, and our allies’ interests. In fact, it’s absolutely critical that we do so.

Energy

China undermining American energy independence, report says

From The Center Square

By

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

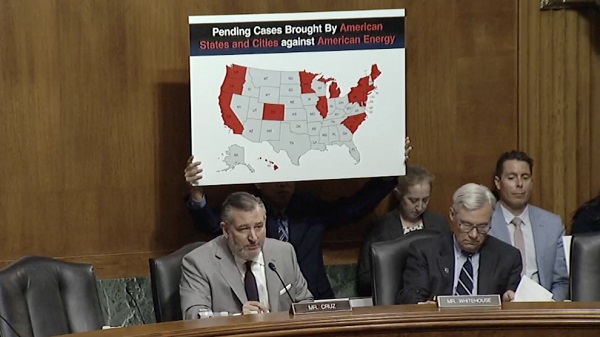

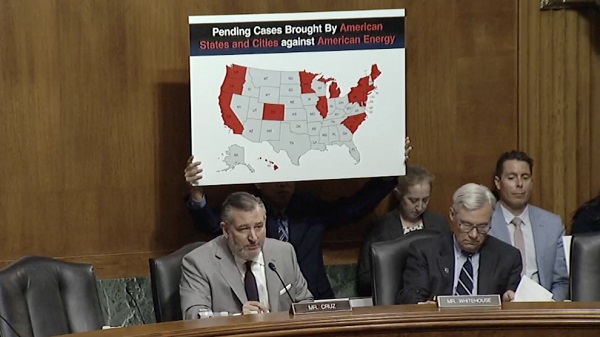

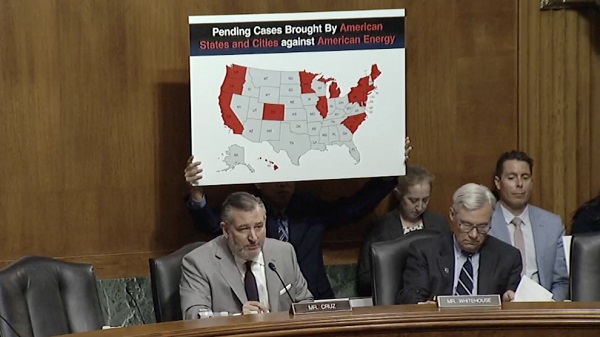

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Automotive1 day ago

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Alberta5 hours ago

Alberta5 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Business8 hours ago

Business8 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Crime7 hours ago

Crime7 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Energy1 day ago

Energy1 day agoChina undermining American energy independence, report says