Business

What an Effective All-of-Government Program Review Might Look Like

More than once in this space I’ve advocated for a comprehensive all-of-government review to find and eliminate waste and corruption. So it’s about time I set finger to keyboard and started mapping out how such a review might unfold.

Why is it just this moment in history that finds me so passionate about reviews?

Canada’s government spends more money than it receives. I know that’s hardly breaking news, but Ottawa’s reckless and frenzied race to max out every credit card in the known universe has driven the federal debt to $1.24 trillion. That’s 42.1 percent of GDP.¹

Among the biggest expenses? Employment growth in the federal civil service. Parliament employed 276,367 people in 2015 but by 2023 that had exploded to 370,368. That 94,001 increase amounts to a jump of 34 percent. For context, Canada’s overall population during that time increased by just 12 percent.

Given that the average weekly earnings for individuals employed in federal government public administration was $1,779 in 2023, just covering salaries for those extra 94,001 workers cost us $8.7 billion through that year.

But workers cost us much more than just their salaries. There are pension and CPP contributions, EI premiums, health and dental benefits, and indirect costs like office accommodations and training. All that could easily add another $50,000 per employee. Multiply that by all the new hires, and the total cost of those extra 94,001 workers has ballooned to $13.4 billion. That would be nearly a quarter of the deficit from the 2024 $61.9 billion fall update.² (Chrystia Freeland may not have been the one to officially announce that number, but she and her boss were the ones who got us there.)

Of course using a lottery to select, say, two out of every five bureaucrats for firing won’t give us the result we’re after. We want to improve government, not cripple it. (Although, to be completely honest, I find the idea of random mass firings way more attractive than I should.)

A successful review will identify programs that aren’t delivering cost-effective value to the people of Canada. Some of those programs will need changes and others should disappear altogether. For some, appropriate next-steps will come to light only through full audits.

But success will also require creating an organizational culture that earns the respect and buy-in of department insiders, stakeholders, and the general public.

The rest of this post will present some foundational principles that can make all that attainable. I should note that this post was greatly enhanced from input using the invaluable experience of a number of The Audit subscribers.

Use Transparent and Well-Defined Goals

Consensus should always be the ideal, but clarity is non-negotiable. Program advocates must be prepared to convincingly explain what they’re trying to achieve, including setting clear metrics for success and failure. Saving taxpayer funds to avoid economic catastrophe is obviously a primary goal. But more effective governance and more professional service delivery also rank pretty high.

Questions to ask and answer before, during, and after review operations:

- Does the program under review fall within the constitutional and operational scope of the federal government?

- Is there overlap with other programs or other levels of government?

- Are the original policy goals that inspired the program still relevant?

- Is the program in its current form the most effective and economical way of achieving those goals?

- Are the changes you’re proposing sustainable or will they sink back into the swamp and disappear as soon as no one’s looking?

Perhaps the most important goal of them all should be getting the job done in our lifetimes. We’ve all seen commissions, working groups, and subcommittees that drag on through multiple years and millions of dollars. You don’t want to make dumb mistakes, but that doesn’t mean you can’t adopt new tools or methodologies (like Agile) to speed things up.

Transparency is a fundamental requirement for public and institutional buy-in. That means publishing program goals and processes along with regular updates. It also means being responsive to reasonable requests for information. Fortunately, someone (Al Gore?) invented the internet, so it should be possible to throw together an interactive browser-based dashboard that keeps the rest of us in the loop and allows for feedback.

Over the years, I’ve personally built nice(ish) websites in minutes, even sites that use pipelines for dynamically pulling data from third-party sources. This isn’t rocket science – especially when you’re not dealing with sensitive private data.

Be Non-Partisan

Going to war against the complexity, toxic politics, incompetence, institutional inertia, NIMBY-ism, and sheer scope of government waste is not for the faint of heart. But setting yourself up as the Righteous Redeemer of only 40 percent of Canadians will make things infinitely more difficult.

Key project positions have to be filled by the most capable individuals from anywhere on the political spectrum. And proposals for cuts should rise above political gamesmanship. It may be unreasonable to expect friendly cross-the-aisle collaboration, but the value of the eventual results should be so self-evident that they’re impossible to oppose in good faith.

Frankly, if you’d ask me, any government that managed to miraculously rise above partisan silliness and genuinely put the country’s needs first would probably guarantee itself reelection for a generation.

Be Efficient

Don’t reinvent the wheel. If internal or external departmental audits already exist, then incorporate their findings. Similarly, make use of any existing best-practice policies, standards, and guidance from bodies like the Office of the Comptroller General and the Treasury Board of Canada Secretariat.

It’ll be important to know who really controls the levers of power within government. So make sure you’ve got members of key insider organizations like the Privy Council Office and the Committee of Senior Officials on speed dial.

Also, incorporate forward-thinking elements into new programs by including sunset clauses, real-time monitoring, and ongoing mini reviews. To keep things moving fast, implement promising auditing and analysis ideas early as pilot programs. If they work, great. Expand. If they don’t work, bury ‘em. No harm done.

AI-driven insights can probably speed up early steps of the review process. For instance, before you even book your first meeting with the dreaded Assistant Deputy Minister, feed the department’s program spending and outcomes data to an AI model and tell it to look for evidence-based inefficiencies and redundancy. The results can set the agenda for the conversation you eventually do have.

You can similarly build simple software models that search for optimal spending balances across the whole government. Complex multivariate calculations that once required weeks of hard math can now be done in seconds.

A friend who administrates a private high school recently tasked ChatGPT with calculating the optimal teaching calendar for the coming school year. After a few seconds, the perfect schedule showed up on-screen. The woman who, in previous years, had spent countless hours on the task, literally laughed with excitement. “What are you so happy about?” My friend asked. “This thing just took your job.”

Consult the Civil Service (and the public)

I know exactly what you’re thinking: is there a better way to destroy any process than burying it under endless rounds of public consultations (followed by years of report writing)? Trust me, I feel your pain.

But it’s 2025. Things can be different now. In fact, contrary to the way it might look to many good people inside the public sector, things can be a lot better.

This consultation would be 100 percent digital and its main stage need last no longer than 60 days. Here’s how it’ll go:

- Build a website, make a lot of noise to attract attention, and invite all Canadians – with a particular focus on current and former civil servants.

- Require login that includes a physical address and (perhaps) a government-issued ID. This will prevent interest groups from gaming the system.

- Use AI tools to identify boilerplate cut-and-paste submissions and flag them for reduced relevance.

- Encourage (but don’t require) participants to identify themselves by their background and employment to permit useful data segmentation. This will make it easier to identify expert submissions.

- Provide ongoing full public access to all submissions. Private information would be redacted, of course. And whistle blowers could have specialized, extra-secure access.

- Use traditional software analytics to flag especially interesting submissions and analyze all submissions using AI models to produce deeper summaries and analyses.

- Publish ongoing overviews of the results.

- [Other stuff…]

- Pick out a nice suit/dress for your Order of Canada investiture ceremony.

There’s absolutely nothing revolutionary about any of this (except the Order of Canada bit). The City of Toronto has been doing most of it for years.

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

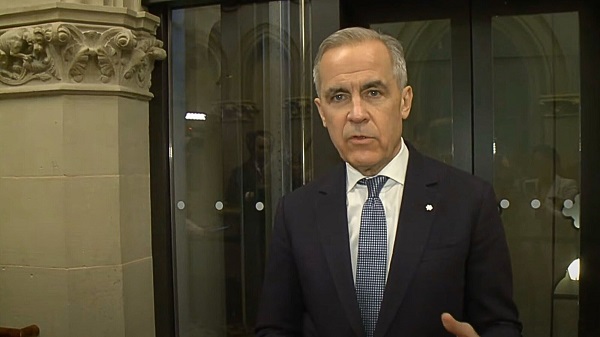

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

Health2 days ago

Health2 days agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

Business8 hours ago

Business8 hours agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

Daily Caller6 hours ago

Daily Caller6 hours agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

Autism2 days ago

Autism2 days agoAutism Rates Reach Unprecedented Highs: 1 in 12 Boys at Age 4 in California, 1 in 31 Nationally