Frontier Centre for Public Policy

We should follow New Zealand on housing and free up more land for growth

From the Frontier Centre for Public Policy

By Wendell Cox

Attempts to contain ‘urban sprawl’ have driven land prices sky-high. It’s time to abandon densification strategies.

Not so long ago, house prices tended to be around three times household incomes in most housing markets in Canada, the U.S., the U.K., Ireland, Australia and New Zealand. But over the past half-century, many local and provincial governments have tried to stop the expansion of urban areas (so-called “sprawl”) by means of urban growth boundaries, greenbelts and other containment strategies.

Though pleasing to planners, the results have been disastrous for middle- and lower-income households, sending housing prices through the roof, lowering living standards and even increasing poverty. International research has associated urban containment with escalating the underlying price of land, not only on the urban fringe where the city meets rural areas, but also throughout the contained area.

Canada’s current housing affordability crisis is centred in “census metropolitan areas” that have tried containment. Vancouver, which routinely places second or third least affordable of 94 major metropolitan areas in the annual Demographia International Housing Affordability report, has experienced a tripling of house prices compared to incomes. In the third quarter of last year, the median house price was 12.3 times median household income. In less than two decades, the Toronto CMA has experienced a doubling of its house price/income ratio, to 9.3.

Not surprisingly, both CMAs are seeing huge net departures, principally to less expensive markets nearby, such as Kitchener-Waterloo, Guelph, London, Nanaimo, Chilliwack and Kelowna. But these areas are also experiencing vanishing affordability as they too impose Vancouver- and Toronto-like policies.

In recent years, Canadian governments have adopted densification strategies — on the assumption that making cities more crowded will restore housing affordability. But evidence of that is limited. Yonah Freemark of the Urban Institute characterizes the literature as indicating “that upzonings offer mixed success in terms of housing production, reduced costs, and social integration in impacted neighborhoods; outcomes depend on market demand, local context, housing types, and timing.”

Like Canada, New Zealand has seen its house prices grow much faster than household incomes, also mainly because of urban containment policies. Auckland routinely ranks as one of the world’s least affordable markets. But in what may be a watershed moment for housing policy worldwide, New Zealand’s recently elected coalition government is giving up on densification and instead, with its Going for Housing Growth program, is aiming at the heart of the issue by addressing the cost of land.

Under new proposals, local governments will be required to zone enough land for 30 years of projected growth and make it available for immediate development. According to the government, local governments’ deliberate decision to restrain growth on their fringes has “driven up the price of land, which has flowed through to house prices,” and it cites research indicating that “urban growth boundaries add NZ$600,000 (C$500,000) to the cost of land for houses in Auckland’s fringes.”

The new policy will rely on a 2020 act allowing public agencies and private developers to establish “Special Purpose Vehicles” — corporations established for financing housing-related infrastructure, with the costs to be repaid by homeowners over up to 50 years. This removes the infrastructure burden from governments, as has also been done in “municipal utility districts” (MUDs) in Texas and Colorado. MUDs are independent entities empowered to issue bonds and collect fees to finance and manage local infrastructure for new developments.

New Zealand’s government believes guaranteeing plentiful access to land will result in an increased supply “inside and at the edge of our cities … so that land prices are not inflated by artificial planning restrictions.” The same strategy could help here. Unlike most urban planners, most Canadians do not want higher population density. A 2019 survey of younger Canadian households by the Mustel Group and Sotheby’s found that on average across four metropolitan areas (Toronto, Montreal, Vancouver and Calgary) 83 per cent of such families preferred detached houses, though only 56 per cent had actually bought one.

Households that move from the big city to Kitchener-Waterloo, say, or Chilliwack not only want to save money, they also want more house and probably a yard. Detached housing predominates in these affordability sanctuaries, compared to the Vancouver and Toronto CMAs.

Urban planners continue to complain about urban expansion, but that is how organic urban growth occurs. Toronto and Vancouver show that the cost of taming expansion is unacceptably high: inflated house prices, higher rents and, for increasing numbers of people, poverty. It is time to prioritize the well-being of Canadian households, not urban planners.

Wendell Cox, a senior fellow at the Frontier Centre for Public Policy, is author of the Centre’s annual Demographia International Housing Affordability report.

Business

The Real Reason Canada’s Health Care System Is Failing

From the Frontier Centre for Public Policy

By Conrad Eder

Conrad Eder supports universal health care, but not Canada’s broken version. Despite massive spending, Canadians face brutal wait times. He argues it’s time to allow private options, as other countries do, without abandoning universality.

It’s not about money. It’s about the rules shaping how Canada’s health care system works

Canada’s health care system isn’t failing because it lacks funding or public support. It’s failing because governments have tied it to restrictive rules that block private medical options used in other developed countries to deliver timely care.

Canada spends close to $400 billion a year on health care, placing it among the highest-spending countries in the Organization for Economic Co-operation and Development (OECD). Yet the system continues to struggle with some of the longest waits for care, the fewest doctors per capita and among the lowest numbers of hospital beds in the OECD. This is despite decades of spending increases, including growth of 4.5 per cent in 2023 and 5.7 per cent in 2024, according to estimates from the Canadian Institute for Health Information.

Canadians are losing confidence that government spending is the solution. In fact, many don’t even think it’s making a difference.

And who could blame them? Median health care wait times reached 30 weeks in 2024, up from 27.7 weeks in 2023, which was up from 27.4 weeks in 2022, according to annual surveys by the Fraser Institute.

Nevertheless, politicians continue to tout our universal health care system as a source of national pride and, according to national surveys, 74 per cent of Canadians agree. Yet only 56 per cent are satisfied with it. This gap reveals that while Canadians value universal health care in principle, they are frustrated with it in practice.

But it isn’t universal health care that’s the problem; it’s Canada’s uniquely restrictive version of it. In most provinces, laws restrict physicians from working simultaneously in public and private systems and prohibit private insurance for medically necessary services covered by medicare, constraints that do not exist in most other universal health care systems.

The United Kingdom, France, Germany and the Netherlands all maintain universal health care systems. Like Canada, they guarantee comprehensive insurance coverage for essential health care services. Yet they achieve better access to care than Canada, with patients seeing doctors sooner and benefiting from shorter surgical wait times.

In Germany, there are both public and private hospitals. In France, universal insurance covers procedures whether patients receive them in public hospitals or private clinics. In the Netherlands, all health insurance is private, with companies competing for customers while coverage remains guaranteed. In the United Kingdom, doctors working in public hospitals are allowed to maintain private practices.

All of these countries preserved their commitment to universal health care while allowing private alternatives to expand choice, absorb demand and deliver better access to care for everyone.

Only 26 per cent of Canadians can get same-day or next-day appointments with their family doctor, compared to 54 per cent of Dutch and 47 per cent of English patients. When specialist care is needed, 61 per cent of Canadians wait more than a month, compared to 25 per cent of Germans. For elective surgery, 90 per cent of French patients undergo procedures within four months, compared to 62 per cent of Canadians.

If other nations can deliver timely access to care while preserving universal coverage, so can Canada. Two changes, inspired by our peers, would preserve universal coverage and improve access for all.

First, allow physicians to provide services to patients in both public and private settings. This flexibility incentivizes doctors to maximize the time they spend providing patient care, expanding service capacity and reducing wait times for all patients. Those in the public system benefit from increased physician availability, as private options absorb demand that would otherwise strain public resources.

Second, permit private insurance for medically necessary services. This would allow Canadians to obtain coverage for private medical services, giving patients an affordable way to access health care options that best suit their needs. Private insurance would enable Canadians to customize their health coverage, empowering patients and supporting a more responsive health care system.

These proposals may seem radical to Canadians. They are not. They are standard practice everywhere else. And across the OECD, they coexist with universal health care. They can do the same in Canada.

Alberta has taken an important first step by allowing some physicians to work simultaneously in public and private settings through its new dual-practice model. More Canadian provinces should follow Alberta’s lead and go one step further by removing legislative barriers that prohibit private health insurance for medically necessary services. Private insurance is the natural complement to dual practice, transforming private health care from an exclusive luxury into a viable option for Canadian families.

Canadians take pride in their health care system. That pride should inspire reform, not prevent it. Canada’s health care crisis is real. It’s a crisis of self-imposed constraints preventing our universal system from functioning at the level Canadians deserve.

Policymakers can, and should, preserve universal health care in this country. But maintaining it will require a willingness to learn from those who have built systems that deliver universality and timely access to care, something Canada’s current system does not.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

Business

Ottawa Is Still Dodging The China Interference Threat

From the Frontier Centre for Public Policy

By Lee Harding

Alarming claims out of P.E.I. point to deep foreign interference, and the federal government keeps stalling. Why?

Explosive new allegations of Chinese interference in Prince Edward Island show Canada’s institutions may already be compromised and Ottawa has been slow to respond.

The revelations came out in August in a book entitled “Canada Under Siege: How PEI Became a Forward Operating Base for the Chinese Communist Party.” It was co-authored by former national director of the RCMP’s proceeds of crime program Garry Clement, who conducted an investigation with CSIS intelligence officer Michel Juneau-Katsuya.

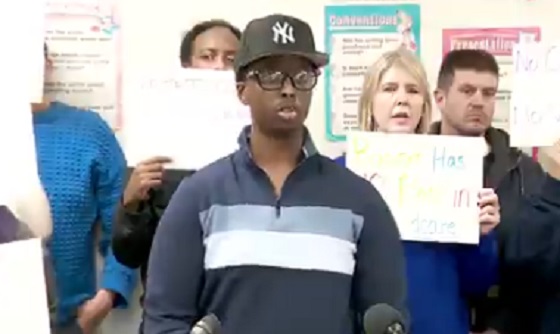

In a press conference in Ottawa on Oct. 8, Clement referred to millions of dollars in cash transactions, suspicious land transfers and a network of corporations that resembled organized crime structures. Taken together, these details point to a vulnerability in Canada’s immigration and financial systems that appears far deeper than most Canadians have been told.

P.E.I.’s Provincial Nominee Program allows provinces to recommend immigrants for permanent residence based on local economic needs. It seems the program was exploited by wealthy applicants linked to Beijing to gain permanent residence in exchange for investments that often never materialized. It was all part of “money laundering, corruption, and elite capture at the highest levels.”

Hundreds of thousands of dollars came in crisp hundred-dollar bills on given weekends, amounting to millions over time. A monastery called Blessed Wisdom had set up a network of “corporations, land transfers, land flips, and citizens being paid under the table, cash for residences and property,” as was often done by organized crime.

Clement even called the Chinese government “the largest transnational organized crime group in the history of the world.” If true, the allegation raises an obvious question: how much of this activity has gone unnoticed or unchallenged by Canadian authorities, and why?

Dean Baxendale, CEO of the China Democracy Fund and Optimum Publishing International, published the book after five years of investigations.

“We followed the money, we followed the networks, and we followed the silence,” Baxendale said. “What we found were clear signs of elite capture, failed oversight and infiltration of Canadian institutions and political parties at the municipal, provincial and federal levels by actors aligned with the Chinese Communist Party’s United Front Work Department, the Ministry of State Security. In some cases, political donations have come from members of organized crime groups in our country and have certainly influenced political decision making over the years.”

For readers unfamiliar with them, the United Front Work Department is a Chinese Communist Party organization responsible for influence operations abroad, while the Ministry of State Security is China’s main civilian intelligence agency. Their involvement underscores the gravity of the allegations.

It is a troubling picture. Perhaps the reason Canada seems less and less like a democracy is that it has been compromised by foreign actors. And that same compromise appears to be hindering concrete actions in response.

One example Baxendale highlighted involved a PEI hotel. “We explore how a PEI hotel housed over 500 Chinese nationals, all allegedly trying to reclaim their $25,000 residency deposits, but who used a single hotel as their home address. The owner was charged by the CBSA, only to have the trial shut down by the federal government itself,” he said. The case became a key test of whether Canadian authorities were willing to pursue foreign interference through the courts.

The press conference came 476 days after Bill C-70 was passed to address foreign interference. The bill included the creation of Canada’s first foreign agent registry. Former MP Kevin Vuong rightly asked why the registry had not been authorized by cabinet. The delay raises doubts about Ottawa’s willingness to confront the problem directly.

“Why? What’s the reason for the delay?” Vuong asked.

Macdonald-Laurier Institute foreign policy director Christopher Coates called the revelations “beyond concerning” and warned, “The failures to adequately address our national security challenges threaten Canada’s relations with allies, impacting economic security and national prosperity.”

Former solicitor general of Canada and Prince Edward Island MP Wayne Easter called for a national inquiry into Beijing’s interference operations.

“There’s only one real way to get to the bottom of what is happening, and that would be a federal public inquiry,” Easter said. “We need a federal public inquiry that can subpoena witnesses, can trace bank accounts, can bring in people internationally, to get to the bottom of this issue.”

Baxendale called for “transparency, national scrutiny, and most of all for Canadians to wake up to the subtle siege under way.” This includes implementing a foreign influence transparency commissioner and a federal registry of beneficial owners.

If corruption runs as deeply as alleged, who will have the political will to properly respond? It will take more whistleblowers, changes in government and an insistent public to bring accountability. Without sustained pressure, the system that allowed these failures may also prevent their correction.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

-

International23 hours ago

International23 hours agoTrump confirms first American land strike against Venezuelan narco networks

-

Business23 hours ago

Business23 hours agoHow convenient: Minnesota day care reports break-in, records gone

-

Business2 days ago

Business2 days agoThe Real Reason Canada’s Health Care System Is Failing

-

Opinion2 days ago

Opinion2 days agoGlobally, 2025 had one of the lowest annual death rates from extreme weather in history

-

Business22 hours ago

Business22 hours agoThe great policy challenge for governments in Canada in 2026

-

Business2 days ago

Business2 days agoFederal funds FROZEN after massive fraud uncovered: Trump cuts off Minnesota child care money

-

Addictions2 days ago

Addictions2 days agoCoffee, Nicotine, and the Politics of Acceptable Addiction

-

Business2 days ago

Business2 days agoDark clouds loom over Canada’s economy in 2026