Environment

Wall Street’s planned theft of America’s lands and waters

From the Frontier Centre for Public Policy

When we are issued carbon allowances, owners of said lands will be able to claim tax deductions and will be able to sell carbon allowances to businesses, families and townships. In the simplest of terms, that’s where the money will be made. WE peons will be renting air from the richest people on earth.

Everything will be monetized and measured and traded, even you.

Up next on Wall Street’s exploitation list.

If not stopped, on November 17th, the U.S. government will pass a rule that allows for America’s protected lands, including parks and wildlife refuges, to be listed on the N.Y. Stock Exchange. Natural Asset Companies (NACs) will be owned, managed, and traded by companies like BlackRock, Vanguard, and even China.

Since the early 2000’s, outfits like Goldman Sachs have been trying to trade air, or specifically carbon without much success. Their 2005 carbon exchange staggered along until it was quietly discontinued, and their Climate Exchange-Traded Fund (ETF) is now facing delisting. “ESG” was the next attempt to monetize the un-monetizable, with the “E” part of that acronym standing for Environment, ill-defined as that was. Now ESG is failing. Market leaders say it is facing “a perfect storm of negative sentiment” and its U.S. investments fell by $163 billion in the first quarter of 2023 alone.

Its stepchild, Net-Zero, is so loathed, it looks like it might blow up the entire carbon scam. Says Australian senator Matt Canavan, “Net-Zero has absolutely carked it. It is a soundbite and totally insane. Almost everything we grow, we make, we do in our society relies on the use of fossil fuels.” Vanguard has pulled out of Net-Zero funds. The British government too is backing out of Net-Zero, saying “we won’t save the planet by bankrupting the British people.” New Zealand’s new government revised the country’s Net-Zero plans in its first week in office. In the hard hit Netherlands, the Farmer-Citizen movement is now the dominant party in the Dutch senate and every provincial assembly. Sweden has abandoned its 100 percent Net-Zero plans and Norway has announced another $18 billion in oil and gas investments.

Not going to happen.

Even in the submissive E.U. voters are turning from the “green” parties toward anti-E.U. parties. Renewables funds are seeing massive outflows because of rising interest rates and declining subsidies. Of course, the massive subsidies taxpayers have already given both “renewables” investors and “renewables” companies will never be clawed back. All we will get is a shrug as they move onto the next kill. Which is so obvious it is a wonder no one predicted it.

The entire universe envies the lush interior of the U.S. Increasingly empty, it is filled with a cornucopia of minerals, fiber, food, waters, extraordinarily fertile soil as well as well-ordered, educated, mostly docile people. Worth in the quadrillions, if one could monetize and trade it, financialize it, the way the market has financialized the future labor of Americans, well, it would be like golden coins raining from the sky.

On October 4th, the Securities and Exchange Commission filed a proposed rule to create Natural Asset Companies (NACs). A twenty-one day comment period was allowed, which is half the minimum number of days generally required. NACs will allow BlackRock, Bill Gates, and possibly even China to hold the ecosystem rights to the land, water, air, and natural processes of the properties enrolled in NACs. Each NAC will hold “management authority” over the land. When we are issued carbon allowances, owners of said lands will be able to claim tax deductions and will be able to sell carbon allowances to businesses, families and townships. In the simplest of terms, that’s where the money will be made. WE peons will be renting air from the richest people on earth.

The following are eligible for NACs: National Parks, National Wildlife Refuges, Wilderness Areas, Areas of Critical Environmental Concern, Conservation Areas on Private and Federal Lands, Endangered Species Critical Habitat, and the Conservation Reserve Program. Lest you think that any conserved land is conserved in your name, the largest Conservation organization in the U.S., is called The Nature Conservancy, or TNC, which, while being a 501(c)3, also holds six billion dollars of land on its books. Those lands have been taken using your money via donations and government grants, and transferred to the Nature Conservancy, which can do with those lands what it wills.

If this rule passes, America’s conserved lands and parks will move onto the balance sheets of the richest people in the world. Management of those lands will be decided by them and their operations, to say the least, will be opaque.

μολὼν λαβέ, buddy.

Farm country is fighting back. American Stewards of Liberty, Committee for a Constructive Tomorrow, Kansas Natural Resource Coalition, Financial Fairness Alliance and Blue Ribbon Coalition have filed comments, Republican senators Pete Ricketts, James Risch and Mike Crapo have sent pointed queries to the SEC. This week, Rep. Harriet Hageman (R-WY) offered an amendment that would defund the SEC proposed rule to approve listing “NACs.”

Most of us ill-understand “financialization.” It is a complex set of maneuvers best explained by the behavior that crashed the economy in 2008 which bundled up questionable mortgages and brokered off the risk to dozens of different funds in order to share that risk. NACs are asset grabs. From ’09-’20, funds asset-stripped America’s manufacturing via debt obligations, buying the company, selling off the equipment, firing the most expensive employees, and gutting, if they could, pension funds. Then they upped the price and sold on the assets. Which were bundled and brokered off. These are called collateralized debt obligations and they thunder doom underneath the debt-fueled economy.

Natural Asset Companies are an attempt to grab hard assets to make up for an inevitable collapse. But taking more land out of production makes it certain that collapse moves ever closer. Land needs to be used, cared for, and maintained by the people who live on and use the land. Otherwise, it runs to desert and invasive species. The mad push to “green” and net-zero has triggered financialization, or a brokering of the future, because only energy spurs real growth — and energy has been increasingly restricted over the past twenty years. NACs are another destroyer of America’s heartland.

Elizabeth Nickson is a Senior Fellow at the Frontier Centre for Public Policy. Her studies and commentaries at the Frontier Centre can be accessed here. Follow her on Substack here. Her best-selling book Eco-Fascists can be purchased here.

Business

Europe backs off greenwashing rules — Canada should take note

From Resource Works

A major shift is underway in Europe — and it’s a warning Canada would do well to heed.

Last week, the European Commission confirmed it plans to scrap its so-called “Green Claims Directive.” The proposal was designed to crack down on corporate greenwashing — companies making vague or misleading claims about how environmentally friendly their products are.

At first glance, that might sound like a worthy goal. Who wants false advertising? But the plan quickly ran into trouble, especially from smaller businesses who warned it would add layers of red tape, compliance costs, and legal risk.

In fact, the Commission itself admitted that as many as 30 million micro-enterprises could end up having to comply with the rules. Even with exemptions written in, the direction of negotiations pointed to increased burdens, not clarity. The result? A lot of businesses — even the well-intentioned ones — would stop talking about their environmental practices altogether, just to stay out of legal trouble.

Czech economist and tax expert Danuše Nerudová, a member of the European Parliament and a lead negotiator on the file, put it plainly: “I welcome the fact that the Commission has listened … and hope this opens the door to a more balanced and effective approach.” The proposal, she said, was “overly complex.”

If that sounds familiar, it should.

Canada’s own Bill C-59, which came into force this month, is already having a similar effect. The bill, which changes the Competition Act to target “greenwashing,” makes it legally risky for companies to say anything about their climate efforts unless they have airtight, independently verified proof — the kind often only available to large companies with big legal budgets.

At Resource Works, we’ve heard from organizations who’ve made the decision to stop communicating about environmental performance entirely. Not because they’ve done something wrong — but because the rules are vague, expensive to follow, and expose them to complaints even when acting in good faith.

That’s a loss. For consumers, for environmental progress, and for transparency.

Canada should be encouraging companies to communicate openly and credibly about their sustainability performance — not shutting down those conversations with threats of litigation. The European Commission has now acknowledged that its own approach, despite good intentions, risks backfiring. It’s time for Ottawa to take a similar step back.

With Prime Minister Mark Carney under pressure to unleash Canadian potential in the resource sector, revisiting Bill C-59 would be a sign of both good faith and practicality. Canada needs more innovation, more investment, and more real progress — not more reasons to say nothing.

It’s time to recycle Bill C-59 into something that actually supports good environmental practice instead of stifling it.

Alberta

Alberta’s carbon diet – how to lose megatonnes in just three short decades

Carl Marcotte, Candu Energy, Scott Henuset, Energy Alberta, and William McLeod

From Resource Works

Solving emissions problem is turning Alberta into a clean-tech powerhouse.

While oil, gas and pipelines took up a lot of oxygen at last week’s Global Energy Canada Show in Calgary, there was also a considerable focus on clean energy, clean-tech and decarbonization.

Alberta’s very survival in a decarbonizing world depends on innovation, best practices and regulations that will allow it to continue to produce oil and gas while trying to meet net zero targets that, like a mirage, appear to move further away the closer we get to them. Necessity being the mother of invention, Wild Rose Country has become rather inventive. It has become something of a clean-tech powerhouse and, as a result, has made some notable progress in its emissions intensity. Alberta’s industrial carbon tax, in place since 2007, and which hit $95 per tonne in 2025, has been used to fund emissions abatement technology and innovation through the Technology Innovation and Emissions Reduction (TIER) program.

According to the Government of Alberta, the province has, to date, achieved:

- an 8.7% decline in overall emissions since 2015;

- a 52% decline in methane emissions since 2014;

- a 26% decline in oil sands emissions intensity since 2012; and

- 15 million tonnes of CO2 sequestered through carbon capture and storage.

The Pembina Institute, it is worth noting, has taken issue with some of Alberta’s reporting. Based on the federal National Inventory Report, Alberta’s methane emissions have declined by 35% between 2014 and 2023, not 52%.

Information sessions at last week’s conference covered topics like geothermal energy, lithium extraction, methane emissions detection and reduction technology, low-carbon hydrogen production and use, carbon capture and storage, and nuclear power. Alberta’s contributions to the energy transition and decarbonization is, I think, a bit of an untold story.

In the case of carbon capture utilization and storage (CCUS), it’s a story that some environmentalists don’t want to hear, and don’t want anyone else to hear. In 2023, Greenpeace and two other environmental NGOs filed a complaint with the Competition Bureau against the Pathways Alliance, saying its claims of potential emissions reduction through CCUS constituted greenwashing. The Trudeau government responded with an anti-greenwashing bill — C-59 — that puts companies at risk of fines for making claims on emission reductions that are not backed by “adequate and proper” testing and evidence. Basically, companies will need to show their homework before making claims on climate benefits or risk hefty fines.”Some of the things that I’ve said would be illegal for my companies to say under the existing law because it would be called greenwashing,” Premier Danielle Smith said at last week ‘s conference. Green fundamentalists don’t want to hear about climate benefits, if it involves things like carbon capture, which they view as extending the lifetime of fossil fuels. Maybe they didn’t get the memo from the Intergovernmental Panel on Climate Change (IPCC) Working Group 3, which last year pronounced in a special report that carbon sequestration is “unavoidable if net zero CO2 or GHG emissions are to be achieved.”

Alberta’s oil and gas industry understands full well there is a big target on their backs: the oil sands. This energy intensive form of extracting oil generated 86.5 million million tonnes of CO2 equivalent (CO2e) in 2023, according to the Alberta government. That accounts for 33% of Alberta’s total GHG emissions, and is getting perilously close to the federal government’s emission’s cap for oil and gas.

Alberta ingenuity and innovation in extracting oil from sand led Canada to become the world’s fourth largest oil producer, with huge economic benefits for Canada. Alberta is now applying that ingenuity to try to shrink its GHG profile. Alberta has had some of the largest emissions reductions in the power generation sector in Canada recently, thanks to the phasing out of coal power.

Last year, it retired its last coal power plant, meaning the province reached its goal of phasing out coal six years ahead of federal and provincial targets of 2030. As a result, emissions from Alberta’s electricity sector declined 54% between 2015 and 2023, according to the Alberta government. It accomplished this by investing in wind and solar power, backed by firm natural gas power. Alberta now has about twice the amount of installed wind power as B.C. Alberta also reached methane emission reduction targets ahead of schedule. The Alberta government reports a 52% decline in methane intensity between 2014 and 2023, exceeding the target of a 45% decrease by 2025.

According to a recent S&P Global report, the GHG intensity of Alberta’s oil sands has declined 23% since 2009. And since 2019, S&P reports, the pace of oil sands emissions growth has slowed, with a 3% increase in emissions since 2019, despite a 9% growth in oil and gas production. Alberta’s challenge is that, as long as it plans to increase oil and gas production — and it does — reducing its emissions is like draining a bathtub while the faucet is still on. While emissions intensity may go down, absolute emissions could still grow with production growth, and Danielle Smith would like to see Alberta’s oil production double. So, some pretty big gains will be needed if Alberta is to achieve the dual goal of increasing oil production while trying to bring its emissions intensity down to zero by 2050. The only way to do that is through large-scale CCUS, and Alberta has become a global leader in its deployment. Thanks to CCUS, Alberta is poised to become a leading producer of blue hydrogen, ammonia and other “net-zero chemicals.” Through CCUS initiatives like the Alberta Carbon Trunk Line and the Shell Quest CCS project, Alberta has already sequestered 13.5 million tonnes of CO2, according to Emissions Reduction Alberta.

The Pathways Alliance — a consortium of Alberta’s biggest oil producers — propose a $10 billion to $20 billion investment that includes a large scale-up of CCUS, to decarbonize oil sands production and Alberta’s petrochemical industry. According to Natural Resources Canada, the estimated sequestration of the Pathways project would be 13.9 Mt CO2 captured by 2030 — 4.2 MT per year — and 62 Mt per year by 2050. A buildout of CCUS infrastructure in Alberta’s refining and petrochemical complex in the Edmonton area would capture CO2 from gas combustion. “That then puts them on the road to net-zero aviation fuels, net-zero chemicals, what-have-you,” Chris Bataille, adjunct research fellow at Columbia University’s Center on Global Energy Policy, told me. “If you look at this as a transition, it’s a necessary thing to do, and we have the right geology for it, and these companies know how to do this kind of thing.”

In addition to CCUS, Alberta also now plans to become a nuclear power producer. A company called Energy Alberta plans to deploy existing Canadian nuclear technology — the CANDU reactor. It proposes to build a 1,000 megawatt twin CANDU MONARK reactor north of Peace River, Alberta. It is now in the early stage of a federal Impact Assessment process. If the federal Liberal government is serious about achieving its ambitious climate policy objectives, it needs to either help Alberta with its ambitious decarbonization efforts, which would include some major federal subsidies, or just get out of its way and let Alberta do what it does best, which is innovate.

-

Automotive1 day ago

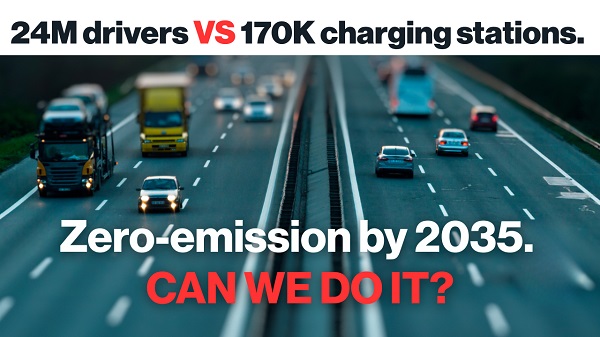

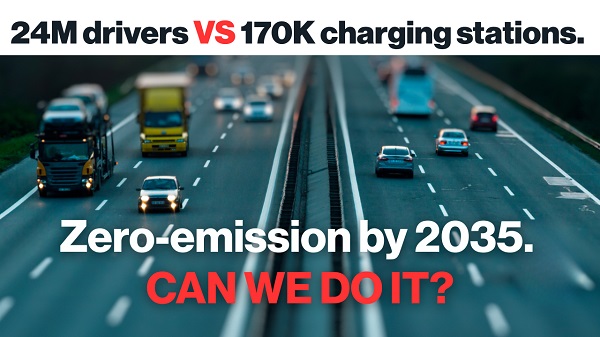

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Alberta6 hours ago

Alberta6 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Business8 hours ago

Business8 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Crime8 hours ago

Crime8 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Energy1 day ago

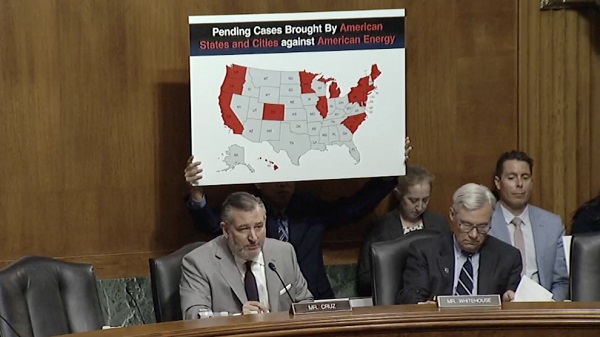

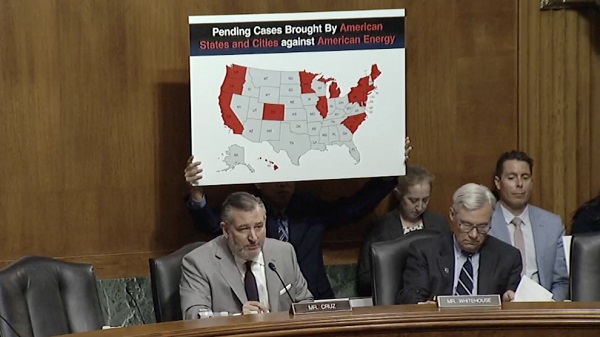

Energy1 day agoChina undermining American energy independence, report says