International

Vice President Vance, Second Lady to visit Greenland on Friday

MxM News

MxM News

Quick Hit:

Vice President JD Vance announced he will join Second Lady Usha Vance in Greenland on Friday, escalating the Trump administration’s focus on the island amid growing global interest and resistance from Danish and Greenlandic officials.

Key Details:

- Vance will join Usha Vance and U.S. officials already in Greenland, including National Security Adviser Mike Waltz and Energy Secretary Chris Wright.

- The trip includes a stop at Pituffik Space Base to assess Arctic security and meet with U.S. Space Force guardians.

- Greenland’s prime minister called the second lady’s earlier visit an “aggressive” move as Trump reaffirms his interest in acquiring the island.

Diving Deeper:

Vice President JD Vance confirmed Tuesday that he will accompany Second Lady Usha Vance to Greenland at the end of the week, intensifying U.S. engagement with the strategically located island that President Donald Trump has long said should be part of the United States. The visit reflects the administration’s ongoing efforts to strengthen America’s geopolitical presence in the Arctic and counter growing threats from adversarial nations seeking influence in the region.

“You know, there was so much excitement around Usha’s visit to Greenland this Friday that I decided that I didn’t want her to have all that fun by herself, and so I’m going to join her,” Vance said in a video posted to X, formerly Twitter.

The vice president said he will be visiting U.S. Space Force personnel stationed at Pituffik Space Base on Greenland’s northwest coast, where he will receive a briefing on security developments in the Arctic and inspect key infrastructure critical to American defense.

“A lot of other countries have threatened Greenland,” Vance warned. “Have threatened to use its territories and its waterways to threaten the United States, to threaten Canada, and, of course, to threaten the people of Greenland. So we’re gonna check out how things are going there.”

The second lady’s presence already drew a sharp rebuke from Greenland’s prime minister, who denounced the visit as an “aggressive” gesture amid renewed speculation that Trump may move to formally acquire the autonomous Danish territory. Despite the backlash, Usha Vance currently holds the distinction of being the highest-ranking U.S. political figure to visit Greenland since Trump returned to the White House as the 47th president in January.

In comments that will likely raise further diplomatic alarms in Copenhagen, Vance reiterated President Trump’s broader Arctic strategy, emphasizing the administration’s commitment to defending Greenland’s people—and the world—from neglect and external threats.

“And I say that speaking for President Trump,” Vance stated, “we want to reinvigorate the security of the people of Greenland because we think it’s important to protect the security of the entire world. Unfortunately, leaders in both America and in Denmark, I think, ignored Greenland for far too long. That’s been bad for Greenland. It’s also been bad for the security of the entire world. We think we can take things in a different direction.”

With national security adviser Mike Waltz and Energy Secretary Chris Wright already on the ground, the full weight of the Trump administration’s Arctic pivot is becoming increasingly visible. Whether Denmark and other NATO allies see the move as cooperative or confrontational remains to be seen—but for now, the United States is clearly asserting itself in one of the world’s most contested and overlooked regions.

Business

Tariff-driven increase of U.S. manufacturing investment would face dearth of workers

From the Fraser Institute

Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

Donald Trump has long been convinced that the United States must revitalize its manufacturing sector, having—unwisely, in his view—allowed other countries to sell all manner of foreign-produced manufactured goods in the giant American market. As president, he’s moved quickly to shift the U.S. away from its previous embrace of liberal trade and open markets as cornerstones of its approach to international economic policy —wielding tariffs as his key policy instrument. Since taking office barely two months ago, President Trump has implemented a series of tariff hikes aimed at China and foreign producers of steel and aluminum—important categories of traded manufactured goods—and threatened to impose steep tariffs on most U.S. imports from Canada, Mexico and the European Union. In addition, he’s pledged to levy separate tariffs on imports of automobiles, semi-conductors, lumber, and pharmaceuticals, among other manufactured goods.

In the third week of March, the White House issued a flurry of news releases touting the administration’s commitment to “position the U.S. as a global superpower in manufacturing” and listing substantial new investments planned by multinational enterprises involved in manufacturing. Some of these appear to contemplate relocating manufacturing production in other jurisdictions to the U.S., while others promise new “greenfield” investments in a variety of manufacturing industries.

President Trump’s intense focus on manufacturing is shared by a large slice of America’s political class, spanning both of the main political parties. Yet American manufacturing has hardly withered away in the last few decades. The value of U.S. manufacturing “output” has continued to climb, reaching almost $3 trillion last year (equal to 10 per cent of total GDP). The U.S. still accounts for 15 per cent of global manufacturing production, measured in value-added terms. In fact, among the 10 largest manufacturing countries, it ranks second in manufacturing value-added on a per-capita basis. True, China has become the world’s biggest manufacturing country, representing about 30 per cent of global output. And the heavy reliance of Western economies on China in some segments of manufacturing does give rise to legitimate national security concerns. But the bulk of international trade in manufactured products does not involve goods or technologies that are particularly critical to national security, even if President Trump claims otherwise. Moreover, in the case of the U.S., a majority of two-way trade in manufacturing still takes place with other advanced Western economies (and Mexico).

In the U.S. political arena, much of the debate over manufacturing centres on jobs. And there’s no doubt that employment in the sector has fallen markedly over time, particularly from the early 1990s to the mid-2010s (see table below). Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

| U.S. Manufacturing Employment, Select Years (000)* | |

|---|---|

| 1990 | 17,395 |

| 2005 | 14,189 |

| 2010 | 14,444 |

| 2015 | 12,333 |

| 2022 | 12,889 |

| 2024 | 12,760 |

| *December for each year shown. Source: U.S. Bureau of Labor Statistics | |

Economists who have studied the trend conclude that the main factors behind the decline of manufacturing employment include continuous automation, significant gains in productivity across much of the sector, and shifts in aggregate demand and consumption away from goods and toward services. Trade policy has also played a part, notably China’s entry into the World Trade Organization (WTO) in 2001 and the subsequent dramatic expansion of its role in global manufacturing supply chains.

Contrary to what President Trump suggests, manufacturing’s shrinking place in the overall economy is not a uniquely American phenomenon. As Harvard economist Robert Lawrence recently observed “the employment share of manufacturing is declining in mature economies regardless of their overall industrial policy approaches. The trend is apparent both in economies that have adopted free-market policies… and in those with interventionist policies… All of the evidence points to deep and powerful forces that drive the long-term decline in manufacturing’s share of jobs and GDP as countries become richer.”

This brings us back to the president’s seeming determination to rapidly ramp up manufacturing investment and production as a core element of his “America First” program. An important issue overlooked by the administration is where to find the workers to staff a resurgent U.S. manufacturing sector. For while manufacturing has become a notably “capital-intensive” part of the U.S. economy, workers are still needed. And today, it’s hard to see where they will be found. This is especially true given the Trump administration’s well-advertised skepticism about the benefits of immigration.

According to the U.S. Bureau of Labor Statistics, the current unemployment rate across America’s manufacturing industries collectively stands at a record low 2.9 per cent, well below the economy-wide rate of 4.5 per cent. In a recent survey by the National Association of Manufacturers, almost 70 per cent of American manufacturers cited the inability to attract and retain qualified employees as the number one barrier to business growth. A cursory look at the leading industry trade journals confirms that skill and talent shortages remain persistent in many parts of U.S. manufacturing—and that shortages are destined to get worse amid the expected significant jump in manufacturing investment being sought by the Trump administration.

As often seems to be the case with Trump’s stated policy objectives, the math surrounding his manufacturing agenda doesn’t add up. Manufacturing in America is in far better shape than the president acknowledges. And a tariff-driven avalanche of manufacturing investment—should one occur—will soon find the sector reeling from an unprecedented human resource crisis.

Jock Finlayson

Senior Fellow, Fraser Institut

Automotive

Trump warns U.S. automakers: Do not raise prices in response to tariffs

MxM News

MxM News

Quick Hit:

Former President Donald Trump warned automakers not to raise car prices in response to newly imposed tariffs, arguing that the move would ultimately benefit the industry by strengthening American manufacturing. However, automakers are signaling that price increases may be unavoidable.

Key Details:

- Trump told auto executives on a recent call that his administration would look unfavorably on price hikes due to tariffs.

- A 25% tariff on imported vehicles and parts is set to take effect on April 2, likely driving up costs for U.S. automakers.

- Industry analysts predict vehicle prices could rise 11% to 12% in response, despite Trump’s insistence that tariffs will benefit American manufacturing.

Diving Deeper:

In a conference call with leading automakers earlier this month, former President Donald Trump issued a stern warning: do not use his new tariffs as an excuse to raise car prices. While Trump presented the tariffs as a boon for American manufacturing, industry leaders remain unconvinced, arguing that the financial burden will inevitably lead to higher costs for consumers.

Trump’s administration is pressing ahead with a 25% tariff on all imported vehicles and parts, set to take effect on April 2. The move is aimed at reshaping trade dynamics in the auto industry, encouraging domestic manufacturing, and reversing what Trump calls the damaging effects of President Joe Biden’s electric vehicle mandates. Despite this, automakers say that rising costs on foreign parts—which many depend on—will leave them little choice but to pass expenses onto consumers.

“You’re going to see prices going down, but going to go down specifically because they’re going to buy what we’re doing, incentivizing companies to—and even countries—companies to come into America,” Trump stated at a recent event, reinforcing his stance that the tariffs will ultimately lower costs in the long run.

However, industry insiders are pushing back, warning that a rapid shift to domestic production is unrealistic. “Tariffs, at any level, cannot be offset or absorbed,” said Ray Scott, CEO of Lear, a major automotive parts supplier. His concern reflects broader anxieties within the industry, as automakers calculate the financial strain of the tariffs. Analysts at Morgan Stanley estimate that vehicle prices could increase between 11% and 12% in the coming months as the new tariffs take effect.

Automakers have been bracing for the fallout. Detroit’s major manufacturers and industry suppliers have voiced their concerns, emphasizing that transitioning supply chains and manufacturing operations back to the U.S. will take years. Meanwhile, auto retailers have stocked up on inventory, temporarily shielding consumers from price hikes. But once that supply runs low—likely by May—the full impact of the tariffs could hit.

Within the Trump administration, inflation remains a pressing concern, though Trump himself rarely discusses it publicly. His economic team is aware of the potential for tariffs to drive up costs, yet the administration’s stance remains firm: automakers must adapt without raising prices. It remains unclear, however, what actions Trump might take should automakers defy his warning.

The auto industry isn’t alone in its concerns. Executives across multiple sectors, from oil and gas to food manufacturing, have been lobbying against major tariffs, arguing that they will inevitably result in higher prices for American consumers. While Trump has largely dismissed these warnings, some analysts suggest that public dissatisfaction with rising costs played a key role in shaping the outcome of the 2024 election.

With the tariffs set to take effect in just weeks, automakers are left grappling with a difficult reality: absorb billions in new costs or risk the ire of a White House determined to remake America’s trade policies.

-

Business2 days ago

Business2 days agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

Alberta1 day ago

Alberta1 day agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era

-

Health1 day ago

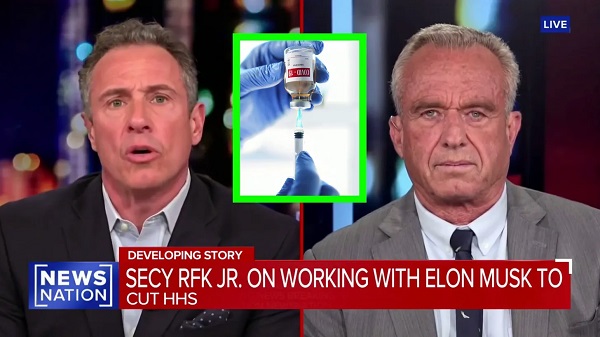

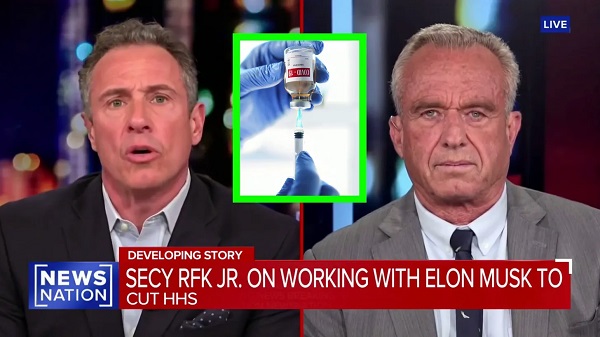

Health1 day agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta1 day ago

Alberta1 day agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoDonald Trump suggests Mark Carney will win Canadian election, touts ‘productive call’ with leader

-

Business21 hours ago

Business21 hours agoElon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

-

Business2 days ago

Business2 days agoTrump Reportedly Shuts Off Flow Of Taxpayer Dollars Into World Trade Organization

-

Energy2 days ago

Energy2 days agoPoll: Majority says energy independence more important than fighting climate change