Automotive

Unrealistic EV mandate requires equivalent of 10 new mega hydro dams

From the Fraser Institute

By G. Cornelis van Kooten

Electric Vehicles and the Demand for Electricity is the latest installment in the Institute’s series on EVs. It finds that Ottawa’s requirement that all new vehicles sold by 2035 be electric could increase Canada’s power demands by as much as 15.3 per cent

Ottawa’s EV mandate—and the increased demand for electricity—unrealistically requires the equivalent of 10 new mega hydro dams or 13 large natural gas plants nationwide within 11 years

The federal government’s requirement that all new vehicles sold by 2035 be electric could increase Canada’s power demands by as much as 15.3 per cent, requiring the equivalent of 10 new mega hydro dams or 13 large natural gas plants to meet the increased power needs, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Requiring all new vehicle sales in Canada to be electric in just 11 years means the provinces need to substantially increase their power generation capabilities, and adding the equivalent of 10 new mega dams or 13 new gas plants in such a short timeline isn’t realistic or feasible,” said G. Cornelis van Kooten, Fraser Institute senior fellow and author of Electric Vehicles and the Demand for Electricity.

The study measures how much additional electricity will be required in Canada and in three major provinces—Ontario, B.C. and Quebec—to charge electric vehicles once the federal government’s electric vehicle sales mandate comes into force.

For context, once Canada’s vehicle fleet is fully electric, it will require 10 new mega hydro dams (capable of producing 1,100 megawatts) nationwide, which is the size of British Columbia’s new Site C dam. It took approximately 10 years to plan and pass environmental regulations, and an additional decade to build. To date, Site C is expected to cost $16 billion.

Alternatively, the provinces could meet the increased electricity demand by building 13 large-scale natural gas plants nationwide capable of generating 500 megawatts of electricity each.

“Canadians need to know just how much additional electricity is going to be required in order to meet Ottawa’s electric vehicle mandate, because its impact on the provinces—and taxpayers and ratepayers—will be significant,” van Kooten said.

ABOUT THE AUTHOR

G. Cornelis van Kooten, a Fraser Institute senior fellow, held the Canada Research Chair in Environmental Studies and Climate at the University of Victoria for 21 years. His research interest focuses on natural resource economics and management, and issues related to the economics of climate change.

Automotive

Canada’s EV Mandate Is Running On Empty

From the Frontier Centre for Public Policy

At what point does Ottawa admit its EV plan isn’t working?

Electric vehicles produce more pollution than the gas-powered cars they’re replacing.

This revelation, emerging from life-cycle and supply chain audits, exposes the false claim behind Ottawa’s more than $50 billion experiment. A Volvo study found that manufacturing an EV generates 70 per cent more emissions than building a comparable conventional vehicle because battery production is energy-intensive and often powered by coal in countries such as China. Depending on the electricity grid, it can take years or never for an EV to offset that initial carbon debt.

Prime Minister Mark Carney paused the federal electric vehicle (EV) mandate for 2026 due to public pressure and corporate failures while keeping the 2030 and 2035 targets. The mandate requires 20 per cent of new vehicles sold in 2026 to be zero-emission, rising to 60 per cent in 2030 and 100 per cent in 2035. Carney inherited this policy crisis but is reluctant to abandon it.

Industry failures and Trump tariffs forced Ottawa’s hand. Northvolt received $240 million in federal subsidies for a Quebec battery plant before filing for bankruptcy. Lion Electric burned through $100 million before announcing layoffs. Arrival, a U.K.-based electric van and bus manufacturer, collapsed entirely. Stellantis and LG Energy Solution extracted $15 billion for Windsor. Volkswagen secured $13 billion for St. Thomas.

The federal government committed more than $50 billion in subsidies and tax credits to prop up Canada’s EV industry. Ottawa defended these payouts as necessary to match the U.S. Inflation Reduction Act, which offers major incentives for EV and battery manufacturing. That is twice Manitoba’s annual operating budget. Every Manitoban could have had a two-year tax holiday with the public money Ottawa wasted on EVs.

Even with incentives, EVs reached only 15 per cent of new vehicle sales in 2024, far short of the mandated levels for 2026 and 2030. When federal subsidies ended in January 2025, sales collapsed to nine per cent, revealing the true level of consumer demand. Dealer lots overflowed with unsold inventory. EV sales also slowed in the U.S. and Europe in 2024, showing that cooling demand is a broader trend.

As economist Friedrich Hayek observed, “The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.” Politicians and bureaucrats cannot know what millions of Canadians know about their own needs. When federal ministers mandate which vehicles Canadians must buy and which companies deserve billions, they substitute the judgment of a few hundred officials for the collective wisdom of an entire market.

Bureaucrats draft regulations that determine the vehicles Canadians must purchase years from now, as if they can predict technology and consumer preferences better than markets.

Green ideology provided perfect cover. Invoke a climate emergency and fiscal responsibility vanishes. Question more than $50 billion in subsidies and you are labelled a climate denier. Point out the environmental costs of battery production, and you are accused of spreading misinformation.

History repeatedly teaches that central planning always fails. Soviet five-year plans, Venezuela’s resource nationalization and Britain’s industrial policy failures all show the same pattern. Every attempt to run economies from political offices ends in misallocation, waste and outcomes opposite to those promised. Concentrated political power cannot ever match the intelligence of free markets responding to real prices and constraints.

Markets collect information that no central planner can access. Prices signal scarcity and value. Profits and losses reward accuracy and punish error. When governments override these mechanisms with mandates and subsidies, they impair the information system that enables rational economic decisions.

The EV mandate forced a technological shift and failed. Billions in subsidies went to failing companies. Taxpayers absorbed losses while corporations walked away. Workers lost their jobs.

Canada needs a full repeal of the EV mandate and a retreat from PMO planners directing market decisions. The law must be struck, not paused. The contrived 2030 and 2035 targets must be abandoned.

Markets, not cabinet ministers, must determine what technologies Canadians choose.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Automotive

Trump Deals Biden’s EV Dreams A Death Blow

From the Daily Caller News Foundation

President Donald Trump dealt the dreams of former President Joe Biden for an all-electric fleet of American cars a fatal blow on Thursday by terminating the onerous Corporate Average Fuel Economy (CAFE) standards Biden invoked in 2022 and further tightened in 2024.

“We’re officially terminating Joe Biden’s ridiculously burdensome, horrible actually, CAFE standards, that imposed expensive restrictions… It puts tremendous pressure on upward car prices,” Trump said during a press conference held in the Oval Office Thursday afternoon.

The Biden standards, which cranked down on allowable tailpipe emissions and raised industry-wide average car mileage to a stratospheric 50.4 miles per gallon requirement by 2030, were the centerpiece of his strategy to force American consumers to buy electric vehicles by intentionally forcing up prices for traditional internal combustion models.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

That’s right, America: Your government, led by Joe Biden’s autopen and the woke staffers who wielded it, intentionally and with malice aforethought drove up the prices of the gas powered cars you actually want to buy to try to force you to purchase electric models that poll after poll proves most of you don’t want. They did this all in the name of the global climate alarm religion, which far too many U.S. politicians use to justify a vast array of authoritarian actions.

The unbridled hubris involved in even entertaining this concept would have in the past been considered scandalous. Yet, today, it is completely in keeping with one of the central goals of the energy transition movement to drive up the costs of all traditional forms of energy to try to make the subsidized alternatives favored by the Democratic Party – wind, solar, and electric vehicles – competitive in the market. Activists in the climate alarm movement no longer even try to deny this goal – they proudly boast about it.

This was the real enterprise behind Biden’s ridiculous CAFE standards, and it is what President Trump interrupted on Thursday. It was just the latest in a series of body blows Trump and his officials have dealt the U.S. EV industry, one that could well prove fatal to many pure-play electric car companies and force major reallocations of capital budgets inside integrated automakers like Ford, GM, and Stellantis.

Naturally, the climate alarm activist community was outraged. “Trump’s action will feed America’s destructive use of oil, while hamstringing us in the green tech race against … foreign carmakers,” said Dan Becker, Director of the notorious far-left conflict group, the Center for Biological Diversity, according to the Guardian.

But here’s the thing: U.S. consumers don’t want to buy the alternative the climate alarm community and Biden administration were trying to force. Even with the attraction of Biden’s economically ruinous $7,500 per unit IRA subsidies, U.S. car buyers made clear their strong preference for big, full-size, gas-or-diesel-powered pickups and SUVs.

This reality is why Stellantis announced in September it was abandoning plans to introduce a full-size electric pickup to compete with Ford’s F-150 Lightning. Even worse for EV boosters, Ford has already cut back on production of the Lightning model, and is planning to eliminate it entirely soon, according to the Wall Street Journal. These decisions and plans were already underway long before Trump’s decision to rescind the CAFE standards, based on simple consumer demand.

Interestingly, many consumers believe Trump didn’t go far enough on Thursday, and that he should simply eliminate mileage requirements altogether. One commenter to my Substack newsletter writes, “why didn’t they just kill CAFE standards once and for all? From what clause in the Constitution does the federal government have the right to limit what type of car I can buy?…They should have just killed it outright.”

It’s a legitimate question: Why do federal regulators believe they have the right to control consumer behavior in the name of climate alarmism? In light of last year’s decision by the Supreme Court to rescind the Chevron deference – which helped facilitate the massive expansion of the federal bureaucracy for 40 long years – it’s a question that could be litigated in the months and years to come.

Joe Biden’s EV dreams are dead now, but that doesn’t mean the situation can’t possibly get even worse for the EV industry in America. Stay tuned.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Business2 days ago

Business2 days agoWhy Does Canada “Lead” the World in Funding Racist Indoctrination?

-

Business2 days ago

Business2 days agoLoblaws Owes Canadians Up to $500 Million in “Secret” Bread Cash

-

Focal Points1 day ago

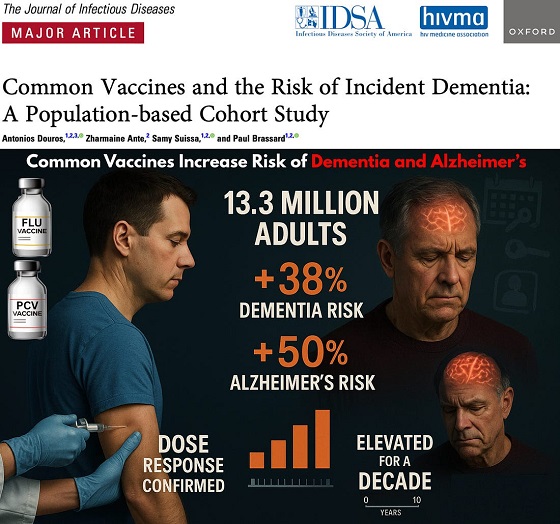

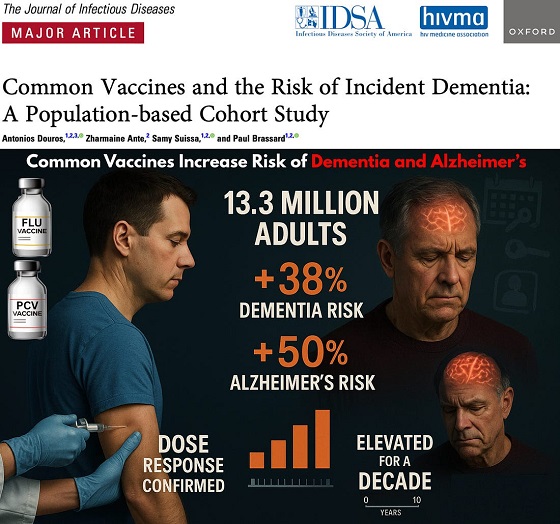

Focal Points1 day agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Dan McTeague2 days ago

Dan McTeague2 days agoWill this deal actually build a pipeline in Canada?

-

Economy14 hours ago

Economy14 hours agoAffordable housing out of reach everywhere in Canada

-

Media2 days ago

Media2 days agoThey know they are lying, we know they are lying and they know we know but the lies continue

-

Business18 hours ago

Business18 hours agoThe EU Insists Its X Fine Isn’t About Censorship. Here’s Why It Is.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoUS Condemns EU Censorship Pressure, Defends X