Business

Trump victory means Canada must get serious about tax reform

From the Fraser Institute

By Jake Fuss and Alex Whalen

Following Donald Trump’s victory in Tuesday’s presidential election, lower taxes for both U.S. businesses and individuals will be at the top of his administration’s agenda. Meanwhile, Prime Minister Trudeau has raised taxes on businesses and individuals, including with his recent capital gains tax hike.

Clearly, Canada and the United States are now moving in opposite directions on tax policy. To prevent Canada from falling even further behind the U.S., policymakers in Ottawa and across Canada should swiftly increase our tax competitiveness.

Before the U.S. election, Canada was already considered a high-tax country that made it hard to do business. Canada’s top combined (federal and provincial) personal income tax rate (as represented by Ontario) ranked fifth-highest out of 38 high-income industrialized (OECD) countries in 2022 (the latest year of available data). And last year, Canadians in every province, across most of the income spectrum, faced higher personal income tax rates than Americans in nearly every U.S. state.

Our higher income tax rates make it harder to attract and retain high-skilled workers including doctors, engineers and entrepreneurs. High tax rates also reduce the incentives to save, invest and start a business—all key drivers of prosperity.

No doubt, we need reform now. To close the tax gap and increase our competitiveness, the federal government should reduce personal income tax rates. One option is to reduce the top rate from 33.0 per cent back down to 29.0 per cent (the rate before the Trudeau government increased it) and eliminate the three middle-income tax rates of 20.5 per cent, 26.0 per cent and 29.0 per cent.

These changes would establish a new personal income tax landscape with just two federal rates. Nearly all Canadians would face a personal income tax rate of 15.0 per cent, while top earners would pay a marginal tax rate of 29.0 per cent.

On business taxes, Canada’s rates are also higher than the global average and uncompetitive compared to the U.S., which makes it difficult to attract business investment and corporate headquarters that provide well-paid jobs and enhance living standards. According to Trump’s campaign promises, he plans to lower the federal business tax rate from 21 per cent to 20 per cent (and reduce the rate to 15 per cent for companies that make their products in the U.S.). Trump must work with congress to implement these changes, but barring any change in Canadian policy, business tax cuts in the U.S. will intensify Canada’s net outflow of business investment and corporate headquarters to the U.S.

The federal government should respond by lowering Canada’s business tax rate to match Trump’s plan. Moreover, Ottawa should (in coordination with the provinces) change tax policy to only tax business profits that are not reinvested in the company—that is, tax dividend payments, share buybacks and bonuses but don’t touch profits that are reinvested into the company (this type of business taxation has helped supercharge the economy in Estonia). These reforms would encourage greater business investment and ultimately raise living standards for Canadians. Finally, given Canada’s massive outflow of business investment, the government should (at a minimum) reverse the recent federal capital gains hike.

Of course, there’s much to quibble with in Trump’s policies. For example, his tariffs will hurt the U.S. economy (and likely Canada’s economy), and tax cuts without spending reductions and deficit-reduction will simply defer tax hikes into the future. But while policymakers in Ottawa can’t control U.S. policy, Trump’s tax plan will significantly exacerbate Canada’s competitiveness problem. We can’t afford to sit idle and do nothing. Ottawa should act swiftly in coordination with the provinces and pursue bold pro-growth tax reform for the benefit of Canadians.

Authors:

Business

Elon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

From LifeSiteNews

Elon Musk said that ‘the sheer amount of waste and fraud’ in federal agencies, is ‘astonishing’ and that DOGE is cutting ‘$4 billion a day’ in misused taxpayer funds.

In a remarkable Fox News interview, Department of Government Efficiency (DOGE) founder Elon Musk and top officials of the DOGE team offered stunning, often infuriating, insights into how the federal government functions.

The interview, which has garnered well over 10 million online views on X in less than 24 hours, provided one extreme example after another of government mismanagement, excess, waste, and fraud while simultaneously promising a future where the D.C. Leviathan is tamed and restored to its proper, efficient role.

The new Deputy Director of the Office of Management and Budget (OMB), former U.S. House Rep. Dan Bishop, averred that the DOGE A-Team interview was the “most amazing and significant half-hour in TV history.”

Musk was joined by DOGE team members Steve Davis, Joe Gebbia, Aram Moghaddassi, Brad Smith, Anthony Armstrong, Tom Krause, and Tyler Hassen – all successful businessmen and entrepreneurs in their own rights – to describe the widespread systemic weaknesses and failures at the Internal Revenue Service (IRS), the National Institutes of Health (NIH), the Department of Health and Human Services (HHS), the Social Security Administration (SSA), and more.

Fox host Bret Baier described the group as “Silicon Valley colliding with government.”

“This is a revolution. And I think it might be the biggest revolution in government since the original revolution,” said Musk during the discussion.

“But at the end of the day, America’s going to be in much better shape,” he promised.

“America will be solvent. The critical programs that people depend upon will work, and it’s going to be a fantastic future.”

My interview with the @elonmusk and the @DOGE team tonight on #SpecialReport pic.twitter.com/KKpxEPtu1Z

— Bret Baier (@BretBaier) March 27, 2025

“The government is not efficient, and there’s a lot of waste and fraud. So we feel confident that a 15% reduction can be done without affecting any of the critical government services,” began Musk, founder and CEO of both Tesla and SpaceX and owner of X.

Musk said that the most stunning thing he’s discovered during the early phases of DOGE is “the sheer amount of waste and fraud in government. It is astonishing. It’s mind-blowing.”

Musk cited the example of a simple 10-question National Park online survey for which the government was charged nearly $1 billion and which in the end served no purpose.

“I think we will accomplish most of the work required to reduce the deficit by a trillion dollars within [130 days],” he predicted. “Our goal is to reduce the waste and fraud by $4 billion a day, every day, seven days a week. And so far, we are succeeding.”

Billionaire Airbnb co-founder Joe Gebbia, is working to digitize the retirement process for government employees, which is currently stuck using 1950s technology, housed in a Pennsylvania cave.

“It’s an injustice to civil servants who are subjected to these processes that are older than the age of half the people watching the show tonight,” said Gebbia. “We really believe that the government can have an Apple store-like experience, beautifully designed, great user experience, modern systems.”

“The retirement process is all by paper, literally, with people carrying paper and manila envelopes into this gigantic mine,” added Musk, limiting the number of federal employees who can retire to no more than 8,000 per month.

Gebbia expects to have the antiquated system updated and overhauled in a matter of months.

“The two improvements that we’re trying to make to Social Security are helping people that legitimately get benefits protect them from fraud that they experience every day on a routine basis and also make the experience better,” said DOGE software engineer Aram Moghaddassi.

He offered an amazing statistic: “When you want to change your (direct deposit) bank account, you can call Social Security. We learned 40% of the phone calls that they get are from fraudsters” who are attempting to commandeer retired seniors’ benefit payments.

“What we’re doing will help their benefits,” assured Musk. “As a result of the work of DOGE, legitimate recipients of social security will receive more money, not less money.”

“There are over 15 million people that are over the age of 120 that are marked as alive in the Social Security system,” said Steve Davis, who has previously worked alongside Musk at SpaceX, the Boring Company, and X

He explained that despite this being discovered by hardworking personnel at the SSA back in 2008, nothing was done. As a result, 15-20 million social security numbers that were clearly fraudulent were just floating around, susceptible to being used for “bad intentions.”

Health care entrepreneur Brad Smith, who has taken charge of auditing HHS and NIH, also cited stunning, troubling statistics displaying the extreme inefficiencies of the nation’s top federal health organizations.

Smith said that at NIH, “Today they have 27 different centers” created by Congress over the years and there are “700 different IT systems,” each using their own IT software.

“They have 27 different CIOs (Chief Information Officers),” added Smith, “so when you think about making great medical discoveries, you have to connect the data.”

Those discoveries are likely severely hampered by NIH’s communications disconnect.

Anthony Armstrong, a Morgan Stanley banker now working for DOGE at the Office of Personnel Management (OPM) talked about “duplicative functions” and “overstaffing” at government agencies. He said that money is “sloshing out the door.”

As an example, he cited the IRS, which has 1,400 employees whose only job is to provision laptops and cell phones to IRS workers.

“As an ex-CFO of a big public tech company, really what we’re doing is, we’re applying public company standards to the federal government, and it is alarming how the financial operations and financial management is set up today,” said Tom Krause, CEO of Cloud Software Group.

He explained that there is virtually no accountability or verification protections when it comes to the Treasury Department disbursing funds to various government agencies.

A 94-year-old grandmother is no longer “going to be robbed by forces like she’s getting robbed today, and the solvency of the federal government will ensure that she continues to receive those social security checks,” added Musk.

“The reason we’re doing this is because if we don’t do it, America is going to go insolvent and go bankrupt, and nobody’s going to get anything,” said Musk.

Tyler Hassen, a former oil executive working at the Interior Department for DOGE alleged that there was no departmental oversight at the Interior Department “whatsoever” under the Biden administration.

Steve Davis talked about the out-of-control issuance and use of federal credit cards.

“There are in the federal government around 4.6 million credit cards for around 2.3 to 2.4 million employees. This doesn’t make sense. So, one of the things all of the teams have worked on is we’ve worked for the agencies and said, ‘Do you need all of these credit cards? Are they being used? Can you tell us physically where they are?’” recounted Davis.

“Clearly there should not be more credit cards than there are people,” interjected Musk.

Musk later described how the Small Business Administration (SBA) has given out $300 million in loans to people “under the age of 11.” An additional $300 million in loans has been handed out to people “over the age of 120.”

Musk said that these government loans are clearly “fraudulent.”

“Terrible things are being done,” he exclaimed. “We’re stopping it.”

Business

Americans rallying behind Trump’s tariffs

The Trump administration’s new tariffs are working:

The European Union will delay tariffs on U.S. exports into the trading bloc in response to the imposition of tariffs on European aluminum and steal, a measure announced in February by the White House as a part of an overhaul of the U.S. trade policies.

Instead of taking effect March 12, these tariffs will not apply until “mid-April”, according to a European official interviewed by The Hill.

This is not the first time the EU has responded this way to U.S. tariff measures. It happened already last time Trump was in office. One of the reasons why Brussels is so accommodative is that the European Parliament emphasized negotiations already back in February. Furthermore, as Forbes notes,

The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By import tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

More on unfair competition in a moment. First, it is important to note that Trump did not start this trade skirmish. Please note what IndustryWeek reported back in 2018:

Trump points to U.S. auto exports to Europe, saying they are taxed at a higher rate than European exports to the United States. Here, facts do offer Trump some support: U.S. autos face duties of 10% while European cars are subject to dugies of only 2.5% in the United States.

They also noted some nuances, e.g., that the United States applies a higher tariff on light trucks, presumably to defend the most profitable vehicles rolling out of U.S. based manufacturing plants. Nevertheless, the story that most media outlets do not tell is that Europe has a history of putting tariffs on U.S. exports to a greater extent than tariffs are applied in the opposite direction.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Facts notwithstanding, this trade war has caught media attention and is reaching ridiculous proportions. According to CNBC,

Auto stocks are digesting President Donald Trump’s annoncement that he would place 25% tariffs on “all cars that are not made in the United Sates,” as well as certain automobile parts. … Shares of the “Detroit Three” all fell.

They also explain that GM took a particularly hard beating, and that Ferrari is going to use the tariffs as a reason to raise prices by ten percent. This sounds dramatic, but keep in mind that stocks fly up and down with impressive amplitude; what was lost yesterday can come back with a bonus tomorrow. As for Ferrari, a ten-percent price hike is basically meaningless since these cars are often sold in highly customized, individual negotiations before they are even produced.

Despite the media hype, these tariffs will not last the year. One reason is the retaliatory nature in President Trump’s tariffs, which—again—has already caught the attention of the Europeans and brought them to the negotiation table. We can debate whether or not his tactics are the best in order to create more fair trade terms between the United States and our trading partners, but there is no question that Trump’s methods have caught the attention of the powers that be (which include Mexico and Canada).

There is another reason why I do not see this tariffs tit-for-tat continuing for much longer. The European economy is in bad shape, especially compared to the U.S. economy. With European corporations already signaling increased direct investment in the U.S. economy, Europe is holding the short end of this stick.

But the bad news for the Europeans does not stop there. They are at an intrinsic disadvantage going into a tariffs-based trade war. The EU has a “tariff” of sorts that we do not have, namely the value-added tax, VAT. Shiphub.co has a succinct summary of how the VAT affects trade:

When importing (into the European Union), VAT should be taken into account. … VAT is calculated based on the customs value (the good’s value and transport costs … ) plus the due duty amount.

The term “duty” here, of course, refers to trade tariffs. This means that when tariffs go up, the VAT surcharge goes up as well. Aside from creating a tax-on-tax problem, this also means that the inflationary effect from U.S. imports is significantly stronger than it is on EU imports to the United States—even when tariffs are equal.

If the U.S. government wanted to, they could include the tax-on-tax effect of the VAT when assessing the effective EU tariffs on imports from the United States. This would quickly expand the tit-for-tat tariff war, with Europe at an escalating disadvantage.

For these reasons, I do not see how this “trade war” will continue beyond the summer, but even that is a pessimistic outlook.

Before I close this tariff topic and declare it a weekend, let me also mention that the use of tariffs in trade war is neither a new nor an unusual tactic. Check out this little brochure from the Directorate-General for Trade under the European Commission’:

Trade defence instruments, such as anti-dumping or anti-subsidy duties, are ways of protecting European production against international trade distortions.

What they refer to as “defence instruments” are primarily tariffs on imports. In a separate report the Directorate lists no fewer than 63 trade-war cases where the EU imposes tariffs to punish a country for unfair trade tactics.

Trade what, and what countries, you wonder? Sweet corn from Thailand, fused alumina from China, biodiesel from Argentina and Indonesia, malleable tube fittings from China and Thailand, epoxy resins from China, South Korea, Taiwan, and Thailand… and lots and lots of tableware from China.

Like most people, I would prefer a world without taxes and tariffs, and the closer we can get to zero on either of those, the better. But until we get there, we should take a deep breath in the face of the media hype and trust our president on this one.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Business23 hours ago

Business23 hours agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Health13 hours ago

Health13 hours agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta11 hours ago

Alberta11 hours agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era

-

Alberta5 hours ago

Alberta5 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

Energy1 day ago

Energy1 day agoEnergy, climate, and economics — A smarter path for Canada

-

2025 Federal Election2 days ago

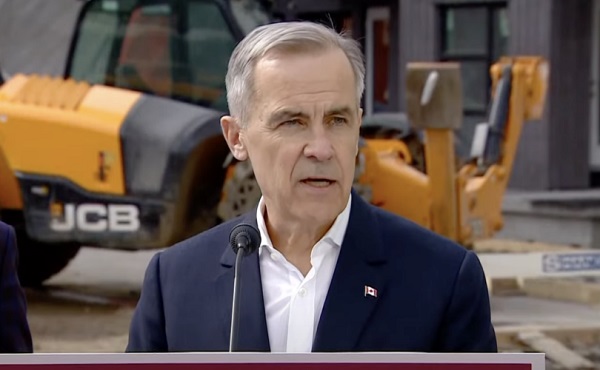

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Business1 day ago

Business1 day agoTrump Reportedly Shuts Off Flow Of Taxpayer Dollars Into World Trade Organization