From The Center Square

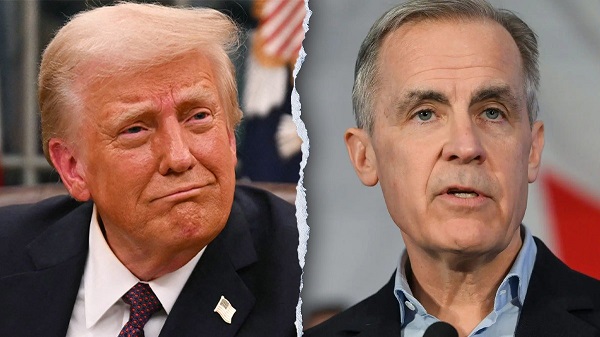

President Donald Trump signed an executive order on Tuesday targeting state-level climate policies – including Washington state’s Climate Commitment Act – calling them unconstitutional and harmful to domestic energy production

The executive order directs attorneys general to take action against state laws and policies that address climate change or involve environmental justice, carbon or greenhouse gas emissions, and funds to collect carbon penalties or carbon taxes.

That includes Washington’s CCA that requires emitters to either reduce their carbon footprint or purchase “allowances” via a cap-and-trade program, which sets a limit on emissions from the state’s largest polluters: oil refineries, utilities, and manufacturers.

The CCA’s cap lowers over time with the goal of getting to carbon neutrality by 2050. While the program has generated billions in revenue, only 11% directly funds emissions-reducing projects, with the rest supports climate resilience, public health programs, and infrastructure planning, as previously reported by The Center Square,

According to a press release from The White House, the executive order targets these state laws and policies because they “burden the use of domestic energy resources and that are unconstitutional, preempted by federal law, or otherwise unenforceable.”

Gov. Bob Ferguson does not believe the executive order has enough teeth to impact the state’s CCA.

“Voters upheld the Climate Commitment Act by a landslide, with 61% approval,” Ferguson told The Center Square in an email. “I am confident we will be able to preserve this and other important laws protecting our climate and investments in clean energy from this latest attack by the Trump administration.”

The Washington Department of Transportation told The Center Square it is working with federal and state partners to seek clarification about the implications and next steps of federal funding actions.

The Department of Ecology did not respond to The Center Square’s request for comment.

If U.S. Attorney General Pam Bondi does go after the CCA and other environmental policies, Washington officials may argue that it’s within the state’s authority to regulate emissions for public health.

For example, The federal Clean Air Act allows states, including Washington, to adopt more stringent motor vehicle emission standards than the federal minimums in certain circumstances.

The 2007 Supreme Court decision Massachusetts v. EPA affirmed states’ standing to sue over carbon emissions, ruling that greenhouse gases endanger public health and are subject to regulation under the Clean Air Act.

This wouldn’t be the first time the state defended its environmental laws against federal challenges from the Trump administration.

Washington also fought emissions rollbacks during the first Trump administration when Ferguson was state attorney general.

One key victory came in 2024, when Washington helped defend California’s right to set stricter vehicle emission standards.

While Ferguson has not commented on the executive order, New York Governor Kathy Hochul and New Mexico Governor Michelle Lujan Grisham – co-chairs of the U.S. Climate Alliance – issued a joint statement on Tuesday that states that the federal government cannot “unilaterally strip states’ independent constitutional authority.”

“We will keep advancing solutions to the climate crisis that safeguard Americans’ fundamental right to clean air and water, create good-paying jobs, grow the clean energy economy, and make our future healthier and safer,” the statement said.